Defoaming Coating Additives Market Size, Share, Value and Forecast 2032

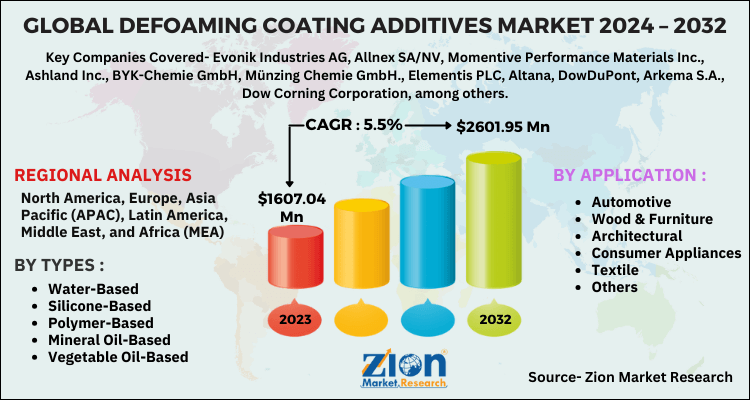

Defoaming Coating Additives Market By Types (Water-Based, Silicone-Based, Polymer-Based, Mineral Oil-Based, and Vegetable Oil-Based), By Applications (Automotive, Wood & Furniture, Architectural, Consumer Appliances, Textile, and Others): Global Industry Perspective, Comprehensive Analysis, and Forecast, 2024-2032

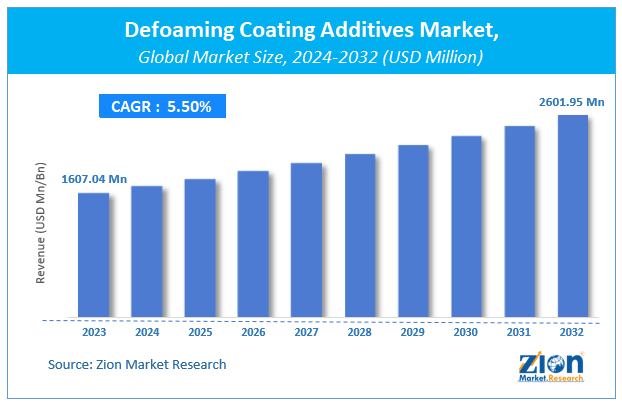

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1607.04 Million | USD 2601.95 Million | 5.5% | 2023 |

Defoaming Coating Additives Market Insights

According to a report from Zion Market Research, the global Defoaming Coating Additives Market was valued at USD 1607.04 Million in 2023 and is projected to hit USD 2601.95 Million by 2032, with a compound annual growth rate (CAGR) of 5.5% during the forecast period 2024-2032. This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the Defoaming Coating Additives Market industry over the next decade.

Defoaming Coating Additives Market: Overview

Defoaming Coating Additives, also called defoamers, are chemical additives that reduce or prevent foams' formation. Commonly used defoamers are silicone, glycols, insoluble oils, stearates, polydimethylsiloxanes, and certain other alcohols. These are added to break the foams which are already formed. The addition of defoamers improves adhesion and resistance to moisture. The rising population of developed and developing regions with increased automobile use, thereby its production and sales, will primarily drive this market.

The consumer needs for lavish infrastructure and commercial housing have become popular recently. Innovations of low or zero Volatile organic components (VOC) coatings have led manufacturers to use water-based defoaming agents to reduce emissions. This trend of using water-based ant-foam coating additives is expected to continue over the forecast period.

Defoaming Coating Additives Market: Growth Factors

The Defoaming Coating Additives Market has shown significant growth mainly due to rising industrialization, population, and urbanization. The rapid development of Industries and their production will propel market growth in the future. With the rising population, there has been an increase in demand for vehicles which will further boost the market. By restricting the formation of foams at the start of production and before applying them in paint, vehicles ensure a smooth appearance and finish. This is likely to grow the market in forecasted years.

The demand for defoaming coating additives will be boosted due to the increased needs for various coatings in the architecture and low volatile organic compounds (VOC). The addition of these additives in the construction sector helps reduce VOC and mandates for environmental safety. The critical characteristics like superior stability, glossiness, and resistance to stains make the additives used on a large scale.

Defoaming Coating Additives Market: Segment Analysis

The Water-based defoamer segment is the fastest growing segment in the market and is attributed mainly due to its significant water content. Water-based defoaming include mineral oils and vegetable oils. The extensive use of water-based defoamers in Pulp and Paper, Paints and Coatings, Food, and Beverages will boost the segment in the forecasted years. The primary factor differentiating with other types is that water-based defoamers do not have hydrocarbon oils, produce low VOC emissions, and are cost-effective.

This is accredited to the rising demand for construction for residential space. It has a higher dominance in this market as the general market is booming concerning Buildings and Constructions Industries. There have been rising standards of living in the people for attractive homes, which with the help of defoaming coating additives will help their needs fulfilled. The appearance of paints and wear resistance will help this segment grow more in the forecast period.

Rising standards of living in the Automobile sector will drive the market. Defoaming Coating Additives is also primarily used in automotive industries due to weight reduction, wear resistance, high inertness, and reinforcement. The increased production of automobile cars and its demand from consumers worldwide will boost the rise of the Defoaming Coating additive market. The critical characteristics of additives like superior stability, glossiness, and resistance to stains will make the additives use on a large scale. Architectural, Consumer Appliances, Textile, and Others form the application segment.

Defoaming Coating Additives Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Defoaming Coating Additives Market |

| Market Size in 2023 | USD 1607.04 Million |

| Market Forecast in 2032 | USD 2601.95 Million |

| Growth Rate | CAGR of 5.5% |

| Number of Pages | 140 |

| Key Companies Covered | Evonik Industries AG, Allnex SA/NV, Momentive Performance Materials Inc., Ashland Inc., BYK-Chemie GmbH, Münzing Chemie GmbH., Elementis PLC, Altana, DowDuPont, Arkema S.A., Dow Corning Corporation, among others. |

| Segments Covered | By Types, By Applications and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Defoaming Coating Additives Market: Regional Analysis

Asia Pacific Defoaming Coating Additives market is likely to significantly increase due to rapid economic and industrial expansion in countries like India, Japan, Malaysia, and China. The development and construction of infrastructure due to an increase in urbanization will foster home appliances, which will drive the market in the forecast years. The textile industry in India will pull the market more significantly.

The European market is supported by its large production and export of the automobile parts to other regions. European countries are second largest contributor to Defoaming Coating Additives Market due to many companies originating from the area. There has been a significant rise in the construction industries in this region, which is among the many reasons behind the growth of this market. The Government Initiatives for Low VOC emissions will help the manufacturers to meet the rising demand for sustainable products.

Defoaming Coating Additives Market: Players & Competitive Landscape

Some of the key players in the Defoaming Coating Additives market include

- Evonik Industries AG

- Allnex SA/NV

- Momentive Performance Materials Inc.

- Ashland Inc.

- BYK-Chemie GmbH

- Münzing Chemie GmbH.

- Elementis PLC

- Altana

- DowDuPont

- Arkema S.A

- Dow Corning Corporation

The global Defoaming Coating Additives market is segmented as follows:

By Types

- Water-Based

- Silicone-Based

- Polymer-Based

- Mineral Oil-Based

- Vegetable Oil-Based

By Applications

- Automotive

- Wood & Furniture

- Architectural

- Consumer Appliances

- Textile

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

According to a report from Zion Market Research, the global Defoaming Coating Additives Market was valued at USD 1607.04 Million in 2023 and is projected to hit USD 2601.95 Million by 2032.

According to a report from Zion Market Research, the global Defoaming Coating Additives Market a compound annual growth rate (CAGR) of 5.5% during the forecast period 2024-2032.

One of the key factors driving the Global Defoaming Coating Additives Market growth is rapid development of Industries and its production, and rising industrialization, population, and urbanization. The demand for defoaming coating additives will be boosted due to increase in needs for various coatings in the architecture and low volatile organic compound (VOC).

Asia Pacific held a substantial share of the Defoaming Coating Additives Market in 2023. The development and construction of infrastructure due to increase in urbanization will contribute heavily to the global market. European Defoaming Coating Additives market is likely to witness a significant increase in the construction industry due to stable economic growth and urbanization, and industrialization. It is supported by its large production and export of the automobile parts to other regions

Some of the key players in the Defoaming Coating Additives market include Evonik Industries AG, Allnex SA/NV, Momentive Performance Materials Inc., Ashland Inc., BYK-Chemie GmbH, Münzing Chemie GmbH., Elementis PLC, Altana, DowDuPont, Arkema S.A., Dow Corning Corporation, among others.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed