Coal Bed Methane Market Growth, Size, Share, Trends, and Forecast 2032

Coal Bed Methane Market By Application (residential, commercial, industrial, power generation, and transportation applications), By Technology (horizontal drilling, proppants, and hydraulic fracturing technology) And By Region: - Global And Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts, 2024-2032

| Market Size in 2023 | Market Forecast in 2032 | Growth Rate (in %) | Base Year |

|---|---|---|---|

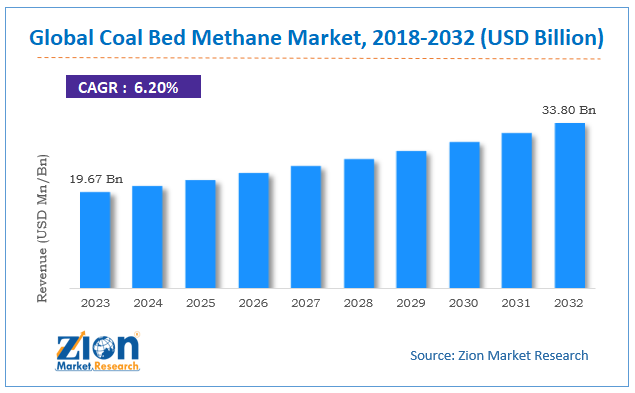

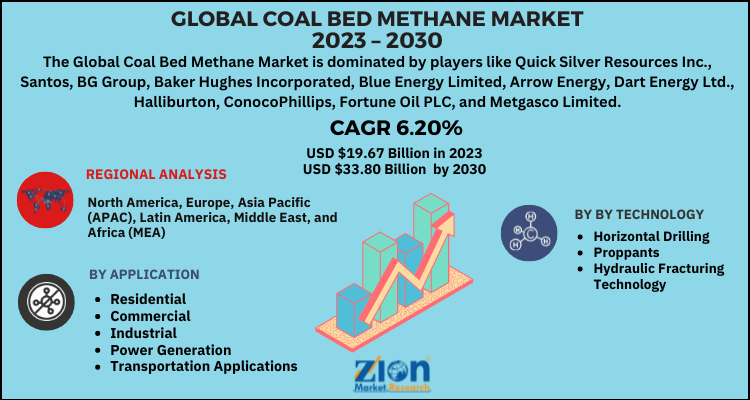

| USD 19.67 Billion | USD 33.80 Billion | CAGR at 6.20% | 2023 |

Description

According to the report published by Zion Market Research, the global Coal Bed Methane Market size was valued at USD 19.67 Billion in 2023 and is predicted to reach USD 33.80 Billion by the end of 2032. The market is expected to grow with a CAGR of 6.20% during the forecast period. The report analyzes the global Coal Bed Methane Market’s growth drivers, restraints, and impact on demand during the forecast period. It will also help navigate and explore the arising opportunities in the Coal Bed Methane Market industry.

Key Insights:

- As per the analysis shared by our research analyst, the coal bed methane market is anticipated to grow at a CAGR of 6.20% during the forecast period (2024-2032).

- The global coal bed methane market was estimated to be worth approximately USD 19.67 billion in 2023 and is projected to reach a value of USD 33.80 billion by 2032.

- The growth of the coal bed methane market is being driven by growing market owing to factors such as a large number of unexplored reserves.

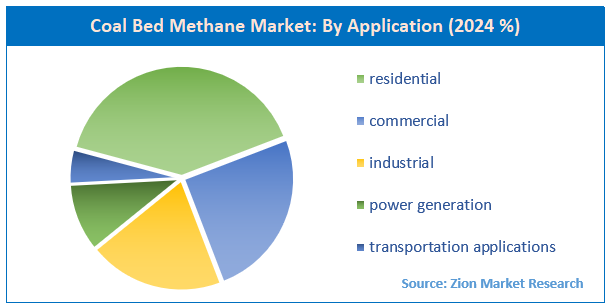

- Based on the application, the residential segment is growing at a high rate and is projected to dominate the market.

- On the basis of technology, the horizontal drilling segment is projected to swipe the largest market share.

- By region, North America is expected to dominate the global market during the forecast period.

Global Coal Bed Methane Market: Overview

Coal bed methane is nothing but the methane that is adsorbed by the solid components of the coal. It is distinct from typical sandstone or other gas reservoirs due to the adsorption process. Owing to the lack of hydrogen sulfide, it is also called as “sweet gas”. The methane adsorbed by the coal is in the near-liquid state. The open fractures may also contain free methane gas. It is important to drain out maximum methane gas during extraction process to avoid the risk of explosion. Countries with abundant coal reserves, high energy demand, and high population serve as lucrative markets.

Global Coal Bed Methane Market: Segmentation

The global coal bed methane market is segmented into its application, technology, and geography.

On the basis of Application, the market is divided into residential, commercial, industrial, power generation, and transportation applications.

Based on Technology, the market is segregated into horizontal drilling, proppants, and hydraulic fracturing technology.

On the basis of the Region, diversification of the market is seen in North America, Asia Pacific, Europe, and Rest of the World.

Global Coal Bed Methane Market: Growth Factors

The coal bed methane market is a growing market owing to factors such as a large number of unexplored reserves, increasing investments which will be profitable in the future technological development and shifting focus towards the use of unconventional sources of energy. Opportunity for further growth is visible due to the vast contribution of the coal bed methane towards the global energy mix. However, there are many restraining factors to the market. This restraint can be categorized into environmental restrains, economically restrains, and technical restrains.

The environmental restrains include safety issues regarding extraction from depths and risk connected with the emission of greenhouse gas. The economical restrains are encountered in the early stages of recovery. These include the high capital requirement, problems arising from the increasing quantities of water pumped, and requirement of the low pressure pipeline system. Technical restrains include issues arising during the completion and optimization of the designs to achieve maximum production with optimum spacing, number, and location of wells.

Recent Developmentst

- In February 2022, ConocoPhillips, a leading U.S. hydrocarbon company, acquired a majority stake in Australia Pacific LNG (APLNG) for $1.645 billion. As one of Australia’s key CBM producers, APLNG offers ConocoPhillips greater control over its investments in the country’s domestic gas sector. The deal underscores the growing interest of major energy companies in consolidating assets within established CBM-producing regions.

Coal Bed Methane Market : Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Coal Bed Methane Market Research Report |

| Market Size in 2023 | USD 19.67 Billion |

| Market Forecast in 2032 | USD 33.80 Billion |

| Growth Rate | CAGR of 6.20% |

| Number of Pages | 196 |

| Key Companies Covered | Quick Silver Resources Inc., Santos, BG Group, Baker Hughes Incorporated, Blue Energy Limited, Arrow Energy, Dart Energy Ltd., Halliburton, ConocoPhillips, Fortune Oil PLC, and Metgasco Limited. |

| Segments Covered | By Application, By Technology and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Coal Bed Methane Market Dynamics

Key Growth Drivers

The Coal Bed Methane (CBM) market is primarily driven by the escalating global demand for cleaner energy sources and the ongoing transition away from traditional, more polluting fossil fuels like coal and oil. CBM, being a form of natural gas, burns more cleanly and produces fewer greenhouse gas emissions, making it an attractive alternative in the context of global climate change initiatives and government policies aimed at reducing carbon footprints. Furthermore, advancements in extraction technologies, such as horizontal drilling and hydraulic fracturing, have significantly improved the efficiency and cost-effectiveness of CBM production, making it a more economically viable resource. The increasing investment in natural gas infrastructure, including pipelines and processing facilities, also supports the integration of CBM into the broader energy mix, thereby driving market growth.

Restraints

Despite its potential, the CBM market faces several significant restraints. The high initial capital expenditure for exploration and drilling, particularly in geologically complex coal seams with low permeability, can be a major barrier to entry for many companies. The process of CBM extraction also produces large volumes of water, often saline or contaminated, which presents a significant and costly challenge for disposal and can pose a risk of groundwater contamination if not managed properly. Furthermore, regulatory uncertainties and a lack of clear and consistent policies regarding land acquisition and environmental clearances in some regions can delay or even halt CBM projects. The competition from other, more established energy sources, including conventional natural gas and increasingly, renewable energy, also acts as a market restraint.

Opportunities

The CBM market is presented with significant opportunities, particularly in a dual-benefit scenario. As a greenhouse gas that is 25 times more potent than carbon dioxide, methane is a major contributor to climate change. Capturing methane from coal seams not only provides a valuable energy source but also prevents it from being vented into the atmosphere, directly addressing a critical environmental concern. This dual role positions CBM as a key component of a low-carbon energy transition strategy. The application of carbon capture and sequestration (CCS) technologies in conjunction with CBM production offers an even greater opportunity to reduce emissions. Additionally, the vast, unexplored CBM reserves in various parts of the world, especially in the Asia-Pacific region, provide a fertile ground for future exploration and production activities, offering long-term growth prospects.

Challenges

The CBM market is not without its challenges. The primary environmental challenge is the management and disposal of the large volumes of produced water, which can be a complex and expensive process. There are also concerns about methane leakage during the drilling and production phases, which can negate the environmental benefits of using CBM as a cleaner fuel. Public opposition and resistance from local communities, often fueled by fears of land degradation, water contamination, and air pollution, can also hinder project development. Technically, the variability in geological conditions and the difficulty in predicting reservoir performance can lead to unpredictable production rates and economic uncertainties. The lack of a skilled workforce and specific technological expertise in some developing regions further compounds these challenges, making it difficult to optimize production and ensure safe operations.

Global Coal Bed Methane Market: Regional Analysis

The largest share of the coal bed methane market is held by North America. The biggest resources for coal bed methane are located in Canada and the US. Following North America is Asia Pacific owing to the large numbers of unexplored reserves in this region and increasing demand for methane gas along with the natural gas. Major countries showing a lucrative market in Asia Pacific include China, Indonesia, Australia, and India. Significant growth of the market will also be witnessed in the UK, Russia, and Poland in the European region.

Global Coal Bed Methane Market: Competitive Players

Some of the major companies in the coal bed methane market are:

- Quick Silver Resources Inc.

- Santos

- BG Group

- Baker Hughes Incorporated

- Blue Energy Limited

- Arrow Energy

- Dart Energy Ltd.

- Halliburton

- ConocoPhillips

- Fortune Oil PLC

- Metgasco Limited.

The Global Coal Bed Methane Market is segmented as follows:

By Application

- Residential

- Commercial

- Industrial

- Power Generation

- Transportation Applications

By Technology

- Horizontal Drilling

- Proppants

- Hydraulic Fracturing Technology

Global Coal Bed Methane Market: Regional Segment Analysis

- North America

- U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- The Middle East and Africa

What Reports Provides

- Full in-depth analysis of the parent market

- Important changes in market dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional markets

- Testimonials to companies in order to fortify their foothold in the market.

Table Of Content

FrequentlyAsked Questions

Based on statistics from the Zion Market Research, the global Coal Bed Methane Market size was projected at approximately US$ 19.67 Billion in 2023. Projections indicate that the market is expected to reach around US$ 33.80 Billion in revenue by 2032.

The global Coal Bed Methane Market is expected to grow at a Compound Annual Growth Rate (CAGR) of around 6.20% during the forecast period from 2024 to 2032.

North America is expected to dominate the global Coal Bed Methane Market.

The global Coal Bed Methane Market is driven by several key factors such as; rising demand for fresh and organic produce, population growth, and health-conscious consumer preferences.

Some of the prominent players operating in the global Coal Bed Methane Market are; Quick Silver Resources Inc., Santos, BG Group, Baker Hughes Incorporated, Blue Energy Limited, Arrow Energy, Dart Energy Ltd., Halliburton, ConocoPhillips, Fortune Oil PLC, and Metgasco Limited.

The global Coal Bed Methane Market report provides a comprehensive analysis of market definitions, growth factors, opportunities, challenges, geographic trends, and competitive dynamics.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed