Automatic Alignment Machines Market Size, Share, Growth, Trends, Forecast 2034

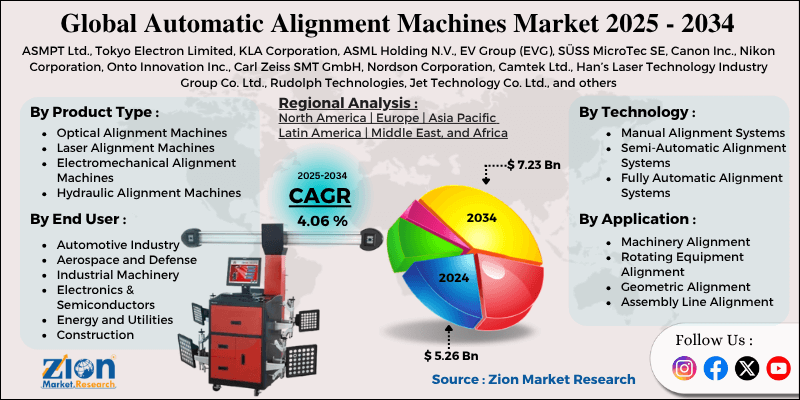

Automatic Alignment Machines Market By Product Type (Optical Alignment Machines, Laser Alignment Machines, Electromechanical Alignment Machines, Hydraulic Alignment Machines, and Others), By Technology (Manual Alignment Systems, Semi-Automatic Alignment Systems, Fully Automatic Alignment Systems), By Application (Machinery Alignment, Rotating Equipment Alignment, Geometric Alignment, Assembly Line Alignment, and Others), By End-User (Automotive Industry, Aerospace and Defense, Industrial Machinery, Electronics and Semiconductors, Energy and Utilities, Construction, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

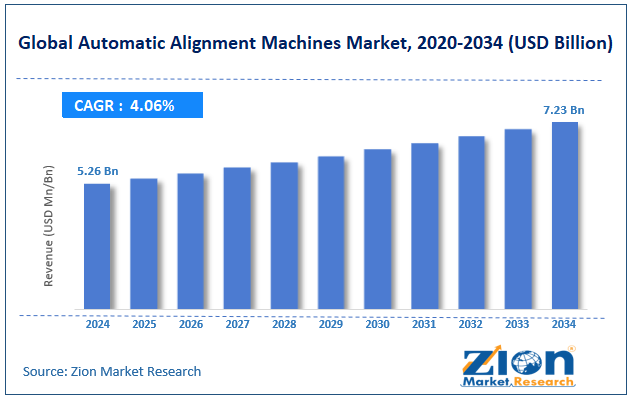

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 5.26 Billion | USD 7.23 Billion | 4.06% | 2024 |

Automatic Alignment Machines Industry Perspective:

The global automatic alignment machines market size was approximately USD 5.26 billion in 2024 and is projected to reach around USD 7.23 billion by 2034, with a compound annual growth rate (CAGR) of approximately 4.06% between 2025 and 2034.

Automatic Alignment Machines Market: Overview

Automatic alignment machines are advanced technologies that precisely align components during the assembly process or manufacturing without human intervention. These machines utilize technologies such as sensors, machine vision, and precision actuators to ensure accurate positioning, enhance production efficiency, and minimize human error. The global automatic alignment machines market is expected to expand rapidly, driven by advancements in electronics assembly automation, improvements in optical alignment technologies, and the growth of the automotive industry. Electronics manufacturers are increasingly automating PCB assembly and component placement. Automatic promise alignment ensures the alignment of micro-sized parts with minimal tolerance for errors. This trend is crucial for the production of IoT devices, smartphones, and wearable electronics.

In optics, accurate alignment is vital for fiber optics, lasers, and lenses. Automatic alignment systems, incorporating AI and machine vision, enable nanometer-scale adjustments. This enhances production and performance in medical imaging devices and optical communication. Furthermore, automotive manufacturing is highly dependent on automated tools for component positioning, mainly in autonomous vehicles and EVs. Cameras, sensors, and LiDAR systems require high-accuracy alignment, driving the adoption of automated solutions.

Despite the growth, the global market is hindered by factors such as the complexity of integrating with legacy systems and the need for calibration and maintenance. Integrating these machines into legacy production systems could pose technical and financial challenges. Staff retraining, customization, and downtime during integration may offer challenges to seamless adoption. Moreover, precision machines need regular maintenance and calibration to promise precision. This incurs additional operational expenses and may lead to production halts, particularly in 24/7 production environments.

Nonetheless, the global automatic alignment machines industry stands to gain from several key opportunities, including the miniaturization of electronic components and the rise in 5G infrastructure development. As electronics shrink, manual alignment becomes increasingly challenging. Automatic alignment machines may handle small components with greater repeatability, facilitating innovations in MEMS devices and microelectronics. Additionally, 5G infrastructure needs accurate assembly of antennas, PCBs, and RF modules. Automated alignment systems improve production speed and quality, meeting growing global demand for telecom machines.

Key Insights:

- As per the analysis shared by our research analyst, the global automatic alignment machines market is estimated to grow annually at a CAGR of around 4.06% over the forecast period (2025-2034)

- In terms of revenue, the global automatic alignment machines market size was valued at around USD 5.26 billion in 2024 and is projected to reach USD 7.23 billion by 2034.

- The automatic alignment machines market is projected to grow significantly due to the rising automation in industrial processes, surging demand for high accuracy and precision in assembly lines, and the proliferation of Industry 4.0 and smart factories.

- Based on product type, the optical alignment machines segment is expected to lead the market, while the laser alignment machines segment is expected to grow considerably.

- Based on technology, the fully automatic alignment systems segment leads the market, while the semi-automatic alignment systems segment holds a second-leading position.

- Based on application, the assembly line alignment segment is the largest, while the rotating equipment alignment segment is projected to experience substantial revenue growth over the forecast period.

- Based on end-user, the electronics and semiconductors segment is expected to lead the market compared to the automotive industry segment.

- Based on region, the Asia Pacific is projected to dominate the global market during the estimated period, followed by North America.

Automatic Alignment Machines Market: Growth Drivers

How does expanding demand for consumer electronics assembly drive the growth of the automatic alignment machines market?

Consumer electronics, especially AR/VR devices, wearables, and smartphones, demand ultra-precise alignment during camera module assembly, sensor integration, and lens alignment. In 2024, more than 1.5 billion smartphones were shipped worldwide. OEMs are actively investing in automatic alignment systems to scale up production while reducing defect rates. This demand has a direct impact on the growth of the global automatic alignment machines market.

In 2024, Apple launched Vision Pro 2, which experienced elevated demand for compact optical alignment systems during lens microdisplay module integration and lens calibration.

Increased investments in optical component manufacturing and photonics fuel the market growth

Laser-based and photonics technologies are experiencing increased applications in various domains, including medical diagnostics, quantum computing, defense, and telecommunications. The worldwide photonics industry is expected to reach USD 1.2 trillion by 2030, according to reports. Alignment equipment is crucial to the packaging and assembly of photonic parts, where micrometer-level accuracy is essential for maintaining signal integrity and performance.

II-VI Incorporated and Lumentum increased their photonic chip production lines in Singapore and the United States with high-class automatic alignment equipment capable of aligning (PICs) photonic integrated circuits with fiber arrays, detectors, and VCSELs.

Automatic Alignment Machines Market: Restraints

How does vulnerability to supply chain disruptions hinder the progress of the automatic alignment machines market?

Automatic alignment machines rely on a highly specialized supply chain for components, including vision systems, precision actuators, and semiconductor-grade optics. A majority of these are sourced from restricted suppliers in Germany, Japan, or the United States. Any disruptions, such as natural disasters, geopolitical events, or logistics delays, may significantly affect serviceability and delivery schedules.

The 2024 Red Sea shipping emergency led to a 16% increase in optical component delivery times, which directly impacted machine availability in the Middle East and Asia.

Automatic Alignment Machines Market: Opportunities

What are the key opportunities driving growth in the automatic alignment machines market?

With front-end semiconductor fabs nearing saturation, there is a growing focus on modernized packaging, heterogeneous integration, and wafer-level optics, all of which require exacting alignment processes. Solutions like (FOWLP) fan-out wafer-level packaging, through-silicon vias (TSVs), and chiplet integration rely on mechanical and precise optical alignment during inspection or bonding.

Global investments in backend semiconductor equipment reached USD 35 billion in 2024, according to SEMI, representing a 14 percent year-over-year increase. Such investments ultimately impact the progress of the automatic alignment machines industry.

Automatic Alignment Machines Market: Challenges

Repair delays and the high cost of downtime due to specialized components restrict the market growth

Automatic alignment machines depend on advanced optics, precision mechatronics, custom vision sensors, and laser modules. If a vital component fails, downtime may stretch for weeks, as spare parts often require recalibration after installation or are region-specific. Downtime is especially high-priced in optical assembly or high-volume fabs where output is continuous.

According to a VDMA report (2024), each hour of unplanned downtime in an electronics assembly line utilizing advanced alignment tools may cost USD 8,000-20,000 in lost productivity.

Automatic Alignment Machines Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Automatic Alignment Machines Market |

| Market Size in 2024 | USD 5.26 Billion |

| Market Forecast in 2034 | USD 7.23 Billion |

| Growth Rate | CAGR of 4.06% |

| Number of Pages | 214 |

| Key Companies Covered | ASMPT Ltd., Tokyo Electron Limited, KLA Corporation, ASML Holding N.V., EV Group (EVG), SÜSS MicroTec SE, Canon Inc., Nikon Corporation, Onto Innovation Inc., Carl Zeiss SMT GmbH, Nordson Corporation, Camtek Ltd., Han’s Laser Technology Industry Group Co. Ltd., Rudolph Technologies, Jet Technology Co. Ltd., and others. |

| Segments Covered | By Product Type, By Technology, By Application, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Automatic Alignment Machines Market: Segmentation

The global automatic alignment machines market is segmented by product type, technology, application, end-user, and region.

Based on product type, the global automatic alignment machines industry is divided into optical alignment machines, laser alignment machines, electromechanical alignment machines, hydraulic alignment machines, and others. The optical alignment machines segment held a notable share of the market owing to their broader use and high precision in semiconductor, medical device, and photonics manufacturing.

Conversely, the laser alignment machines hold a second-leading share due to their accuracy, speed, and increasing use in the automotive, heavy machinery, and aerospace sectors.

Based on technology, the global market is segmented into manual alignment systems, semi-automatic alignment systems, and fully automatic alignment systems. The fully automatic alignment systems segment dominates the global market owing to their speed, efficiency, and minimal human intervention.

Nonetheless, the semi-automatic alignment systems segment ranks second in the market, as they offer a better balance between manual and automated control, thereby increasing their suitability for mid-sized manufacturers.

Based on application, the global automatic alignment machines market is segmented into machinery alignment, rotating equipment alignment, geometric alignment, assembly line alignment, and others. The assembly line alignment category dominates the global market due to its widespread use in electronics, automotive, and consumer goods manufacturing.

On the other hand, the rotating equipment alignment segment holds a considerable market share due to its significance in maintaining health in industries such as oil & gas, heavy manufacturing, and power generation.

Based on end-user, the global market is segmented into the automotive industry, aerospace and defense, industrial machinery, electronics and semiconductors, energy and utilities, construction, and others. The electronics and semiconductor segment holds a substantial market share due to its need for ultra-precise alignment in chip fabrication, optical device integration, and PCB assembly.

However, the automotive industry holds a second rank, fueled by the speedy shift towards electric vehicles, autonomous driving solutions, and ADAS.

Automatic Alignment Machines Market: Regional Analysis

What key factors contribute to the dominance of the Asia Pacific in the automatic alignment machines market?

Asia Pacific is anticipated to retain its leading role in the global automatic alignment machines market as a result of prominence in electronics and semiconductor manufacturing, growing investments in industrial automation, and growing EV adoption and automotive production. The Asia Pacific is a leading hub for prominent electronics and semiconductor manufacturing, with notable hubs in South Korea, Taiwan, and Japan. These nations account for more than 70% of the total semiconductor fabrication capacity in 2024. The high demand for chip assembly and water-level alignment fuels the adoption of automatic alignment equipment in the region.

Additionally, industries and governments in the APAC region are investing rigorously in robotics and smart manufacturing. This inclination towards Industry 4.0 amplifies the deployment of automatic alignment systems in workshops. Additionally, nations such as India, South Korea, China, and Japan are among the leading automotive exporters and producers. In 2023, China alone produced more than 30 million vehicles, with electric vehicles accounting for the maximum share. Automatic alignment machines are broadly used in aligning EV batteries, components, and sensors on high-speed assembly lines.

North America ranks as the second-largest region in the global automatic alignment machines industry, driven by a strong electronics and semiconductor infrastructure, improved EV manufacturing and automotive base, and widespread adoption of smart manufacturing and Industry 4.0. North America is home to leading semiconductor companies, including NVIDIA, Texas Instruments, and Intel. In 2023, the United States accounted for more than 13% of the global semiconductor manufacturing volume. This propels the demand for precise alignment machines in chip assembly and fabrication. The region holds a well-developed automotive industry, with the United States generating more than 10 million units in 2023.

Key electric vehicle players, such as Ford, Tesla, and GM, are expanding their production lines, which require high-precision alignment for battery packs, ADAS modules, and sensors. This majorly contributes to the surge of automatic alignment machines. Furthermore, North American manufacturers are early adopters of Industry 4.0 solutions, comprising machine vision, AI-based automation, and robotics. Automatic alignment systems are vital tools in achieving high-throughput and zero-defect manufacturing goals.

Automatic Alignment Machines Market: Competitive Analysis

The leading players in the global automatic alignment machines market are:

- ASMPT Ltd.

- Tokyo Electron Limited

- KLA Corporation

- ASML Holding N.V.

- EV Group (EVG)

- SÜSS MicroTec SE

- Canon Inc.

- Nikon Corporation

- Onto Innovation Inc.

- Carl Zeiss SMT GmbH

- Nordson Corporation

- Camtek Ltd.

- Han’s Laser Technology Industry Group Co. Ltd.

- Rudolph Technologies

- Jet Technology Co. Ltd.

Automatic Alignment Machines Market: Key Market Trends

Adoption of fully automated, closed-loop systems:

There is a growing shift towards closed-loop and fully automatic alignment systems that can consistently adjust and monitor positioning without manual input. These systems promise faster throughput and higher repeatability, mainly in electronics and semiconductor applications. They perfectly align with smart factory and Industry 4.0 initiatives.

Customizable and modular machine designs:

Vendors are actively offering modular alignment systems tailored to specific workflows and industries. These enable faster deployment, easy upgrades, and flexible configurations. Customization helps address the diverse needs of the aerospace, automotive, precision optics, and photonics sectors.

The global automatic alignment machines market is segmented as follows:

By Product Type

- Optical Alignment Machines

- Laser Alignment Machines

- Electromechanical Alignment Machines

- Hydraulic Alignment Machines

- Others

By Technology

- Manual Alignment Systems

- Semi-Automatic Alignment Systems

- Fully Automatic Alignment Systems

By Application

- Machinery Alignment

- Rotating Equipment Alignment

- Geometric Alignment

- Assembly Line Alignment

- Others

By End User

- Automotive Industry

- Aerospace and Defense

- Industrial Machinery

- Electronics and Semiconductors

- Energy and Utilities

- Construction

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Automatic alignment machines are advanced technologies that precisely align components during the assembly process or manufacturing without human intervention. These machines utilize technologies such as sensors, machine vision, and precision actuators to ensure accurate positioning, enhance production efficiency, and minimize human error.

The global automatic alignment machines market is projected to grow due to improvements in sensor and vision technologies, the growth of the electronics and semiconductor industry, and the miniaturization of electronic components.

According to study, the global automatic alignment machines market size was worth around USD 5.26 billion in 2024 and is predicted to grow to around USD 7.23 billion by 2034.

The CAGR value of the automatic alignment machines market is expected to be approximately 4.06% from 2025 to 2034.

Asia Pacific is expected to lead the global automatic alignment machines market during the forecast period.

Electronics and semiconductors are expected to experience substantial growth due to the rising demand for precision in wafer bonding and MEMS packaging. The automotive sector, especially EVs and ADAS, will drive demand for accurate sensor alignment to ensure safety and performance.

The key players profiled in the global automatic alignment machines market include ASMPT Ltd., Tokyo Electron Limited, KLA Corporation, ASML Holding N.V., EV Group (EVG), SÜSS MicroTec SE, Canon Inc., Nikon Corporation, Onto Innovation Inc., Carl Zeiss SMT GmbH, Nordson Corporation, Camtek Ltd., Han’s Laser Technology Industry Group Co., Ltd., Rudolph Technologies, and Jet Technology Co., Ltd.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed