Cryogenic Equipment Market Size, Share, Value and Forecast 2032

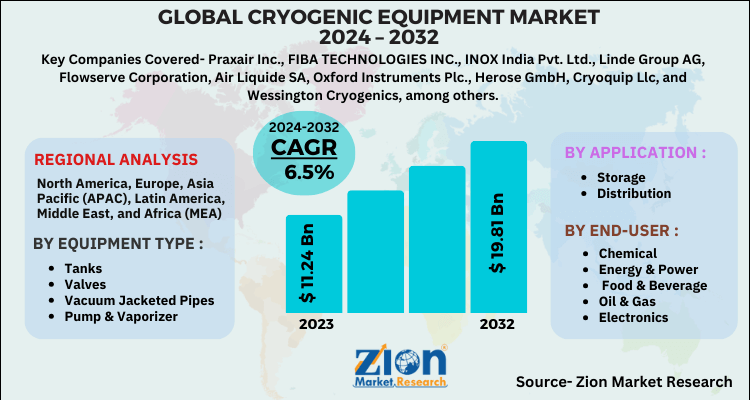

Cryogenic Equipment Market By Equipment Type (Tanks, Valves, Vacuum Jacketed Pipes, and Pump and Vaporizer), By Application (Storage and Distribution), By End-User (Chemical, Energy & Power, Food & Beverage, Oil & Gas, and Electronics): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024-2032

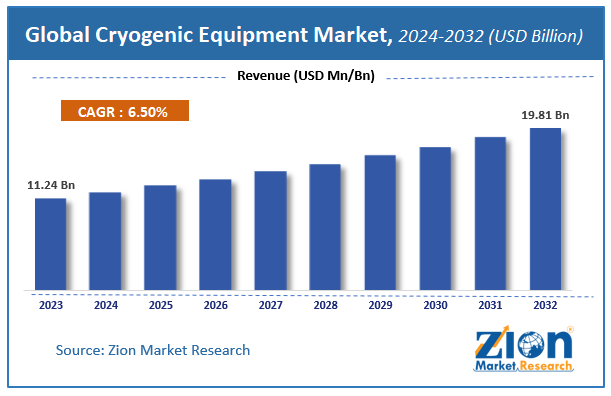

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 11.24 Billion | USD 19.81 Billion | 6.5% | 2023 |

Cryogenic Equipment Market Insights

According to a report from Zion Market Research, the global Cryogenic Equipment Market was valued at USD 11.24 Billion in 2023 and is projected to hit USD 19.81 Billion by 2032, with a compound annual growth rate (CAGR) of 6.5% during the forecast period 2024-2032. This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the Cryogenic Equipment Market industry over the next decade.

Cryogenic Equipment Market: Overview

Cryogenic equipment houses and produces very low-temperature materials. Cryogenics, the study of very low temperatures, involves temperatures that are colder than those that can be attained with conventional refrigeration equipment. Cryogenic equipment is designed to reach ultra-low temperatures at a slow rate in order to prevent thermal shock to the components being treated. At this temperature, materials that are natural gases can be liquefied and several metals lose electrical resistance, as they get colder.

Cryogenic equipment includes cryogenic storage boxes and racks, temperature controllers, cryogenic tanks, cryogenic accessories and cryogenic refrigerators. Key players are focusing upon advancement of product and integrating the equipment with new features. The manufacturers are emphasizing on mergers & acquisitions to strengthen their position in the market.

Cryogenic Equipment Market: Growth Factors

Major driving factors for the growth of cryogenic equipment market are raising LNG demand, improving healthcare services in the growing economies and the development of high temperature superconductor power cables. The global cryogenic equipment market offers new growth opportunities, due to increasing trade of natural gases and rise in cryogenic energy storage systems. Decrease in global steel production could be a restraining factor for the cryogenic equipment market. The rapid speed of industrialization & urbanization and improved demand across the healthcare industry are also boosting the growth projection of global cryogenic equipment market.

Cryogenic Equipment Market: Segment Analysis Preview

Based on equipment, the global cryogenic equipment market is segmented into tanks, valves, vacuum jacketed pipes, and pump & vaporizer. Among these equipment, tanks was the leading segment of the global cryogenic equipment market in 2020. In the cargo tanks, LNG carriers an enormous amount of LNG, and therefore, maintaining the tank stress is of high importance. Extended service life, high quality insulation and low maintenance cost are several benefits provided by the cryogenic tanks. Vacuum jacketed pipe is a high performance, and low heat escape vacuum insulated pipe specially designed to transport cryogenic liquids. General practice of vacuum jacketed pipes in thermal vacuum chambers and rubber flashing is expected to increase the demand during the forecast period.

On the basis of end-user industries, the cryogenic equipment market is segmented into chemical, energy & power, food & beverage, oil & gas, and electronics. The cryogenic equipment market for energy & power accounted for the largest share in 2020. Increase in investments across the power sector, particularly in the developing regions provides avenues for growth. Factors such as legislations governing the food & beverage manufacturing, and the impact of manufacturing on carbon emissions segment has considerably tending the choice of freezing technology.

On the basis of application, the cryogenic equipment market is segmented into storage and distribution. Storage segment is estimated to account for the largest cryogenic equipment market share among all the applications. The device is utilized for creating low temperature conditions for storing gases such as nitrogen, oxygen, liquefied natural gas, and argon. For storing these gases the apparatus is utilized for creating low temperature conditions. Variations in external gases temperature within the container provides alteration of temperature and also provides insulation.

Cryogenic Equipment Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Cryogenic Equipment Market |

| Market Size in 2023 | USD 11.24 Billion |

| Market Forecast in 2032 | USD 19.81 Billion |

| Growth Rate | CAGR of 6.5% |

| Number of Pages | 150 |

| Key Companies Covered | Praxair Inc., FIBA TECHNOLOGIES INC., INOX India Pvt. Ltd., Linde Group AG, Flowserve Corporation, Air Liquide SA, Oxford Instruments Plc., Herose GmbH, Cryoquip Llc, and Wessington Cryogenics, among others. |

| Segments Covered | By Equipment Type, By Application, By End-User and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Cryogenic Equipment Market: Regional Segment Analysis Preview

Asia Pacific dominated the market of cryogenic equipment in 2020 and accounted significant share of the market. In Asia Pacific, increasing investments in the energy sector and significant growth in other end-user industries are the factors attributed for the growth of the cryogenic equipment market in this region. The major factor for the growth of cryogenic equipment market is the presence of leading steel production in countries such as China, Japan, India and South Korea.

Key Market Players & Competitive Landscape

The major players operating in the Cryogenic Equipment market are

- Praxair Inc

- FIBA TECHNOLOGIES INC

- INOX India Pvt. Ltd

- Linde Group AG

- Flowserve Corporation

- Air Liquide SA

- Oxford Instruments Plc

- Herose GmbH

- Cryoquip Llc

- Wessington Cryogenics

The global Cryogenic Equipment market is segmented as follows:

By Equipment Type

- Tanks

- Valves

- Vacuum Jacketed Pipes

- Pump & Vaporizer

By Application

- Storage

- Distribution

By End-User

- Chemical

- Energy & Power

- Food & Beverage

- Oil & Gas

- Electronics

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

According to a report from Zion Market Research, the global Cryogenic Equipment Market was valued at USD 11.24 Billion in 2023 and is projected to hit USD 19.81 Billion by 2032.

According to a report from Zion Market Research, the global Cryogenic Equipment Market a compound annual growth rate (CAGR) of 6.5% during the forecast period 2024-2032.

Major driving factors for the growth of cryogenic equipment market are raising LNG demand, improving healthcare services in the growing economies and the development of high temperature superconductor power cables. The global cryogenic equipment market offers new growth opportunities, due to increasing trade of natural gases and rise in cryogenic energy storage systems.

Asia Pacific dominated the market of cryogenic equipment in 2020 and accounted significant share of the market. In Asia Pacific, increasing investments in the energy sector and significant growth in other end-user industries are the factors attributed for the growth of the cryogenic equipment market in this region. The major factor for the growth of cryogenic equipment market is the presence of leading steel production in countries such as China, Japan, India and South Korea. Europe countries have strict regulation governing the use of inland LNG-fueled ships. Also certain countries such as Russia also plan to develop LNG powered locomotives.

The major players operating in the Cryogenic Equipment market are Praxair Inc., FIBA TECHNOLOGIES INC., INOX India Pvt. Ltd., Linde Group AG, Flowserve Corporation, Air Liquide SA, Oxford Instruments Plc., Herose GmbH, Cryoquip Llc, and Wessington Cryogenics, among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed