Automotive Lubricants Market Size, Share, Trends and Forecast, 2034

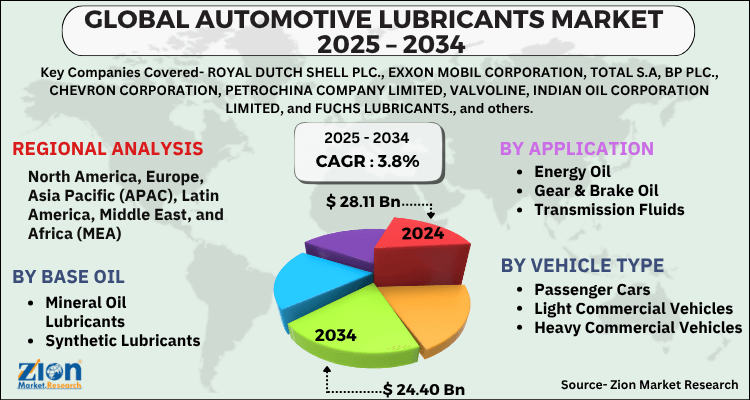

Automotive Lubricants Market Size - By Base oil (Mineral Oil Lubricants, Synthetic Lubricants, Semisynthetic Lubricants and Bio-based Lubricants), By Application (Energy Oil, Gear & Brake Oil, Transmission Fluids, Greases and Others), By Vehicle type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles and Others) and By Region - Global Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data and Forecasts 2025 - 2034

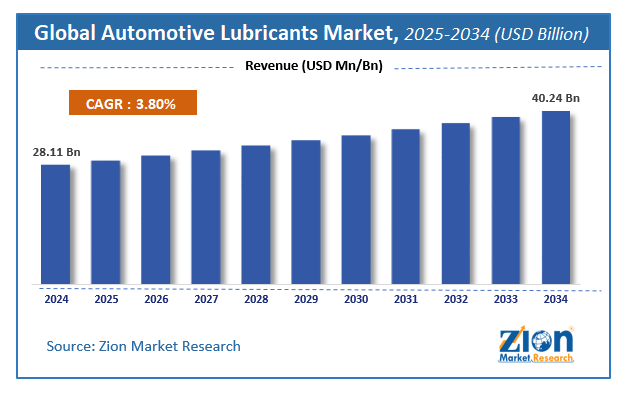

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 28.11 Billion | USD 40.24 Billion | 3.8% | 2024 |

Automotive Lubricants Market Industry Perspective:

The global Automotive Lubricants market size was worth around USD 28.11 Billion in 2024 and is predicted to grow to around USD 40.24 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 3.8% between 2025 and 2034. The report analyzes the global automotive lubricants market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the automotive lubricants industry.

Automotive Lubricants Market: Overview

In Automotive Lubricants Market Report, Lubricant is a fluidic material that is used to reduce friction between contact surfaces in order to prevent wear and tear. It is prepared using various additives and base oils from specific groups depending on the end-uses. The most prevalent uses for automotive lubricants are engine, gear, and hydraulic oils. Because of the growing use of high-performance lubricants, the market is expected to grow. The tremendous growth in car sales and infrastructure development in emerging countries has produced a large demand for these coolants and lubricants. Other factors driving the lubricant and coolant industry include rising demand for light passenger and heavy-duty vehicles, rising conventional fuel prices, and an increase in the average vehicle lifespan.

Furthermore, the vehicle oil and coolant industries will benefit from government-imposed tight emission rules. To avoid negative environmental implications, the current trend is to use bio-based lubricants, which will boost the market's total growth. Traditional lubricants have been replaced with synthetic lubricants as the demand for fuel efficiency in automobiles has increased. All of these reasons contribute to the automotive lubricants market's expansion. In terms of energy consumption, the engine components consume over 60% of the vehicle's total energy.

As a result, advancements in automotive lubricants are a great place to start when it comes to improving engine performance. High-performance automobile lubricants have outstanding solvency and hydrophilic properties. The engine runs longer because of the lighter viscosity classes of high-performance lubricants utilized in these automotive lubricants. Furthermore, synthetic lubricants with lower viscosity and improved performance improve engine fuel efficiency to a greater extent.

Key Insights

- As per the analysis shared by our research analyst, the global automotive lubricants market is estimated to grow annually at a CAGR of around 3.8% over the forecast period (2025-2034).

- Regarding revenue, the global automotive lubricants market size was valued at around USD 28.11 Billion in 2024 and is projected to reach USD 40.24 Billion by 2034.

- The automotive lubricants market is projected to grow at a significant rate due to increasing vehicle production and sales, stringent emission regulations demanding high-performance lubricants, and the growing complexity of modern engines requiring specialized lubrication solutions.

- Based on Base oil, the Mineral Oil Lubricants segment is expected to lead the global market.

- On the basis of Application, the Energy Oil segment is growing at a high rate and will continue to dominate the global market.

- Based on the Vehicle type, the Passenger Cars segment is projected to swipe the largest market share.

- Based on region, Asia-Pacific is predicted to dominate the global market during the forecast period.

Request Free Sample

Request Free Sample

Automotive Lubricants Market: Growth Drivers

Automotive Lubricants Market Drivers:

Various factors influence the global demand for automotive lubricants. Lubricants used in industrial operations help the company save money because lubricated machines produce less friction, requiring less fuel and emitting less carbon dioxide. Furthermore, as the population grows, so does the demand for automobiles, which has a direct impact on the market demand for lubricants.

Restraint:

Despite the fact that the global automotive lubricants market is expanding rapidly, several factors are impeding its expansion. The presence of stringent environmental rules and norms governing carbon dioxide emissions stifles growth. The majority of manufacturers are shifting toward electronic vehicles, which is severely limiting the growth of the automotive lubricant market.

Opportunities:

The global market's demand for lubricants is increasing. Increasing vehicle demand in both developed and developing countries drives up global demand for automotive lubricants. Furthermore, significant investment is made in the research and development sector to achieve consistent improvements in oil quality, which also provides various growth opportunities. During the forecasted period, improvements in the quality of semi-synthetic and synthetic oil will also provide growth opportunities.

Automotive Lubricants Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Automotive Lubricants Market |

| Market Size in 2024 | USD 28.11 Billion |

| Market Forecast in 2034 | USD 40.24 Billion |

| Growth Rate | CAGR of 3.8% |

| Number of Pages | 177 |

| Key Companies Covered | ROYAL DUTCH SHELL PLC., EXXON MOBIL CORPORATION, TOTAL S.A, BP PLC., CHEVRON CORPORATION, PETROCHINA COMPANY LIMITED, VALVOLINE, INDIAN OIL CORPORATION LIMITED, and FUCHS LUBRICANTS., and others. |

| Segments Covered | By Base oil, By Application, By Vehicle type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global Automotive Lubricants Market: Segmentation

The global Automotive Lubricants market is segregated based on Base oil, Application, and Vehicle type.

Based on Base oil, the market is segmented into Mineral Oil Lubricants, Synthetic Lubricants, Semisynthetic Lubricants, and Bio-based Lubricants. The mineral oil segment controls the majority of the automotive lubricants market. Despite the fact that synthetic lubricant adoption and demand are increasing significantly, it is less likely to overtake conventional oil's market share during the forecast period due to the relatively low prices of conventional lubricants.

By application, the market is segmented into Energy Oil, Gear & Brake Oil, Transmission Fluids, Greases, and Others. The engine is commonly referred to as the "heart" of a vehicle, and engine oil plays an important role in the proper operation of an automobile's engine. Engine oil aids in the proper operation of moving parts and keeps the engine cool. Engine oil must be changed on a regular basis to extend engine life and prevent sludge and contaminants from accumulating in the engine.

Recent Developments

- In November 2021, Parkland Corp. will acquire a few assets owned by Lynch Oil through its Parkland USA subsidiary, including five large-format forecourts and convenience stores, two standalone car washes, and two travel centers. This acquisition expands Parkland's presence throughout the Pacific Northwest, complementing its existing commercial, wholesale, and retail operations in Idaho. It will increase annual fuel sales by more than 47 million gallons.

- In November 2019, Nye Lubricants Inc., a company involved in the formulation, manufacturing, and innovation of synthetic products, has been acquired by the FUCHS Group, a supplier and manufacturer based in Germany. It will assist the company in expanding its portfolio of synthetic lubricants.

Regional Landscape

The North American market is expected to see major growth due to increased consumer demand for high-quality and efficient lubricants, the synthetic automotive lubricants segment is rapidly expanding in the region. The Asia-Pacific region has the largest market share in the global market due to being the fastest-growing region. The growing demand for vehicles, combined with the region's growing population, drives the market growth. In addition, the rising demand for semi-synthetic and synthetic lubricants in countries such as Indonesia, Japan, China, and India drives market growth.

Automotive Lubricants Market Competitive Landscape

Some of the main competitors dominating the global Automotive Lubricants market include-

- ROYAL DUTCH SHELL PLC.

- EXXON MOBIL CORPORATION

- TOTAL S.A

- BP PLC.

- CHEVRON CORPORATION

- PETROCHINA COMPANY LIMITED

- VALVOLINE

- INDIAN OIL CORPORATION LIMITED

- FUCHS LUBRICANTS.

The Global Automotive Lubricants market is segmented as follows:

By Base oil

- Mineral Oil Lubricants

- Synthetic Lubricants

- Semisynthetic Lubricants

- Bio-based Lubricants

By Application

- Energy Oil

- Gear & Brake Oil

- Transmission Fluids

- Greases

- Others

By Vehicle type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global automotive lubricants market is expected to grow due to rising demand for high-performance and synthetic lubricants, increasing vehicle production and ownership, growing focus on fuel efficiency and engine protection, and advancements in lubricant technology and additives.

According to a study, the global automotive lubricants market size was worth around USD 28.11 Billion in 2024 and is expected to reach USD 40.24 Billion by 2034.

The global automotive lubricants market is expected to grow at a CAGR of 3.8% during the forecast period.

Asia-Pacific is expected to dominate the automotive lubricants market over the forecast period.

Leading players in the global automotive lubricants market include ROYAL DUTCH SHELL PLC., EXXON MOBIL CORPORATION, TOTAL S.A, BP PLC., CHEVRON CORPORATION, PETROCHINA COMPANY LIMITED, VALVOLINE, INDIAN OIL CORPORATION LIMITED, and FUCHS LUBRICANTS., among others.

The report explores crucial aspects of the automotive lubricants market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed