Aviation (MRO) Market Size, Share, Trends, Growth 2034

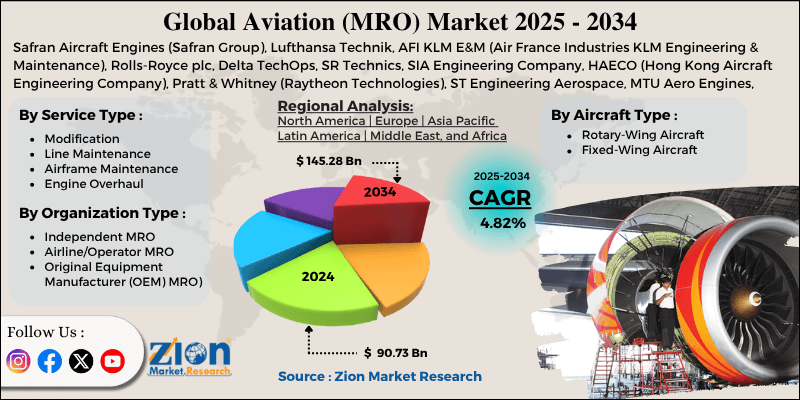

Aviation (MRO) Market By Service Type (Modification, Line Maintenance, Airframe Maintenance, Engine Overhaul, and Others), By Organization Type (Independent MRO, Airline/Operator MRO, and Original Equipment Manufacturer (OEM) MRO), By Aircraft Type (Rotary-Wing Aircraft and Fixed-Wing Aircraft), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

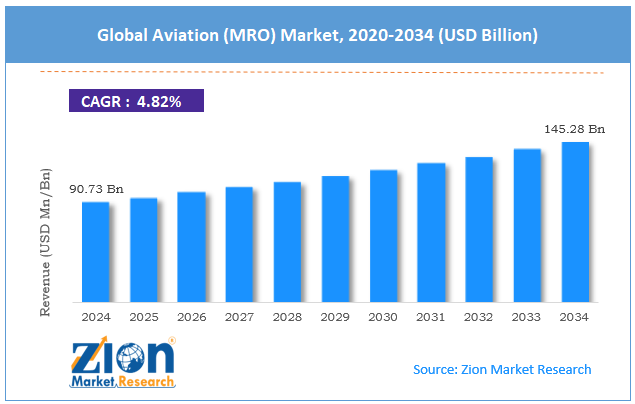

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 90.73 Billion | USD 145.28 Billion | 4.82% | 2024 |

Aviation (MRO) Industry Perspective:

The global aviation (MRO) market size was worth around USD 90.73 billion in 2024 and is predicted to grow to around USD 145.28 billion by 2034 with a compound annual growth rate (CAGR) of roughly 4.82% between 2025 and 2034.

Aviation (MRO) Market: Overview

Aviation Maintenance, Repair, and Overhaul (MRO) services are all activities conducted to ensure flight safety during operations. MRO in aviation is a critical procedure conducted regularly so that the aircraft are safe to fly at all times.According to industry research, airports worldwide offer MRO services on-site. In recent times, traditional MRO activities have extended to component-based maintenance, repair, and overhaul. Depending on the type of MRO required, certain services can be delivered on-site at airports.

However, for other services, off-airport facilities may be more useful. Regular aviation maintenance assists in prolonging the overall lifespan of an operational aircraft. Repair work, on the other hand, is conducted in the event of a component failing to deliver the expected performance.In overhaul procedures, aircraft are broken down piece by piece, and each component is inspected separately. Aircraft overhauling is critical to the aircraft’s lifecycle management and enhancement.

During the forecast period, demand for aviation maintenance, repair, and overhaul (MRO) services is expected to grow due to several factors. Increasing aircraft safety regulations and the rising number of airports worldwide will fuel the market growth rate. The cost constraints related to aviation MRO may limit the industry’s smooth growth trajectory.

Key Insights:

- As per the analysis shared by our research analyst, the global aviation (MRO) market is estimated to grow annually at a CAGR of around 4.82% over the forecast period (2025-2034)

- In terms of revenue, the global aviation (MRO) market size was valued at around USD 90.73 billion in 2024 and is projected to reach USD 145.28 billion, by 2034.

- The aviation (MRO) market is projected to grow at a significant rate due to the growing number of airports worldwide.

- Based on the service type, the line maintenance segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- Based on the aircraft type, the fixed-wing aircraft segment is anticipated to command the largest market share.

- Based on region, North America is projected to dominate the global market during the forecast period.

Aviation (MRO) Market: Growth Drivers

Growing number of airports worldwide to fuel market revenue during the forecast period

The global aviation (MRO) market is projected to be driven by the rising number of airports worldwide. According to market research, most airports, especially facilities that deal with international fleets, have MRO facilities. These institutes provide MRO services to airlines, including regular maintenance and repair work.In November 2024, Air India, one of the largest carriers in the Indian market operating on a global scale, announced the launch of new MRO services at the Kempegowda International Airport in Bengaluru. The ongoing expansion of airport infrastructure worldwide, with the addition of new terminals and technology integration, will promote higher revenue for aviation MRO.

In May 2025, reports emerged suggesting that Ethiopia is working on constructing a massive new airport, which is expected to serve 60 million travelers per year by 2040.Saudi Arabia and the United Arab Emirates are among the largest investors in airport facilities. The surge in the number of business or leisure-based travelers is creating an urgent need to improve existing airport infrastructure, creating scope for MRO service providers.

Rising construction of new MRO services globally to generate massive returns on investment (ROI)

In recent times, aviation MRO services have witnessed significant investments from key stakeholders. During the projection period, these investments are expected to generate considerable returns.In March 2025, Thales Group, a leading multinational firm offering services across various sectors, including aerospace, announced the launch of a new MRO facility in Gurugram, India. The unit is located near the New Delhi airport.

According to official reports, the center is expected to deliver a comprehensive range of services according to the latest needs of aircraft maintenance and repair. The surge in the number of service providers is expected to drive significant revenue growth in the global aviation (MRO) market during the forecast period.

Aviation (MRO) Market: Restraints

Cost-related barriers to continue affecting market growth trajectory during the forecast period

The global aviation (MRO) industry is expected to be restricted due to the cost-related barriers plaguing the market. MRO services for aircraft are highly expensive due to the involvement of modern machinery in conducting maintenance, repair, or overhaul.Additionally, skilled labor is required to conduct optimal MRO services, further adding to the overall cost. For instance, the average cost of repairing the engine of a wide-body jet can range between USD 5 million and USD 12.5 million.

Aviation (MRO) Market: Opportunities

Introduction of new aircraft in the market to create innovation opportunities for MRO providers

The global aviation (MRO) market is expected to generate growth opportunities due to the rising introduction of new aircraft in the aerospace industry. The addition of novel flying machines with advanced body parts and components will encourage MRO service providers to increase innovation-led investments.

For instance, the latest development in aircraft engine technology has emerged in the form of turboprop/turboshaft and turbofan engines used in business aircraft of all sizes.

According to research, these engines reduce fuel consumption by 20% compared to existing solutions. In addition to this, aircraft component makers are working on developing foldable wings that will improve the wingspan range for aircraft during flight.

In April 2025, United, a dominant US-based airline, announced its plan to purchase around 200 blended-wing body aircraft designed by JetZero. The latter is an emerging player in the aerospace industry. The new aircraft is expected to seat around 250 passengers. Furthermore, advancements in MRO technologies using next-generation equipment can further accelerate the market growth rate.

Aviation (MRO) Market: Challenges

Impact of downtime on business operations to challenge market growth trends

The global aviation (MRO) industry is expected to be challenged by growing concerns over the impact of downtime caused by maintenance, repair, or overhaul. In cases of extensive MRO-related work, companies can lose crucial business hours, leading to financial losses. Moreover, growing incidents of extreme delay in MRO from the end of service providers have further created more challenges for market players.

Aviation (MRO) Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Aviation (MRO) Market |

| Market Size in 2024 | USD 90.73 Billion |

| Market Forecast in 2034 | USD 145.28 Billion |

| Growth Rate | CAGR of 4.82% |

| Number of Pages | 215 |

| Key Companies Covered | Safran Aircraft Engines (Safran Group), Lufthansa Technik, AFI KLM E&M (Air France Industries KLM Engineering & Maintenance), Rolls-Royce plc, Delta TechOps, SR Technics, SIA Engineering Company, HAECO (Hong Kong Aircraft Engineering Company), Pratt & Whitney (Raytheon Technologies), ST Engineering Aerospace, MTU Aero Engines, EgyptAir Maintenance & Engineering, Turkish Technic, GE Aerospace, AAR Corp., and others. |

| Segments Covered | By Service Type, By Organization Type, By Aircraft Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Aviation (MRO) Market: Segmentation

The global aviation (MRO) market is segmented based on service type, organization type, aircraft type, and region.

Based on the service type, the global market segments are modification, line maintenance, airframe maintenance, engine overhaul, and others. In 2024, line maintenance emerged as the highest revenue generator. Line maintenance refers to regular inspections carried out between flights. It is the most frequent form of MRO service. A-check type of line maintenance, which involves light management, generally occurs every 400 to 600 flight hours.

Based on organization type, the global aviation (MRO) industry is divided into independent MRO, airline/operator MRO, and original equipment manufacturer (OEM) MRO.

Based on the aircraft type, the global market divisions are rotary-wing aircraft and fixed-wing aircraft. In 2024, the highest growth was recorded in the fixed-wing aircraft segment, primarily due to the increased use of the variant across both military and commercial applications. Emirates, a leading airline from the Middle East, owns over 261 aircraft according to recent reports. Rotary-wing aircraft segment will deliver considerable revenue during the projection period.

Aviation (MRO) Market: Regional Analysis

North America to continue dominating the industry during the projection period

The global aviation (MRO) market is expected to be driven by North America during the forecast period. The US is home to one of the world’s most advanced aviation MRO infrastructures, according to industry analysis. Some of the major airports connecting global locations are in the US, creating massive growth avenues for MRO service providers.

In April 2025, Lufthansa Technik announced the launch of a used serviceable material (USM) business for its North American clients, focusing on aircraft carriers. The company plans to source the parts from global customers but aims to deliver USM services primarily in the US market.

In November 2024, SkyDrive Inc., a leading aircraft manufacturer based in Japan, announced a strategic partnership with US-based F&E Aircraft Maintenance. The latter is a leading provider of line maintenance solutions. The partnership is expected to establish a robust framework for supporting, maintaining, and scaling electric vertical takeoff and landing (eVTOL) aircraft in the US and other regions.

The growing rate of aircraft-related innovation in North America will further influence improved revenue in the regional market. Military applications of aviation (MRO) will continue to deliver considerable growth opportunities for North American aviation MRO service providers.

Aviation (MRO) Market: Competitive Analysis

The global aviation (MRO) market is led by players like:

- Safran Aircraft Engines (Safran Group)

- Lufthansa Technik

- AFI KLM E&M (Air France Industries KLM Engineering & Maintenance)

- Rolls-Royce plc

- Delta TechOps

- SR Technics

- SIA Engineering Company

- HAECO (Hong Kong Aircraft Engineering Company)

- Pratt & Whitney (Raytheon Technologies)

- ST Engineering Aerospace

- MTU Aero Engines

- EgyptAir Maintenance & Engineering

- Turkish Technic

- GE Aerospace

- AAR Corp.

The global aviation (MRO) market is segmented as follows:

By Service Type

- Modification

- Line Maintenance

- Airframe Maintenance

- Engine Overhaul

- Others

By Organization Type

- Independent MRO

- Airline/Operator MRO

- Original Equipment Manufacturer (OEM) MRO)

By Aircraft Type

- Rotary-Wing Aircraft

- Fixed-Wing Aircraft

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Aviation Maintenance, Repair, and Overhaul (MRO) services are all activities conducted to ensure flight safety during operations.

The global aviation (MRO) market is projected to be driven by the rising number of airports worldwide.

According to study, the global aviation (MRO) market size was worth around USD 90.73 billion in 2024 and is predicted to grow to around USD 145.28 billion by 2034.

The CAGR value of the aviation (MRO) market is expected to be around 4.82% during 2025-2034.

The global aviation (MRO) market is expected to be driven by North America during the forecast period.

The global aviation (MRO) market is led by players like Safran Aircraft Engines (Safran Group), Lufthansa Technik, AFI KLM E&M (Air France Industries KLM Engineering & Maintenance), Rolls-Royce plc, Delta TechOps, SR Technics, SIA Engineering Company, HAECO (Hong Kong Aircraft Engineering Company), Pratt & Whitney (Raytheon Technologies), ST Engineering Aerospace, MTU Aero Engines, EgyptAir Maintenance & Engineering, Turkish Technic, GE Aerospace, and AAR Corp.

The report explores crucial aspects of the aviation (MRO) market, including a detailed discussion of existing growth factors and restraints, while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed