Chemical Surface Treatment Market Size, Share, Trends, Growth 2032

Chemical Surface Treatment Market By Type (Plating Chemicals, Conversion Coating and Cleaners) and by End Use (Construction, Transportation, and General Technology), And By Region - Global And Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts 2024 - 2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

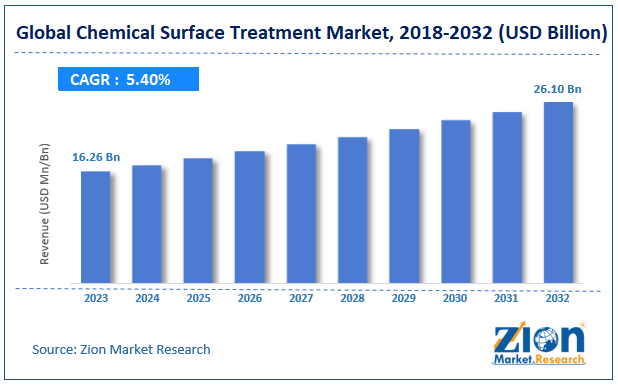

| USD 16.26 Billion | USD 26.10 Billion | 5.40% | 2023 |

Chemical Surface Treatment Market: Industry Perspective

The global chemical surface treatment market size was evaluated at USD 16.26 billion in 2023 and is slated to hit USD 26.10 billion by the end of 2032 with a CAGR of nearly 5.40% between 2024 and 2032.

The study includes drivers and restraints for the chemical surface treatment market along with the impact they have on the demand over the forecast period. Additionally, the report includes the study of opportunities available in the chemical surface treatment market on a global level.

In order to give the users of this report a comprehensive view of the chemical surface treatment, we have included a detailed competitive scenario and product portfolio of key vendors. To understand the competitive landscape in the market, an analysis of Porter’s Five Forces model for the chemical surface treatment market has also been included. The study encompasses a market attractiveness analysis, wherein product segments are benchmarked based on their market size, growth rate, and general attractiveness.

The study provides a decisive view of the chemical surface treatment market by segmenting the market based on type, end use, and regions. All the segments have been analyzed based on present and future trends and the market is estimated from 2018 to 2023. Major types covered under this study include plating chemicals, conversion coating, and cleaners. On the basis of end users, the market has been segmented into construction, transportation, and general technology.

Chemical Surface Treatment Market : Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Chemical Surface Treatment Market Research Report |

| Market Size in 2023 | USD 16.26 Billion |

| Market Forecast in 2032 | USD 26.10 Billion |

| Growth Rate | CAGR of 5.40% |

| Number of Pages | 215 |

| Key Companies Covered | Platform Specialty Products Corporation, NOF Corporation, Atotech Deutschland GmbH, Henkel AG & Co. KGaA, Chemetall, Inc., Nihon Parkerizing Co., Ltd., and PPG Industries, Inc., A Brite Company, Advanced Chemical Company, and DOW. |

| Segments Covered | By Type, By End-Use and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

The regional segmentation includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa. Each region has been further segmented into major countries such as the U.S., the U.K., France, Germany, China, India, Japan, and Brazil. This segmentation includes demand for chemical surface treatment based on types and end-users in all regions and countries.

The report covers a detailed competitive outlook including the market share and company profiles of the key participants operating in the global market.

Chemical Surface Treatment Market: Competitive Space

The global chemical surface treatment market profiles key players such as:

- Platform Specialty Products Corporation

- NOF Corporation

- Atotech Deutschland GmbH

- Henkel AG & Co. KGaA

- Chemetall, Inc

- Nihon Parkerizing Co Ltd

- PPG Industries Inc

- A Brite Company

- Advanced Chemical Company

- DOW

This report segments the global chemical surface treatments market as follows:

Chemical Surface Treatments Market: Type Analysis

- Plating Chemicals

- Conversion Coating

- Cleaners

Chemical Surface Treatments Market: End-Use Analysis

- Construction

- Transportation

- General Technology

Chemical Surface Treatments Market: Regional Analysis

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- The Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Chemical surface treatment pertains to the utilization of chemical procedures in order to modify or adjust the inherent characteristics of a substance's surface. In numerous industries, this treatment is frequently employed to improve the functionality, durability, and performance of materials. The objective is to attain particular surface properties while preserving the material's bulk properties unchanged. Various chemical procedures are implemented in accordance with the nature of the substance and the intended result.

The correlation between chemical surface treatment demand and industrial and manufacturing operations is substantial. Construction, automotive, aerospace, and electronics, among others, are expanding sectors that increase the demand for surface coatings to improve the properties of materials utilized in these fields. The increasing prominence of environmental issues has led to a corresponding surge in the need for sustainable and ecologically sound surface remediation methods. Organizations that provide environmentally sustainable chemical surface treatment alternatives could potentially benefit from expanded market prospects.

Global chemical surface treatment market size was evaluated at USD 16.26 billion in 2023 and is slated to hit USD 26.10 billion by the end of 2032.

Global chemical surface treatment market with a CAGR of nearly 5.40% between 2024 and 2032.

Present and anticipated demand for North America, Europe, Asia-Pacific, Latin America, the Middle East, and Africa are incorporated into the regional segmentation. Subsequent to this, significant nations including the United States, United Kingdom, France, Germany, China, India, Japan, and Brazil have been assigned to each region. Demand for chemical surface treatment is segmented according to end-users and product categories across all regions and countries.

Platform Specialty Products Corporation, NOF Corporation, Atotech Deutschland GmbH, Henkel AG & Co. KGaA, Chemetall, Inc., Nihon Parkerizing Co., Ltd., and PPG Industries, Inc., A Brite Company, Advanced Chemical Company, and DOW.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed