Global CMP Slurry Market Size, Share, Growth Analysis Report - Forecast 2034

CMP Slurry Market By Type (Aluminum Oxide CMP Slurry, Cerium Oxide CMP Slurry, Ceramic CMP Slurry, Silica CMP Slurry), By Application (Silicon Wafers, Disk-Drive Components, Optical Substrates, Others, DIY Activities), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

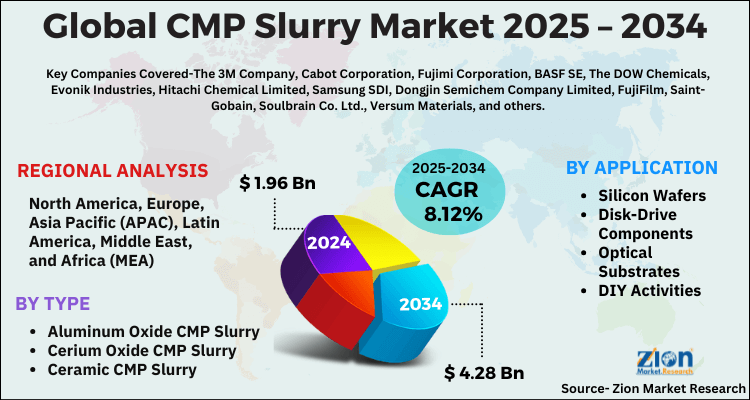

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1.96 Billion | USD 4.28 Billion | 8.12% | 2024 |

CMP Slurry Market: Industry Perspective

The global CMP slurry market size was worth around USD 1.96 Billion in 2024 and is predicted to grow to around USD 4.28 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 8.12% between 2025 and 2034. The report analyzes the global CMP slurry market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the CMP slurry industry.

The CMP slurry market report is an indispensable guide on growth factors, challenges, restraints, and opportunities in the global marketspace. The report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, PESTEL analysis, SWOT analysis, Porter’s five force analysis, and value chain analysis. Additionally, the CMP slurry industry report explores the investor and stakeholder space to help companies make data-driven decisions.

CMP Slurry Market: Overview

Chemical mechanical planarization (CMP) slurry is a liquid dispersion comprising active chemicals & micro-abrasive grains that are utilized in the chemical mechanical planarization (CMP) process. Reportedly, CMP is a surface polishing and material removal process demonstrating both chemical attack and abrasive removal features. For the record, CMP slurry is used in combination with CMP cloths and polishing naps. Moreover, the former is rotated and held against a substrate during the process of planarization.

Key Insights

- As per the analysis shared by our research analyst, the global CMP slurry market is estimated to grow annually at a CAGR of around 8.12% over the forecast period (2025-2034).

- Regarding revenue, the global CMP slurry market size was valued at around USD 1.96 Billion in 2024 and is projected to reach USD 4.28 Billion by 2034.

- The CMP slurry market is projected to grow at a significant rate due to increasing demand for advanced semiconductors due to the miniaturization of electronic devices, the expansion of semiconductor manufacturing facilities, and the rising adoption of technologies like 5G, AI, IoT, and electric vehicles.

- Based on Type, the Aluminum Oxide CMP Slurry segment is expected to lead the global market.

- On the basis of Application, the Silicon Wafers segment is growing at a high rate and will continue to dominate the global market.

- Based on region, Asia-Pacific is predicted to dominate the global market during the forecast period.

CMP Slurry Market: Dynamics

Key Growth Drivers:

The CMP slurry market is mainly driven by rapid expansion and continuous scaling of the semiconductor industry—demand for smaller nodes and better surface planarity raises the need for advanced, high-performance slurries. Growth in consumer electronics, 5G, AI accelerators, and automotive electronics increases wafer volumes and complexity, boosting slurry consumption. Innovations in slurry chemistries (for oxide, copper, tungsten, and low-k dielectric polishing) and tighter process control that improve yield and throughput also propel market adoption. Finally, rising investments in new fabs and capacity expansions across Asia and other regions create sustained, large-volume demand for CMP consumables.

Restraints:

Adoption of advanced CMP slurries is constrained by high development and qualification costs—custom formulations require long, costly process integration and validation at fabs. Strict purity and contamination control requirements raise manufacturing complexity and capital expenditure for slurry producers. Price sensitivity from large OEMs and the concentration of buying power among a few chip manufacturers can compress supplier margins. Environmental regulations and the need for safe handling and disposal of slurry waste further increase operating costs and can delay market entry in some jurisdictions.

Opportunities:

Opportunities exist in developing slurries tailored for emerging materials and applications—advanced nodes, 3D packaging, heterogeneous integration, MEMS, LEDs, and power devices each need specialized chemistries and abrasives. Growth of regional fab investments in India, Southeast Asia, and expanding capacity in China and Taiwan presents new customer bases for local or regional slurry suppliers. Process-intensification trends (higher throughput, single-step polish) and digital process monitoring offer scope for value-added offerings (formulation + analytics + on-site support). Eco-friendly/recyclable slurry formulations and waste-minimization services can also open differentiated, regulatory-friendly revenue streams.

Challenges:

Key challenges include maintaining ultra-low contamination and batch-to-batch consistency while scaling production—even trace impurities can cause yield loss at advanced nodes. Intense competition from established global suppliers makes differentiation difficult without continuous R&D investment. Supply chain volatility for critical raw materials (abrasives, specialty chemicals) can disrupt production and pricing. Finally, the long lead times to qualify new slurries with fabs and the close co-development required with customers make revenue ramp slower and resource-intensive for new entrants.

CMP Slurry Market: Segmentation

The global CMP slurry market is sectored into type, application, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2025 to 2034.

In type terms, the global CMP slurry market is segregated into aluminum oxide CMP slurry, cerium oxide CMP slurry, ceramic CMP slurry, and silica CMP slurry segments. In addition to this, the aluminum oxide CMP slurry segment, which accrued more than 35% of the global market share in 2022, is predicted to record the fastest CAGR in the forecast timeline. The growth of the segment in the coming years can be credited to its easy availability for the tungsten CMP process that requires excellent planarity and accurate uniform control. In addition to this, aluminum oxide offers exceptional planarity and outstanding performance.

On the basis of the application, the CMP slurry industry across the globe is sectored into silicon wafers, disk-drive components, optical substrates, and others segments. Furthermore, the silicon wafers segment, which accrued a huge chunk of the global industry share in 2022, is projected to lead the segmental expansion in the upcoming years. The segmental expansion in the forecast timeline can be subject to a surge in the use of silicon wafers in the production of semiconductor chips, advanced complementary metal oxide semiconductor ICs, and microelectromechanical system equipment for reducing heat & power along with improving the performance.

The Regional, this segment includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America,and the Middle East and Africa.

CMP Slurry Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | CMP Slurry Market |

| Market Size in 2024 | USD 1.96 Billion |

| Market Forecast in 2034 | USD 4.28 Billion |

| Growth Rate | CAGR of 8.12% |

| Number of Pages | 223 |

| Key Companies Covered | The 3M Company, Cabot Corporation, Fujimi Corporation, BASF SE, The DOW Chemicals, Evonik Industries, Hitachi Chemical Limited, Samsung SDI, Dongjin Semichem Company Limited, FujiFilm, Saint-Gobain, Soulbrain Co. Ltd., Versum Materials, and others. |

| Segments Covered | By Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

CMP Slurry Market: Regional Insights

Asia-Pacific to establish its domination in the global market over the forecast timeline

Asia-Pacific, which accumulated more than two-fifths of the global CMP slurry market revenue in 2024, is anticipated to record a notable surge over the assessment timeline. The market expansion in the region over 2025 - 2034 can be due to a rise in the demand for CMP slurry in the semiconductor sector. Apart from this, the rise in the demand for consumer electronic products in countries such as China will prompt the regional market size. In addition to this, countries such as Japan, South Korea, Singapore, and China are major producers of semiconductor chips and have contributed majorly towards the growth of the market in the region.

Furthermore, the CMP slurry industry in North America is expected to register the highest CAGR in the assessment timeline. The factors that are projected to lucratively impact the expansion of the regional industry include the escalating demand for the product in silicon wafer processing and optical substrates in the region. Moreover, the presence of reputed product manufacturers in the sub-continent will embellish regional industry trends.

CMP Slurry Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the CMP slurry market on a global and regional basis.

The global CMP slurry market profiles key players such as:

- The 3M Company

- Cabot Corporation

- Fujimi Corporation

- BASF SE

- The DOW Chemicals

- Evonik Industries

- Hitachi Chemical Limited

- Samsung SDI

- Dongjin Semichem Company Limited

- FujiFilm

- Saint-Gobain

- Soulbrain Co. Ltd.

- Versum Materials.

The global CMP slurry market is segmented as follows:

By Type

- Aluminum Oxide CMP Slurry

- Cerium Oxide CMP Slurry

- Ceramic CMP Slurry

- Silica CMP Slurry

By Application

- Silicon Wafers

- Disk-Drive Components

- Optical Substrates

- Others

- DIY Activities

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Chemical mechanical planarization (CMP) slurry is a liquid dispersion comprising active chemicals & micro-abrasive grains that are utilized in the chemical mechanical planarization (CMP) process. Reportedly, CMP is a surface polishing and material removal process demonstrating both chemical attack and abrasive removal features. For the record, CMP slurry is used in combination with CMP cloths and polishing naps.

The global CMP slurry market is expected to grow due to rising demand for semiconductor wafer polishing, advancements in nanotechnology, and growth in the electronics manufacturing sector.

According to a study, the global CMP slurry market size was worth around USD 1.96 Billion in 2024 and is expected to reach USD 4.28 Billion by 2034.

The global CMP slurry market is expected to grow at a CAGR of 8.12% during the forecast period.

Asia-Pacific is expected to dominate the CMP slurry market over the forecast period.

Leading players in the global CMP slurry market include The 3M Company, Cabot Corporation, Fujimi Corporation, BASF SE, The DOW Chemicals, Evonik Industries, Hitachi Chemical Limited, Samsung SDI, Dongjin Semichem Company Limited, FujiFilm, Saint-Gobain, Soulbrain Co. Ltd., Versum Materials, among others.

The report explores crucial aspects of the CMP slurry market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed