Animal Drug Compounding Market Size, Share, and Growth Report 2032

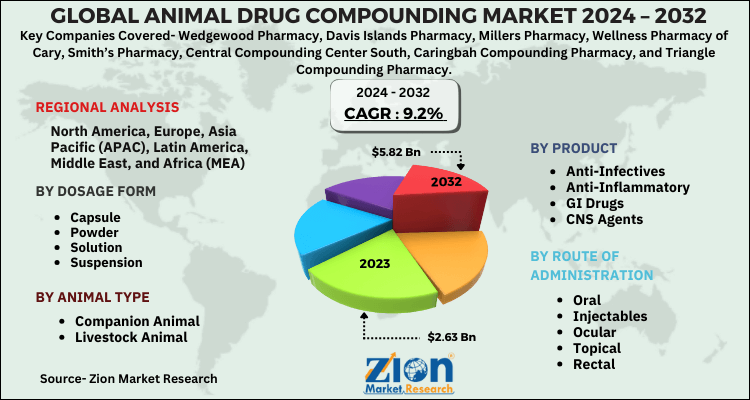

Animal Drug Compounding Market - By Product (Anti-Infectives, Anti-Inflammatory, GI Drugs, and CNS Agents), By Animal Type (Companion Animal and Livestock Animal), By Dosage Form (Capsule, Powder, Solution, and Suspension), By Route of Administration (Oral, Ocular, Injectables, Topical, and Rectal), And By Region- Global Industry Perspective, Comprehensive Analysis, and Forecast, 2024 - 2032-

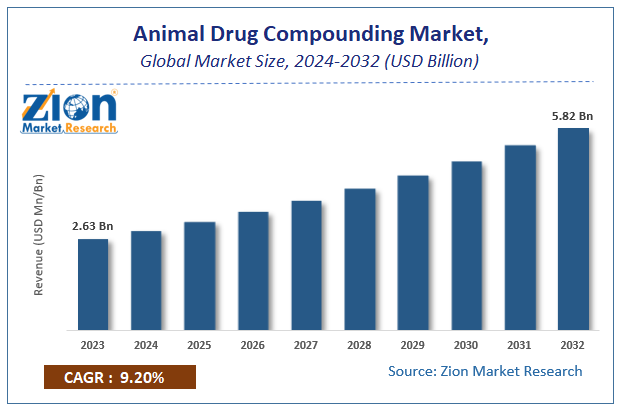

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 2.63 Billion | USD 5.82 Billion | 9.2% | 2023 |

Animal Drug Compounding Market Insights

According to Zion Market Research, the global Animal Drug Compounding Market was worth USD 2.63 Billion in 2023. The market is forecast to reach USD 5.82 Billion by 2032, growing at a compound annual growth rate (CAGR) of 9.2% during the forecast period 2024-2032.

The report offers a comprehensive analysis of the market, highlighting the factors that will determine growth, potential challenges, and opportunities that could emerge in the Animal Drug Compounding Market industry over the next decade.

The report offers an assessment and analysis of the Animal Drug Compounding market on a global and regional level. The study offers a comprehensive assessment of the market competition, constraints, revenue estimates, opportunities, evolving trends, and industry-validated data. The report provides historical data from 2018 to 2020 along with a forecast from 2024 to 2032 based on revenue (USD Billion).

Animal Drug Compounding Market: Synopsis

Animal drug compounding is a process of mixing and changing ingredients for creating medicine tailored to the requirements of a particular animal or a small animal group. These drugs play a major role in veterinary activities. Furthermore, animal-compounded drugs are manufactured & licensed by either veterinarians or pharmacists. According to U.S. FDA, the federal food, drug, and cosmetic act allow animal drug compounding when active ingredient source is a finished FDA-approved medicine and not a bulk material. Reportedly, on June 11 2020, the U.S. FDA released revised draft guidance on animal drug compounding from bulk drug materials. This include (i) filling of patient-specific medical prescriptions by veterinarians & pharmacists for non-food manufacturing animals, (ii) compounding antidotes for food-producing animals, and (iii) compounding office stock from bulk drug materials for non-food producing animals.

Furthermore, when a pet gets ill and there is no apt medicine available for treating it, pharmacists or veterinarians prescribe drug formulation through the animal drug compounding process. They depend on two key animal drug compounding methods including bulk ingredients and extra-label drugs. In bulk ingredients process, pharmacists compound new medicines by combining bulk ingredients with fillers, suspension solutions, and flavors. In case of extra-label drugs procedure, the pharmacist makes use of FDA-approved veterinary medicine and combines it with tablets & other ingredients for fulfill medical needs of pet animal.

Animal Drug Compounding Market: Growth Factors

Safe & effective drugs are a key for veterinarians for treating animals & pets. Moreover, a veterinarian drug approved by U.S. FDA is not always available to veterinary doctors for treating pets and in such situations, veterinarians make use of compounded drugs for effectively treating animal conditions. Such moves & initiatives are anticipated to expedite growth of animal drug compounding market. Apparently, animal health sector aids usage of animal drug compounding activities for addressing medical requirements of animals, thereby embellishing growth of animal drug compounding market. Surge in demand for myriad animal anti-infective drugs & animal anti-inflammatory medicines like tramadol, metronidazole, and ketoconazole will create new growth avenues for animal drug compounding industry during forecast timespan.

Furthermore, key producers are trying to launch new products with different routes of administration including oral, ocular, topical, and injection. This, in turn, will translate into increase in market size during forthcoming years. Apparently, rise in demand for product across companion animal & livestock sector will drive industry trends. Breakthroughs in pharmaceutical industry will spearhead growth of animal drug computing market in foreseeable future.

Regional Landscape

Europe To Make Notable Contributions Towards Global Market Size By 2032

The growth of animal drug compounding market in Europe Over 2021-2032 is due to massive production of animal drug compounding in countries such as Germany. In addition to this, escalating demand for anti-infectives and anti-inflammatories along with thriving pharma sector will drive regional market trends. Apart from this, favorable laws aiding use of customized animal drug compounding for treating pets in countries such as the UK, Italy, Russia, France, Belgium, Switzerland, and Germany will prompt growth of animal drug compounding business in Europe. Focus of players in continent for addressing medicine shortages will aid regional market growth.

Competitive Landscape

Key players influencing market growth and profiled in study are-

- Wedgewood Pharmacy

- Davis Islands Pharmacy

- Millers Pharmacy

- Wellness Pharmacy of Cary

- Smith’s Pharmacy

- Central Compounding Center South

- Caringbah Compounding Pharmacy

- Triangle Compounding Pharmacy.

Animal Drug Compounding Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Animal Drug Compounding Market |

| Market Size in 2023 | USD 2.63 Billion |

| Market Forecast in 2032 | USD 5.82 Billion |

| Growth Rate | CAGR of 9.2% |

| Number of Pages | 130 |

| Key Companies Covered | Wedgewood Pharmacy, Davis Islands Pharmacy, Millers Pharmacy, Wellness Pharmacy of Cary, Smith’s Pharmacy, Central Compounding Center South, Caringbah Compounding Pharmacy, and Triangle Compounding Pharmacy |

| Segments Covered | By Product, By Animal Type, By Dosage Form, By Route of Administration, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

The global Animal Drug Compounding Market is segmented as follows:

By Product

- Anti-Infectives

- Anti-Inflammatory

- GI Drugs

- CNS Agents

By Animal Type

- Companion Animal

- Livestock Animal

By Dosage Form

- Capsule

- Powder

- Solution

- Suspension

By Route of Administration

- Oral

- Injectables

- Ocular

- Topical

- Rectal

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Safe & effective drugs are a key for veterinarians for treating animals & pets. Moreover, a veterinarian drug approved by U.S. FDA is not always available to veterinary doctors for treating pets and in such situations veterinarians make use of compounded drugs for effectively treating animal conditions. Such moves & initiatives are anticipated to expedite growth of animal drug compounding market. Apparently, animal health sector aids usage of animal drug compounding activities for addressing medical requirements of animals, thereby embellishing growth of animal drug compounding market. Surge in demand for myriad animal anti-infective drugs & animal anti-inflammatory medicines like tramadol, metronidazole, and ketoconazole will create new growth avenues for animal drug compounding industry during forecast timespan.

Furthermore, key producers are trying to launch new products with different routes of administration including oral, ocular, topical, and injection. This, in turn, will translate into increase in market size during forthcoming years. Apparently, rise in demand for product across companion animal & livestock sector will drive industry trends. Breakthroughs in pharmaceutical industry will spearhead growth of animal drug computing market in foreseeable future.

Animal Drug Compounding Market size is set to expand from $ 2.63 Billion in 2023 to $ 5.82 Billion by 2032, with an anticipated CAGR of around 9.2% from 2024 to 2032.

Europe will contribute lucratively towards the global market value over the estimated timeline. The regional market surge is subject to massive production of animal drug compounding in countries such as Germany. In addition to this, escalating demand for anti-infectives and anti-inflammatories along with thriving pharma sector will drive regional market trends. Apart from this, favorable laws aiding use of customized animal drug compounding for treating pets in countries such as the UK, Italy, Russia, France, Belgium, Switzerland, and Germany will prompt growth of animal drug compounding business in Europe. Focus of players in continent for addressing medicine shortages will aid regional market growth.

The key market participants include Wedgewood Pharmacy, Davis Islands Pharmacy, Millers Pharmacy, Wellness Pharmacy of Cary, Smith’s Pharmacy, Central Compounding Center South, Caringbah Compounding Pharmacy, and Triangle Compounding Pharmacy.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed