Anticoagulants Market Size, Share, Growth, and Forecast 2032

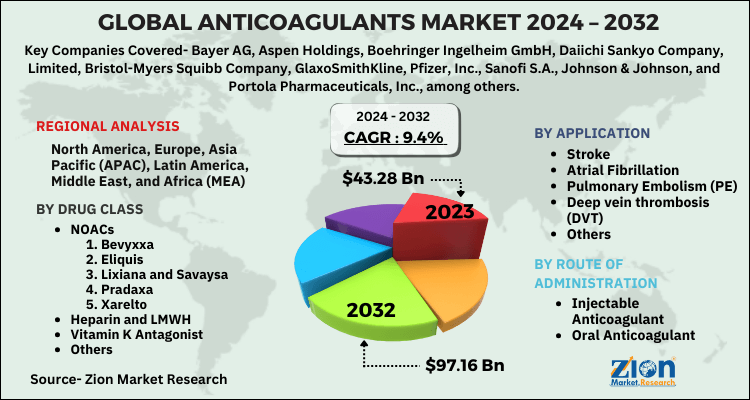

Anticoagulants Market By Drug Class (NOACs, Heparin & LMWH, Vitamin K Antagonist, And Others), By Route Of Administration (Injectable Anticoagulant And Oral Anticoagulant), By Application (Stroke, Atrial Fibrillation, Pulmonary Embolism (PE), Deep Vein Thrombosis (DVT), And Others), By Region - Global And Regional Industry Overview, market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts 2024-2032

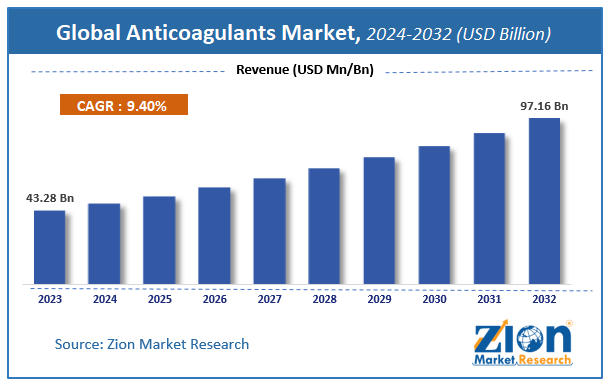

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 43.28 Billion | USD 97.16 Billion | 9.4% | 2023 |

Anticoagulants Market Size

The global anticoagulants market size was worth around USD 43.28 billion in 2023 and is predicted to grow to around USD 97.16 billion by 2032 with a compound annual growth rate (CAGR) of roughly 9.4% between 2024 and 2032.

The study provides historical data from 2018 to 2022 along with a forecast from 2024 to 2032 based on revenue (USD billion). The report covers a forecast and an analysis of the anticoagulants market on a global and regional level.

Anticoagulants Market: Overview

Anticoagulants are a class of medications that help prevent the formation of blood clots, reducing the risk of conditions such as stroke, deep vein thrombosis (DVT), and pulmonary embolism. They work by interfering with the blood clotting process, either by inhibiting clotting factors or by blocking the action of certain proteins essential for clot formation. Common types of anticoagulants include warfarin, heparin, and newer direct oral anticoagulants (DOACs) such as apixaban and rivaroxaban. These medications are crucial in the management of conditions like atrial fibrillation, artificial heart valves, and certain genetic disorders that increase clotting risk.

The anticoagulant market is expanding rapidly due to several key factors. The aging global population is a significant driver, as older individuals are more susceptible to cardiovascular conditions requiring anticoagulation therapy. Additionally, the increasing prevalence of conditions like atrial fibrillation and venous thromboembolism, which necessitate long-term anticoagulation, is boosting demand. Advances in anticoagulant therapy, particularly the development of DOACs, which offer more predictable pharmacokinetics and fewer dietary restrictions compared to traditional anticoagulants like warfarin, are also contributing to market growth. Furthermore, ongoing research into novel anticoagulants and the expansion of healthcare infrastructure in emerging markets are expected to sustain the growth of this market in the coming years.

Anticoagulants Market: Segmentation Analysis

The study provides a decisive view of the anticoagulants market based on drug class, route of administration, application, and region.

By drug class, the anticoagulants market is segmented into NOACs, heparin and LMWH, vitamin K antagonist, and others. The NOACs is sub-segmented into bevyxxa, eliquis, lixiana and savaysa, pradaxa, and xarelto.

Based on route of administration segment market is divided into injectable anticoagulant and oral anticoagulant.

Based on application segment the market is segmented into stroke, atrial fibrillation, pulmonary embolism (PE), deep vein thrombosis (DVT), and others.

Anticoagulants Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Anticoagulants Market |

| Market Size in 2023 | USD 43.28 Billion |

| Market Forecast in 2032 | USD 97.16 Billion |

| Growth Rate | CAGR of 9.4% |

| Number of Pages | 189 |

| Key Companies Covered | Bayer AG, Aspen Holdings, Boehringer Ingelheim GmbH, Daiichi Sankyo Company, Limited, Bristol-Myers Squibb Company, GlaxoSmithKline, Pfizer, Inc., Sanofi S.A., Johnson & Johnson, and Portola Pharmaceuticals, Inc., among others |

| Segments Covered | By Drug Class, By Route of Administration, By Application and By region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Anticoagulants Market: Regional Analysis

The regional segment includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa with its further fragmented into major countries including the U.S., Germany, France, UK, China, Japan, India, and Brazil.

By region, North America will lead the global anticoagulants market over the forecast time period, owing to the presence of state-of-the-art healthcare setup, high demand for innovative therapeutics, huge target population, the existence of trained healthcare professionals, and rising incidences of cardiovascular disorders. Europe will be the second largest market for anticoagulants in the years ahead, due to the escalating aging population, rising occurrences of chronic diseases, advantageous government policies, and the rising number of obese people. The Asia Pacific will propagate at a speedy rate over the forecast time period, owing to the huge population, growing number of people suffering from chronic disorders, such as cancer, diabetes, and cardiovascular diseases, promising government policies, and growing investments made by pharmaceutical companies for research and development.

Anticoagulants Market: Competitive Players

Some players of the global anticoagulants market are

- Bayer AG

- Aspen Holdings

- Boehringer Ingelheim GmbH

- Daiichi Sankyo Company Limited

- Bristol-Myers Squibb Company

- GlaxoSmithKline

- Pfizer Inc.

- Sanofi S.A.

- Johnson & Johnson

- Portola Pharmaceuticals Inc.

The Global Anticoagulants Market is segmented as follows:

Global Anticoagulants Market: By Drug Class

- NOACs

- Bevyxxa

- Eliquis

- Lixiana and Savaysa

- Pradaxa

- Xarelto

- Heparin and LMWH

- Vitamin K Antagonist

- Others

Global Anticoagulants Market: By Route of Administration

- Injectable Anticoagulant

- Oral Anticoagulant

Global Anticoagulants Market: By Application

- Stroke

- Atrial Fibrillation

- Pulmonary Embolism (PE)

- Deep vein thrombosis (DVT)

- Others

Global Anticoagulants Market: By Region

- North America

- U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Anticoagulants are a class of medications used to prevent the formation of blood clots or to treat existing clots.

According to study, the Anticoagulants market size was worth around USD 43.28 billion in 2023 and is predicted to grow to around USD 97.16 billion by 2032.

The CAGR value of Anticoagulants market is expected to be around 9.4% during 2024-2032.

North America has been leading the Anticoagulants market and is anticipated to continue on the dominant position in the years to come.

The Anticoagulants market is led by players like Bayer AG, Aspen Holdings, Boehringer Ingelheim GmbH, Daiichi Sankyo Company Limited, Bristol-Myers Squibb Company, GlaxoSmithKline, Pfizer Inc., Sanofi S.A., Johnson & Johnson, and Portola Pharmaceuticals Inc., among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed