Antithrombin Market Size, Share, Trends, Growth and Forecast 2032

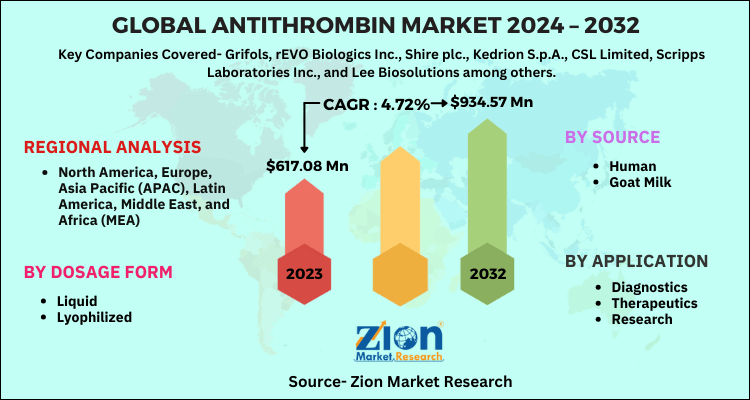

Antithrombin Market by Source (Human and Goat Milk), Application (Diagnostics, Therapeutics, and Research), By Dosage Form (Liquid and Lyophilized): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032.-

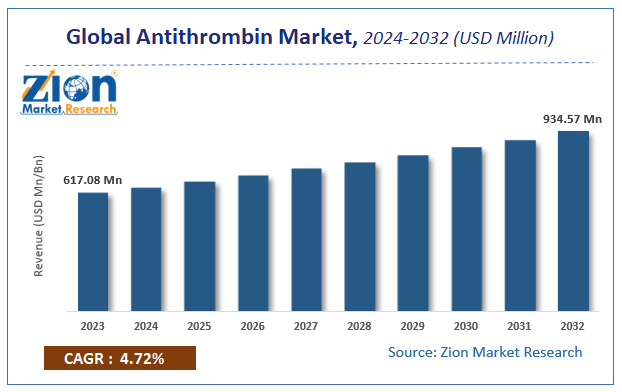

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 617.08 Million | USD 934.57 Million | 4.72% | 2023 |

Antithrombin Market Insights

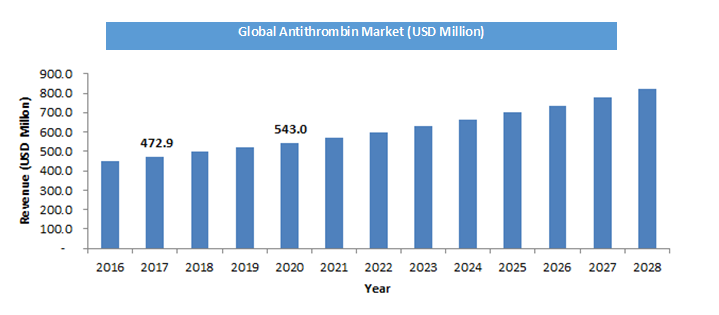

According to Zion Market Research, the global Antithrombin Market was worth USD 617.08 Million in 2023. The market is forecast to reach USD 934.57 Million by 2032, growing at a compound annual growth rate (CAGR) of 4.72% during the forecast period 2024-2032.

The report offers a comprehensive analysis of the market, highlighting the factors that will determine growth, potential challenges, and opportunities that could emerge in the Antithrombin Market industry over the next decade.

Market Overview

Antithrombin is a protein present in the blood stream, which functions as a naturally occurring mild blood thinner. Antithrombin helps to control too much clotting. A person with low antithrombin levels has more tendency to clot more easily. Vice-versa, if antithrombin levels are too high, a person could, theoretically, have a more bleeding tendency. However, raised levels of antithrombin do not appear to cause bleeding or have any clinical significance.

Antithrombin is a serpin which is similar in structure to most other plasma protease inhibitors. According to the report published by U.S. Department of health & human services in 2018, Antithrombin deficiency is expected to occur in about 1 in 2000 people across the globe.

Antithrombin is a protein present in the blood stream, which functions as a naturally occurring mild blood thinner. It helps to prevent too much clotting. By inactivating the blood clotting protein thrombin, it blocks the blood clotting mechanism; hence it is known as anti-thrombin. There are two major causes of antithrombin deficiency (AT), inherited or genetic antithrombin deficiency, and acquired antithrombin deficiency. An inherited or genetic deficiency occurred due to a genetic mutation or abnormality, and an acquired deficiency due to some other disease such as liver failure, nephrotic syndrome, metastatic tumors, severe trauma etc.

The global antithrombin market is segmented on the basis of source, application, dosage form, and geographically. Based on the source, the antithrombin market has been segmented as human, and goat milk. The human source segment accounted major shares in 2016. The goat source segment is expected to register high CAGR over the forecast period. The increasing adoption of goat milk for the production of antithrombin is expected to propel the growth of segment over the forecast period. The goat milk derived antithrombin is currently available in Europe and North America. However, the availability of these products in other regions such as Asia Pacific, Middle East & Africa is projected to drive the market share of goat milk source segment over the forecast period.

COVID-19 Impact Analysis:

The Covid-19 has positively impacted on the growth of the Antithrombin market. As the Antithrombin is a protein which helps to regulate blood clot formation. Due to corona virus spread in the community, the protein level and immunity of the people drop due to severe attack of virus. In order to increase the protein level, the Antithrombin plays important role prevention of blood clotting as it acts as a natural blood thinner and extensively used while performing surgical procedures in the patient with low antithrombic levels. However, the world markets are slowly opening to their full potential and theirs a surge in demand of Antithrombin is likely to increase in the coming years. The market would remain bullish in upcoming year.

Growth Factors

The widespread use of antithrombin for the treatment of various medical conditions such as extracorporeal membrane oxygenation, hereditary antithrombin deficiency, sepsis, and disseminated intravascular coagulation are the major factors responsible for the growth of global antithrombin market. Moreover, the rising adoption of antithrombin as a combination therapy with heparin is expected to open huge growth opportunities for antithrombin market.

Antithrombin Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Antithrombin Market |

| Market Size in 2023 | USD 617.08 Million |

| Market Forecast in 2032 | USD 934.57 Million |

| Growth Rate | CAGR of 4.72% |

| Number of Pages | 132 |

| Key Companies Covered | Grifols, rEVO Biologics Inc., Shire plc., Kedrion S.p.A., CSL Limited, Scripps Laboratories Inc., and Lee Biosolutions among others |

| Segments Covered | By Source, By Application, By Dosage Form and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Source Segment Analysis Preview

By source, the antithrombin market has been segmented as human, and goat milk. The human source, the segment is estimated to account major shares in global antithrombin market in 2016. Humans are the major source of antithrombins, but know a day’s the use of goat milk for the production of antithrombin is increasing. Goats produce about 800 liters of milk per year. As compared to cell culture model, the yield of the active protein by goat model is 10 times more. The transgenic goats are the excellent source for antithrombin production, as they produce plenty of milk in short generation time, and these factors are responsible for the high growth of goat milk segment over the forecast period. Currently, the goat milk produced antithrombins are available in developed countries such as U.S., UK, and Germany etc. The increasing adoption of newer technologies and advanced products in developing countries is expected to drive the growth of segment over the forecast period.

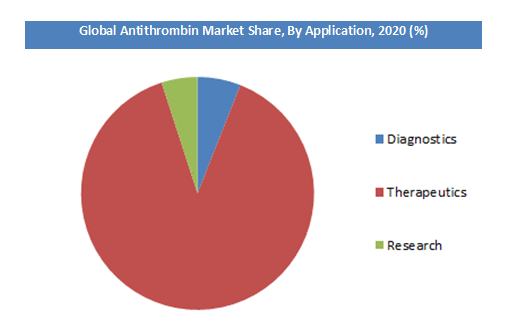

On the basis of application, the global antithrombin market is segmented into major three types such as diagnostics, therapeutics, and research.

By application, the therapeutics segment is estimated to account major share in global antithrombin market. The increasing research and development activities and rising government initiatives for research are expected to drive the growth of research segment globally.

On the basis of the dosage form, the global antithrombin market is segmented as a liquid and lyophilized.

The lyophilized dosage form accounted major share in the global market in 2016 and expected to register high CAGR. Lyophilized antithrombins have good self-life, easy to handle and, have wide application and these factors are expected to propel the growth of segment over the forecast period.

By region, the global antithrombin market is segmented into five major regions, North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. Europe is expected to remain the dominant region over the forecast period. Early availability of advanced technologies, rising adoption of antithrombin therapies owing to high awareness are the major factors contributing towards the growth of the market in Europe. North America was the second largest market followed by the Asia Pacific. Asia Pacific market is projected to grow at the highest rate during the forecast period owing to increasing healthcare budgets, and extensive research initiatives in the region. The Middle East and Africa, and Latin America are also expected to experience moderate growth in the years to come.

Key Market Players & Competitive Landscape

Some of the key players in global Antithrombin market include-

- Grifols

- rEVO Biologics Inc.

- Shire plc.

- Kedrion S.p.A.

- CSL Limited

- Scripps Laboratories Inc.

- Lee Biosolutions among others.

The global Antithrombin market is segmented as follows:

By Source

- Human

- Goat Milk

By Application

- Diagnostics

- Therapeutics

- Research

By Dosage Form

- Liquid

- Lyophilized

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Antithrombin Market size is set to expand from $ 617.08 Million in 2023

$ 934.57 Million by 2032, with an anticipated CAGR of around 4.72% from 2024 to 2032

Some of the key factors driving the global Antithrombin market growth are Increasing Number of Surgical Procedures and Technological Advancement.

Europe is anticipated to remain the leading region over the forecast period. The rising adoption of antithrombin therapies owing to high awareness in the region is expected to boost the growth of the market in Europe.

The key dominant player’s operative in global Antithrombin market Grifols, rEVO Biologics Inc., Shire plc., Kedrion S.p.A., CSL Limited, Scripps Laboratories Inc., and Lee Biosolutions among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed