Dental Insurance Market Size, Share, Trends, Growth, Forecast 2034

Dental Insurance Market By Type (Major, Basic, and Preventive), By Coverage (Dental Preferred Provider Organizations [DPPO], Dental Health Maintenance Organizations [DHMO], Dental Indemnity Plans, and Others), By Demographic (Senior Citizens, Adults, and Minors), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 231.92 Billion | USD 472.38 Billion | 9.30% | 2024 |

Dental Insurance Market: Industry Perspective

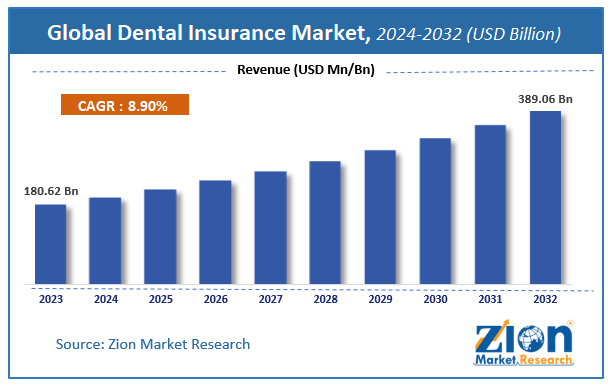

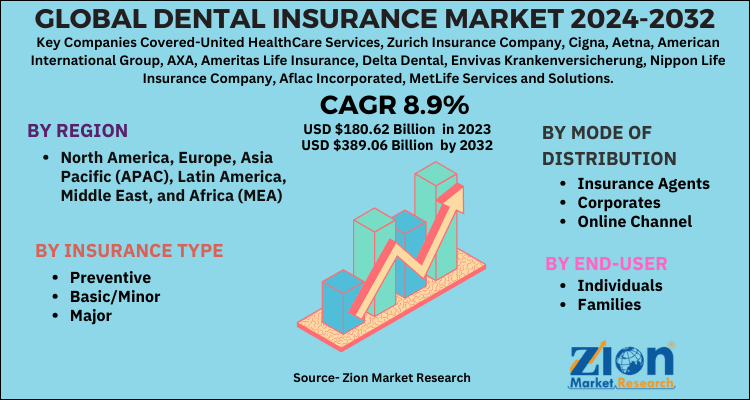

The global dental insurance market size was worth around USD 231.92 billion in 2024 and is predicted to grow to around USD 472.38 billion by 2034, with a compound annual growth rate (CAGR) of roughly 9.30% between 2025 and 2034.

Dental Insurance Market: Overview

Dental insurance is a kind of health insurance that helps patients manage the fees of preventive, major, and basic dental care services. It usually encompasses routine check-ups, X-rays, cleanings, fillings, and more extensive procedures like orthodontics, crowns, and root canals, depending on the plan. The global dental insurance market is projected to witness substantial growth driven by growing cases of oral diseases, a rising senior population, and increasing dental care costs.

According to worldwide health bodies, over 3.5 million individuals suffer from various oral conditions, including tooth loss, gum disease, and cavities. The high pressure of these conditions is compelling more people to seek corrective and preventive treatments. Dental insurance reduces high out-of-pocket costs, driving industry adoption. The growing elderly populations, mainly in North America, Europe, and APAC, mostly face issues like tooth decay and periodontal disease. This demographic trend is fueling the demand for coverage that entails long-term oral health. Insurance companies are modifying senior-specific dental plans to explore and progress this market.

Moreover, dental treatment expenses have increased remarkably, with complex procedures like orthodontics and implants becoming expensive. This cost inflation increases the appeal of insurance as a financial safety net. Both individuals and employers are largely adopting dental plans to manage these expenditures.

Although drivers exist, the global market is challenged by factors like restricted coverage scope and low penetration in the developing regions. Some plans exclude cosmetic dentistry, advanced procedures, and orthodontics, which can limit the perceived value of dental care. This gap builds dissatisfaction among consumers. Policyholders may shift to alternate financing choices instead. In developing nations, affordability and a lack of awareness hinder industry growth. Cultural perceptions of dental care being non-essential also hampers the demand. Insurance providers face challenges in building a robust consumer base.

Even so, the global dental insurance industry is well-positioned due to tele-dentistry integration and wellness program bundling. Integrating virtual consultations may extend geographic reach to remote and rural areas. This method decreases obstacles to care and fuels policyholder engagement. It also contributes value to insurance plans. Moreover, insurers may offer dental coverage, in addition to broader wellness benefits, including preventive health services and nutrition. This incorporated technique attracts health-conscious individuals and improves cross-selling opportunities.

Key Insights:

- As per the analysis shared by our research analyst, the global dental insurance market is estimated to grow annually at a CAGR of around 9.30% over the forecast period (2025-2034)

- In terms of revenue, the global dental insurance market size was valued at around USD 231.92 billion in 2024 and is projected to reach USD 472.38 billion by 2034.

- The dental insurance market is projected to grow significantly due to increasing healthcare expenditure, government initiatives for dental care coverage, and the growing senior population.

- Based on type, the preventive segment is expected to lead the market, while the basic segment is expected to grow considerably.

- Based on coverage, the dental preferred provider organizations (DPPO) segment is the dominating segment. In contrast, the dental health maintenance organizations (DHMO) segment is projected to witness sizeable revenue over the forecast period.

- Based on demographic, the adults segment is expected to lead the market compared to the senior citizens segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Europe.

Dental Insurance Market: Growth Drivers

How is the growth of voluntary benefits and employer-sponsored channels fueling the dental insurance market growth?

Several employers add dental coverage as a component of benefits packages to retain and attract talent. In specific markets, voluntary/ancillary dental plans sold via affinity groups or employers, fuel huge enrollment gains. This channel also facilitates group pricing, which reduces the price of coverage per capita and boosts penetration, mainly in the developing corporate market.

Product innovation, care-delivery models, and digitization majorly propel the market growth

Digital claims, remote consults, and tele-dentistry triage, and integration with electronic dental records simplify claims processing and underwriting, and expand access in the underserved and rural areas. These technology improvements reduce administrative costs and promote new product types, such as on-demand virtual add-ons and subscription dental plans, which fuel market appeal and insurer margins. These developments notably propel the demand and need among patients, thus impacting the worldwide dental insurance market.

Dental Insurance Market: Restraints

How is the perceived low value of dental insurance and lack of awareness hindering the dental insurance market development?

Several consumers believe dental insurance is not worth the price or underrate the significance of oral health, particularly if they have fewer dental issues. This lack of awareness decreases retention and enrollment rates.

A 2023 survey disclosed that more than 40% of uninsured individuals in Europe mentioned 'not needing it' as the key reason for avoiding dental plans. WHO’s 2024 Global Oral Health Status Report underscored that untreated oral diseases impact nearly 3.5 billion individuals, yet insurance coverage growth is slow.

Dental Insurance Market: Opportunities

How are government initiatives to enhance oral health access offering advantageous conditions for the dental insurance market development?

Government subsidies and public health campaigns for dental services provide opportunities for private insurers to offer their services, fueling the global dental insurance industry. In nations where the state provides just basic dental coverage plans, insurers may tap in for cosmetic and advanced treatments. Programs targeting vulnerable groups, such as seniors, children, and low-income families, typically create a parallel demand for balancing private coverage.

The Canadian Dental Plan distributed CAD 13 billion in 5 years starting in 2023. In 2024, the United Kingdom announced NHS dental reforms to increase free check-ups for kids, potentially growing supplemental coverage demand.

Dental Insurance Market: Challenges

Workforce shortages in dental care limit the market growth

The lack of a proficient workforce, mainly in the underserved and rural areas, restricts access to care even for insured individuals. Long appointment wait times may undermine the perceived value of insurance coverage and demotivate policy renewals. Workforce gaps are often exacerbated by the migration of skilled dentists to high-income countries.

The United States is expected to witness a scarcity of 5,000 dental professionals by 2030. In 2024, the American Dental Association cautioned that staffing scarcity was negatively affecting service delivery in several states.

Dental Insurance Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Dental Insurance Market |

| Market Size in 2024 | USD 231.92 Billion |

| Market Forecast in 2034 | USD 472.38 Billion |

| Growth Rate | CAGR of 9.30% |

| Number of Pages | 214 |

| Key Companies Covered | MetLife, Cigna, Delta Dental, UnitedHealthcare, Aetna, Humana, Guardian Life Insurance Company, Sun Life Financial, Allianz, Renaissance Dental, Denplan, Principal Financial Group, Ameritas Life Insurance Corp., Spirit Dental & Vision, DentaQuest, and others. |

| Segments Covered | By Type, By Coverage, By Demographic, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Dental Insurance Market: Segmentation

The global dental insurance market is segmented based on type, coverage, demographic, and region.

Based on type, the global dental insurance industry is divided into major, basic, and preventive. The preventive dental coverage segment registers a leading market share, fueled by the maintenance of oral health and the rising emphasis on early detection. It entails routine services like check-ups, cleanings, and X-rays, which are essential for preventing expensive treatments in the future. Dental associations, governments, and insurers are encouraging preventive care to decrease the long-term impact. The accessibility and affordability of preventive plans make them broadly adopted by employers, individuals, and groups.

Based on coverage, the global dental insurance market is segmented as Dental Preferred Provider Organizations (DPPO), Dental Health Maintenance Organizations (DHMO), dental indemnity plans, and others. The Dental Preferred Provider Organizations (DPPO) segment holds dominance due to its flexibility, helping policyholders to visit out-of-network and in-network dentists, with more coverage for in-network services. They offer a broader range of providers and usually do not need referrals, improving convenience. This makes them highly appealing to individuals who prefer flexibility and wide access to dental care. This robust adoption in Europe, the United States, and other well-developed insurance markets reinforces their leading dominance.

Based on demographic, the global market is segmented into senior citizens, adults, and minors. The adults segment holds leadership fueled by high employer-sponsored coverage and workforce participation. This group seeks major, preventive, and basic dental services, usually balancing oral health needs with aesthetic dentistry. The growing awareness of the link between overall well-being and oral health also propels the demand. Adults' high disposable income, compared to seniors and minors, aids the augmentation of comprehensive plans.

Dental Insurance Market: Regional Analysis

What enables North America to have a strong foothold in the global Dental Insurance Market?

North America is likely to sustain its leadership in the dental insurance market due to high insurance penetration rates, advanced healthcare infrastructure, and growing dental treatment costs. North America, especially the United States, holds the leading dental insurance penetration across the globe, with more than 77% of the population suffering from at least one form of dental coverage. This is mainly because of the high incidence of employer-sponsored group dental plans. Robust cultural focus on oral health and regular check-ups continues to steady demand.

Furthermore, the region's well-established healthcare systems and strong network of certified dental workforce increase the accessibility and efficiency of insurance. According to the American Dental Association, there were more than 202,000 practicing dental professionals in the U.S. in 2023. This strong infrastructure backs a high utilization rate of dental care services among insured people.

Also, dental procedures in the region are high-priced, with complex treatments like implants ranging from $3000-$5000 per tooth. This fuels strong consumer demand for insurance as a form of financial protection. The price factor also incentivizes employers to offer dental advantages as a unit of competitive compensation packages.

Europe continues to secure the second-highest share in the dental insurance industry owing to strong private and public dental systems, rising demand for supplementary dental plans, and an aging population needing oral health. Several European nations, like the United Kingdom, France, and Germany, have public dental care integrated into their healthcare systems, accompanied by private insurance for extra services.

In Germany, more than 85% of residents are covered by statutory health insurance, which comprises limited dental benefits. This amalgamation promises consistent utilization and high coverage. While basic dental care is publicly funded in many nations, cosmetic and advanced procedures usually need private coverage.

In France, approximately 96% of the population has complementary private health insurance, which often comprises dental upgrades. This dual-coverage structure fuels a strong private dental insurance sector. The region also has a high geriatric population, with more than 21% aged 65 or older. The elderly group needs more specialized and frequent dental care, from periodontal treatment to dentures. Insurers are offering senior-focused dental plans to satisfy this demand.

Dental Insurance Market: Competitive Analysis

The leading players in the global dental insurance market are -

- MetLife

- Cigna

- Delta Dental

- UnitedHealthcare

- Aetna

- Humana

- Guardian Life Insurance Company

- Sun Life Financial

- Allianz

- Renaissance Dental

- Denplan

- Principal Financial Group

- Ameritas Life Insurance Corp.

- Spirit Dental & Vision

- DentaQuest.

Dental Insurance Market: Key Market Trends

Growing prominence of preventive-focused plans:

There is a growing inclination towards insurance packages that focus on preventive care, comprising more frequent cleanings, wellness incentives, and early screenings. Preventive dentistry decreases long-term costs for policyholders and insurers. This trend is backed by public health campaigns underscoring oral-systemic health links.

Rise in modular and customized coverage options:

Insurers are offering à-la-carte, highly flexible plans where individuals can select the preventive level, major, and basic coverage they need. This caters to gig workers, the younger demographic, and freelancers looking for personalization and affordability. It also enhances customer retention by resolving specific requirements.

The global dental insurance market is segmented as follows:

By Type

- Major

- Basic

- Preventive

By Coverage

- Dental Preferred Provider Organizations (DPPO)

- Dental Health Maintenance Organizations (DHMO)

- Dental Indemnity Plans

- Others

By Demographic

- Senior Citizens

- Adults

- Minors

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Dental insurance is a kind of health insurance that helps patients manage the fees of preventive, major, and basic dental care services. It usually encompasses routine check-ups, X-rays, cleanings, fillings, and more extensive procedures like orthodontics, crowns, and root canals, depending on the plan.

The global dental insurance market is projected to grow due to rising awareness of oral health, improvements in dental treatments, and increasing cases of dental diseases.

According to study, the global dental insurance market size was worth around USD 231.92 billion in 2024 and is predicted to grow to around USD 472.38 billion by 2034.

The CAGR value of the dental insurance market is expected to be around 9.30% during 2025-2034.

North America is expected to lead the global dental insurance market during the forecast period.

Technological advancements, such as tele-dentistry platforms and AI-driven claim processing, are enhancing accuracy, efficiency, and accessibility in dental insurance services. They allow personalized plan offerings, improved customer engagement, and faster reimbursements, driving industry competitiveness.

The key players profiled in the global dental insurance market include MetLife, Cigna, Delta Dental, UnitedHealthcare, Aetna, Humana, Guardian Life Insurance Company, Sun Life Financial, Allianz, Renaissance Dental, Denplan, Principal Financial Group, Ameritas Life Insurance Corp., Spirit Dental & Vision, and DentaQuest.

Stakeholders should invest in AI-powered claim management, digital transformation, and tele-dentistry integration to enhance service delivery. They should emphasize customer-centric, flexible plans, preventive care initiatives, and strategic partnerships to strengthen industry presence.

Regulatory reforms, such as compliance with health data protection laws and mandatory dental coverage policies, are transforming the market dynamics. Environmental factors, such as public health initiatives that support preventive dental care, also fuel demand for insurance services.

The report examines key aspects of the dental insurance market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed