Global Cheese Market Size, Share, Growth Analysis Report - Forecast 2034

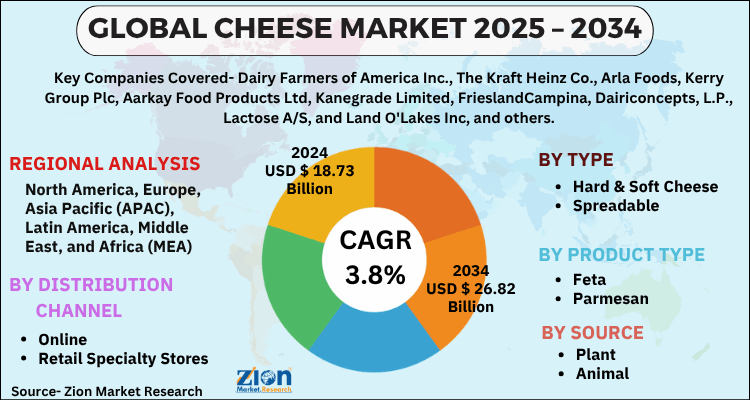

Cheese Market By Distribution Channel (Online, Retail Specialty Stores, Convenience Stores, and Hypermarkets), By Type (Hard & Soft Cheese, Spreadable, Block, Natural, and Processed), Product Type (Feta, Parmesan, and Mozzarella), Source (Plant and Animal-based Sources), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

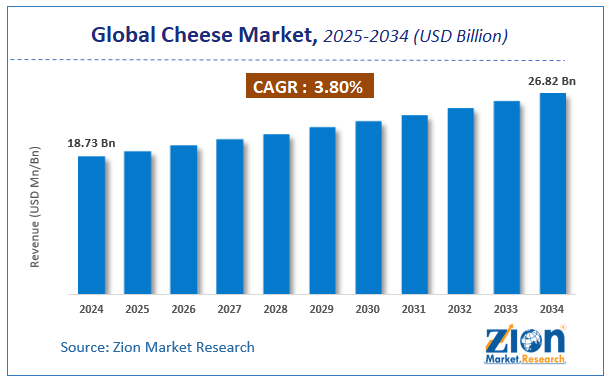

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 18.73 Billion | USD 26.82 Billion | 3.8% | 2024 |

Cheese Market: Industry Perspective

The global cheese market size was worth around USD 18.73 Billion in 2024 and is predicted to grow to around USD 26.82 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 3.8% between 2025 and 2034. The report analyzes the global cheese market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the cheese industry.

Cheese Market: Overview

Cheese is a highly palatable and nutritious product extracted from dairy sources. It is found in a wide range of aromas, textures, and tastes global. At present, there are around 2000 varieties of cheese in the market. Typically, the distinction is made on the basis of raw material used, for example, the type of milk-producing animal, climatic factor, grazing process, and others. Cheese consumes one-tenth volume of milk, thereby offering a longer shelf life as compared to milk. It is highly rich in calcium, fat, minerals, proteins, etc. Furthermore, it also facilitates several health benefits like good heart health and strong bones & teeth. It also aids in the prevention of osteoporosis. Some varieties of cheese like Roquefort, parmesan, and cheddar are ideal to be consumed by milk-allergic and lactose-intolerant people.

Key Insights

- As per the analysis shared by our research analyst, the global cheese market is estimated to grow annually at a CAGR of around 3.8% over the forecast period (2025-2034).

- Regarding revenue, the global cheese market size was valued at around USD 18.73 Billion in 2024 and is projected to reach USD 26.82 Billion by 2034.

- The cheese market is projected to grow at a significant rate due to rising consumer preference for dairy-based products and premium cheese varieties.

- Based on Distribution Channel, the Online segment is expected to lead the global market.

- On the basis of Type, the Hard & Soft Cheese segment is growing at a high rate and will continue to dominate the global market.

- Based on the Product Type, the Feta segment is projected to swipe the largest market share.

- By Source, the Plant segment is expected to dominate the global market.

- Based on region, Europe & North America is predicted to dominate the global market during the forecast period.

Growth Drivers Of Cheese Market

The growing working women population is driving the growth of the global market.

The growth of the global cheese market brought forth three major channels food manufacturers, food service, and retail distribution channels. The constantly growing women working population is expanding the scope of cheese globally. Ready-to-eat and convenience food products take less time to cook. Therefore, by combining both of these factors, the market is likely to grow indefinitely in the forthcoming years. The global fast-food sector is also referred to as the quick-service restaurant industry, which is growing significantly. Cheese is witnessing exponential demand from the end-user sector as it is used as a key ingredient in a wide range of food products. The fast proliferating fast food chains like Papa John's International Inc, Pizza Hut of Young Brands, and Domino’s Pizza are further strengthening the demand in the market. Transforming lifestyles and the growing dependency of people on ready-made meals owing to their hectic schedules are some of the key factors expected to fuel the growth of the market globally.

Cheese Market: Restraints

Growing health awareness among people will restrain the growth of the global market.

The surging consumer awareness regarding the ill impacts of cheese is likely to restrain the growth of the global market. High cholesterol levels and obesity are some of the major health conditions resulting from the high consumption of processed cheese.

Cheese Market: Opportunities

The emergence of plant-based cheese alternatives is likely to open new growth avenues in the global market.

The advent of plant-based cheese alternatives is likely to create several lucrative growth opportunities in the global market. The demand for plant-based cheese alternatives can be attributed to the growing trend of veganism & higher aversion to meat and growing pricing concern regarding animal cruelty. Also, the growing awareness of people regarding clean label products is also soaring the trend of plant-based products in the market. The market players are also taking initiatives to work on sustainability principles, which in turn will also open new growth avenues in the market. Additionally, in recent years, consumers have been looking forward to trying new exotic tastes and cuisines along with the combination of cheese products like Mexican and Italian cuisines, which in turn is likely to expand the scope of the cheese market in the forthcoming years. Manufacturers are increasing their research activities to innovate products with creams and powders to capture a large market base.

Challenges

Strict government regulations are a huge challenge in the global market.

Several government regulations regarding cheese manufacturing, accurate labeling, and packaging processes are likely to pose a huge challenge to the growth of the global market.

Segmentation

The global cheese market can be segmented into the distribution channel, types, products, sources, and regions.

By distribution channel, the market can be segmented into online, retail specialty stores, convenience stores, and hypermarkets.

By type, the market can be segmented into hard & soft cheese, spreadable, block, natural, and processed.

By product type, the market can be segmented into feta, parmesan, mozzarella, and others.

By source, the market can be segmented into plant- and animal-based sources. The plant-based segment can further be bifurcated into soya, almond, cashew, and others. The animal-based segment can further be bifurcated into camel, goat, sheep, and cattle.

Cheese Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Cheese Market |

| Market Size in 2024 | USD 18.73 Billion |

| Market Forecast in 2034 | USD 26.82 Billion |

| Growth Rate | CAGR of 3.8% |

| Number of Pages | 177 |

| Key Companies Covered | Dairy Farmers of America Inc., The Kraft Heinz Co., Arla Foods, Kerry Group Plc, Aarkay Food Products Ltd, Kanegrade Limited, FrieslandCampina, Dairiconcepts, L.P., Lactose A/S, and Land O'Lakes Inc, and others. |

| Segments Covered | By Distribution Channel, By Type, By Product Type, By Source, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Market Regional Landscape

Europe accounts for the largest share in the global cheese market due to the presence of major milk-producing countries in the region. Additionally, the market players involved in the food service sector adopt strategic promotional activities to expand the marketplace for processed cheese products.

North America is the fastest-growing region in the global market due to the high demand for clean-label dairy products in the region. Manufacturers in the region are trying to innovate lactose-free, organic, and non-GMO products to cater to the changing demands of the people.

Recent Developments

- Glanbia, in August 2020, acquired Foodarom. This initiative will help the company strengthen its capability in the space of flavors and nutritional solutions.

- Brownes Dairy, in July 2020, announced the launch of traditional cheddar cheese on surging demands for products in a household on the retail platforms.

Cheese Market: Competitive Landscape

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the cheese market on a global and regional basis.

The global cheese market is dominated by players like:

- Dairy Farmers of America Inc.

- The Kraft Heinz Co.

- Arla Foods

- Kerry Group Plc

- Aarkay Food Products Ltd

- Kanegrade Limited

- FrieslandCampina

- Dairiconcepts

- L.P.

- Lactose A/S

- Land O'Lakes, Inc.

The global Cheese Market is segmented as follows:

By Distribution Channel

- Online

- Retail Specialty Stores

- Convenience Stores

- Hypermarkets

By Type

- Hard & Soft Cheese

- Spreadable

- Block

- Natural

- Processed

By Product Type

- Feta

- Parmesan

- Mozzarella

By Source

- Plant

- Animal

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Cheese is a highly palatable and nutritious product extracted from dairy sources.

The global cheese market is expected to grow due to rising consumer preference for dairy products, increasing demand for premium and flavored cheeses, and growing foodservice sector.

According to a study, the global cheese market size was worth around USD 18.73 Billion in 2024 and is expected to reach USD 26.82 Billion by 2034.

The global cheese market is expected to grow at a CAGR of 3.8% during the forecast period.

Europe & North America is expected to dominate the cheese market over the forecast period.

Leading players in the global cheese market include Dairy Farmers of America Inc., The Kraft Heinz Co., Arla Foods, Kerry Group Plc, Aarkay Food Products Ltd, Kanegrade Limited, FrieslandCampina, Dairiconcepts, L.P., Lactose A/S, and Land O'Lakes Inc, among others.

The report explores crucial aspects of the cheese market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed