Aviation Coating Market Size, Share, Trends, Growth and Forecast 2032

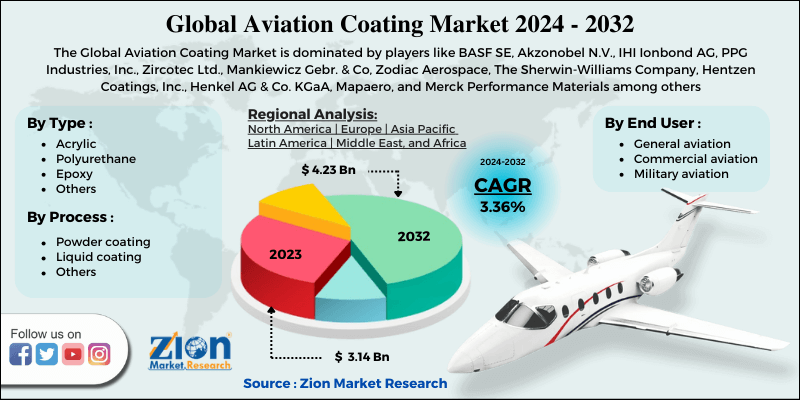

Aviation Coating Market By Type (Acrylic, Polyurethane, Epoxy, and Others), By Process (Powder Coating, Liquid Coating, and Others), By End User (General Aviation, Commercial Aviation, and Military Aviation), and By Region: Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032

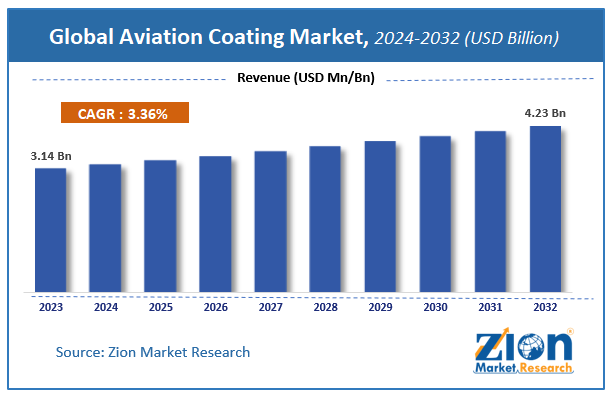

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 3.14 Billion | USD 4.23 Billion | 3.36% | 2023 |

Aviation Coating Market Insights

According to Zion Market Research, the global Aviation Coating Market was worth USD 3.14 Billion in 2023. The market is forecast to reach USD 4.23 Billion by 2032, growing at a compound annual growth rate (CAGR) of 3.36% during the forecast period 2024-2032.

The report offers a comprehensive analysis of the market, highlighting the factors that will determine growth, potential challenges, and opportunities that could emerge in the Aviation Coating Market industry over the next decade.

Aviation Coating Market: Market Overview

Aviation coating offers the metals with a wide wear-resistant finish that can prohibit water and air from the surface of the metal to prevent corrosion. There has been tremendous growth in the use of aviation in emerging economies across the globe. Aviation coating is generally carried out using two major processes such as powder coating, liquid coating, and another process.

The factors for the growth of the market are increased demand for aerospace coatings from various end users such as military aviation, commercial, and general aviation. The coatings are used on the exterior surface of the aircraft for decorative paintings to enhance its appearance. Moreover, the increase in production of aircraft is likely to positively impact on the growth of the market. For instance, In Canada, aircraft production has risen from 18,783,235 in 2017 to 19,742,834 in 2018.

COVID-19 Impact Analysis:

The global aviation coating market has witnessed a significant decrease due to the lockdown enforcement placed by the various governments across the globe in order to contain COVID spreading. People had no option but to remain indoor, so the travel industry had decrease drastically. The restrictions imposed by various nations to contain COVID had stopped the travelling to any other countries resulting in a disruption across the globe.

However, the world markets are slowly opening to their full potential and theirs a surge in demand of aviation coating. The market would remain bullish in upcoming two-three year.

Aviation Coating Market: Growth Factors

Rapidly developing industrialization and urbanization in emerging economies is expected to boost the growth of aviation market which in turn is expected to fuel the aviation coating market. However, regulations restricting Volatile Organic Compound (VOC) emission along with hazardous waste generation and disposal may hamper the growth of aviation coating market.

Nonetheless, ongoing research for development in aviation coating is anticipated to propel the growth of aviation coating market in the forecast period. Moreover, growing demand from emerging countries for the aviation coating market is likely to offer new opportunities in the coming years.

Aviation Coating Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Aviation Coating Market |

| Market Size in 2023 | USD 3.14 Billion |

| Market Forecast in 2032 | USD 4.23 Billion |

| Growth Rate | CAGR of 3.36% |

| Number of Pages | 110 |

| Key Companies Covered | BASF SE, Akzonobel N.V., IHI Ionbond AG, PPG Industries, Inc., Zircotec Ltd., Mankiewicz Gebr. & Co, Zodiac Aerospace, The Sherwin-Williams Company, Hentzen Coatings, Inc., Henkel AG & Co. KGaA, Mapaero, and Merck Performance Materials among others |

| Segments Covered | By Type, By Process, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Aviation Coating Market: Segment Analysis

The aviation coating market is segmented by type, process, end user, and region.

On the basis of types, the aviation coating market can be segmented as acrylic, polyurethane, epoxy, and others. Polyurethane provides enhanced moisture resistance with high flexibility. Thus, polyurethane is the leading segment due to various end-user applications. Furthermore, acrylic and epoxy are likely to gain market in the foreseen period.

Based on Process, The aviation coating market is segmented by powder coating, liquid coating, and others. Liquid coating is the largest revenue-generating segment owing to the simplicity of application and cost-effective coating. There has been a high usage of powder coatings in defense and other aerospace high-performance applications have been inadequate. This is mainly due to demanding specification requirements, test and development expenses, disinclined customer acceptance of powders, and comparatively low production rates as compared to commercial applications. However, powders are rapidly gaining demand owing to huge environmental regulations and cost constraints on other applications.

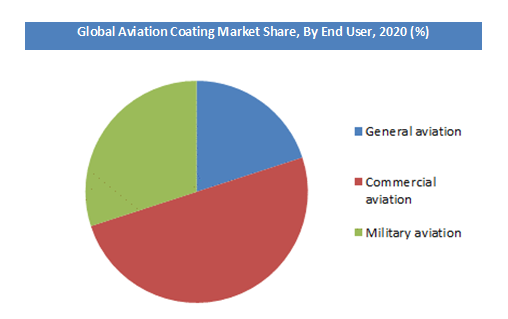

General aviation, commercial aviation, and military aviation are the end-user segments of the aviation coating market. Commercial aviation was the leading segment of the aviation coating market in 2023 with a significant market share.

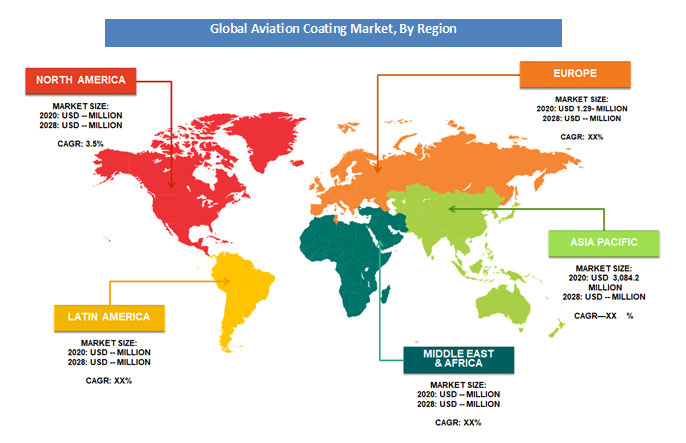

Aviation Coating Market: Regional Analysis

Asia Pacific held the largest market share for aviation coating followed by North America in 2023. Escalating investment in developing economies such as China and India along with the sharp rise in investment for defense in China is expected to spur the overall aviation coating market growth in Asia Pacific. In addition, increasing government initiatives to uphold the development in the defense and tourism sectors is expected to aid the growth of aviation coatings market in this region.

Europe held significant market share in 2023 owing to the frequency of cargo transportation in Europe along with a high number of domestic and international travelers. Latin America is anticipated to specter decent growth in the forecast period. The Middle East and Africa are likely to exhibit moderate growth over the coming years.

Request Free Sample

Request Free Sample

Aviation Coating Market: Competitive Landscape

Some of the key players in the Aviation Coating market are;

- BASF SE

- Akzonobel N.V.

- IHI Ionbond AG

- PPG Industries, Inc.

- Zircotec Ltd.

- Mankiewicz Gebr. & Co

- Zodiac Aerospace

- The Sherwin-Williams Company

- Hentzen Coatings, Inc.

- Henkel AG & Co. KGaA

- Mapaero

- Merck Performance Materials

The global Aviation Coating market is segmented as follows:

By Type

- Acrylic

- Polyurethane

- Epoxy

- Others

By Process

- Powder coating

- Liquid coating

- Others

By End User

- General aviation

- Commercial aviation

- Military aviation

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Aviation Coating Market size is set to expand from $ 3.14 Billion in 2023

Aviation Coating Market size is set to expand from $ 3.14 Billion in 2023 to $ 4.23 Billion by 2032, with an anticipated CAGR of around 3.36% from 2024 to 2032.

Some of the key factors driving the global Aviation Coating market growth are Strong presence of aerospace and defense industry players, Technological advancements along with supportive government initiatives and research projects, and Increasing commercial aircraft orders and deliveries.

Asia Pacific region held a substantial share of the Aviation Coating market in 2020. This was mainly due to the huge investment in defense by the governing bodies of China & India. Moreover, accomplishment from the Indian government for improvement of tourism in India is expected to be the most prominent markets in the near future.

Some of the major companies operating in Aviation Coating market are BASF SE, Akzonobel N.V., IHI Ionbond AG, PPG Industries, Inc., Zircotec Ltd., Mankiewicz Gebr. & Co, Zodiac Aerospace, The Sherwin-Williams Company, Hentzen Coatings, Inc., Henkel AG & Co. KGaA, Mapaero and Merck Performance Materials among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed