Chlorine Market Growth, Size, Share, Trends, and Forecast 2032

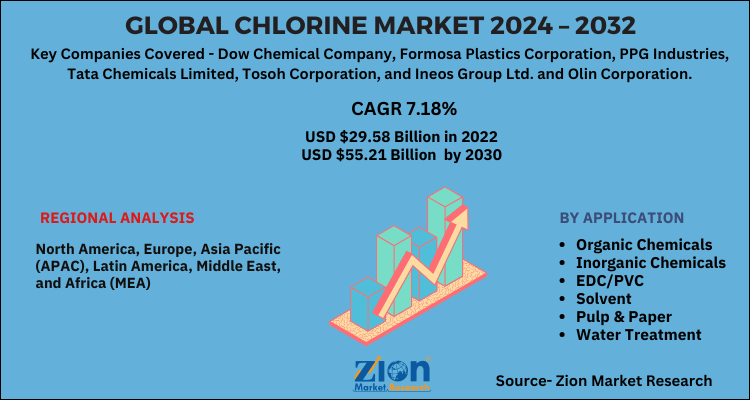

Chlorine Market: By Application (Organic Chemicals, Inorganic Chemicals, EDC/PVC, Solvent, Pulp & Paper, Water Treatment, Others), and Region : Global Industry Perspective, Comprehensive Analysis, Size, Share, Growth, Segment, Trends And Forecast, 2024-2032

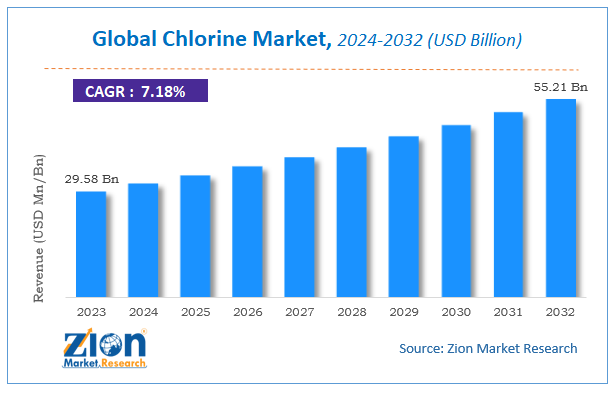

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 29.58 Billion | USD 55.21 Billion | 7.18% | 2023 |

Global Chlorine Market Insights

Zion Market Research has published a report on the global Chlorine Market, estimating its value at USD 29.58 Billion in 2023, with projections indicating that it will reach USD 55.21 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 7.18% over the forecast period 2024-2032. The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Chlorine Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Chlorine Market Size Overview

PVC products and water treatment can’t be imagined without chlorine. It is, in fact, looked upon as the most valuable chemical across the industry vertical and is expected to witness a stupendous CAGR in the next 10 years. It is a known fact that chloride pipes are more durable as well as stronger than conventional pipes. As such, high-rise buildings where it needs to stand sunlight, rain, and gravity ask for chloride pipes

Chlorine is a part of the group of chemicals called halogen, which includes fluorine, bromine, and iodine. Chlorine does not exist naturally as it’s too reactive. Chlorine is widely used in the disinfection of public water supplies to prevent the transmission of waterborne diseases such as cholera and typhoid. Chlorine can be found dissolved in seas and salty lakes as well as in the ground as rock salts or halite. Chlorine is available in various forms, which include hypo-chloride solution, chlorine gas and other compounds in solid or liquid forms. Chlorine is used in several consumer products such as in batteries, nickel chlorine etc.

Chlorine Market Growth Factors:

The global chlorine market is predominantly driven by the growing need for sanitization in public places. It is a widely used disinfectant in agrochemicals, pharmaceuticals, and other industries. Moreover, chlorine is essential in the water treatment process. With the emergence of SMART Cities and townships, stringent regulations have been incorporated for the disposal of wastewater. In modern colonies, wastewater is recycled and reused through a chlorine filtration process. Therefore, chlorine forms an important and inseparable ingredient in application-based industries.

Chlorine market is expected to show high growth in light of its extensive usage in aromatics, textiles, agrochemicals, pharmaceuticals, insecticides etc. Furthermore, an increase of water treatment and pharmaceutical industries across the globe and their demand for chlorine is another key factor contributes to driving the market growth. Chlorine is wildly used as a raw material for the production of important chemicals which is further anticipated to propel the market growth within the forecast period.

Furthermore, more than 95% of water treatment plants and 85% of pharmaceutical industries across the globe use chlorine in production processes. However, its energy intensive operations coupled with environmental concerns may pose a threat to the market growth over the years. Nevertheless, increasing demand in EDC/PVC which is required in the construction industry is expected to open up new growth opportunities in the years to come.

Chlorine Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Chlorine Market |

| Market Size in 2023 | USD 29.58 Billion |

| Market Forecast in 2032 | USD 55.21 Billion |

| Growth Rate | CAGR of 7.18% |

| Number of Pages | 192 |

| Key Companies Covered | Dow Chemical Company, Formosa Plastics Corporation, PPG Industries, Tata Chemicals Limited, Tosoh Corporation, and Ineos Group Ltd. and Olin Corporation. |

| Segments Covered | By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Application Segment Analysis Preview:

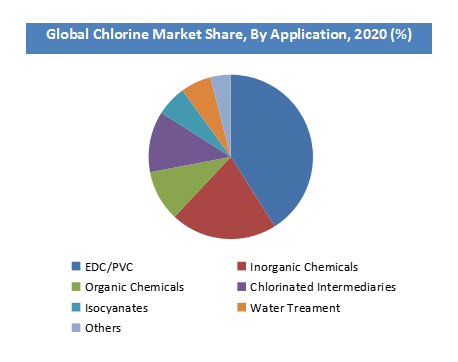

Based on application, the chlorine market is segmented as EDC/PVC, inorganic chemicals, organic chemicals, chlorinated intermediaries, isocyanates, pulp & paper, water treatment, and others (TiO2 & HCl). EDC/PVC accounted for a significant share in 2019 owing to an increase in demand from the construction industry. Water treatment is the second leading segment attributed to hygiene and sanitization demands for public utilities.

Regional Segment Analysis Preview:

The Asia Pacific accounted for a significant market share in 2020. The presence of plastic and paint industries in the Asia Pacific is expected to propel regional market growth. Besides, chlorine is largely used as a disinfectant for hygiene in lavatories. Europe and North America are expected to follow the Asia Pacific owing to the rise in the importance of Chlorine for public utilities.

Key Players and Competitive Landscape:

Some of the key players in the chlorine market include-

- The Dow Chemical Company

- Formosa Plastics Corporation

- PPG Industries

- Tata Chemicals Limited

- Tosoh Corporation

- Ineos Group Ltd

- Olin Corporation

The Global Chlorine Market is segmented as :

By Application:

- Organic Chemicals

- Inorganic Chemicals

- EDC/PVC

- Solvent

- Pulp & Paper

- Water Treatment

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global chlorine market was valued at USD 29.58 Billion in 2023.

The global chlorine market is expected to reach USD 55.21 Billion by 2032, expanding at a CAGR of 7.18% between 2024 to 2032.

Some of the key factors driving the global chlorine market growth include the growing need for sanitization in public places. It is a widely used disinfectant in agrochemicals, pharmaceuticals, and other industries.

Asia Pacific accounted for a substantial share of the chlorine market in 2022. This is attributable to the presence of top companies such as he Dow Chemical Company, Formosa Plastics Corporation, PPG Industries, Tata Chemicals Limited. China is world’s largest manufacturer and the consumer of chlorine owing it to the large population and the raw material available.

Some of the major companies operating in the global chlorine market are The Dow Chemical Company, Formosa Plastics Corporation, PPG Industries, Tata Chemicals Limited, Tosoh Corporation, and Ineos Group Ltd. and Olin Corporation.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed