Carbon Thermoplastic Composites Market Size, Share, Trends, Growth and Forecast 2034

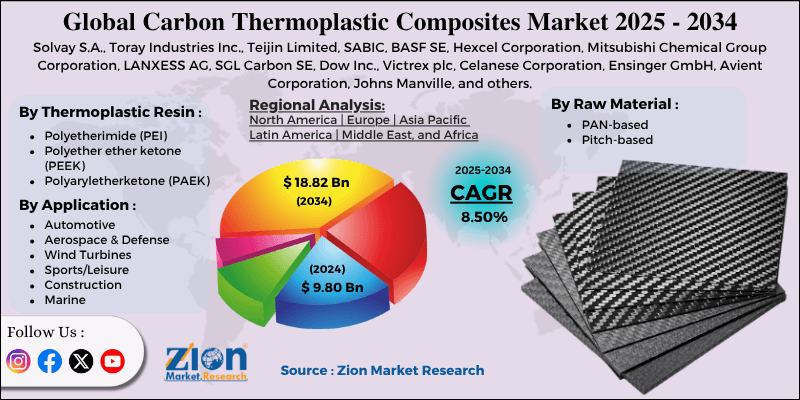

Carbon Thermoplastic Composites Market By Thermoplastic Resin (Polyetherimide [PEI], Polyether ether ketone [PEEK], Polyaryletherketone [PAEK], and Others), By Raw Material (PAN-based, Pitch-based), By Application (Automotive, Aerospace & Defense, Wind Turbines, Sports/Leisure, Construction, Marine, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

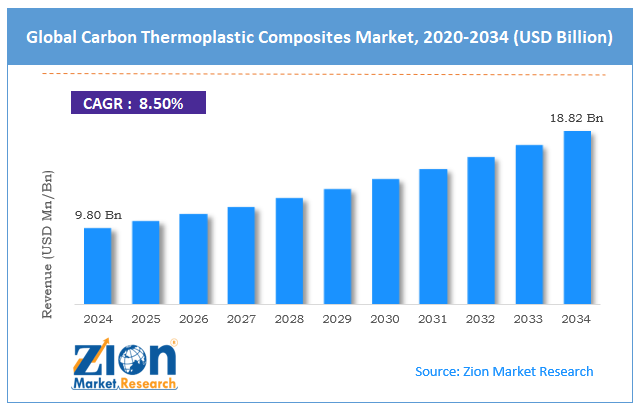

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 9.80 Billion | USD 18.82 Billion | 8.50% | 2024 |

Carbon Thermoplastic Composites Industry Perspective:

The global carbon thermoplastic composites market size was worth around USD 9.80 billion in 2024 and is predicted to grow to around USD 18.82 billion by 2034, with a compound annual growth rate (CAGR) of roughly 8.50% between 2025 and 2034.

Carbon Thermoplastic Composites Market: Overview

Carbon thermoplastic composites refer to the advanced materials made by blending carbon fibers with thermoplastic resins. These composites offer optimal impact resistance, greater strength-to-weight ratio, and speed processing capabilities, increasing their significance and use in automotive, aerospace, industrial applications, and sports equipment.

The global carbon thermoplastic composites market is driven by the increased use in the defense and aerospace industries, as well as enhanced recyclability, impact resistance, and short cycle times, all of which facilitate rapid manufacturing.

The aerospace sector is increasingly using thermoplastics for structural components due to their fatigue resistance and strength. Airbus and Boeing use these components in new aircraft models to enhance performance and reduce weight. The aircraft fleet industry is projected to experience remarkable growth by 2042, thereby propelling demand.

Unlike thermoset composites, thermoplastic composites can be reshaped, reheated, and recycled multiple times. This increases their applications in sustainability-focused sectors, such as automotive and electronics. Their reusability complies with circular economy goals, driving their adoption in eco-conscious industries.

Moreover, carbon thermoplastics offer faster processing times than thermosets because they can be molded without requiring a curing process. This allows high-volume production, mainly for automotive mass production. Methods such as injection molding and thermoforming are enhancing the cost-effectiveness and efficiency of production.

Nevertheless, the global market is restricted by the limited availability of raw materials and technical challenges in processing. The supply chain for high-performance thermoplastics and carbon fibers is still comparatively limited. Geopolitical stresses and global disturbances impact the sourcing of raw materials. This typically results in production delays and price fluctuations.

Furthermore, processing carbon thermoplastics requires temperature, pressure, and control, as well as well-developed equipment and an expert workforce. Not all manufacturers possess the technical expertise to promise consistency. Barriers and errors in processing may lead to weak bonding or delamination, which negatively impact product quality.

Still, the global carbon thermoplastic composites industry benefits from the growth in electric vehicle production and their integration into wearables and smart textiles. Electronic vehicle manufacturers prefer ultra-light components to enhance their battery usage and efficacy. Carbon thermoplastics are discovered for structural supports, battery enclosures, and body panels. The booming sales of EVs are a leading frontier for the industry.

Also, flexible thermoplastic composites equipped with sensors are used in health-monitoring devices and smart clothing. The smart textiles industry is projected to surpass USD 13 billion by 2030.

Key Insights:

- As per the analysis shared by our research analyst, the global carbon thermoplastic composites market is estimated to grow annually at a CAGR of around 8.50% over the forecast period (2025-2034)

- In terms of revenue, the global carbon thermoplastic composites market size was valued at around USD 9.80 billion in 2024 and is projected to reach USD 18.82 billion by 2034.

- The carbon thermoplastic composites market is projected to grow significantly due to the escalating demand for lightweight materials in the automotive industry, fast manufacturing and short cycle times, and surging demand from consumer electronics.

- Based on thermoplastic resin, the polyether ether ketone (PEEK) segment is expected to lead the market, while the polyaryletherketone (PAEK) segment is expected to grow considerably.

- Based on raw material, the PAN-based segment is the dominant one, while the pitch-based segment is projected to witness sizable revenue growth over the forecast period.

- Based on application, the automotive segment is expected to lead the market, followed by the aerospace & defense segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Europe.

Carbon Thermoplastic Composites Market: Growth Drivers

Recycling benefits and sustainability drive market growth

Carbon thermoplastic composites offer significant sustainability benefits over thermoset alternatives. They can be reshaped, generate less production waste, can be remolded with heat, and are recyclable. With the growing strictness of global regulations for emissions and plastic wastage, industries are increasingly preferring and shifting towards materials that support circular economy objectives.

The European Commission's Fit for 55 and Green Deal programs have elevated the importance of recycling as a cornerstone of material innovation. In response to this, many Tier 1 suppliers in North America and Europe, such as Solvay and Toray, have leveraged closed-loop recycling solutions for thermoplastic composites.

The speedy expansion of wind energy installations notably fuels the market growth

The wind energy industry, particularly offshore wind, is utilizing carbon thermoplastic composites to produce longer, lighter, and more durable turbine blades. These materials help reduce downtime, enable high blade lengths, and enhance efficacy while maintaining structural integrity.

With the growing scalability of wind farms, the demand for these composites is increasing, thus impacting the growth of the carbon thermoplastic composites market.

Siemens Gamesa and Vestas have deployed thermoplastic resin systems for turbine blades, enabling easy transport logistics and facilitating end-of-life recyclability.

Carbon Thermoplastic Composites Market: Restraints

Challenges in joining and bonding techniques adversely impact the market progress

While thermoplastic composites offer faster cycle times and recyclability, they provide several challenges in bonding, joining, and surface finishing. Thermoplastics require accurate mechanical or thermal joining methods, such as riveting and welding, which increases cost and complexity. In contrast, thermosets can be easily bonded with adhesives.

A study by EuCIA (2024) highlighted that over 40% of manufacturing companies face challenges in achieving trustworthy joints for thermoplastic structures, primarily in aerospace and automotive applications.

Carbon Thermoplastic Composites Market: Opportunities

Growth in infrastructure projects with prefabricated composite systems favorably impacts market growth

Global infrastructure development is increasingly leaning towards lightweight, modular, and corrosion-resistant materials, primarily for urban rail systems, marine applications, and bridges. Carbon thermoplastics composites offer reduced maintenance, easy installation, and durability compared to concrete or steel in such applications.

Strongwell Corporation supplied thermoplastic-based pedestrian bridge parts for a coastal project in Florida in June 2024. It leveraged the material's resistance to UV exposure and saltwater. This underscores surging attraction in non-traditional industries for thermoplastics, thus propelling the global carbon thermoplastic composites industry.

Carbon Thermoplastic Composites Market: Challenges

Limited simulation tools and design knowledge restrict the growth of market

Design engineers often lack familiarity with the anisotropic behavior and failure modes of these composites, particularly under extreme temperatures or multi-axial loads. In addition, most Finite Element Analysis (FEA) and Computer-Aided Engineering (CAE) tools are optimized for thermosets and metals, thereby limiting the ability to simulate thermoplastic performance accurately.

The complexity of fiber orientation, interfacial bonding, and crystallinity further intricate the design procedure. This lack of modern simulation potential often results in underutilization or overdesign, thereby reducing efficacy.

Carbon Thermoplastic Composites Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Carbon Thermoplastic Composites Market |

| Market Size in 2024 | USD 9.80 Billion |

| Market Forecast in 2034 | USD 18.82 Billion |

| Growth Rate | CAGR of 8.50% |

| Number of Pages | 214 |

| Key Companies Covered | Solvay S.A., Toray Industries Inc., Teijin Limited, SABIC, BASF SE, Hexcel Corporation, Mitsubishi Chemical Group Corporation, LANXESS AG, SGL Carbon SE, Dow Inc., Victrex plc, Celanese Corporation, Ensinger GmbH, Avient Corporation, Johns Manville, and others. |

| Segments Covered | By Thermoplastic Resin, By Raw Material, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Carbon Thermoplastic Composites Market: Segmentation

The global carbon thermoplastic composites market is segmented based on thermoplastic resin, raw material, application, and region.

Based on thermoplastic resin, the global industry is divided into polyetherimide (PEI), polyether ether ketone (PEEK), polyaryletherketone (PAEK), and others. The polyether ether ketone (PEEK) segment held the leading market share due to its unique chemical resistance, mechanical strength, and high-temperature stability. It is broadly used in the automotive, aerospace, oil & gas, and medical industries for semi-structural and structural parts. PEEK composites hold the leading industry share due to their exceptional performance in demanding environments, such as those used in EV battery and jet engine components.

Based on raw material, the global carbon thermoplastic composites market is segmented into PAN-based and pitch-based. The PAN-based segment captured a leading market share due to its overwhelming use in thermoplastic composites. They deliver an optimal balance of stiffness, high tensile strength, and processability, increasing their preference for a broader range of industries. PAN-based fibers are the leading materials because of their well-developed supply chains and high mechanical performance.

Based on application, the global market is segmented into automotive, aerospace & defense, wind turbines, sports/leisure, construction, marine, and others. The automotive segment holds a dominant share of the market due to high production volume and rapid cycle times for thermoplastics. Automakers widely use these materials in interiors, structural components, and battery enclosures to reduce vehicle weight and comply with emission regulations and fuel efficiency standards. The growth of EVs and lightweight initiatives in manufacturers is propelling the demand in the automotive sector.

Carbon Thermoplastic Composites Market: Regional Analysis

North America to witness significant growth over the forecast period

North America is anticipated to hold a larger regional share in the global carbon thermoplastic composites market due to advanced automotive manufacturing and adoption of EVs, a strong supply chain, and rising demand for leisure and sports equipment.

The United States automotive brands, such as Tesla, Ford, and GM, are incorporating carbon thermoplastics in lightweight vehicle parts, primarily in electric motors. With government programs, the region's demand for lightweight and high-performing materials is growing.

North America boasts a well-developed supply chain for thermoplastic resins and carbon fibers, with several key producers, including Hexcel, Solvay, and others. The integrated value chain from raw materials to component fabrication promises consistent product quality and lower lead times. This industrial sophistication offers superiority over other regions.

Additionally, the region is a key hub for performance-based sports equipment, including hockey sticks, tennis rackets, and carbon fiber bicycles, all of which utilize thermoplastic composites. Brands are actively using these materials for strength-to-weight ratio benefits. The U.S. sports equipment industry was estimated to be over $17 billion in 2023, contributing to the rising adoption of composites.

Europe is projected to hold a second-leading position in the carbon thermoplastic composites industry, backed by the strong presence of automotive and aerospace OEMs, growing EV production in the region, and surging adoption of wind energy.

Europe is home to global aerospace leaders such as Leonardo, Dassault Aviation, and Airbus, which widely utilize carbon thermoplastic composites for interior panels, aircraft fuselages, and engine components. Automotive brands also propel through lightweight initiatives in luxury vehicles and EVs.

Additionally, nations like the Netherlands, Germany, and France are experiencing rapid growth in the adoption of electric cars, which drives higher demand for lightweight thermoplastic composite parts. Carbon thermoplastic is largely used in structural components, EV battery enclosures, and underbody systems. Thermoplastic components are gaining prominence in sustainable building materials and wind turbine blade parts in Europe.

With robust government targets for renewable energy, in 2023, Europe deployed 19 GW of novel wind capacity. Corrosion-resistant, lightweight thermoplastic composites are supporting the achievement of durable and highly efficient systems.

Carbon Thermoplastic Composites Market: Competitive Analysis

The leading players in the global carbon thermoplastic composites market are:

- Solvay S.A.

- Toray Industries Inc.

- Teijin Limited

- SABIC

- BASF SE

- Hexcel Corporation

- Mitsubishi Chemical Group Corporation

- LANXESS AG

- SGL Carbon SE

- Dow Inc.

- Victrex plc

- Celanese Corporation

- Ensinger GmbH

- Avient Corporation

- Johns Manville

Carbon Thermoplastic Composites Market: Key Market Trends

Focus on circular economy and recyclability:

Unlike thermoset composites, thermoplastics can be reshaped and remelted, aligning with circular economy goals and sustainability objectives. Industries and governments are heavily investing in closed-loop recycling systems to reuse thermoplastic matrices and recover carbon fibers. Recyclability is a vital purchasing factor, particularly in North America and Europe.

Growth in construction applications and infrastructure:

Although conventionally restricted to the automotive and aerospace industries, carbon thermoplastic composites are now finding applications in construction, particularly for use in load-bearing components, buildings, and bridges. Their resistance to impact, corrosion, and weather increases their suitability for enduring infrastructure.

The global carbon thermoplastic composites market is segmented as follows:

By Thermoplastic Resin

- Polyetherimide (PEI)

- Polyether ether ketone (PEEK)

- Polyaryletherketone (PAEK)

- Others

By Raw Material

- PAN-based

- Pitch-based

By Application

- Automotive

- Aerospace & Defense

- Wind Turbines

- Sports/Leisure

- Construction

- Marine

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Carbon thermoplastic composites refer to the advanced materials made by blending carbon fibers with thermoplastic resins. These composites offer optimal impact resistance, greater strength-to-weight ratio, and speed processing capabilities, increasing their significance and use in automotive, aerospace, industrial applications, and sports equipment.

The global carbon thermoplastic composites market is projected to grow due to their heavy use in the defense and aerospace sectors, their recyclability, superior impact resistance, and improvements in composite manufacturing technologies.

According to study, the global carbon thermoplastic composites market size was worth around USD 9.80 billion in 2024 and is predicted to grow to around USD 18.82 billion by 2034.

The CAGR value of the carbon thermoplastic composites market is expected to be approximately 8.50% from 2025 to 2034.

North America is expected to lead the global carbon thermoplastic composites market during the forecast period.

The key players profiled in the global carbon thermoplastic composites market include Solvay S.A., Toray Industries, Inc., Teijin Limited, SABIC, BASF SE, Hexcel Corporation, Mitsubishi Chemical Group Corporation, LANXESS AG, SGL Carbon SE, Dow Inc., Victrex plc, Celanese Corporation, Ensinger GmbH, Avient Corporation, and Johns Manville.

The report examines key aspects of the carbon thermoplastic composites market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed