Chemical Vapour Deposition (CVD) Equipment Market Size, Growth, Industry Trends 2034

Chemical Vapour Deposition (CVD) Equipment Market By Type (Atmospheric Pressure CVD, Low Pressure CVD, and Ultrahigh Vacuum CVD), By Material Type (Metal, Ceramic, and Composite), By Technology (Plasma-Assisted and Thermal), By Application (Semiconductor, Solar Panels, LED, Data Storage, and Others), By End-user (Cutting Tools, Electronics, Aerospace, Automotive, Industrial, Medical Devices, and Others), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

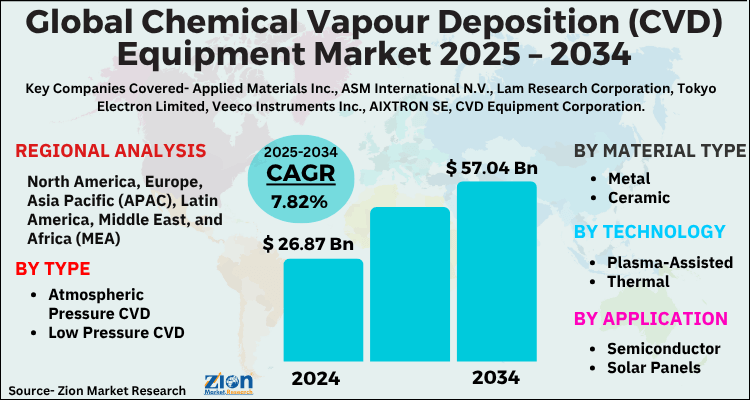

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 26.87 Billion | USD 57.04 Billion | 7.82% | 2024 |

Chemical Vapour Deposition (CVD) Equipment Market: Industry Perspective

The global chemical vapour deposition (CVD) equipment market size was worth around USD 26.87 Billion in 2024 and is predicted to grow to around USD 57.04 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 7.82% between 2025 and 2034. The report analyzes the global chemical vapour deposition (CVD) equipment market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the chemical vapour deposition (CVD) equipment industry.

Chemical Vapour Deposition (CVD) Equipment Market: Overview

Chemical vapor deposition (CVD) equipment is a manufacturing device used during the process of chemical vapor deposition. In this process, thin films of various materials are deposited on solid substrates, such as silicon wafers. This assists in creating functional layers or coatings that provide specific properties. The equipment consists of a reactor or a chamber where the process of deposition takes place. The design of the device allows the creation of a controlled environment that has precise conditions allowing thin film deposition. CVD equipment can be customized depending on the final requirements. This helps in optimizing the process for specific materials and applications. CVD equipment is used in various industries such as semiconductor manufacturing, solar cells, optical coatings, and thin-film electronics. The choice of the process and the equipment depends entirely on desired film characteristics along with substrate material, and specific application requirements.

Key Insights

- As per the analysis shared by our research analyst, the global chemical vapour deposition (CVD) equipment market is estimated to grow annually at a CAGR of around 7.82% over the forecast period (2025-2034).

- Regarding revenue, the global chemical vapour deposition (CVD) equipment market size was valued at around USD 26.87 Billion in 2024 and is projected to reach USD 57.04 Billion by 2034.

- The chemical vapour deposition (CVD) equipment market is projected to grow at a significant rate due to Rising use in semiconductors, solar panels, and advanced coatings fuels demand. Technological advancements and miniaturization trends further support growth.

- Based on technology, plasma-assisted was predicted to show maximum market share in the year 2024

- Based on end-user, electronics segment is growing at a high rate and will continue to dominate the global market.

- On the basis of region, Asia-Pacific is predicted to dominate the global market during the forecast period.

Chemical Vapour Deposition (CVD) Equipment Market: Growth Drivers

Increasing application in semiconductor industry to propel market demand

The global chemical vapor deposition (CVD) equipment market is projected to grow owing to the increasing application of the equipment in one of the fastest-growing and valuable sectors which is the semiconductor industry. There are several applications of CVD equipment in this sector. For instance, it is used in the deposition of thin film on semiconductor substrates. This includes materials such as silicon dioxide (SiO2), silicon nitride (Si3N4), and various metal films. They are important for the fabrication of transistor gates, interconnects, dielectric layers, and other components of integrated circuits (ICs). Moreover, the application of CVD equipment in the Epitaxial growth process has allowed more demand in the industry. In this process, a single-crystal layer is deposited on a silicon wafer. Other processes such as Low-Pressure Chemical Vapor Deposition (LPCVD) and Diffusion Barrier Deposition have also led to higher use of the device.

Chemical Vapour Deposition (CVD) Equipment Market: Restraints

High initial investment to restrict market expansion

CVD equipment requires high initial investment due to the complex design of the machine. It is made of specialized components and has sophisticated control designs. Moreover, if the machine has to be customized depending on the user’s needs, the cost may go up even higher. This has led to restricted growth in the global chemical vapor deposition equipment industry especially in small and medium-sized end-user companies. Additionally, there is a growing segment of consumers showing an inclination toward other alternative methods such as physical vapor deposition (PVD) and atomic layer deposition (ALD).

Chemical Vapour Deposition (CVD) Equipment Market: Opportunities

Emerging use in nanotechnology to provide growth opportunities

The global chemical vapor deposition equipment industry can expect several growth opportunities owing to the increasing application of CVD equipment in nanotechnology which is fast gaining momentum in the science field. Nanotechnology applications are growing in various fields such as electronics, healthcare, energy, and materials science. CVD equipment is likely to play a crucial role in fabricating nanoscale structures and thin films with precise measurements.

Chemical Vapour Deposition (CVD) Equipment Market: Challenges

Technological complexity to challenge the market expansion

The global sales volume of the chemical vapor deposition equipment market may be limited due to the high complexity associated with the technology since CVD processes involve complex chemical reactions and physical phenomena. It requires a deep understanding of materials science, deposition techniques, and process optimization. The development and maintenance of expertise in CVD technology can be a challenge due to the availability of a limited workforce.

Chemical Vapour Deposition (CVD) Equipment Market: Segmentation

The global chemical vapor deposition (CVD) equipment market is segmented based on type, material type, technology, application, end-user, and region.

Based on type, the global chemical vapour deposition (cvd) equipment market is divided into atmospheric pressure CVD, low pressure CVD, and ultrahigh vacuum CVD.

On the basis of material type, the global chemical vapour deposition (cvd) equipment market is bifurcated into metal, ceramic, and composite.

Based on technology, the global market segments are plasma-assisted and thermal. The industry witnessed the highest growth in the plasma-assisted segment in 2024. The technology is also known as plasma-enhanced CVD (PECVD) and it involves the use of plasma to optimize CVD processes. Plasma is created by energizing a gas using an electrical discharge. It leads to the formation of reactive species that assist in the deposition of thin films. The technology offers several benefits such as lower deposition temperatures, improved film quality, enhanced step coverage, and the ability to deposit a wide range of materials. Thermal CVD is also known as traditional CVD or LPCVD and relies on high temperatures to start and drive the chemical reactions for deposition. The temperature range in this process lies between 500°C to 1200°C.

Based on end-user, the chemical vapor deposition equipment is divided into cutting tools, electronics, aerospace, automotive, industrial, medical devices, and others. The highest growth was observed in the electronic segment where the equipment is crucial for the fabrication of several forms of electronic components and semiconductor devices. The industry relies heavily on CVD equipment for important processes such as deposition, diffusion, epitaxy, and etching. Some of the advantages of using the technology include ensuring uniformity, conformality, and precise control of film properties. It is also used in the production of display panels, LED (light-emitting diode) devices, and other electronic components. A result survey concluded that an average American has access to around 10 connected devices in their household.

Recent Developments

- In May 2023, CVD Equipment Corporation, a global leader that provides chemical vapor deposition and thermal process equipment, announced that after the market closes on 15th May 2023, the company will release its first-quarter financial results of 2023. The company is expected to provide a live and archived webcast of the conference call on its official website after the call is conducted on the same day

- In February 2023, Veeco Instruments Inc. announced its acquisition of Epiluvac AB on January 31, 2023. The latter is a private company that manufactures CVD epitaxy systems that cater to the electric vehicle market. Epiluvac was founded in 2013 in Sweden and is home to highly experienced professionals with thorough knowledge of silicon carbide (SiC) applications

Chemical Vapour Deposition (CVD) Equipment Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Chemical Vapour Deposition (CVD) Equipment Market |

| Market Size in 2024 | USD 26.87 Billion |

| Market Forecast in 2034 | USD 57.04 Billion |

| Growth Rate | CAGR of 7.82% |

| Number of Pages | 214 |

| Key Companies Covered | Applied Materials Inc., ASM International N.V., Lam Research Corporation, Tokyo Electron Limited, Veeco Instruments Inc., AIXTRON SE, CVD Equipment Corporation, ULVAC Technologies Inc., Plasma-Therm LLC, SENTECH Instruments GmbH, SPTS Technologies (an Orbotech company), Oxford Instruments plc, Centrotherm AG, Canon Anelva Corporation, Semicore Equipment, Inc., Picosun Group, LPE S.p.A., Ningbo Deyi High-Technology Development Co., Ltd., Denton Vacuum LLC, Mustang Vacuum Systems, Soleras Advanced Coatings, EVATEC AG, Hauzer Techno Coating, and Angstrom Engineering Inc., and others. |

| Segments Covered | By Type, By Material Type, By Technology, By Application, By End-user, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Chemical Vapour Deposition (CVD) Equipment Market: Regional Analysis

Asia-Pacific to continue its dominance

The global chemical vapour deposition (CVD) equipment market is expected to witness the highest growth in the Asia-Pacific region during the forecast period. The region has already dominated the industry in the last few years. The high growth rate is mainly driven by the presence of a well-established semiconductor industry in countries such as Taiwan, China, India, and Japan. One of the largest suppliers of semiconductors to the global electronics market is Taiwan. As indicated by The Register, the country controlled over 61% of the world's capacity to produce chips that are under 16 nm process nodes.

Furthermore, the region is witnessing intensive research on developing more efficient and advanced CVD equipment to keep up with changing demand and requirements in the commercial market. The presence of key players and growing end-verticals applications, such as in the electric vehicle and electronics segment, is also crucial to the regional expansion. The region emphasizes innovation and technological advancements which could lead to higher growth.

Chemical Vapour Deposition (CVD) Equipment Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the chemical vapour deposition (CVD) equipment market on a global and regional basis.

The global chemical vapour deposition (CVD) equipment market is dominated by players like:

- Applied Materials Inc.

- ASM International N.V.

- Lam Research Corporation

- Tokyo Electron Limited

- Veeco Instruments Inc.

- AIXTRON SE

- CVD Equipment Corporation

- ULVAC Technologies Inc.

- Plasma-Therm LLC

- SENTECH Instruments GmbH

- SPTS Technologies (an Orbotech company)

- Oxford Instruments plc

- Centrotherm AG

- Canon Anelva Corporation

- Semicore Equipment Inc.

- Picosun Group

- LPE S.p.A.

- Ningbo Deyi High-Technology Development Co. Ltd.

- Denton Vacuum LLC

- Mustang Vacuum Systems

- Soleras Advanced Coatings

- EVATEC AG

- Hauzer Techno Coating

- Angstrom Engineering Inc.

The global chemical vapour deposition (CVD) equipment market is segmented as follows;

By Type

- Atmospheric Pressure CVD

- Low Pressure CVD

- Ultrahigh Vacuum CVD

By Material Type

- Metal

- Ceramic

- Composite

By Technology

- Plasma-Assisted

- Thermal

By Application

- Semiconductor

- Solar Panels

- LED

- Data Storage

- Others

By End-user

- Cutting Tools

- Electronics

- Aerospace

- Automotive

- Industrial

- Medical Devices

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Chemical vapor deposition (CVD) equipment is a manufacturing device used during the process of chemical vapour deposition. In this process, thin films of various materials are deposited on solid substrates, such as silicon wafers.

The global chemical vapor deposition (CVD) equipment market is projected to grow owing to the increasing application of the equipment in one of the fastest-growing and valuable sectors which is the semiconductor industry.

According to a study, the global chemical vapour deposition (CVD) equipment market size was worth around USD 26.87 Billion in 2024 and is expected to reach USD 57.04 Billion by 2034.

The global chemical vapour deposition (CVD) equipment market is expected to grow at a CAGR of 7.82% during the forecast period.

The global chemical vapour deposition (CVD) equipment market is expected to witness the highest growth in Asia-Pacific during the forecast period.

The global chemical vapor deposition (CVD) equipment market is led by players like Applied Materials Inc., ASM International N.V., Lam Research Corporation, Tokyo Electron Limited, Veeco Instruments Inc., AIXTRON SE, CVD Equipment Corporation, ULVAC Technologies Inc., Plasma-Therm LLC, SENTECH Instruments GmbH, SPTS Technologies (an Orbotech company), Oxford Instruments plc, Centrotherm AG, Canon Anelva Corporation, Semicore Equipment, Inc., Picosun Group, LPE S.p.A., Ningbo Deyi High-Technology Development Co., Ltd., Denton Vacuum LLC, Mustang Vacuum Systems, Soleras Advanced Coatings, EVATEC AG, Hauzer Techno Coating, and Angstrom Engineering Inc.

The report explores crucial aspects of the chemical vapour deposition (CVD) equipment market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed

-equipment-market-size.png)