Automated Optical Inspection (AOI) Equipment Market Size, Share, Trends & Forecast 2034

Automated Optical Inspection (AOI) Equipment Market By Type (2D AOI, 3D AOI), By Technology (Inline, Offline), By End Use (IT & Telecom, Consumer Electronics, Automotive, Industrial Electronics, Aerospace & Defense, Medical, Others), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

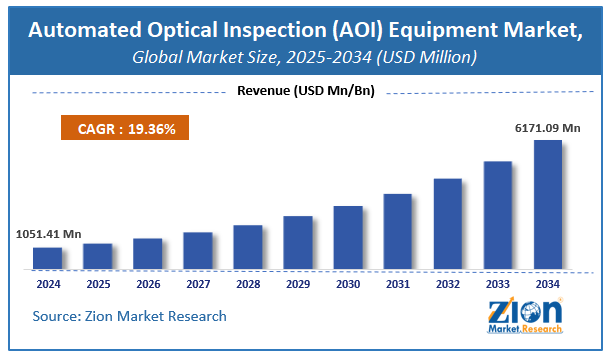

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

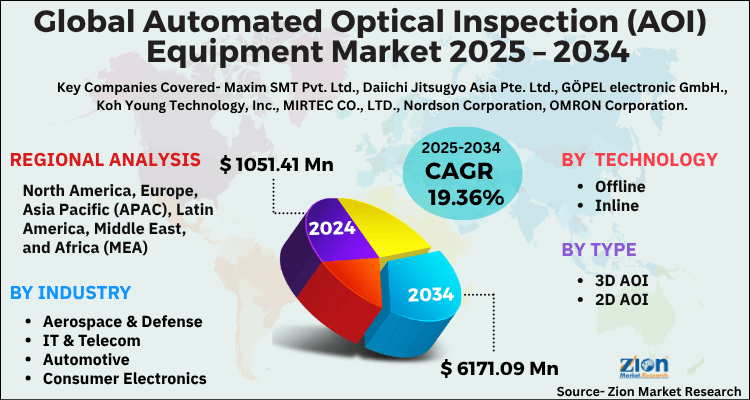

| USD 1051.41 Million | USD 6171.09 Million | 19.36% | 2024 |

Global Automated Optical Inspection (AOI) Equipment Market: Industry Perspective

The global automated optical inspection (AOI) equipment market size was worth around USD 1051.41 Million in 2024 and is predicted to grow to around USD 6171.09 Million by 2034 with a compound annual growth rate (CAGR) of roughly 19.36% between 2025 and 2034. The report analyzes the global automated optical inspection (AOI) equipment market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the automated optical inspection (AOI) equipment industry.

The report delves deeper into several crucial aspects of the global automated optical inspection (AOI) equipment industry. It includes a detailed discussion of existing growth factors and restraints. Future growth opportunities and challenges that impact the automated optical inspection (AOI) equipment market are comprehensively addressed in the report.

Global Automated Optical Inspection (AOI) Equipment Market: Overview

Automated optical inspection (AOI) is a form of visual inspection methodology that works using automation technology. AOI equipment is used to test and identify any defects in printed circuit board assemblies (PCBAs). The equipment, when in use, independently scans the surface of PCBAs and assists in detecting 2 main types of defects. One of these defaults includes quality failures such as non-standard or skewed components or a misshapen filet. The second type of defect includes catastrophic failures, a prime example of which is a missing component. Studies indicate that AOI equipment shows better performance in applications that deal with lower component variability and high volumes mainly because such designs are complicated and time-consuming. They have to be set up for part configuration or specific design which further calls for the use of AOI equipment.

Request Free Sample

Request Free Sample

Global Automated Optical Inspection (AOI) Equipment Market: Growth Drivers

Increasing demand for cost-effective and high-performance consumer electronics to drive market growth

The global automated optical inspection (AOI) equipment market is projected to grow owing to the increasing demand for cost-effective and high-performance consumer electronics. This segment includes products such as laptops, smartphones, and smart home devices to name a few. As the consumption rate of consumer electronics has grown over the years, the requirement for efficient PCBAs has risen simultaneously. Consumer electronics manufacturers are seeking measures through which they improve the output performance of the device while justifying the associated cost of owning such devices. Moreover, there is a greater emphasis on energy efficiency. Achieving all these points is possible only through the development of high-grade printed circuit boards which, in turn, has resulted in higher consumption of advanced AOI equipment to ensure product expectations are met. AOI technology is a non-contact test method and has proven efficient in detecting PCB errors accurately for specific categories of programmed defects. In April 2023, Marantz Electronics announced the launch of the Mek iSpector inline AOI system. It is entry-level equipment and can meet the need for high-quality AOI solutions at a low cost.

Automated Optical Inspection (AOI) Equipment Market: Restraints

Performance limitation of AOI equipment to restrict market expansion

AOI systems are limited in terms of performance capabilities. For instance, they do not detect any new defects on PCBAs but can only detect defects that are pre-programmed in the system. It means that the product lacks in terms of innovativeness as it can only deliver as per what is fed prior in the system. In addition to this, it also lacks defect detection flexibility. For any new change to be detected, it has to be first programmed in the system which raises questions over the total efficiency of AOI systems. Furthermore, it does not detect errors that may be caused by seal or glue defects and manufacturers may have to invest in additional technology for accurate results.

Automated Optical Inspection (AOI) Equipment Market: Opportunities

Rising number of product launches and integration of advanced systems to provide growth opportunities

The automated optical inspection equipment industry is expected to benefit from the growing rate of new products launched in the commercial market in addition to the integration of advanced systems which may help end-users defeat the several performance limitations possessed by AOI equipment. For instance, in May 2022, Saki Corporation, a leading player in the field of X-ray and automated optical inspection equipment, announced the development of a new high-precision, high-speed, and next-generation 3D AOI system. It can be used for extremely complicated analysis and inspection of high-density PCBs along with other tall or very small components. It is expected to deliver in terms of reduced cycles by providing ultra-sharp high-definition 3D pictures.

Automated Optical Inspection (AOI) Equipment Market: Challenges

Availability of other PCB tools to challenge the market expansion

AOI is not the only solution that PCB manufacturers and users have for inspecting printed circuit boards. There is a wide range of alternatives that companies, across sizes are using to improve product performance. Some examples include inspection with infrared rays, X-ray inspection, flying probe test, and in-circuit test. Inspection carried out through infrared rays is called thermography and deals with exploiting the heat dissipating out of the components or the PCB. It is most widely used in power applications. The in-circuit testing method is equally popular as it helps in the accurate detection of defects arising during PCB assembly or manufacturing. Growing number of players offering other inspection tools could cause a loss of revenue for AOI equipment makers.

Key Insights

- As per the analysis shared by our research analyst, the global automated optical inspection (AOI) equipment market is estimated to grow annually at a CAGR of around 19.36% over the forecast period (2025-2034).

- Regarding revenue, the global automated optical inspection (AOI) equipment market size was valued at around USD 1051.41 Million in 2024 and is projected to reach USD 6171.09 Million by 2034.

- The automated optical inspection (AOI) equipment market is projected to grow at a significant rate due to increasing complexity and miniaturization of electronic components, the escalating demand for high-quality and defect-free products across various industries, and the growing adoption of Industry 4.0 and smart manufacturing practices incorporating AI and .

- Based on Type, the 2D AOI segment is expected to lead the global market.

- On the basis of Technology, the Inline segment is growing at a high rate and will continue to dominate the global market.

- Based on the End Use, the IT & Telecom segment is projected to swipe the largest market share.

- Based on region, Asia-Pacific is predicted to dominate the global market during the forecast period.

Global Automated Optical Inspection (AOI) Equipment Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Automated Optical Inspection (AOI) Equipment Market |

| Market Size in 2024 | USD 1051.41 Million |

| Market Forecast in 2034 | USD 6171.09 Million |

| Growth Rate | CAGR of 19.36% |

| Number of Pages | 226 |

| Key Companies Covered | Maxim SMT Pvt. Ltd., Daiichi Jitsugyo Asia Pte. Ltd., GÖPEL electronic GmbH., Koh Young Technology, Inc., MIRTEC CO., LTD., Nordson Corporation, OMRON Corporation, SAKI CORPORATION, Test Research, Inc., Viscom SE, and others. |

| Segments Covered | By Type, By Technology, By End Use, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global Automated Optical Inspection (AOI) Equipment Market: Segmentation

The global automated optical inspection equipment market is segmented based on technology, type, end use and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2025 to 2034.

Based on technology, the automated optical inspection equipment industry is divided into offline and inline. The highest revenue is expected to be generated by the inline segment mainly due to the performance efficiency of this technology. Inline AOI equipment can be used for a detailed examination of a particular defect. PCBs do not have to be manually flipped for the AOI system to access the unexposed side which results in less manual labor and more time effectiveness. Additionally, inline systems deliver results quickly. The average price of an AOI system ranges between USD 50,000 to USD 200,000.

Based on type, the automated optical inspection equipment industry is divided into 3D AOI and 2D AOI. Currently, the highest-performing segment is the 2D AOI section and will continue the same trend during the forecast period. The main growth propelling factor is the cost-effectiveness of 2D systems alongside more specific programming requirements. With 2D systems, it is possible to detect every small and large defect on a PCB. 3D AOI systems may also witness more takers as it can detect defects using an additional dimension.

By End Use, the global automated optical inspection (AOI) equipment market is split into IT & Telecom, Consumer Electronics, Automotive, Industrial Electronics, Aerospace & Defense, Medical, Others.

The Regional, this segment includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America,and the Middle East and Africa.

Global Automated Optical Inspection (AOI) Equipment Market: Regional Analysis

The global automated optical inspection (AOI) equipment market will continue to be led by Asia-Pacific during the forecast period. The region is home to some of the largest and most dominant manufacturers of PCBAs. Currently, China leads the world in terms of PCB production and export. In addition to this, the country not only supplies in Asian countries but is one of the most crucial PCB trading partners for European and North American companies. Moreover, Taiwan is considered the hub of manufacturing advanced printed circuit boards.

India has been a strong player in PCB production however, in the last few years, the region has amped up its effort to strengthen its foothold. For instance, as of April 2024, more hearables and wearables products in the Indian region are likely to be equipped with home-grown PCBs which may result in higher demand for advanced AOI equipment. The growing number of product launches along with the rising interest of foreign players in the Asian semiconductor market will work in the favor of regional expansion.

Global Automated Optical Inspection (AOI) Equipment Market: Competitive Analysis

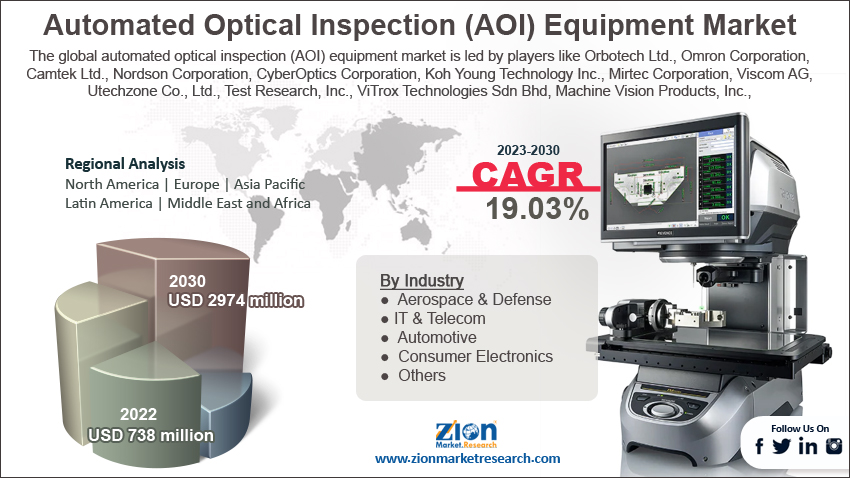

The global automated optical inspection (AOI) equipment market is led by players like:

- Orbotech Ltd.

- Omron Corporation

- Camtek Ltd.

- Nordson Corporation

- CyberOptics Corporation

- Koh Young Technology Inc.

- Mirtec Corporation

- Viscom AG

- Utechzone Co. Ltd.

- Test Research Inc.

- ViTrox Technologies Sdn Bhd

- Machine Vision Products Inc.

- Goepel electronic GmbH

- Saki Corporation

- Parmi Corporation

- AOI Systems Ltd.

- Sinic-Tek Vision Technology Co. Ltd.

Global Automated Optical Inspection (AOI) Equipment Market: Segmentation Analysis

The global automated optical inspection (AOI) equipment market is segmented as follows:

By Industry

- Aerospace & Defense

- IT & Telecom

- Automotive

- Consumer Electronics

- Others

By Technology

- Offline

- Inline

By Type

- 3D AOI

- 2D AOI

- Others

Global Automated Optical Inspection (AOI) Equipment Market: Regional Segment Analysis

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Automated optical inspection (AOI) is a form of visual inspection methodology that works using automation technology. AOI equipment is used to test and identify any defects in printed circuit board assemblies (PCBAs). The equipment, when in use, independently scans the surface of PCBAs and assists in detecting 2 main types of defects. One of these defaults includes quality failures such as non-standard or skewed components or a misshapen filet.

The global automated optical inspection (AOI) equipment market is expected to grow due to rising demand for high-quality PCB manufacturing, increasing miniaturization of electronics, stringent quality standards, and growth in automotive and consumer electronics sectors.

According to a study, the global automated optical inspection (AOI) equipment market size was worth around USD 1051.41 Million in 2024 and is expected to reach USD 6171.09 Million by 2034.

The global automated optical inspection (AOI) equipment market is expected to grow at a CAGR of 19.36% during the forecast period.

Asia-Pacific is expected to dominate the automated optical inspection (AOI) equipment market over the forecast period.

Leading players in the global automated optical inspection (AOI) equipment market include Maxim SMT Pvt. Ltd., Daiichi Jitsugyo Asia Pte. Ltd., GÖPEL electronic GmbH., Koh Young Technology, Inc., MIRTEC CO., LTD., Nordson Corporation, OMRON Corporation, SAKI CORPORATION, Test Research, Inc., Viscom SE, among others.

The report explores crucial aspects of the automated optical inspection (AOI) equipment market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed