Construction Composites Market Size, Share Report, Analysis, Trends, Growth 2032

Construction Composites Market by Fiber Type (Glass Fiber, Carbon Fiber, and Others), by Resin Type (Polypropylene, Vinyl Ester, Polyester, and Polyethylene), and by Application (Commercial, Industrial, Residential, and Others): Global Industry Perspective, Comprehensive Analysis, and Forecast, 2024-2032

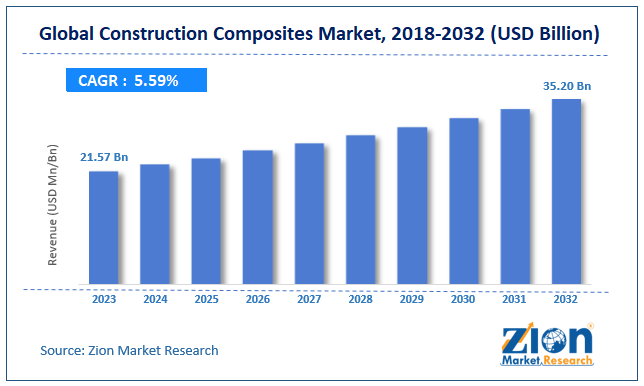

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 21.57 Billion | USD 35.20 Billion | 5.59% | 2023 |

Construction Composites Industry Perspective:

The global Construction Composites market size accrued earnings worth approximately USD 21.57 Billion in 2023 and is predicted to gain revenue of about USD 35.20 Billion by 2032, is set to record a CAGR of nearly 5.59% over the period from 2024 to 2032.

Key Insights

- As per the analysis shared by our research analyst, the construction composites market is anticipated to grow at a CAGR of 5.59% during the forecast period (2024-2032).

- The global construction composites market was estimated to be worth approximately USD 21.57 billion in 2023 and is projected to reach a value of USD 35.20 billion by 2032.

- The growth of the construction composites market is being driven by the rising need for lightweight, durable, and high-performance materials in modern infrastructure projects.

- Based on the fiber type, the glass fiber segment is growing at a high rate and is projected to dominate the market.

- On the basis of resin type, the polypropylene segment is projected to swipe the largest market share.

- In terms of applications, the commercial segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

Construction Composites Market: Overview

Construction composites skillfully arrange various materials together to form the single entity with improved and advanced properties than the materials in the composite. These materials are widely used in various applications such as industrial, automotive, wind energy, marine, and aerospace.

Increased use of the composites in the construction sector and the less maintenance cost and long shelf life provided by the composites are expected to drive the global construction composites market. Moreover, economic growth and rapid urbanization in both developed and emerging economies are estimated to boost the construction composites market. However, high initial installation and production costs for composites and issues of recyclability are anticipated to impede the growth of the market. Nevertheless, the increased demand for the construction composites in the civil applications and rising demand in pultruded profiles are likely to set new wings to the global construction composites within the years to come.

Construction Composites Market Growth Analysis

Consciousness and Substitution

Strict government laws regarding the usage of construction composites will increase awareness and create more profitable prospects for market players in the construction composites industry from 2024 to 2032.

Furthermore, the diverse variety of applications in sectors such as construction, infrastructure, aerospace, and defense will contribute to the significant expansion of the construction composites market, creating abundant prospects for growth.

The study includes major drivers and restraints for the construction composites market, along with the impact they have on the demand over the forecast period. Additionally, the report includes the study of opportunities available in the construction composites market on a global level.

For providing the users of this report with a comprehensive view of the construction composites, we have included a product portfolio of key vendors and a detailed competitive scenario. To understand the competitive landscape in the market, an analysis of Porter’s Five Forces model for the construction composites market has also been included. The construction composites market report covers an in-depth study of the global and regional market and market attractiveness analysis, wherein application segments are benchmarked based on their growth rate, general attractiveness, and market size.

Recent Development

- In July 2022, Saint-Gobain finalized the acquisition of Kaycan, a family-owned Canadian manufacturer and distributor of exterior building materials, in a deal valued at US$928 million. The acquisition supports Saint-Gobain’s “Grow & Impact” strategy, strengthening its position as a global leader in light and sustainable construction.

- In June 2022, Owens Corning, a global leader in building and construction materials, acquired WearDeck, a premium producer of high-performance composite decking. The acquisition strategically expands Owens Corning’s Composites business and strengthens its presence in the growing market for durable, low-maintenance outdoor living solutions.

Construction Composites Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Construction Composites Market |

| Market Size in 2023 | USD 21.57 Billion |

| Market Forecast in 2032 | USD 35.20 Billion |

| Growth Rate | CAGR of 5.59% |

| Number of Pages | 202 |

| Key Companies Covered | Hughes Brothers, Inc., Schoeck International, Advanced Environmental Recycling Technologies, Inc., Jamco Corporation, UPM Biocomposites, Exel Composites Oyj, Bedford Reinforced Plastics, Diversified Structural Composites, Strongwell Corporation, and Trex Company, Inc |

| Segments Covered | By Fiber Type, By Resin Type, By Applications, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Construction Composites Market Segment Analysis

The construction composites market is classified into fiber type, resin type, application, and region. In terms of fiber type, the market is categorized into the glass fiber, carbon fiber, and others. The carbon fiber segment accounted for the largest market share in 2023. It is anticipated to be the dominating segment in the near future. In terms of resin type, the market is categorized into polypropylene, vinyl ester, polyester, and polyethylene. In terms of application, construction composites market is segmented into commercial, industrial, residential, and others. Industrial application accounted for the largest market share in 2023. Rapid usage of composites for walkways, ladders, trash gates, stairways, and gratings in the industrial applications, due to the moisture-proof and anti-corrosion properties of composites has fueled the demand for the construction composites market during the forecast period.

Construction Composites Market Regional Analysis

The Asia Pacific is the largest market for the construction composites market followed by Europe and North America. The major rising markets and the developments are registered in the developing and developed regions such as China, Japan, Indonesia, South Korea, and India. The expansion in the demand for production and the low cost of ownership is fuelling the market growth in the Asia Pacific. Some of the other factors which are boosting the market in the region are the rising infrastructure industry, increasing disposable income of the middle-class population, growing investments for the construction and developments of the big infrastructure projects in the region. The Middle East & Africa and Latin America are projected to witness significant demand in coming years, owing to the growing construction industry in the region.

The key manufacturers in the global construction composites market are

- Hughes Brothers, Inc.

- Schoeck International

- Advanced Environmental Recycling Technologies, Inc.

- Jamco Corporation

- UPM Biocomposites

- Exel Composites Oyj

- Bedford Reinforced Plastics

- Diversified Structural Composites

- Strongwell Corporation

- and Trex Company, Inc

This report segments the construction composites market as follows:

Construction Composites Market: Fiber Type

- Glass fiber

- Carbon fiber

- Others

Construction Composites Market: Resin Type

- Polypropylene

- Vinyl Ester

- Polyester

- Polyethylene

Construction Composites Market: Applications

- Commercial

- Industrial

- Residential

- Others

Construction Composites Market: Region Analysis

-

North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- The Middle East and Africa

Table Of Content

Methodology

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed