Anti Inflammatory Therapeutics Market Size, Share, Value & Forecast 2034

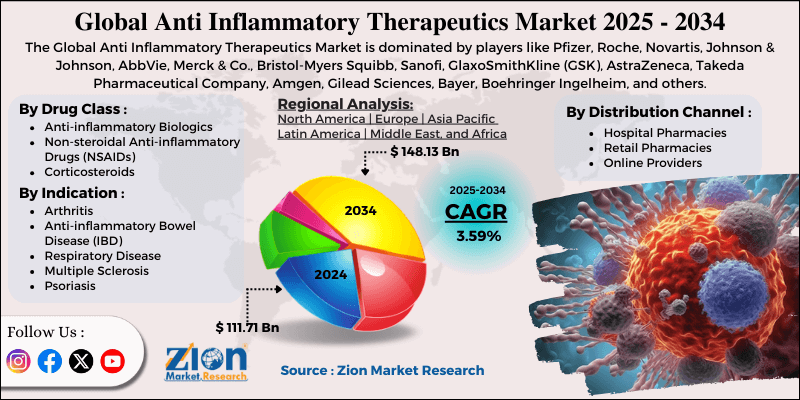

Anti Inflammatory Therapeutics Market By Drug Class (Anti-inflammatory Biologics, Non-steroidal Anti-inflammatory Drugs [NSAIDs], Corticosteroids), By Indication (Arthritis, Anti-inflammatory Bowel Disease [IBD], Respiratory Disease, Multiple Sclerosis, Psoriasis, and Others), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Providers), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

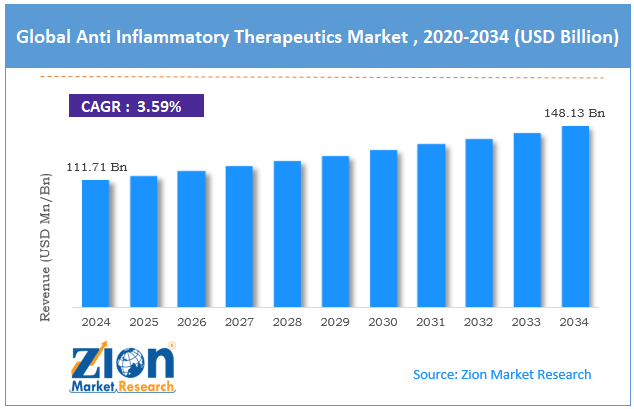

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 111.71 Billion | USD 148.13 Billion | 3.59% | 2024 |

Anti Inflammatory Therapeutics Industry Perspective:

The global anti inflammatory therapeutics market size was worth around USD 111.71 billion in 2024 and is predicted to grow to around USD 148.13 billion by 2034, with a compound annual growth rate (CAGR) of roughly 3.59% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global anti inflammatory therapeutics market is estimated to grow annually at a CAGR of around 3.59% over the forecast period (2025-2034)

- In terms of revenue, the global anti inflammatory therapeutics market size was valued at around USD 111.71 billion in 2024 and is projected to reach USD 148.13 billion by 2034.

- The anti inflammatory therapeutics market is projected to grow significantly, driven by advances in biologics and targeted therapies, growing awareness of inflammation and related diseases, and the rising incidence of autoimmune and respiratory disorders.

- Based on drug class, the Non-steroidal Anti-inflammatory Drugs (NSAIDs) segment is expected to lead the market, while the anti-inflammatory biologics segment is expected to grow considerably.

- Based on the indication, the arthritis segment is the dominant segment, while the Anti-Inflammatory Bowel Disease (IBD) segment is projected to witness significant revenue growth over the forecast period.

- Based on distribution channel, the retail pharmacies segment is expected to lead the market, followed by the hospital pharmacies segment.

- By region, North America is projected to dominate the global market during the forecast period, followed by Europe.

Anti Inflammatory Therapeutics Market: Overview

Anti-inflammatory therapeutics are biologic agents and medications dedicated to lessening inflammation – the body’s natural but sometimes injurious immune response. They work through various mechanisms, such as blocking inflammatory enzymes, suppressing immune overactivity, or targeting specific immune pathways involved in chronic inflammatory diseases, as in biologics used for IBD or rheumatoid arthritis. The global anti inflammatory therapeutics market is likely to expand rapidly, driven by rising incidences of chronic inflammatory and autoimmune diseases, an aging population and comorbidities, and advances in targeted therapies and biologics. As lifestyle changes, aging populations, worldwide, and environmental factors lead to surging cases of diseases like osteoarthritis, inflammatory bowel disease, psoriasis, and rheumatoid arthritis, demand for long-term management grows accordingly.

Moreover, older populations are mostly affected by chronic degenerative conditions, age-associated inflammation, and joint disorders. This demographic move raises overall demand for anti-inflammatory therapy, both disease-modifying and symptomatic (pain relief). Furthermore, the development of biologic therapies and targeted small molecules offers more effective, usually safer, long-term treatments than older broad-spectrum anti-inflammatory agents, thereby increasing uptake and expanding the patient pool.

Despite growth, the global market is constrained by factors such as adverse effects and safety concerns associated with broad-spectrum anti-inflammatory agents, as well as the high prices of targeted treatments and biologics. Traditional NSAIDs and corticosteroids hold risks, which limit long-term use and may deter physicians and some patients from prescribing them. Similarly, while highly effective, biologic agents and newer small-molecule drugs are mostly high-priced. This makes them less accessible, particularly in middle- and low-income regions and among underinsured/uninsured populations.

Nonetheless, the global anti inflammatory therapeutics industry stands to gain from several key opportunities, including the adoption and development of biosimilars to reduce costs, the adoption of personalized medicine, and the development of precision anti-inflammatory therapies. As patents on current biologics expire, biosimilar versions can offer comparable efficacy at lower prices, expanding access in both emerging and developed markets and fueling volume growth. Additionally, using genetic profiling and biomarkers to tailor therapy, like small molecule or the most effective biologic for a patient’s inflammatory profile, could enhance outcomes, open new therapeutic niches, and lessen side effects.

Anti Inflammatory Therapeutics Market Dynamics

Growth Drivers

How is the anti inflammatory therapeutics market driven by advances in biologics, targeted therapies, and drug innovation?

The market has experienced speedy development of small-molecule inhibitors, biologics, and targeted anti-inflammatory drugs with enhanced efficacy and safety profiles. These advancements enable treatment of serious, resistant, or complex inflammatory conditions. Precision and personalized medicine approaches have widened patient access to advanced therapies. The launch of novel therapeutics simulates both industry adoption and investment in research pipelines. Constant innovation, hence, expands the range of treatment options and fuels the market growth.

How is the anti inflammatory therapeutics market fueled by the surge in lifestyle-related diseases and comorbid conditions?

Lifestyle changes like sedentary behavior, obesity, pollution, and poor diet contribute to growing cases of cardiovascular, metabolic, and respiratory diseases with inflammatory components. These comorbidities usually need simultaneous management of inflammation, thereby broadening the patient pool for anti-inflammatory therapeutics. The growing pressure of chronic lifestyle-related conditions has elevated both long-term and short-term demand. Pharmaceutical companies are responding with expanded product portfolios that target broader patient segments. Lifestyle-driven health challenges, therefore, primarily accelerate the growth of the anti inflammatory therapeutics market.

Restraints

High cost of biologics and advanced therapies negatively impacts the market progress

Biologic anti-inflammatory drugs and targeted therapies are often expensive, restricting patient access, particularly in middle- and low-income regions. High therapy prices may also result in reimbursement or insurance restrictions. This financial pressure hampers the adoption rate of advanced treatments. Hence, market growth may be limited in price-sensitive populations. Affordability remains a major barrier to broader uptake.

Opportunities

How is personalized and precision medicine creating promising avenues for the anti inflammatory therapeutics industry growth?

Patient-specific and biomarker-driven therapies are gaining prominence, offering tailored treatment plans. Personalized medicine can enhance patient outcomes and adherence. This approach surges the adoption of high-value targeted therapies. Precision therapies create opportunities for pharmaceutical innovation and premium pricing. The trend toward individualized care offers remarkable potential for the anti inflammatory therapeutics industry.

Challenges

Market fragmentation and competition from alternative therapies restrict the market growth

The market is highly fragmented, with numerous generic drugs, drug classes, and alternative therapies such as herbal anti-inflammatory agents and nutraceuticals. Physicians and patients often have different preferences, harming market uniformity. Self-medication trends and competing products challenge industry ranking. Capturing patient loyalty and distinguishing products requires innovation and strategic marketing. Fragmentation creates a constant competitive challenge.

Anti Inflammatory Therapeutics Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Anti Inflammatory Therapeutics Market |

| Market Size in 2024 | USD 111.71 Billion |

| Market Forecast in 2034 | USD 148.13 Billion |

| Growth Rate | CAGR of 3.59% |

| Number of Pages | 216 |

| Key Companies Covered | Pfizer, Roche, Novartis, Johnson & Johnson, AbbVie, Merck & Co., Bristol-Myers Squibb, Sanofi, GlaxoSmithKline (GSK), AstraZeneca, Takeda Pharmaceutical Company, Amgen, Gilead Sciences, Bayer, Boehringer Ingelheim, and others. |

| Segments Covered | By Drug Class, By Indication, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Anti Inflammatory Therapeutics Market: Segmentation

The global anti inflammatory therapeutics market is segmented based on drug class, indication, distribution channel, and region.

Based on drug class, the global anti inflammatory therapeutics industry is divided into anti-inflammatory biologics, Non-steroidal Anti-inflammatory Drugs (NSAIDs), and corticosteroids. The Non-Steroidal Anti-inflammatory Drugs (NSAIDs) segment dominates with nearly 48-50% share because of their wide use and affordability. They are easily available OTC, making them simply accessible for chronic conditions like arthritis and acute pain. NSAIDs are broadly prescribed for musculoskeletal injuries, inflammatory disorders, and post-operative pain. Their established safety profile and versatility for short-term use sustain elevated market demand. This broad applicability assures NSAIDs dominate as the top revenue-generating segment.

On the other hand, the anti-inflammatory biologics hold a second-leading share of roughly 32-36%, fueled by robust uptake in autoimmune and chronic conditions that require targeted therapies. Their value and high cost also significantly contribute to industry revenue, making them an influential and fastest-growing segment.

Based on indication, the global anti inflammatory therapeutics market is segmented into arthritis, Anti-Inflammatory Bowel Disease (IBD), respiratory disease, multiple sclerosis, psoriasis, and others. The arthritis segment holds a leading market share of 35-38%, driven by its high global incidence, particularly among aging populations. Chronic conditions like rheumatoid arthritis and osteoarthritis need long-term management, fueling the demand for NSAIDs, biologics, and corticosteroids. The broad patient base and continuous demand for disease-modifying therapies and pain relief make arthritis the leading revenue-generating indication.

Conversely, the Anti-inflammatory Bowel Disease (IBD) segment holds nearly 18-20% share in the market. This growth is backed by the growing cases of chronic conditions like ulcerative colitis and Crohn’s disease that need targeted and long-term anti-inflammatory treatment. The rising cases of IBD worldwide, along with the use of specialty drugs and high-value biologics, fuel strong demand and a major industry share.

Based on distribution channel, the global market is segmented into hospital pharmacies, retail pharmacies, and online providers. The retail pharmacies segment holds a 47-50% market share due to their convenience and wide accessibility. They offer OTC and prescription anti-inflammatory drugs, catering to a wide patient population for both acute and chronic conditions. Their broad presence in rural and urban areas assures consistent availability and elevated volume sales.

However, the hospital pharmacies segment ranks second at 30-35%, as it handles high-cost, specialized anti-inflammatory therapies. This comprises biologics that need clinical supervision and ideal storage. The need for professional oversight and administration in the management of severe or chronic inflammatory conditions, and in healthcare settings, fuels its major market share.

Anti Inflammatory Therapeutics Market: Regional Analysis

What gives North America a competitive edge in the global Anti Inflammatory Therapeutics Market?

North America is anticipated to retain its leading position, with a 6.2% CAGR in the global anti inflammatory therapeutics market. This growth is attributed to the advanced healthcare infrastructure and high per-capita spending, strong adoption of advanced therapies and biologics, robust R&D, and favorable reimbursement environment. Well-established healthcare systems and high per capita healthcare expenditure enable broader access to specialist and diagnostic care. This supports the timely prescription and management of chronic inflammatory diseases.

Subsequently, adoption of both advanced and conventional anti-inflammatory therapies is strong. North America accounted for nearly 75% of the global anti-inflammatory biologics industry in 2022. Physicians and patients favor targeted therapies for chronic and autoimmune conditions. This preference augments industry revenues than with regions that depend mainly on older drugs.

Furthermore, the region hosts prominent pharmaceutical companies that are investing heavily in novel anti-inflammatory therapies, including biosimilars and biologics. Insurance coverage and reimbursement policies enhance patient access to high-priced treatments. These factors together amplify adoption and industry growth.

Europe ranks second among regions, with a 5.9% CAGR in the global anti inflammatory therapeutics industry. This growth is supported by the high prevalence of chronic inflammatory diseases, well-developed healthcare systems and reimbursement systems, and the rising adoption of targeted therapies and biologics. Europe has a significant patient population affected by psoriasis, arthritis, and inflammatory bowel disease. Aging demographics further raise the incidence of chronic conditions. This fuels consistent demand for both biologics and NSAIDs.

Moreover, most European nations have improved healthcare infrastructure and private or public reimbursement schemes. Hence, treatment uptake in autoimmune and chronic conditions is high. There is a strong adoption of biologics in Europe, especially for chronic and autoimmune inflammatory diseases. Clinicians and physicians steadily prefer targeted therapies over corticosteroids or traditional NSAIDs. The trend contributed to sustained industry growth in the region.

Anti Inflammatory Therapeutics Market: Competitive Analysis

The leading players in the global anti inflammatory therapeutics market are:

- Pfizer

- Roche

- Novartis

- Johnson & Johnson

- AbbVie

- Merck & Co.

- Bristol-Myers Squibb

- Sanofi

- GlaxoSmithKline (GSK)

- AstraZeneca

- Takeda Pharmaceutical Company

- Amgen

- Gilead Sciences

- Bayer

- Boehringer Ingelheim

Anti Inflammatory Therapeutics Market: Key Market Trends

Growth of novel small‑molecule inhibitors and oral therapies:

Beyond biologic injections and traditional NSAIDs, new small-molecule anti-inflammatory drugs and oral formulations are increasing clinical use and pipeline. These offer benefits such as ease of administration, potentially lower costs, and greater patient convenience, thereby widening the appeal of anti-inflammatory treatment.

Shift toward biologics, biosimilars, and targeted therapies:

The market is steadily moving away from traditional broad-spectrum drugs toward biosimilars and biologics that target specific inflammatory pathways. This trend is driven by reduced side-effect profiles and greater efficacy compared with older treatments. The rise in these targeted therapies denotes a demand for precision treatment in chronic and autoimmune diseases.

The global anti inflammatory therapeutics market is segmented as follows:

By Drug Class

- Anti-inflammatory Biologics

- Non-steroidal Anti-inflammatory Drugs (NSAIDs)

- Corticosteroids

By Indication

- Arthritis

- Anti-inflammatory Bowel Disease (IBD)

- Respiratory Disease

- Multiple Sclerosis

- Psoriasis

- Others

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Providers

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed