Antifungal Treatment Market Size, Share, Trend, Growth, Industry Analysis 2034

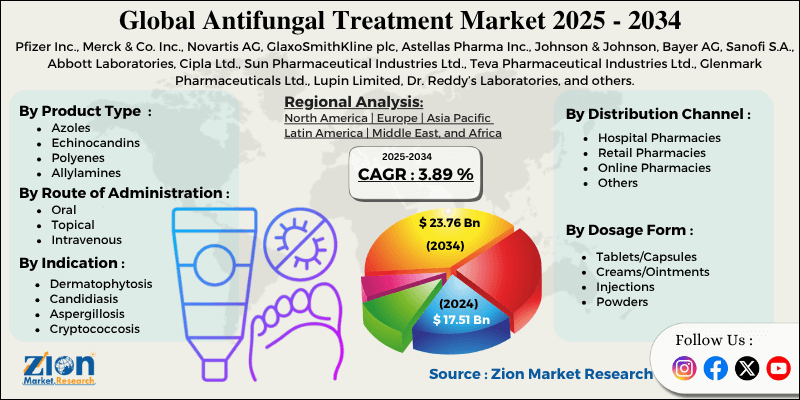

Antifungal Treatment Market By Product Type (Azoles, Echinocandins, Polyenes, Allylamines, and Others), By Indication (Dermatophytosis, Candidiasis, Aspergillosis, Cryptococcosis, and Others), By Dosage Form (Tablets/Capsules, Creams/Ointments, Injections, Powders, and Others), By Route of Administration (Oral, Topical, Intravenous, and Others), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

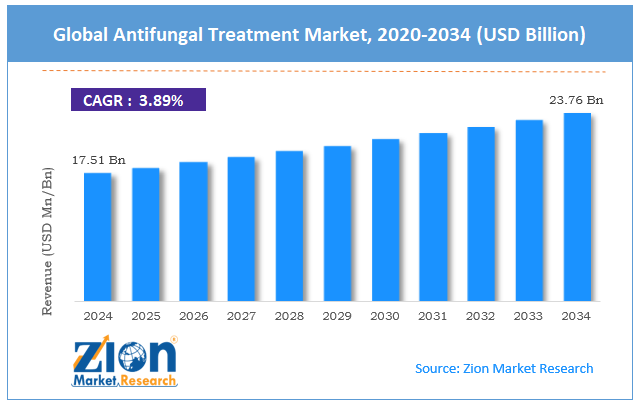

| USD 17.51 Billion | USD 23.76 Billion | 3.89% | 2023 |

Antifungal Treatment Industry Perspective:

The global antifungal treatment market size was approximately USD 17.51 billion in 2024 and is projected to reach around USD 23.76 billion by 2034, with a compound annual growth rate (CAGR) of approximately 3.89% between 2025 and 2034.

Antifungal Treatment Market: Overview

Antifungal treatment involves the medical management of fungal infections using drugs that either prevent fungal growth or kill the fungi. These infections may range from superficial conditions, such as ringworm or athlete's foot, to more serious systemic infections that impact internal organs, particularly in immunocompromised individuals. The global antifungal treatment market is expected to expand rapidly, driven by the increasing prevalence of immunocompromised individuals and the elderly population, rising awareness and early diagnosis, as well as the emergence of fungal drug resistance. Geriatric patients and individuals undergoing organ transplants, chemotherapy, or suffering from AIDS/HIV are prone to invasive fungal infections. As this demographic expands globally, the demand for antifungal drugs increases substantially.

Moreover, higher clinic and public awareness of fungal diseases, coupled with the availability of diagnostic solutions, is helping early detection. This proactive approach contributes to higher prescriptions of antifungal drugs and increased industry demand. Furthermore, the emergence of antifungal-resistant strains, such as Candida auris, has heightened the urgency for the development of new treatments. This prompts pharmaceutical investment and research funding into next-generation antifungals.

Despite the growth, the global market is impeded by factors such as toxicity and side effects, treatment failures, and drug resistance. Some antifungal drugs, mainly amphotericin B, are prominent for their adverse effects, such as nephrotoxicity and toxicity. This restricts their use and impacts patient adherence to treatment routines. Fungal pathogens are rapidly developing resistance to current antifungal categories, which may result in treatment failure and increased mortality, thus necessitating novel research and development, while also posing clinical complexities.

Nonetheless, the global antifungal treatment industry stands to gain from several key opportunities, including the development of new antifungal molecules, combination therapies, and remote diagnostics and digital health solutions. There is an urgent need for novel antifungal agents with wide-spectrum activity and fewer side effects. Advanced drug platforms, such as monoclonal antibodies and nanotechnology, offer promising treatment solutions.

Additionally, the use of combination treatments to reduce resistance and improve efficiency is gaining prominence. This domain is projected to experience commercialization and clinical trials in the upcoming years. The growth of remote diagnostics and telemedicine helps faster detection of fungal infection and prescription of antifungal therapies, especially in isolated or rural areas.

Key Insights:

- As per the analysis shared by our research analyst, the global antifungal treatment market is estimated to grow annually at a CAGR of around 3.89% over the forecast period (2025-2034)

- In terms of revenue, the global antifungal treatment market size was valued at around USD 17.51 billion in 2024 and is projected to reach USD 23.76 billion by 2034.

- The antifungal treatment market is projected to grow significantly due to the increasing number of hospital-acquired infections, the growing elderly population worldwide, and high investments in research and development for new antifungal agents.

- Based on product type, the azoles segment is expected to lead the market, while the echinocandins segment is anticipated to experience significant growth.

- Based on indication, the candidiasis segment is the largest, while the dermatophytosis segment is projected to experience substantial revenue growth over the forecast period.

- Based on dosage form, the tablets/capsules segment is expected to lead the market, followed by the creams/ointments segment.

- Based on the route of administration, the oral segment leads the global market, followed by the topical segment.

- Based on distribution channel, the retail pharmacies segment dominates the market over the hospital pharmacies segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Europe.

Antifungal Treatment Market: Growth Drivers

Growing diagnosis and awareness of fungal infections spur the market growth

Increased awareness programs, campaigns, and medical training on fungal infection diagnosis and management have significantly contributed to early treatment and detection. Improved diagnostic tools like galactomannan testing, POC kits, and PCR-based assays have reduced diagnostic delays and enhanced detection accuracy.

Moreover, global health organizations are also raising awareness about fungal infections, primarily in high-pressure nations, leading to increased antifungal prescription quantities and the adoption of novel treatment regimens.

Growth of antifungal product approvals and pipeline substantially propels the market growth

The antifungal pipeline has made notable progress, with multiple new drugs receiving approvals from the EMA and FDA. For example, Scynexis’ (Brexafemme) ibrexafungerp was approved for vulvovaginal candidiasis in the United States, while F2G's olorofim, targeting invasive mold infections, received FDA orphan drug status.

According to the 2024 report by Pharma Intelligence, more than 45 antifungal candidates were in clinical trials, with 15 in Phase III or Phase II, indicating a strong growth outlook. The augmented availability of broad-spectrum, orally administered, and safer antifungal drugs is transforming the global antifungal treatment market, especially in outpatient settings.

Antifungal Treatment Market: Restraints

The high cost of advanced antifungal therapies is a key barrier to market progress

Several modern antifungal drugs, particularly those with liposomal formulations and broad-spectrum activity, are expensive. The high cost restricts access, primarily in middle- or low-income nations, where fungal infection cases are often higher due to inadequate healthcare infrastructure and improper sanitation.

The cost barrier also negatively impacts national formulary decisions, resulting in continued dependency on older, potentially more toxic or less effective treatments, such as traditional amphotericin B, thereby restricting the growth of the antifungal treatment industry.

Antifungal Treatment Market: Opportunities

Development of new antifungal drug classes favorably impacts market growth

The global antifungal treatment industry is experiencing significant opportunities with the emergence of new drug classes beyond conventional azoles, echinocandins, and polyenes. Novel agents, such as oteseconazole (Mycovia Pharmaceuticals) and ibrexafungerp (Scynexis), have recently gained regulatory approval, offering new treatment options for resistant fungal infections.

The FDA approved ibrexafungerp for the treatment of recurrent vulvovaginal candidiasis in 2024, making it the first non-azole oral antifungal medication designed explicitly for vaginal infections.

Antifungal Treatment Market: Challenges

Inadequate reporting systems and surveillance restrict the growth of the market

Fungal infections are underreported in several nations, especially in middle- and low-income regions, due to poor surveillance and a lack of mandatory reporting protocols. Therefore, the actual impact of fungal diseases is often undervalued, which challenges strategic funding, planning, and policy development.

According to an analysis by GAFFI, more than 80% of nations do not include fungal diseases in their national disease surveillance programs, and the fungal death rate is rarely documented on death certificates. Without strong epidemiological data, pharmaceutical investments and industry forecasting are limited.

Antifungal Treatment Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Antifungal Treatment Market |

| Market Size in 2024 | USD 17.51 Billion |

| Market Forecast in 2034 | USD 23.76 Billion |

| Growth Rate | CAGR of 3.89% |

| Number of Pages | 217 |

| Key Companies Covered | Pfizer Inc., Merck & Co. Inc., Novartis AG, GlaxoSmithKline plc, Astellas Pharma Inc., Johnson & Johnson, Bayer AG, Sanofi S.A., Abbott Laboratories, Cipla Ltd., Sun Pharmaceutical Industries Ltd., Teva Pharmaceutical Industries Ltd., Glenmark Pharmaceuticals Ltd., Lupin Limited, Dr. Reddy’s Laboratories, and others. |

| Segments Covered | By Product Type, By Indication, By Dosage Form, By Route of Administration, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Antifungal Treatment Market: Segmentation

The global antifungal treatment market is segmented based on product type, indication, dosage form, route of administration, distribution channel, and region.

Based on product type, the global industry is divided into azoles, echinocandins, polyenes, allylamines, and others. The azoles segment registered a notable market share because of their broad-spectrum efficiency, topical and oral availability, and broader use in systemic and superficial infections.

Based on indication, the global market is segmented into dermatophytosis, candidiasis, aspergillosis, cryptococcosis, and others. Candidiasis is the forerunning segment among others, owing to high prevalence in ICU and hospitalized patients, who are undergoing organ transplants or chemotherapy, and diabetic people.

Based on dosage form, the global antifungal treatment industry is segmented into tablets/capsules, creams/ointments, injections, powders, and others. The tablets/capsules segment held a notable market share due to their ease of administration, broad availability, and improved patient compliance. This makes them the most preferred format among others.

Based on route of administration, the global antifungal treatment market is segmented into oral, topical, intravenous, and others. The oral segment captured a substantial market share, as it is widely used for both systemic and superficial infections. They are preferred due to their high patient compliance, wide availability, and greater convenience.

Based on distribution channel, the global market is segmented into hospital pharmacies, retail pharmacies, online pharmacies, and others. The retail pharmacies segment leads the global market, backed by their volume of prescriptions and OTC sales for common fungal infections, such as ringworm, athlete's foot, and vaginal candidiasis.

Antifungal Treatment Market: Regional Analysis

North America to witness significant growth over the forecast period

North America is expected to maintain its leading position in the global antifungal treatment market due to its advanced healthcare infrastructure, high spending on prescription drugs, and growing population of immunocompromised individuals. The region benefits from a well-established healthcare system with broader access to specialist care, diagnostics, and antifungal therapies. Clinics and hospitals are equipped with advanced machinery and equipment to treat invasive fungal infections using intravenous echinocandins and novel agents, such as ibrexafungerp. This ecosystem backs the adoption of improved antifungal treatment rules and advanced therapeutics.

Furthermore, North America is a forerunner in global pharmaceutical spending, with the United States accounting for more than 40% of the worldwide prescription drug expenditures in 2024. This high spending capacity enables better access to costly antifungal treatments, including hospital-based IV formulations and long-term oral therapies, thereby improving industry dominance.

Furthermore, the region has a higher number of cases who are susceptible to fungal infections, comprising transplant recipients, individuals with diabetes or HIV/AIDS, and cancer patients. For example, more than 1.2 million Americans have HIV, a medical condition closely associated with possible fungal infections. This demographic inclination sustains long-term demand for antifungal treatment.

Europe ranks as the second-largest region in the global antifungal treatment industry, primarily due to its well-established healthcare systems, strong presence of biotech and pharmaceutical companies, and higher rates of ICU admissions and hospitalizations. European nations maintain comprehensive and universal healthcare systems, promising broader access to antifungal treatments in both private and public sectors.

Countries such as the United Kingdom, Italy, France, and Germany have developed protocols for managing infectious diseases, contributing to the steady use of systemic antifungal and topical medications. Europe is home to several key pharmaceutical companies and research institutes, including F2G and Basilea Pharmaceutica, which focus on developing new antifungal treatments. Continuous R&D efforts have led to the introduction of advanced delivery systems and molecules, enabling Europe to gain a competitive advantage in the industry.

Moreover, European hospitals often manage immunocompromised, geriatric, and post-operative patients who are susceptible to HAIs. For instance, nearly 30% of patients in European ICUs are at risk for fungal infections, triggering the use of prophylactic antifungal agents like triazoles and echinocandins to decrease mortality rates.

Antifungal Treatment Market: Competitive Analysis

The leading players in the global antifungal treatment market are:

- Pfizer Inc.

- Merck & Co. Inc.

- Novartis AG

- GlaxoSmithKline plc

- Astellas Pharma Inc.

- Johnson & Johnson

- Bayer AG

- Sanofi S.A.

- Abbott Laboratories

- Cipla Ltd.

- Sun Pharmaceutical Industries Ltd.

- Teva Pharmaceutical Industries Ltd.

- Glenmark Pharmaceuticals Ltd.

- Lupin Limited

- Dr. Reddy’s Laboratories

Antifungal Treatment Market: Key Market Trends

Development of novel therapies and growing antifungal resistance:

Antifungal resistance, mainly in azole-resistant Aspergillus species and Candida auris, is becoming a severe global health concern. This has prompted accelerated research and development investment in new antifungal categories, such as orotomides and triterpenoids. Pharmaceutical companies are shifting their focus towards developing broad-spectrum and resistance-breaking drugs to combat treatment failures and drug-resistant infections.

Surging use of prophylactic antifungal treatment in hospitals:

Hospitals are actively using prophylactic antifungal regimens for high-risk patients, such as cancer wards, ICUs, or post-transplant care. The growth of invasive fungal infections among immunocompromised individuals is driving the routine use of oral azoles and echinocandins for the prevention of these infections. This trend is highly evident in Europe and North America, adding to overall industry growth.

The global antifungal treatment market is segmented as follows:

By Product Type

- Azoles

- Echinocandins

- Polyenes

- Allylamines

- Others

By Indication

- Dermatophytosis

- Candidiasis

- Aspergillosis

- Cryptococcosis

- Others

By Dosage Form

- Tablets/Capsules

- Creams/Ointments

- Injections

- Powders

- Others

By Route of Administration

- Oral

- Topical

- Intravenous

- Others

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Antifungal treatment involves the medical management of fungal infections using drugs that either prevent fungal growth or kill the fungi. These infections may range from superficial conditions, such as ringworm or athlete's foot, to more serious systemic infections that impact internal organs, particularly in immunocompromised individuals.

The global antifungal treatment market is projected to grow due to the expansion of healthcare infrastructure in developing markets, the rise of multi-drug-resistant fungal strains, and the increasing use of antifungals in veterinary and agricultural medicine.

According to study, the global antifungal treatment market size was worth around USD 17.51 billion in 2024 and is predicted to grow to around USD 23.76 billion by 2034.

The CAGR value of the antifungal treatment market is expected to be around 3.89% during 2025-2034.

North America is expected to lead the global antifungal treatment market during the forecast period.

The key players profiled in the global antifungal treatment market include Pfizer Inc., Merck & Co., Inc., Novartis AG, GlaxoSmithKline plc, Astellas Pharma Inc., Johnson & Johnson, Bayer AG, Sanofi S.A., Abbott Laboratories, Cipla Ltd., Sun Pharmaceutical Industries Ltd., Teva Pharmaceutical Industries Ltd., Glenmark Pharmaceuticals Ltd., Lupin Limited, and Dr. Reddy’s Laboratories.

The report examines key aspects of the antifungal treatment market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed