Ammonia Storage and Transportation Market Size, Share Report 2034

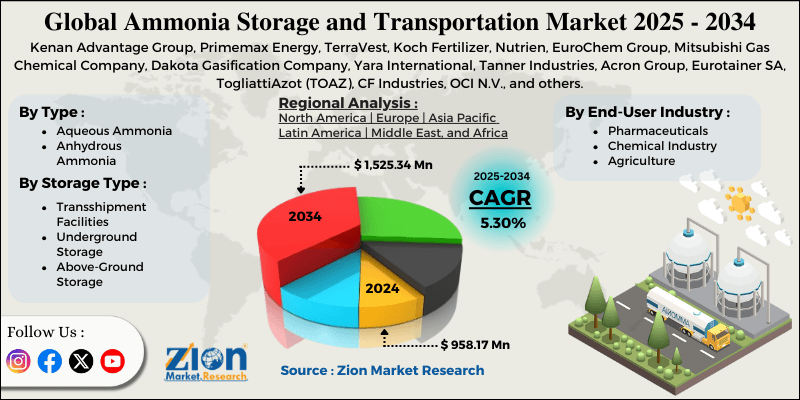

Ammonia Storage and Transportation Market By Type (Aqueous Ammonia and Anhydrous Ammonia), By Storage Type (Transshipment Facilities, Underground Storage, and Above-Ground Storage), By End-User Industry (Pharmaceuticals, Chemical Industry, and Agriculture), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

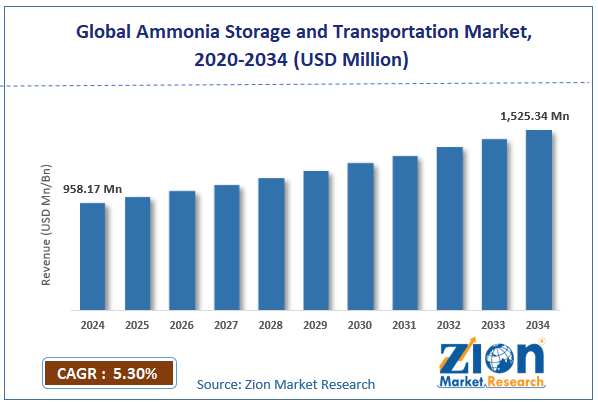

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 958.17 Million | USD 1,525.34 Million | 5.30% | 2024 |

Ammonia Storage and Transportation Industry Perspective:

What will be the size of the global ammonia storage and transportation market during the forecast period?

The global ammonia storage and transportation market size was worth around USD 958.17 million in 2024 and is predicted to grow to around USD 1,525.34 million by 2034, with a compound annual growth rate (CAGR) of roughly 5.30% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global ammonia storage and transportation market is estimated to grow annually at a CAGR of around 5.30% over the forecast period (2025-2034)

- In terms of revenue, the global ammonia storage and transportation market size was valued at around USD 958.17 million in 2024 and is projected to reach USD 1,525.34 million by 2034.

- The ammonia storage and transportation market is projected to grow at a significant rate due to rising demand for fertilizers in the agriculture sector

- Based on the type, the anhydrous ammonia segment is growing at a high rate and will continue to dominate the global market, as per industry projections

- Based on the end-user industry, the agriculture sector segment is anticipated to command the largest market share

- Based on region, the Asia-Pacific is projected to dominate the global market during the forecast period

Ammonia Storage and Transportation Market: Overview

Ammonia storage and transportation involve specialized solutions for securely storing, moving, and transporting ammonia without risk to the environment. Ammonia is a colorless gas with wide applications across multiple end-user industries. It is used for the production of chemical products and fertilizers. According to industry analysis, the majority of ammonia produced across the globe is transported in liquid form using rail tank cars, pipelines, ships, or trucks. During the forecast period, the industry for ammonia storage and transportation is expected to register improved investments driven by several favorable factors.

For instance, the growing demand for effective fertilizers in the agricultural industry will promote market growth trends. Additionally, surging advancements in ammonia storage and transportation solutions will further create new growth opportunities during the projection period. A major drawback for industry players may emerge in the form of the high cost of storage and transportation technologies. Furthermore, health risks associated with ammonia can create growth barriers for market leaders during the projection period.

Ammonia Storage and Transportation Market: Dynamics

Growth Drivers

How will the growing demand for fertilizers in agriculture influence the ammonia storage and transportation market growth?

The global ammonia storage and transportation market is expected to be driven by rising demand for fertilizers in the agricultural sector. Industry analysis confirms that ammonia plays a crucial role in shaping the modern agricultural sector across the globe. Ammonia is one of the most essential components of fertilizers. More than 80% of global ammonia production is used to produce nitrogen-based fertilizers. It helps increase crop yield and quality. In addition, ammonia-containing fertilizers reduce waste and have a limited impact on the environment. The rising focus on precision farming across the globe will create more demand for ammonia in the coming years, subsequently driving investments in the development of storage and transportation solutions. The growing global population, along with increased food demand, has created a greater scope for solutions that enhance crop production rates. These factors will eventually work in favor of the ammonia storage and transportation market.

Applications in the renewable energy sector to promote market expansion in the long run

As per recent statistics, the renewable energy industry is emerging as a dominant end-user of ammonia. The rising global transition toward green and clean energy will fuel increased demand for a robust infrastructure that supports safe storage and transportation of ammonia. According to the International Renewable Energy Agency, ammonia is emerging as a zero-carbon fuel for stationary power generation. Furthermore, it has also shown applications as a hydrogen carrier for the international trade of carbon-free energy. The rising production of renewable ammonia at an industrial scale will emerge as an essential driver for the global ammonia storage and transportation market.

Restraints

Why will health hazards impact growth in the ammonia storage and transportation market?

The global industry for ammonia storage and transportation is expected to be restricted due to several health hazards associated with the chemical compound. Exposure to ammonia, in all forms, can lead to serious health impacts, including respiratory diseases, lung damage, and skin & eye burns. For instance, liquid ammonia stored at cold temperatures can cause frostbite upon contact with the skin or eyes. If ingested, it can cause severe burns to the gastrointestinal tract.

Opportunities

Ongoing advancements in ammonia storage and transportation solutions to open new growth opportunities

The global ammonia storage and transportation market is expected to generate growth opportunities due to the rising investments in advanced solutions, especially those designed for the industry. In June 2025, AVTL, a leading operator of a network of terminals in the Indian market, announced that it would develop an exclusive brownfield ammonia terminal at the existing Pipavav location. The site will serve as the country's first independent ammonia storage terminal. The facility will have a storage capacity of 36,000 metric tons and is expected to become operational by 2026.

In June 2025, INOX India, a leading provider of cryogenic technology, launched a new ultra-high-purity ammonia ISO tank container. The novel range is expected to serve the growing global solar panel and semiconductor manufacturing. The T-50 container is built from high-performance stainless steel that can withstand harsh environments and the corrosiveness of ammonia. In October 2025, Sumitomo Corporation received a government grant from the Maritime and Port Authority of Singapore. The funds will be used for researching & developing an effective and safe supply chain for ammonia to be used as a marine fuel at the Port of Singapore.

Challenges

How will technical complexities and a lack of infrastructure challenge the ammonia storage and transportation market growth?

The global ammonia storage and transportation industry is expected to be challenged by the presence of several technical complexities in the market. For instance, storing and transporting ammonia requires solutions made of materials that can handle the chemical’s extreme corrosiveness. However, these materials are expensive to procure, and their supply rate is highly influenced by supply chain fluctuations. Furthermore, a lack of robust infrastructure that allows smooth storage and transportation of ammonia from the production site to ultimate users can further impede market expansion in the long run.

Ammonia Storage and Transportation Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Ammonia Storage and Transportation Market |

| Market Size in 2024 | USD 958.17 Million |

| Market Forecast in 2034 | USD 1,525.34 Million |

| Growth Rate | CAGR of 5.30% |

| Number of Pages | 212 |

| Key Companies Covered | Kenan Advantage Group, Primemax Energy, TerraVest, Koch Fertilizer, Nutrien, EuroChem Group, Mitsubishi Gas Chemical Company, Dakota Gasification Company, Yara International, Tanner Industries, Acron Group, Eurotainer SA, TogliattiAzot (TOAZ), CF Industries, OCI N.V., and others. |

| Segments Covered | By Type, By Storage Type, By End-User Industry, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Ammonia Storage and Transportation Market: Segmentation

The global ammonia storage and transportation market is segmented based on type, storage type, end-user industry, and region.

Based on type, the global market segments are aqueous ammonia and anhydrous ammonia. In 2024, more than 60% of the market share was held by the anhydrous ammonia segment due to its high nitrogen content. Anhydrous ammonia has extensive applications in fertilizer production, which will result in segmental dominance during the projection period. The aqueous ammonia segment has more industrial applications, leading to considerable revenue for the segment.

Based on storage type, the global ammonia storage and transportation industry is divided into transshipment facilities, underground storage, and above-ground storage.

Based on the end-user industry, the global market is fragmented into pharmaceuticals, the chemical industry, and agriculture. According to industry analysis, more than 75% of final returns were listed in the agriculture sector due to the drastic applications of ammonia in fertilizer production. Growing food demand worldwide and increased focus on improving crop yields will facilitate improved CAGR in the agriculture sector during the forecast period.

Ammonia Storage and Transportation Market: Regional Analysis

Why will Asia-Pacific emerge as the most dominant region in the ammonia storage and transportation market?

The global ammonia storage and transportation market is expected to be led by Asia-Pacific, registering a CAGR of 5.5% during the forecast period. China is one of the world’s largest producers of ammonia, serving a global client base. In addition, the growing demand for ammonia across India, Japan, and other Asian countries will further facilitate regional dominance over the forecast period.

In December 2025, NH3 Clean Energy Ltd announced its plans to strengthen the emerging clean ammonia bunkering sector in the Asia-Pacific region. The company has signed a Memorandum of Understanding (MoU) with ITOCHU Corporation. The latter is a Japan-based trading house. The MoU outlines a 2-year collaboration to develop clean ammonia bunkering operations in Western Australia’s Pilbara region by 2030.

North America is anticipated to emerge as the fastest-growing market during the forecast period. It is anticipated to deliver a CAGR of 6.57% in the coming years. The US will lead the region’s growth rate. The country has witnessed an increase in partnerships among industry players to scale ammonia production, ultimately driving investments in novel chemical storage and transportation solutions.

In October 2025, SAMSUNG E&A announced that it had signed a new EPF (Engineering, Procurement, and Fabrication) contract worth USD 475 million for the construction of America's first low-carbon ammonia plant. Growing focus on developing robust ammonia storage and transportation infrastructure will facilitate North America’s growing CAGR over the forecast duration.

Ammonia Storage and Transportation Market: Competitive Analysis

The global ammonia storage and transportation market is led by players like:

- Kenan Advantage Group

- Primemax Energy

- TerraVest

- Koch Fertilizer

- Nutrien

- EuroChem Group

- Mitsubishi Gas Chemical Company

- Dakota Gasification Company

- Yara International

- Tanner Industries

- Acron Group

- Eurotainer SA

- TogliattiAzot (TOAZ)

- CF Industries

- OCI N.V.

What are the key trends in the global Ammonia Storage and Transportation Market?

Growing demand for green ammonia

The chemical industry worldwide is witnessing a growing shift toward green ammonia production, as it offers opportunities in the carbon-free fuel sector. These advancements will open new opportunities for breakthrough green ammonia storage and transportation solutions during the projection period.

Global partnerships

An emerging trend in the ammonia storage and transportation sector is the growing number of global partnerships led by business leaders. Strategic collaboration across geographical borders will allow companies to explore new markets and reduce growth barriers in novel regions with limited infrastructure.

The global ammonia storage and transportation market is segmented as follows:

By Type

- Aqueous Ammonia

- Anhydrous Ammonia

By Storage Type

- Transshipment Facilities

- Underground Storage

- Above-Ground Storage

By End-User Industry

- Pharmaceuticals

- Chemical Industry

- Agriculture

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed