Baijiu Market Size, Growth, Global Trends, Forecast Report 2034

Baijiu Market By Source (Sorghum, Corn, Barley, Wheat, and Rice), By Flavor (Sauce-Flavor, Sesame-Flavor, Light-Flavor, Strong-Flavor, Chi-Flavor, Rice-Flavor, and Others), By Application (Drinking, Medicinal Use, Culinary Use, and Others), By Distribution Channel (Specialty Stores, Online Stores, Hypermarkets & Supermarkets, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

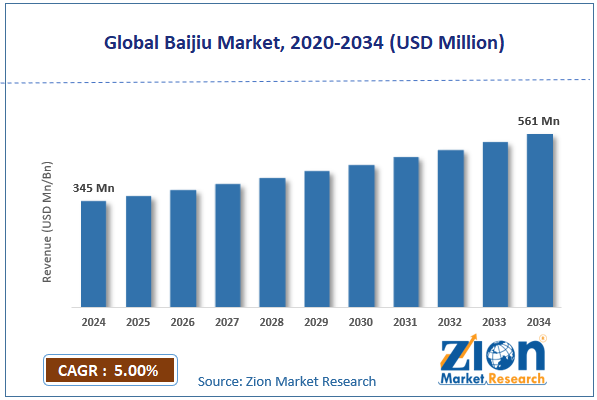

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 345 Million | USD 561 Million | 5.0% | 2024 |

Baijiu Industry Perspective:

What will be the size of the global baijiu market during the forecast period?

The global baijiu market size was worth around USD 345 million in 2024 and is predicted to grow to around USD 561 million by 2034, with a compound annual growth rate (CAGR) of roughly 5.0% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global baijiu market is estimated to grow annually at a CAGR of around 5.0% over the forecast period (2025-2034).

- In terms of revenue, the global baijiu market size was valued at around USD 345 million in 2024 and is projected to reach USD 561 million by 2034.

- Premiumization and rising disposable incomes are expected to drive the baijiu market.

- Based on the source, the sorghum source dominated the market in 2024.

- Based on the flavor, the sauce flavor dominates the market in 2024, with over 32% revenue share.

- Based on the application, the drinking is expected to hold the largest market share over the projected period.

- Based on the distribution channel, the specialty stores segment captures the largest revenue share in 2024.

- Based on region, the Asia Pacific is expected to lead the Baijiu market over the projected period.

Baijiu Market: Overview

People think that baijiu, a traditional Chinese distilled alcoholic drink, is the biggest type of alcohol in the world. Most of the time, baijiu is made from fermented grains like sorghum, but it can also be produced from rice, wheat, corn, and barley. It is transparent and has a high alcohol content, typically 35-60% ABV. It is made by solid-state fermentation using a starter called qu, followed by distillation and, in many cases, aging in clay jars or ceramic vessels. Baijiu is known for its strong smell and wide range of flavors, which can be gentle and floral or deep, savory, and spicy. There are four main forms of aroma: strong, sweet, light, and rice. These types originate from different regions and reflect distinct methods of product production and the types of bacteria present in those areas. Baijiu is a big part of Chinese culture. It is a gesture of hospitality, respect, and social connection during parties, business meetings, and other important events.

Baijiu Market: Dynamics

Growth Drivers

Why premiumization and rising disposable incomes drive the baijiu market growth?

The baijiu market is growing due to premiumization and rising disposable incomes. This is changing how people shop, from buying basic items to higher-value items. As people's incomes rise, especially in cities with middle- and upper-class families, they have more money to spend on premium, branded, and higher-quality goods rather than cheap ones. In the baijiu sector, this means people are moving up from lower- or mid-tier spirits to higher-end brands such as Kweichow Moutai, Wuliangye Yibin, and Luzhou Laojiao. This effect of trading up raises the average price per bottle, thereby increasing overall market revenue, even though total consumption rises only slightly.

Also, high-end products often show that a brand is more valuable, exclusive, and a marker of status. In places like China, where baijiu is strongly associated with social events, gift-giving, and business ties, people with higher incomes tend to buy more expensive brands to show off their wealth and build social capital. Premium items also have higher profit margins, allowing manufacturers to invest more in marketing, distribution, innovation, and international growth, which, in turn, drives market growth. So, higher disposable income drives demand growth, while premiumization increases revenue and profits, which drives long-term market growth.

Restraints

Do government policies and anti-corruption/banquet bans pose a significant restraint on baijiu market growth?

Government rules and bans on corruption or banquets can have a significant impact on market growth, especially for businesses like baijiu that have long relied on official banquets, corporate entertainment, and high-end gifts. When governments cut spending or crack down on corruption, constraints on expensive gifts and lavish spending directly reduce demand for high-end spirits. In the past, anti-corruption efforts in China have hurt high-end baijiu brands like Kweichow Moutai and Wuliangye Yibin because some of their sales were linked to official functions and business banquets. These rules not only reduce institutional purchases but also raise concerns about conspicuous consumption, which could harm sales of very high-end products. Even as the whole market may eventually shift toward retail and private consumption channels, such laws can make it very hard for businesses to boost sales in the short to medium term, especially in the luxury sector.

Opportunities

Does the growing product innovation offer a development opportunity for the baijiu industry?

As companies introduce new products, they may reach more customers, adapt to changing tastes, and find new ways to generate revenue. This is a big opportunity for the baijiu market to flourish. Younger, health-conscious consumers who may find classic high-proof baijiu too strong are more likely to purchase it if it is available in lower-alcohol versions, flavored expressions, modern packaging, and cocktail-friendly shapes. It also helps the company grow internationally by making the product easier for people around the world to find who aren't used to its powerful aroma. Top brands like Kweichow Moutai and Wuliangye Yibin have invested more in high-end packaging, limited editions, and partnerships with brands in other categories to make their products more appealing. In a competitive market, companies that develop new ideas can differentiate themselves, increase revenue, and adapt quickly to changes in customer behavior, thereby improving their chances of long-term growth.

Challenges

Counterfeiting and brand trust issues pose a significant challenge to market expansion

Counterfeiting and problems with brand trust are major obstacles to market growth, especially in high-end industries like baijiu. Counterfeiters often target big brands because they command high retail prices and carry a lot of prestige. This leads to fake or watered-down products being sold both online and offline. Not only does this cause immediate income losses, but it also harms the brand's reputation and reduces customer confidence. High-end brands like Kweichow Moutai and Wuliangye Yibin are especially at risk, as they are in high demand and can be sold for a high price. When consumers cannot distinguish between genuine and counterfeit products, they are less inclined to pay high prices. This lowers pricing power and slows overall baijiu market growth.

Additionally, companies must spend a lot of money on anti-counterfeiting technologies, legal enforcement, secure distribution systems, and authentication procedures, which increases their business expenses. Because of this, counterfeiting not only harms short-term sales but also undermines long-term brand equity and market growth efforts.

Baijiu Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Baijiu Market |

| Market Size in 2024 | USD 345 Million |

| Market Forecast in 2034 | USD 561 Million |

| Growth Rate | CAGR of 5.0% |

| Number of Pages | 216 |

| Key Companies Covered | Kweichow Moutai Co. Ltd., Anhui Gujing Group Co. Ltd., Jiangsu Yanghe Distillery Co. Ltd., Luzhou Laojiao Co. Ltd., Jiangsu King’s Luck Brewery Joint-Stock Co. Ltd., Shanxi Xinghuacun Fen Wine Factory Co. Ltd., Wuliangye Yibin Co. Ltd., Shanxi Xifeng Liquor Co. Ltd., Guizhou Guotai Junhao Group Co. Ltd., Sichuan Langjiu Group Co. Ltd., Jiugui Liquor Co. Ltd., Xiamen Yuetai Group Co. Ltd., Shandong Dong-E E-Jiao Co. Ltd., Hebei Hengshui Laobaigan Liquor Co. Ltd., Ningxia Tianyuan Manganese Industry Group Co. Ltd., and others. |

| Segments Covered | By Source, By Flavor, By Application, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Baijiu Market: Segmentation

Source Insights

Why is sorghum a dominant category in 2024 in the baijiu market?

The sorghum source dominated the market in 2024. Sorghum is the main raw material utilized to make good baijiu. Sorghum is well-known for its high starch content and its suitability for solid-state fermentation, which is necessary to produce the complex aromas and flavors found in high-quality baijiu.

As more people seek high-end, unique baijiu, manufacturers need a steady supply of high-quality sorghum. This is because people are willing to pay more for authentic spirits that are made in the traditional way. Kweichow Moutai and Wuliangye Yibin are two of the largest companies that rely on specific sorghum varieties to ensure product quality and build their brands. As a result, premium baijiu manufacturing immediately boosts revenue growth throughout the sorghum supply chain, including cultivation, procurement, and processing.

Flavor Insights

What factor causes sauce flavor to be a dominant segment in the baijiu industry?

The sauce-flavor dominates the market in 2024 with over 32% revenue share because it is so closely related to premium positioning and brand respect. The fermentation process for sauce-flavored baijiu is more complicated, it takes longer to mature, and it has a rich, umami-like aroma that makes it more expensive than light- or strong-aroma baijiu. Big companies like Kweichow Moutai control the market, and their products are used as high-end gifts and as status symbols at business dinners. The demand for sauce-flavored goods has increased because people have more money to spend, the middle and upper classes are growing, and more people are interested in collectible and investment-grade spirits.

Additionally, because fermentation and aging are time-consuming, limited production capacity leads to supply shortages, keeping prices stable and margins high. So, even small increases in volume lead to big gains in revenue, making sauce-flavor baijiu an important value driver for the whole business.

Application Insights

Why does the drinking segment dominate the baijiu industry?

The drinking is expected to hold the largest market share over the projected period. The baijiu market's primary source of revenue remains drinking, as the spirit is a significant part of social, cultural, and business activities across China. Baijiu is different from other alcoholic drinks in that it is strongly linked to banquets, weddings, festivals, family gatherings, and business meetings, which keeps demand high all year long.

As people have more money and cities flourish, they spend more on dining out and parties, which immediately leads to more baijiu consumption. This trend is quite good for high-end brands like Kweichow Moutai and Wuliangye Yibin. People often prefer more expensive bottles for social drinking to show off their wealth and hospitality. Also, the shift from casual drinking to more formal settings, such as banquets and restaurants, raises the average price per bottle.

Distribution Channel Insights

Does the specialty stores segment dominate the baijiu market?

The specialty stores segment captures the largest revenue share in 2024. Their growth has been fueled by their ability to create a high-end, brand-focused retail space that increases customer confidence in their purchases and trust in the brand. Specialty booze stores and brand-exclusive locations offer carefully curated selections, genuine product guarantees, and trained staff who can teach clients about different types of fragrances, how to age them, and how they differ by region.

Regional Insights

Why does the Asia Pacific hold the largest market share in the baijiu market?

Asia Pacific is expected to drive industry growth. The Asia-Pacific market is growing, with a focus on high-value investments, new ideas from young people, and expansion into new markets. Baijiu has become a major investment in preserved liquor in the Asia Pacific. The 2024 AIFIAN report states that Baijiu accounts for about half of all liquor investments in the area. This shows that it has significant cultural value and that investors believe it will increase over time.

At the same time, distillers are updating their products to appeal to younger consumers by producing lower-alcohol Baijiu, adding fruit flavors, and adopting more attractive packaging. These changes are backed by digital and influencer-led marketing campaigns. Also, as more people move to cities and wages rise in Tier 2 and Tier 3 cities in China and Southeast Asia, demand for mid-range and luxury Baijiu is going up. This is because people want things that integrate traditional heritage with modern attractiveness.

Baijiu Market: Competitive Analysis

The global baijiu market is dominated by players like:

- Kweichow Moutai Co. Ltd.

- Anhui Gujing Group Co. Ltd.

- Jiangsu Yanghe Distillery Co. Ltd.

- Luzhou Laojiao Co. Ltd.

- Jiangsu King’s Luck Brewery Joint-Stock Co. Ltd.

- Shanxi Xinghuacun Fen Wine Factory Co. Ltd.

- Wuliangye Yibin Co. Ltd.

- Shanxi Xifeng Liquor Co. Ltd.

- Guizhou Guotai Junhao Group Co. Ltd.

- Sichuan Langjiu Group Co. Ltd.

- Jiugui Liquor Co. Ltd.

- Xiamen Yuetai Group Co. Ltd.

- Shandong Dong-E E-Jiao Co. Ltd.

- Hebei Hengshui Laobaigan Liquor Co. Ltd.

- Ningxia Tianyuan Manganese Industry Group Co. Ltd.

The global baijiu market is segmented as follows:

By Source

- Sorghum

- Corn

- Barley

- Wheat

- Rice

By Flavor

- Sauce-Flavor

- Sesame-Flavor

- Light-Flavor

- Strong-Flavor

- Chi-Flavor

- Rice-Flavor

- Others

By Application

- Drinking

- Medicinal Use

- Culinary Use

- Others

By Distribution Channel

- Specialty Stores

- Online Stores

- Hypermarkets & Supermarkets

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed