Combat System Integration Market Size, Share, Growth, Trends, Forecast 2032

Combat System Integration Market By Platform (Large Combat Ships, Medium Combat Ships, Helicopters, Small Combat Ships, Submarines, Fighter Aircraft And Armored Vehicles/Artillery), By Application (Naval, Airborne And Land-Based), and By Region: Global Industry Perspective, Comprehensive Analysis And Forecast, 2024-2032

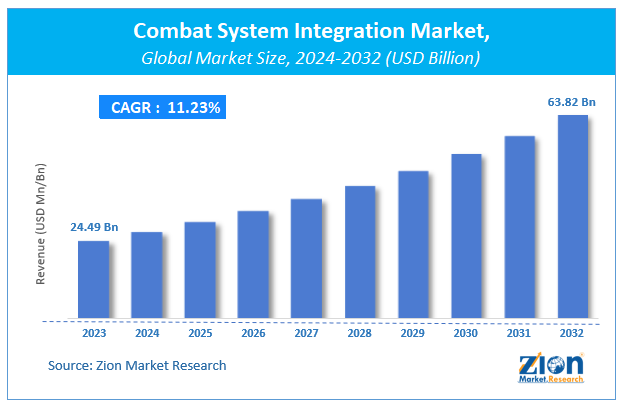

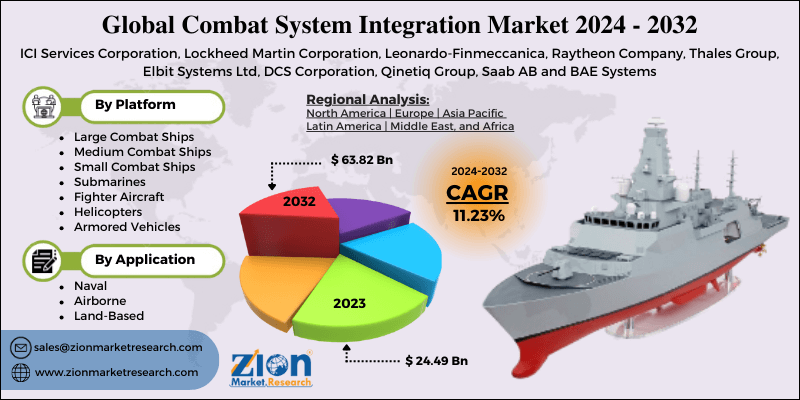

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 24.49 Billion | USD 63.82 Billion | 11.23% | 2023 |

Combat System Integration Market Insights

Zion Market Research has published a report on the global Combat System Integration Market, estimating its value at USD 24.49 Billion in 2023, with projections indicating that it will reach USD 63.82 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 11.23% over the forecast period 2024-2032.

The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Combat System Integration Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Global Combat System Integration Market: Overview

A combat system architecture is a reference model for functional tasks by combat forces. It comprises a well designed sequence of combat scenarios and is helpful to navigate during a large combat. The systems are well supportive of transformational and operating processes. Various countries tend to enhance defence systems to cope with border issues. Therefore, the growing need for unmanned systems is likely to emerge as a transformation in the weapon industry.

COVID-19 Impact Analysis:

The outbreak of COVID-19 has certainly compelled the combat system integration take a backseat, as combating Covid-19 is the topmost priority as of now. Though the defense personnel are full-on with their tasks, research pertaining to warfare has slowed down, as budgets are being diverted towards the healthcare vertical in wake of the ongoing pandemic. It will take atleast mid-2022 for the situation to normalize with more than 80% of the global population getting vaccinated. Thereafter, combat system integration is likely to pick up pace.

Combat System Integration Market: Growth Factors

Combat system integration implies emphasis on application of system engineering and architecture to design and construct modern-day combat systems and integrating them. The basic drivers to combat system integration market are rise in the interconnected warfare systems, focus on defense budgets by various countries, and continuous upgradation in the existing combat systems. The naval sector is also paid heed to – with new warships being commissioned. The existing submarines are also being upgraded. These factors are enough to drive the combat system integration market in the upcoming period.

Combat System Integration Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Combat System Integration Market |

| Market Size in 2023 | USD 24.49 Billion |

| Market Forecast in 2032 | USD 63.82 Billion |

| Growth Rate | CAGR of 11.23% |

| Number of Pages | 150 |

| Key Companies Covered | ICI Services Corporation, Lockheed Martin Corporation, Leonardo-Finmeccanica, Raytheon Company, Thales Group, Elbit Systems Ltd, DCS Corporation, Qinetiq Group, Saab AB and BAE Systems |

| Segments Covered | By Platform, By Application and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Combat System Integration Market: Segment Analysis

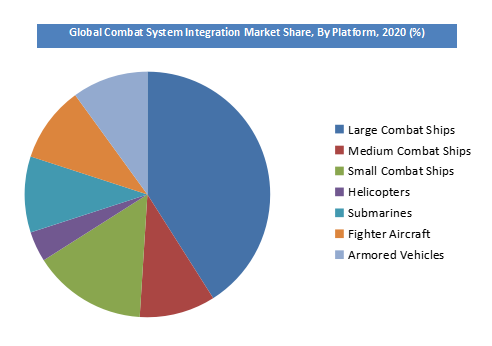

Platform Segment Analysis Preview

Based on the platform, global combat system integration market is categorized into large combat ships, medium combat ships, helicopters, small combat ships, submarines, fighter aircraft and armored vehicles/artillery. Submarines dominated in the past few years and it is expected that it will continue dominating in the coming years owing to their specialty for long-range attacks.

Application Segment Analysis Preview

Based on application, the global combat system integration market is categorized into naval, airborne, and land-based. Naval application accounted for a significant share due to advanced research and development of state-of-the-art weapons. Besides, intense research and development is likely to encourage a significant market development.

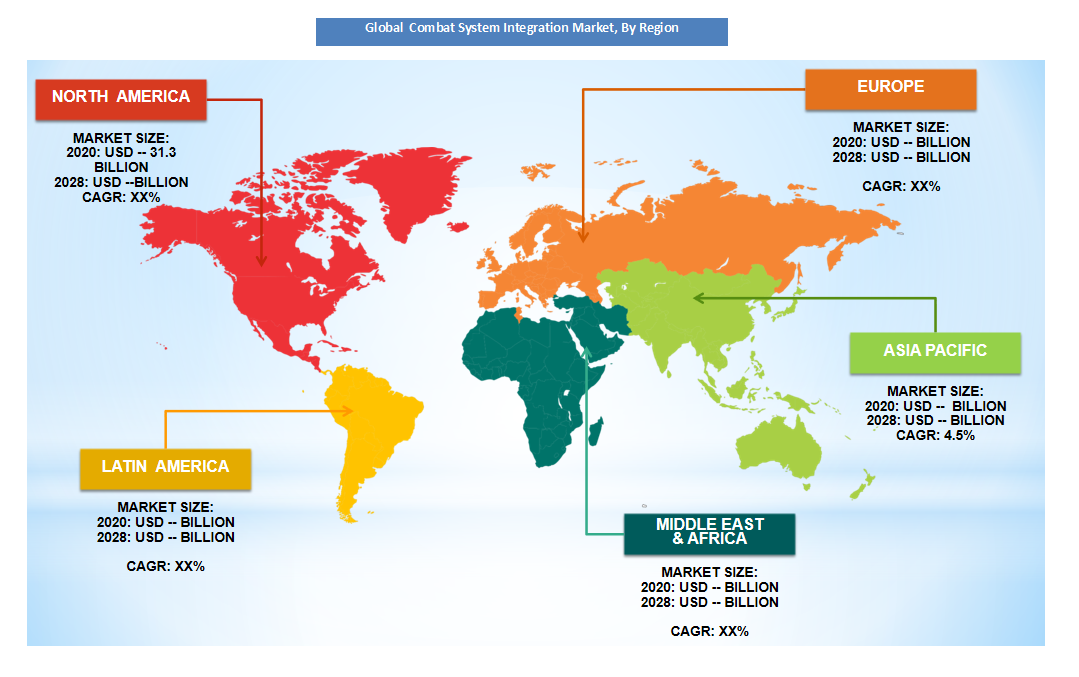

Combat System Integration Market: Regional Segment Analysis Preview:

Asia Pacific is anticipated to have a significant growth in the coming years owing to rapid advancements taking place in its warfare systems by emerging countries of Asia Pacific coupled with the need for improved integration of combat system. Europe and North America are more likely to register significant growth due to rise in development in warfare studies.

Combat System Integration Market: Competitive Landscape

Some of the key players in the combat system integration market are-

- ICI Services Corporation

- Lockheed Martin Corporation

- Leonardo-Finmeccanica

- Raytheon Company

- Thales Group

- Elbit Systems Ltd

- DCS Corporation

- Qinetiq Group

- Saab AB and BAE Systems amongst others.

The Global Combat System Integration Market is segmented into

By Platform

- Large Combat Ships

- Medium Combat Ships

- Small Combat Ships

- Submarines

- Fighter Aircraft

- Helicopters

- Armored Vehicles

By Application

- Naval

- Airborne

- Land-Based

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Combat System Integration Market market size valued at US$ 24.49 Billion in 2023

Combat System Integration Market market size valued at US$ 24.49 Billion in 2023, set to reach US$ 63.82 Billion by 2032. CAGR of about 11.23% from 2024 to 2032.

Some of the key factors driving the global Combat System Integration market include the rise in the interconnected warfare systems, focus on defense budgets by various countries, and continuous upgradation in the existing combat systems.

Asia Pacific held a substantial share of the Combat System Integration market in 2020. This is attributable to the advanced research and availability of technology. China is world’s largest manufacturer of warfare weapons and use of innovative technology.

Some of the major companies operating in Combat System Integration market are ICI Services Corporation, Lockheed Martin Corporation, Leonardo-Finmeccanica, Raytheon Company, Thales Group, Elbit Systems Ltd, DCS Corporation, Qinetiq Group, Saab AB and BAE Systems amongst others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed