Asset Integrity Management (AIM) Market Size, Share, Trends, Growth and Forecast 2032

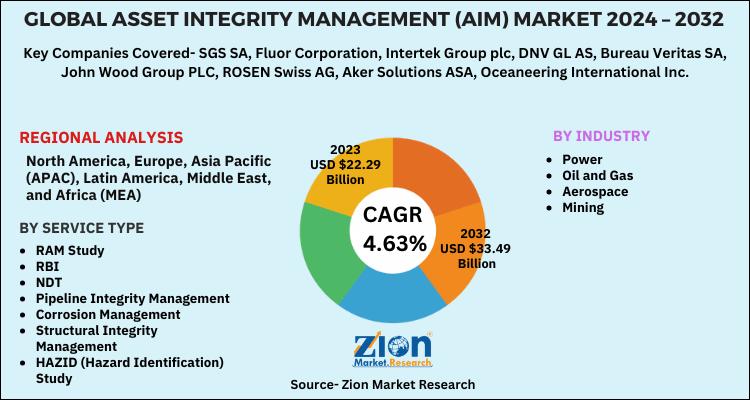

Asset Integrity Management (AIM) Market by Service Type (RAM Study, RBI, NDT, Pipeline Integrity Management, Corrosion Management, Structural Integrity Management, HAZID (Hazard Identification) Study and Others), By Industry (Power, Oil and Gas, Aerospace, Mining and Others) - Global Industry Perspective, Comprehensive Analysis, and Forecast, 2024 - 2032.-

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 22.29 Billion | USD 33.49 Billion | 4.63% | 2023 |

Asset Integrity Management (AIM) Market Insights

According to a report from Zion Market Research, the global Asset Integrity Management (AIM) Market was valued at USD 22.29 Billion in 2023 and is projected to hit USD 33.49 Billion by 2032, with a compound annual growth rate (CAGR) of 4.63% during the forecast period 2024-2032. This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the Asset Integrity Management (AIM) industry over the next decade.

This report analyzes and estimates the asset integrity management at global, regional, and country-level. The research study provides historic data from 2016 to 2019 along with a forecast from 2020 to 2026 based on revenue (USD Billion). Assessment of the asset integrity management provides detailed insights into market drivers and restraints along with their impact analysis at a global level from 2016 to 2026.

The report covers an in-depth analysis of the strategies adopted by major competitors in asset integrity management. To understand the competitive landscape in asset integrity management, an analysis of Porter’s Five Forces model is also included. The research study comprises of market attractiveness analysis, wherein service type, indsutry, and regional segments are benchmarked on the basis of their market size and growth rate.

The research study provides a decisive view on the asset integrity management based on service type, industry, and region. All the segments of asset integrity management have been analyzed based on the past, present, and future trends. The market is estimated from 2016 to 2026. The regional segment is further split into the U.S., Canada, Mexico, UK, France, Germany, China, Japan, India, South Korea, Brazil, and Argentina among others.

Asset Integrity Management (AIM) Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Asset Integrity Management (AIM) Market |

| Market Size in 2023 | USD 22.29 Billion |

| Market Forecast in 2032 | USD 33.49 Billion |

| Growth Rate | CAGR of 4.63% |

| Number of Pages | 113 |

| Key Companies Covered | SGS SA, Fluor Corporation, Intertek Group plc, DNV GL AS, Bureau Veritas SA, John Wood Group PLC, ROSEN Swiss AG, Aker Solutions ASA, Oceaneering International Inc. and TechnipFMC plc among others |

| Segments Covered | By Service Type, By Industry And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Detailed analysis of the major players in the global asset integrity management includes their financial overview, business strategies, recent developments, and the product offered by them in the market. This will help in assessing the market competition.

Key competitors included in this report are :

- SGS SA

- Fluor Corporation

- Intertek Group plc

- DNV GL AS

- Bureau Veritas SA

- John Wood Group PLC

- ROSEN Swiss AG

- Aker Solutions ASA

- Oceaneering International Inc.

- TechnipFMC plc among others.

This report segments the global asset integrity management as follows:

Global Asset Integrity Management: Service Type Segment Analysis

- RAM Study

- RBI

- NDT

- Pipeline Integrity Management

- Corrosion Management

- Structural Integrity Management

- HAZID (Hazard Identification) Study

- Others

Global Asset Integrity Management: Industry Segment Analysis

- Power

- Oil and Gas

- Aerospace

- Mining

- Others

Global Asset Integrity Management: Regional Segment Analysis

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

What are the major challenges restraining the growth of the asset integrity management (AIM) market?

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed

-market-size.png)