Bio-Solvents Market Size, Share, Growth Report 2032

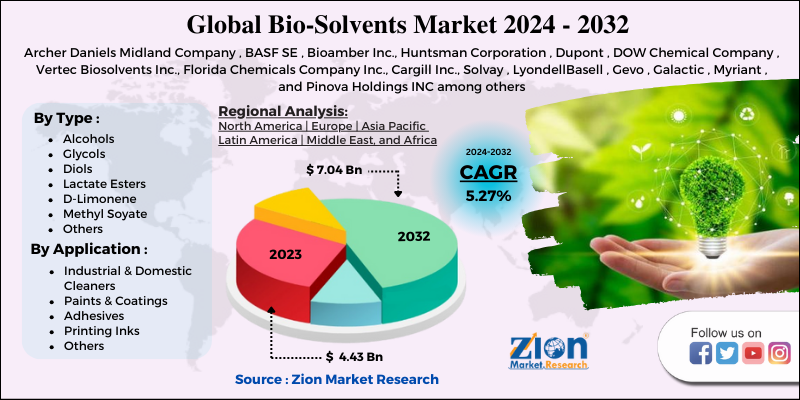

Bio-Solvents Market By type,(Alcohols, Glycols, Diols, Lactate Esters, D-Limonene, Methyl Soyate & Others) by Application (Industrial & Domestic Cleaners, Paints & Coatings, Adhesives, Printing Inks & Other Applications), and By Region: Global Industry Perspective, Comprehensive Analysis And Forecast, 2024 - 2032

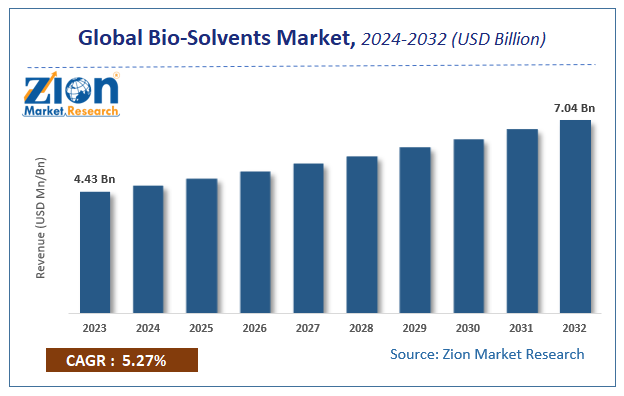

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 4.43 Billion | USD 7.04 Billion | 5.27% | 2023 |

Bio-Solvents Market Insights

According to a report from Zion Market Research, the global Bio-Solvents Market was valued at USD 4.43 Billion in 2023 and is projected to hit USD 7.04 Billion by 2032, with a compound annual growth rate (CAGR) of 5.27% during the forecast period 2024-2032. This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the Bio-Solvents Market industry over the next decade.

Bio-Solvents Market: Overview

Solvents are organic compounds that have a wide range of industrial uses in a variety of industries. Solvents are widely used in sectors such as textiles, paints & coatings, plastics & rubber, pharmaceuticals, oil & gas, manufacturing, and chemical synthesis and many others. Solvents are used in paints and coatings to remove various chemicals to make them safe for use. Solvent-based paints dry quicker than its alternatives, allowing for a faster pace of output. The domination of traditional petroleum feedstock-based solvents in the global solvents industry can be seen in the above industries. The widespread use of petroleum-based solvents is said to have resulted in environmental damage.

As a result, the environmental concerns has led regulatory authorities to enforce strict legislation aimed at addressing the harm caused by such hazardous chemical substances. Bio-solvents are now being used as an option to the traditional petroleum feedstock-based solvents. Bio-based solvents or bio-solvents are carbon-neutral, free of volatile organic compounds, non-toxic, and renewable options for use in a variety of industries because they are made from natural, environmentally friendly feedstock. Bio-solvents are generally produced using sugars, cellulose, oils, & fats, agricultural products, among others.

The growing understanding of the adverse effects of traditional solvents in pharmaceutical and Adhesives is expected to boost demand for bio solvents in these applications. The bio-solvents industry is expected to be fuelled by low volatile organic compound emissions, eco-friendliness, stringent environmental regulations, and a high demand and approval rate from end consumer industries.

Bio-Solvents Market: Growth Factors

The rapid use of bio-solvents in the domestic and industrial cleaning sectors is expected to propel the industry further. Increasing health and hygiene concerns among consumers, as well as numerous government and academic initiatives, are expected to propel the bio-solvents market forward. The bio solvent industry is expected to expand as bio solvents become more widely used in coatings, paints, sealants and adhesives, and printing inks. Other growth-inducing influences include several advances in manufacturing technology and a significant number of product developments.

The lack of regulations of the use of sustainable alternatives, as well as a lack of knowledge about such alternatives, is likely to impede the global bio-solvents market's development. Another aspect that is expected to influence the acceptance of bio-solvents in some areas of the world during the projected period is comparatively higher costs.

Bio-Solvents Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Bio-Solvents Market |

| Market Size in 2023 | USD 4.43 Billion |

| Market Forecast in 2032 | USD 7.04 Billion |

| Growth Rate | CAGR of 5.27% |

| Number of Pages | 110 |

| Key Companies Covered | Archer Daniels Midland Company , BASF SE , Bioamber Inc., Huntsman Corporation , Dupont , DOW Chemical Company , Vertec Biosolvents Inc., Florida Chemicals Company Inc., Cargill Inc., Solvay , LyondellBasell , Gevo , Galactic , Myriant , and Pinova Holdings INC among others |

| Segments Covered | By Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Bio-Solvents Market: Segment Analysis

The bio-solvents market is segmented on the basis of type, application, and region.

By Type Segment Analysis

The global market is divided into seven segments based on the type of Bio-solvents: Alcohols, Glycols, Diols, Lactate Esters, D-limonene, Methyl Soyate and others. Lactate esters are expected to become more common in the general bio-solvents industry in the near future due to their lower price, limited application area, and ease of availability as compared to other bio-solvents. Another big style division in the bio-solvents industry is methyl soyate. In the near future, it is expected to see a significant rise in revenue.

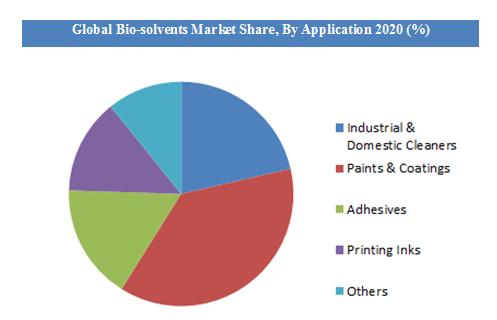

By Application Segment Analysis

On the basis of application, the bio-solvents market is segmented as domestic and industrial cleaners, adhesives, paints and coatings, printing inks, and others. Paints and coatings dominated the bio-solvents industry in 2020, accounting for almost 37.5% of total bio-solvents sales. In the near future, the global bio-solvents industry is expected to be dominated by the paints and coatings application division.

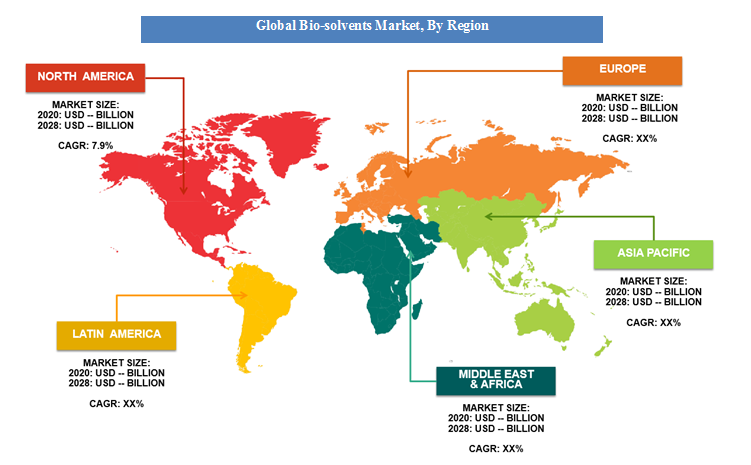

Bio-Solvents Market: Regional Analysis

In 2016, North America was the largest market for bio-solvents followed by Europe. A high level of awareness regarding the health and environmental effects of conventional solvents coupled with stringent environmental regulations leads toa higher market share in the region. Furthermore, robust improvement in the U.S. & the Mexican construction industry is expected to further boost the market growth in the forecast period.

Asia Pacific is expected to register a significant growth rate on account of the growing automotive and construction industries. In addition, rapid industrialization in developing markets of India and China is expected to drive bio-solvent demand in the region.

Bio-Solvents Market: Competitive Landscape

Some of the major players in the global Bio-solvents market include:

- Archer Daniels Midland Company

- BASF SE

- Bioamber Inc

- Huntsman Corporation

- Dupont

- DOW Chemical Company

- Vertec Biosolvents Inc

- Florida Chemicals Company Inc

- Cargill Inc

- Solvay

- LyondellBasell

- Gevo

- Galactic

- Myriant

- Pinova Holdings INC among others.

The global Bio-solvents Market is segmented as follows:

By Type

- Alcohols

- Glycols

- Diols

- Lactate Esters

- D-Limonene

- Methyl Soyate

- Others

By Application

- Industrial & Domestic Cleaners

- Paints & Coatings

- Adhesives

- Printing Inks

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global Bio-solvents Market was valued at USD 4.43 Billion in 2024.

The global Bio-solvents Market is expected to reach USD USD 7.04 Billion by 2032, growing at a CAGR of 5.27% between 2024-2032.

The bio solvent industry is expected to expand as bio solvents become more widely used in coatings, paints, sealants and adhesives, and printing inks. Other growth-inducing influences include several advances in manufacturing technology and a plethora of product developments.

North America was a large consumer of bio solvents in 2024, accounting for 32 percent of the overall sales share. Because of the rising building and automotive industries, Asia Pacific is expected to expand at a rapid pace. Adhesives and sealants demand is expected to be driven by rapid industrialization in emerging markets such as China and India. This trend, along with increasing concerns about the degradability of synthetic solvents, is expected to propel Asia Pacific demand growth even further.

Some of the major players of global Bio-solvents market includes Archer Daniels Midland Company , BASF SE , Bioamber Inc , Huntsman Corporation , Dupont , DOW Chemical Company , Vertec Biosolvents Inc , Florida Chemicals Company Inc , Cargill Inc , Solvay , Lyondell Basell , Gevo , Galactic , Myriant , and Pinova Holdings INC among others. .

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed