Automotive Solar Control Glass Market Size, Share, Trends, Growth and Forecast 2034

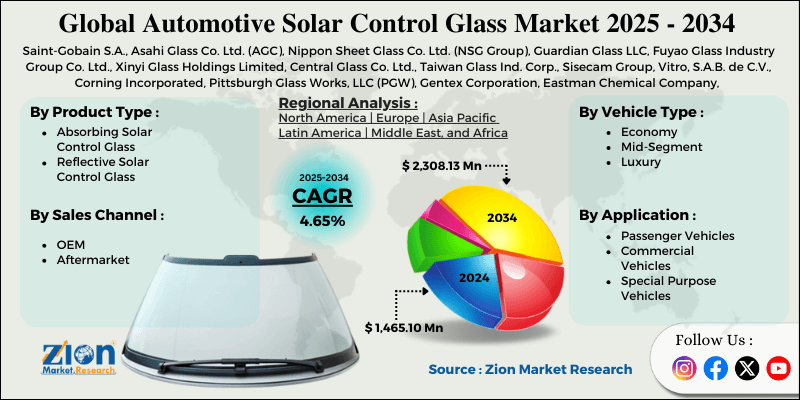

Automotive Solar Control Glass Market By Product Type (Absorbing Solar Control Glass and Reflective Solar Control Glass), By Application (Passenger Vehicles, Commercial Vehicles, and Special Purpose Vehicles), By Vehicle Type (Economy, Mid-Segment, and Luxury), By Sales Channel (OEM and Aftermarket) and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

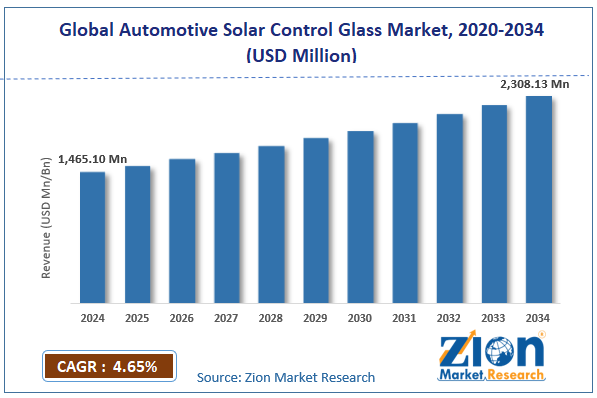

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1,465.10 Million | USD 2,308.13 Million | 4.65% | 2024 |

Automotive Solar Control Glass Industry Perspective:

The global automotive solar control glass market was valued at approximately USD 1,465.10 million in 2024 and is expected to reach around USD 2,308.13 million by 2034, growing at a compound annual growth rate (CAGR) of roughly 4.65% between 2025 and 2034.

Automotive Solar Control Glass Market: Overview

Automotive solar control glass is specialized glazing designed to reduce heat transmission, block harmful UV radiation, and manage light penetration into vehicle interiors while maintaining visibility and structural integrity for enhanced passenger comfort and efficiency. These products offer thermal management, UV protection, glare reduction, privacy, and customization.

Products range from basic tinted glass with minimal solar control to multi-layered glazing systems with metallic coatings, ceramic nanoparticles, and specialized interlayers to perform across different climates and vehicle types.

The growing consumer preference for stringent fuel efficiency, emissions regulations, and technological advancements in glass manufacturing are expected to drive growth in the global automotive solar control glass industry.

Key Insights:

- As per the analysis shared by our research analyst, the global automotive solar control glass market is estimated to grow annually at a CAGR of around 4.65% over the forecast period (2025-2034)

- In terms of revenue, the global automotive solar control glass market size was valued at around USD 1,465.10 million in 2024 and is projected to reach USD 2,308.13 million by 2034.

- The automotive solar control glass market is projected to grow significantly due to rising consumer demand for vehicle comfort features, increasing electric vehicle adoption necessitating energy-efficient components, advancements in glass manufacturing technology, and raising awareness of UV radiation protection for vehicle occupants.

- Based on product type, absorbing solar control glass leads the segment and will continue to lead the global market.

- Based on application, passenger vehicles are expected to lead the market.

- Based on vehicle type, mid-segment vehicles are anticipated to command the largest market share.

- Based on sales channel, OEM is expected to lead the market during the forecast period.

- Based on region, Asia Pacific is projected to lead the global market during the forecast period.

Automotive Solar Control Glass Market: Growth Drivers

Vehicle comfort enhancement and energy efficiency requirements

The automotive solar control glass market is growing fast as car makers prioritize comfort and energy efficiency across all segments. Interior temperature management is now a key comfort feature as solar control glass can reduce cabin temperatures by up to 10°C compared to standard glass. The HVAC load reduction from solar glazing directly impacts the fuel economy in conventional cars and the electric car range.

Regulatory pressure for better efficiency forces OEMs to adopt solar glazing as a passive efficiency technology. Consumer awareness about skin protection and cancer prevention has made UV blocking a primary buying consideration.

Electric vehicle integration and sustainability trends

The automotive solar control glass market is valuable in the electric vehicle revolution, addressing critical range optimization needs while supporting broader sustainability goals. Electric vehicle (EV) range extension through reduced air conditioning load directly addresses consumer range anxiety. Battery protection from heat exposure extends longevity and performance, creating long-term value for EV owners.

The lightweight properties of advanced solar glazing contribute to overall vehicle weight reduction strategies, critical for EV efficiency. These benefits have positioned automotive solar control glass as a standard feature in EVs and a common adoption in mass-market electric vehicles.

Automotive Solar Control Glass Market: Restraints

Cost sensitivity and integration challenges

Despite its benefits, the automotive solar control glass industry faces challenges with premium costs in price-sensitive vehicle markets and manufacturing complexity with advanced solutions. The premium price for solar control glazing creates adoption barriers in entry-level vehicle markets where cost considerations exceed comfort features. Integration complexity with other vehicle systems like antennas, sensors, and defrosting elements requires advanced design and manufacturing approaches.

The weight-performance balance remains challenging as thinner glass reduces weight but may compromise other functional properties. In many markets, consumer education regarding the differentiated benefits between basic tinting and advanced solar control technologies remains insufficient.

Automotive Solar Control Glass Market: Opportunities

Advanced technologies and customization options

The automotive solar control glass market offers strong growth opportunities through new technologies and custom solutions tailored to regional needs and consumer preferences. Smart glass with a tint that changes based on light is becoming a valuable segment. Adding solar control to augmented reality displays helps create premium features.

Custom glass designed for different climates allows manufacturers to perform better in specific regions. Bundling solar control with safety, security, and connectivity can increase product value. As more consumers customize their cars, companies that provide flexible solar control solutions across various prices and performance levels are likely to gain a larger market share.

Automotive Solar Control Glass Market: Challenges

Technical performance tradeoffs and regional regulation variations

The automotive solar control glass industry faces significant challenges with performance compromises, as darker tints block more heat but can reduce visibility at night. Some metallic coatings that help with heat control can interfere with radio signals used in connected cars.

Premium carmakers often want glass that looks clear and neutral in color, which makes it harder to keep strong heat-blocking features. Rules about tint levels, light transmission, and testing vary widely across countries, making it hard for global manufacturers to stay compliant everywhere. The glass must also work well with defogging and defrosting systems in cold climates.

Automotive Solar Control Glass Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Automotive Solar Control Glass Market |

| Market Size in 2024 | USD 1,465.10 Million |

| Market Forecast in 2034 | USD 2,308.13 Million |

| Growth Rate | CAGR of 4.65% |

| Number of Pages | 215 |

| Key Companies Covered | Saint-Gobain S.A., Asahi Glass Co. Ltd. (AGC), Nippon Sheet Glass Co. Ltd. (NSG Group), Guardian Glass LLC, Fuyao Glass Industry Group Co. Ltd., Xinyi Glass Holdings Limited, Central Glass Co. Ltd., Taiwan Glass Ind. Corp., Sisecam Group, Vitro, S.A.B. de C.V., Corning Incorporated, Pittsburgh Glass Works, LLC (PGW), Gentex Corporation, Eastman Chemical Company, 3M Company, Magna International Inc., Sekisui Chemical Co. Ltd., Pilkington Group Limited, PPG Industries Inc., TESA SE., and others. |

| Segments Covered | By Product Type,By Application, By Vehicle Type, By Sales Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Automotive Solar Control Glass Market: Segmentation

The global automotive solar control glass market is segmented into product, application, vehicle, sales channel, and region.

Based on product type, the market is segregated into absorbing solar control glass and reflective solar control glass. Absorbing solar control glass leads the market due to its cost-effectiveness and ease of integration with existing manufacturing processes.

Based on application, the automotive solar control glass industry is classified into passenger, commercial, and special purpose vehicles. Of these, passenger vehicles hold the largest market share due to higher production volumes, stronger consumer demand for comfort features, and greater willingness to pay for premium glass options in this segment.

Based on vehicle type, the automotive solar control glass market is divided into economy, mid-segment, and luxury vehicles. Mid-segment vehicles are expected to lead the market during the forecast period as they represent the optimal balance between price sensitivity and feature adoption.

Based on sales channels, the market is segmented into OEM and aftermarket. The OEM segment leads the market due to integration advantages, quality assurance, warranty considerations, and the trend toward factory-installed premium features across expanding vehicle segments.

Automotive Solar Control Glass Market: Regional Analysis

Asia Pacific to lead the market

Asia Pacific leads the automotive solar control glass market due to huge vehicle production volumes, increasing demand for comfort features, and rapid electric vehicle adoption in key countries. The region accounts for 45% of the global market, with China, Japan, and South Korea driving innovation and adoption. The hot and humid climate in many populated areas makes practical sense for solar control solutions.

Rapid urbanization and the growing middle-class drive demand for premium features focused on comfort and efficiency. The region’s leadership in electric vehicle production has accelerated the adoption of range-extending technologies, including advanced glazing solutions. Growing consumer awareness of skin protection from UV radiation is driving demand for protective vehicle features.

The presence of major glass manufacturers and automotive OEMs creates opportunities for innovation across the value chain. Government initiatives for vehicle efficiency and emissions reduction indirectly support adopting thermal management technologies, including solar control glass.

Europe is set to grow significantly.

Europe is the second-largest and fastest-growing automotive solar control glass market, driven by environmental regulations, premium vehicle production, and advanced manufacturing capabilities. Countries like Germany, France, and the UK are leading the way in implementing advanced glazing technologies in both premium and mass-market vehicles.

The region’s strict CO2 emissions standards indirectly drive the adoption of efficiency-enhancing technologies, including thermal management solutions. The premium vehicle segment focuses on comfort, technology, and sustainability, creating perfect conditions for high-performance glazing adoption. European consumers are aware of the comfort and health benefits of solar control glass.

Recent Market Developments:

- In April 2025, Gentex Corporation completed the acquisition of Voxx International. This $175 million deal expands Gentex's portfolio in automotive electronics, potentially enhancing its solar control glass technologies offerings.

Automotive Solar Control Glass Market: Competitive Analysis

The global automotive solar control glass market is led by players like:

- Saint-Gobain S.A.

- Asahi Glass Co. Ltd. (AGC)

- Nippon Sheet Glass Co. Ltd. (NSG Group)

- Guardian Glass LLC

- Fuyao Glass Industry Group Co. Ltd.

- Xinyi Glass Holdings Limited

- Central Glass Co. Ltd.

- Taiwan Glass Ind. Corp.

- Sisecam Group

- Vitro

- S.A.B. de C.V.

- Corning Incorporated

- Pittsburgh Glass Works

- LLC (PGW)

- Gentex Corporation

- Eastman Chemical Company

- 3M Company

- Magna International Inc.

- Sekisui Chemical Co. Ltd.

- Pilkington Group Limited

- PPG Industries Inc.

- TESA SE.

The global automotive solar control glass market is segmented as follows:

By Product Type

- Absorbing Solar Control Glass

- Reflective Solar Control Glass

By Application

- Passenger Vehicles

- Commercial Vehicles

- Special Purpose Vehicles

By Vehicle Type

- Economy

- Mid-Segment

- Luxury

By Sales Channel

- OEM

- Aftermarket

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Automotive solar control glass is specialized glazing designed to reduce heat transmission, block harmful UV radiation, and manage light penetration into vehicle interiors while maintaining visibility and structural integrity for enhanced passenger comfort and vehicle efficiency.

The automotive solar control glass market is expected to be driven by increasing consumer demand for thermal comfort in vehicles, growing electric vehicle adoption requiring energy-efficient components, stricter fuel efficiency regulations, advancements in glass coating technologies, and rising awareness of health protection from UV radiation.

According to our study, the global automotive solar control glass market was worth around USD 1,465.10 million in 2024 and is predicted to grow to around USD 2,308.13 million by 2034.

The CAGR value of the automotive solar control glass market is expected to be around 4.65% during 2025-2034.

The global automotive solar control glass market will register the highest growth in Asia Pacific during the forecast period.

Key players in the automotive solar control glass market include Saint-Gobain S.A., Asahi Glass Co., Ltd. (AGC), Nippon Sheet Glass Co., Ltd. (NSG Group), Guardian Glass LLC, Fuyao Glass Industry Group Co., Ltd., Xinyi Glass Holdings Limited, Central Glass Co., Ltd., Taiwan Glass Ind. Corp., Sisecam Group, Vitro, S.A.B. de C.V., Corning Incorporated, Pittsburgh Glass Works, LLC (PGW), Gentex Corporation, Eastman Chemical Company, 3M Company, Magna International Inc., Sekisui Chemical Co., Ltd., Pilkington Group Limited, PPG Industries, Inc., and TESA SE.

The report comprehensively analyzes the automotive solar control glass market, including an in-depth discussion of market drivers, restraints, emerging trends, regional dynamics, and future growth opportunities. It also examines competitive dynamics, technological innovations, regulatory influences, and the evolving performance requirements shaping the automotive glazing industry.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed