Cash Flow Management Market Size, Share, Trends, Industry Analysis & Growth 2032

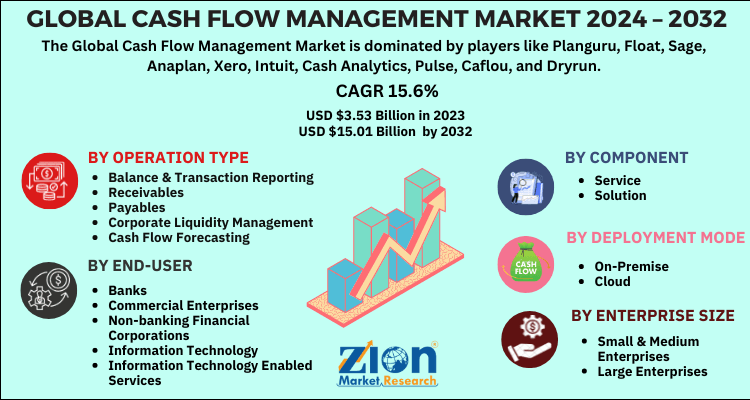

Cash Flow Management Market By component (service and solution), By deployment mode (on-premise and cloud), By operation type (Balance & transaction reporting, receivables, payables, corporate liquidity management, cash flow forecasting, and others), By enterprise size (small & medium enterprises and large enterprises), By end-user (banks, commercial enterprises, non-banking financial corporations, retail, healthcare, Information Technology (IT), and Information Technology Enabled Services (ITes), and others) And By Region: - Global And Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts, 2024-2032

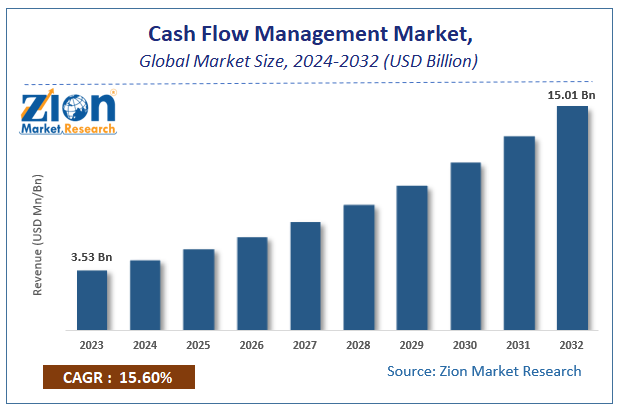

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 3.53 Billion | USD 15.01 Billion | 15.6% | 2023 |

Description

Cash Flow Management Market Insights

According to the report published by Zion Market Research, the global Cash Flow Management Market size was valued at USD 3.53 Billion in 2023 and is predicted to reach USD 15.01 Billion by the end of 2032. The market is expected to grow with a CAGR of 15.6% during the forecast period. The report analyzes the global Cash Flow Management Market's growth drivers, restraints, and impact on demand during the forecast period. It will also help navigate and explore the arising opportunities in the Cash Flow Management industry.

Global Cash Flow Management Market: Overview

The process of tracking in and out of the money in the business is termed cash flow management. It is generally a set of strategies and practices that help the user to analyze and enhance the business financials. Cash flow management helps the user to predict how much money is available and how much money is required to cover the debts. It also helps to prepare for the future, spot trends, and tackle any problems with the cash flow.

Global Cash Flow Management Market: Growth Factors

The global cash flow management market is growing at a significant rate. The growing necessity for streamlining the business revenue, rise in adoption of cloud-based deployments by small & mid-size enterprises, and rapidly growing e-commerce sector are some of the factors that are fostering the growth of the global market. Cash is the backbone of each organization and maintaining proper cash flow records helps to file sales or income taxes easily. Cash management is the prime factor that defines the future of the company, whether it’s a loss or profit. The company can also closely monitor the company’s cash inflow, and outflow helps to expand the business.

It also benefits the company as it enables to pay staff on time, purchase the raw materials that are necessary to fulfill the order requirements, avoid overspending, and grow the business. Thus, small enterprises and startups are adopting cash flow management solutions at a rapid rate as cash flow is the lifeblood for them. This is propelling the growth of the global cash flow management market. In addition to this, growing investment in the development of cash flow management solutions and growing demand from the IT sector are also fueling the growth of the market. Furthermore, an increase in the integration of artificial intelligence and machine learning with new features of cash flow management may create several opportunities for the growth of the global cash flow management market over the forecast period. However, emerging new financial rules and regulations may impede the growth of the global cash flow management market.

The Covid-19 pandemic has resulted in a financial crisis across the world as it has severely hit the majority of the business sectors. Complete lockdown, restriction on movement, enforced temporary halt in the manufacturing and development units have slowed the market growth. Thus, owing to the uncertain impact of the Covid-19 pandemic, there has raised a necessity for cash flow management among the small as well as large enterprises. Additionally, organizations are seeking for technologically advanced cash flow management solutions to get ready for the future and obtain financial insights. Thus, a rise in the growth of the global cash flow management market during the pandemic and is expected to grow during the forecast period.

Global Cash Flow Management Market: Segmentation

The global cash flow management market is categorized based on component, deployment mode, operation type, enterprise size, end-user, and region.

Based on the component, the global cash flow management market is split into service and solution.

The deployment mode segment is bifurcated into on-premise and cloud.

Balance & transaction reporting, receivables, payables, corporate liquidity management, cash flow forecasting, and others are the operation type of cash flow management.

The enterprise size segment consists of small & medium enterprises and large enterprises.

The end-user segment comprises banks, commercial enterprises, non-banking financial corporations, retail, healthcare, Information Technology (IT), and Information Technology Enabled Services (ITes), and others.

Cash Flow Management Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Cash Flow Management Market |

| Market Size in 2023 | USD 3.53 Billion |

| Market Forecast in 2032 | USD 15.01 Billion |

| Growth Rate | CAGR of 15.6% |

| Number of Pages | 211 |

| Key Companies Covered | Planguru, Float, Sage, Anaplan, Xero, Intuit, Cash Analytics, Pulse, Caflou, and Dryrun |

| Segments Covered | By Component, By Deployment Mode, By Operation Type, By Enterprise Size, By End-User And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global Cash Flow Management Market: Regional Analysis

Among the regions, North America is anticipated to be the largest contributor of revenue and lead the global cash flow management market during the forecast period. Increase in adoption of advanced technologies including machine learning & artificial intelligence and growing demand for cash flow management solution for cash flow forecasting in the organizations. Europe is expected to contribute a significant share in the market and offer lucrative opportunities in this region. Asia Pacific is projected to grow at a faster pace during the forecast period and this is attributed to the growing adoption of cash flow management services & solutions from small & medium-size enterprises to enhance their financial outcomes & business operations.

Global Cash Flow Management Market: Competitive Players

- Planguru

- Float

- Sage

- Anaplan

- Xero

- Intuit

- Cash Analytics

- Pulse

- Caflou

- Dryrun

are some of the major players that are operating in the global cash flow management market.

The Global Cash Flow Management Market is segmented as follows:

By component

- service

- solution

By deployment mode

- on-premise

- cloud

By operation type

- Balance & transaction reporting

- receivables

- payables

- corporate liquidity management

- cash flow forecasting

- and others

By enterprise size

- small & medium enterprises

- large enterprises

By end-user

- banks

- commercial enterprises

- non-banking financial corporations

- retail

- healthcare

- Information Technology (IT)

- Information Technology Enabled Services (ITes)

- and others

Global Cash Flow Management Market: Regional Segment Analysis

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

What Reports Provides

- Full in-depth analysis of the parent market

- Important changes in market dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional markets

- Testimonials to companies in order to fortify their foothold in the market.

Table Of Content

FrequentlyAsked Questions

The growing necessity for streamlining the business revenue, rise in adoption of cloud-based deployments by small & mid-size enterprises, and rapidly growing e-commerce sector are some of the factors that are fostering the growth of the global market. Furthermore, an increase in the integration of artificial intelligence and machine learning with new features of cash flow management may create several opportunities for the growth of the global cash flow management market over the forecast period.

Planguru, Float, Sage, Anaplan, Xero, Intuit, Cash Analytics, Pulse, Caflou, and Dryrun are some of the major players that are operating in the global cash flow management market.

Among the regions, North America is anticipated to be the largest contributor of revenue and lead the global cash flow management market during the forecast period. Increase in adoption of advanced technologies including machine learning & artificial intelligence and growing demand for cash flow management solution for cash flow forecasting in the organizations.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed