Barite Market Size, Share & Trends Report, 2034

Barite Market By Form (Lumps and Power), By Grade (Up to Grade 3.9, Grade 4.0, Grade 4.1, Grade 4.2, Grade 4.3, and Grade above 4.3), Color (White & Off-white, Grey, Brown, and Others), Deposit Type (Residual, Bedding, Vein, and Cavity Filling), End-Use Industry (Oil & Drilling, Paints & Coatings, Pharmaceuticals, Rubber & Plastics, Textiles, Adhesives, and Others), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

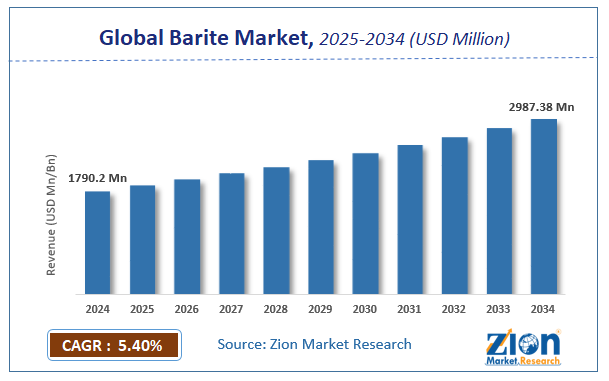

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1790.2 Million | USD 2987.38 Million | 5.4% | 2024 |

Barite Market Size And Industry Analysis

The global barite market size was worth around USD 1790.2 Million in 2024 and is predicted to grow to around USD 2987.38 Million by 2034 with a compound annual growth rate (CAGR) of roughly 5.4% between 2025 and 2034. The report analyzes the global barite market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the barite industry.

Barite Market: Overview

Baryte, often known as barite, is a white or colorless mineral that is an important source of barium. Barite is typically found in lead-zinc veins in limestones and is deposited via a variety of mechanisms such as evaporation, hydrothermal, and biogenic, among others. The increasing demand for oil and gas around the world is a primary element driving growth in the worldwide barite market.

Along with its utility as a weighting agent for drilling fluids, barite is most commonly used in the oil and gas industry. Additionally, rising demand for barite in the paints and coatings and pharmaceutical industries is likely to drive the barite market forward. Furthermore, due to its low oil absorption and great brightness, barite is suitable for use as a pigment in paints and coatings for automobiles and consumer products. As a result, the expanding vehicle sector contributes to the expansion of the worldwide barite market.

The use of barite in the construction of radiation-resistant structures in healthcare settings is becoming a new market trend. Since barites can efficiently filter radiations such as gamma rays and X-rays, they are being used in laboratories, power plants, and hospitals.

Key Insights

- As per the analysis shared by our research analyst, the global barite market is estimated to grow annually at a CAGR of around 5.4% over the forecast period (2025-2034).

- Regarding revenue, the global barite market size was valued at around USD 1790.2 Million in 2024 and is projected to reach USD 2987.38 Million by 2034.

- The barite market is projected to grow at a significant rate due to rising oil & gas drilling activities where barite is used as a weighting agent in drilling fluids.

- Based on Form, the Lumps segment is expected to lead the global market.

- On the basis of Grade, the Up to Grade 3.9 segment is growing at a high rate and will continue to dominate the global market.

- Based on the Color, the White & Off-white segment is projected to swipe the largest market share.

- By Deposit Type, the Residual segment is expected to dominate the global market.

- In terms of End-Use Industry, the Oil & Drilling segment is anticipated to command the largest market share.

- Based on region, Asia-Pacific is predicted to dominate the global market during the forecast period.

Barite Market: Driver

Barite is used in the production of barium carbonate. It is also utilized in the creation of LED glass, which is used in the production of televisions, monitor screens, mobile phones, bulbs, and a variety of other electrical equipment. Electronic gadgets are widely used in the industry, which is a major driving force in boosting the barite market size. The primary application of barite is in the extraction and drilling of oil and gas for a variety of processes.

Barite Market: Restraints

Globally, it has been discovered that a reduction in the mining process has been implemented, which has harmed market demand as well as the expansion of the barite industry. Since the extraction of several new metals is hazardous to the environment, a change in the drilling method was proposed. This has been the market's most significant impediment.

Barite Market: Opportunities

The primary application of barium sulfate is as a lubricant in oils, paints, lubricants, polymers, and rubbers. Barite is in high demand due to its low cost, the convenience of use, and accessibility, which expands its prospects in the barite sector. It is particularly useful in hospital equipment such as x-ray and gamma-ray devices. It is copious and exceedingly pure, owing to which it has a good absorbing character. Globally, barite has been identified as the largest and most prominent segment, accounting for the majority of the barite market share.

Barite Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Barite Market |

| Market Size in 2024 | USD 1790.2 Million |

| Market Forecast in 2034 | USD 2987.38 Million |

| Growth Rate | CAGR of 5.4% |

| Number of Pages | 163 |

| Key Companies Covered | CHINHANA GROUP, DEMETER O&G SUPPLIES SN BHD, KIA ENERGY COMPANY LTD., NHAT HUY GROUP, ASHAPURA GROUP, GENERAL ELECTRIC, HALLIBURTON, SIBELCO, SCHLUMERGER LIMITED, SOJITZ CORPORATION, and others. |

| Segments Covered | By Form, By Grade, By Color, By Deposit Type, By End-Use Industry, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2024 |

| Forecast Year | 2025 to 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Barite Market: Segmentation

The Barite Market is segregated based on Form, Grade, Color, Deposit Type, and End-Use Industry.

By Grade, the market is classified into Up to Grade 3.9, Grade 4.0, Grade 4.1, Grade 4.2, Grade 4.3, and Grade above 4.3. Grade 4.3 is expected to increase at a rapid rate throughout the forecast period because of its applications in the rapidly increasing rubber & tire, healthcare, and paints & coatings industries. Other applications for Grade 4.3 include television and computer monitors, radiation shielding, sound-proofing material in automobiles; traffic cones; brake linings, and so on. High-grade barite, such as 4.3 and higher, is always in high demand because of its purity and hardness.

By Color, the market is classified into White & Off- white, Grey, Brown, and Others. The grey sub-segment is expected to have a significant market share in the forecast period. Grey barite is a naturally occurring mineral type of barium sulfate. Grey barite is frequently utilized as an aggregate, filler extender, and drilling mud weighting agent. Due to its high specific gravity, barite is employed in drilling to prevent the explosive release of gas and oil. During the analysis period, these variables are expected to fuel the growth of the capture sub-segment.

By Deposit Type, the market is classified into Residual, Bedding, Vein, and Cavity Filling. The bedding sub-segment is expected to have a dominant market over the forecast period. This is due to the fact that bedded barite is the most economically important form of barite, which is thought to have developed as emission from seafloor sediments. Bedded barite has a fine-grained syrupy texture and is usually medium to dark grey in color. Furthermore, bedded deposits of barite may be easily extracted utilizing large-scale open-pit mining processes, and extraction involves only a few basic steps. Furthermore, bedded barite deposits are widespread and have stable grades, making them valuable for a variety of industrial and oil and gas drilling operations. These factors are expected to drive the size of the bedding sub-segment market in the approaching years.

Barite Market: Regional Landscape

North America is the largest barite market and is likely to remain dominant throughout the projection period. The region's shale oil revolution has fuelled growth in exploration and development activities, which has resulted in a significant capacity increase, increasing demand for barite as a weighing agent in the oil and gas industry. The increase of exploration and production operations in the North Sea, in particular, has strengthened the region's barite market. Moreover, the region's prominent automobile and consumer goods industries have raised the demand for paint and coating in the region, which is driving the barite market due to its substantial use in pigments in the paint and coating industry.

During the projection period, the Middle East and Africa accounted for the second-largest revenue share. This is due to the region's widespread existence of crude oil reserves and exploration. Due to the high availability of oil wells and natural reservoirs, bauxite is particularly well-known in Qatar, Dubai, and several locations in the United Arab Emirates. The increase in construction activity and surge in demand for paints and coatings from the automotive sector in emerging countries such as Qatar, Dubai, and some regions of the United Arab Emirates are expected to drive demand for paints and coatings, which will likely augment demand for barite from paints and coatings manufacturers.

Barite Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the barite market on a global and regional basis.

The global barite market is dominated by players like:

- CHINHANA GROUP

- DEMETER O&G SUPPLIES SN BHD

- KIA ENERGY COMPANY LTD.

- NHAT HUY GROUP

- ASHAPURA GROUP

- GENERAL ELECTRIC

- HALLIBURTON

- SIBELCO

- SCHLUMERGER LIMITED

- SOJITZ CORPORATION

The global barite market is segmented as follows;

By Form

- Lumps

- Power

By Grade

- Up to Grade 3.9

- Grade 4.0

- Grade 4.1

- Grade 4.2

- Grade 4.3

- and Grade above 4.3

By Color

- White & Off-white

- Grey

- Brown

- and Others

By Deposit Type

- Residual

- Bedding

- Vein

- and Cavity Filling

By End-Use Industry

- Oil & Drilling

- Paints & Coatings

- Pharmaceuticals

- Rubber & Plastics

- Textiles

- Adhesives

- and Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

The global barite market is expected to grow due to rising oil and gas drilling activities, as barite is used in drilling fluids, along with increasing applications in paints and plastics.

According to a study, the global barite market size was worth around USD 1790.2 Million in 2024 and is expected to reach USD 2987.38 Million by 2034.

The global barite market is expected to grow at a CAGR of 5.4% during the forecast period.

Asia-Pacific is expected to dominate the barite market over the forecast period.

Leading players in the global barite market include CHINHANA GROUP, DEMETER O&G SUPPLIES SN BHD, KIA ENERGY COMPANY LTD., NHAT HUY GROUP, ASHAPURA GROUP, GENERAL ELECTRIC, HALLIBURTON, SIBELCO, SCHLUMERGER LIMITED, SOJITZ CORPORATION, among others.

The report explores crucial aspects of the barite market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed