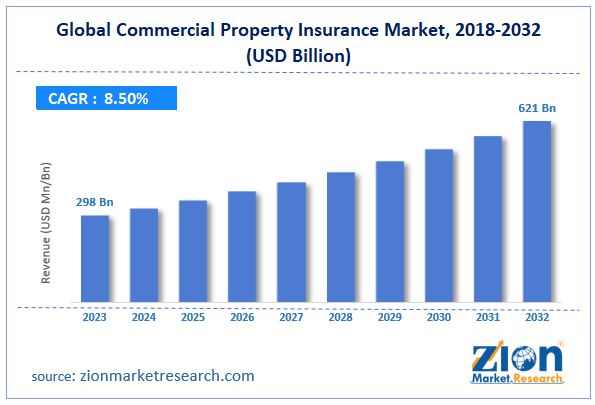

The Commercial Property Insurance Market is expected to grow with a CAGR of 8.5% by 2032 due to expanding commercial real estate development

03-Dec-2025 | Zion Market Research

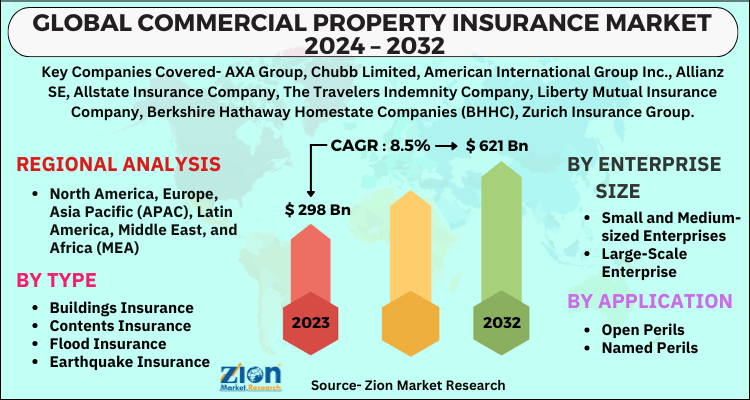

The global commercial property insurance market size was worth around USD 298 billion in 2023 and is predicted to grow to around USD 621 billion by 2032, with a compound annual growth rate (CAGR) of roughly 8.5% between 2024 and 2032.

Commercial property insurance is a type of coverage that protects businesses from financial loss when their buildings, equipment, or inventory are damaged by events like fire, theft, vandalism, or natural disasters. This insurance applies to many property types, such as offices, retail stores, warehouses, factories, restaurants, and hotels, helping businesses avoid large financial setbacks after unexpected damage. Coverage usually includes the main building, business items like computers and furniture, improvements made to rented spaces, and outdoor features such as signs or fences. Policies may pay based on replacement cost or actual cash value, which affects the amount a business receives after a loss. Business owners can buy separate property policies or combine them with liability coverage in a business owner’s package. Extra options cover special risks like floods, earthquakes, equipment failures, or lost income when operations stop after property damage. Insurance companies look at many factors when setting prices, including the location, building materials, fire protection systems, security features, and the type of work done at the property. Some insurers also offer risk engineering services to help businesses find weak areas and reduce the chances of future losses.

Browse the full “Commercial Property Insurance Market By Type (Buildings Insurance, Contents Insurance, Flood Insurance, Earthquake Insurance, and Others), By Enterprise Size (Small & Medium-sized Enterprises and Large-Scale Enterprise), By Application (Open Perils and Named Perils), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032” Report at https://www.zionmarketresearch.com/report/commercial-property-insurance-market

The commercial property insurance market growth is primarily driven by increasing climate-related weather events causing property damage, rising commercial real estate values requiring higher coverage limits, and stricter lender requirements for property insurance on financed buildings.

Market Growth Factors

Several factors are propelling the expansion of the commercial property insurance market.

- Natural disaster frequency: More hurricanes, wildfires, floods, and severe storms are causing higher property damage claims, leading businesses to buy stronger coverage and insurers to update pricing for high-risk areas.

- Commercial construction growth: New offices, retail centers, warehouses, and industrial buildings increase the number of properties that need insurance during both construction and everyday operations.

- Supply chain vulnerability awareness: Recent disruptions showed how damage at supplier or customer locations can interrupt business operations, encouraging companies to secure coverage that protects against indirect losses in their supply networks.

Restraints

- Rising premium costs: More frequent and severe natural disasters are pushing insurers to raise premiums in high-risk regions, making coverage expensive for many businesses or forcing them to accept higher deductibles and lower coverage limits.

- Coverage availability gaps: Some insurers leave high-risk markets or remove certain hazards from their policies, creating situations where businesses struggle to find proper coverage even when they are willing to pay.

Commercial Property Insurance Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Commercial Property Insurance Market |

| Market Size in 2023 | USD 298 Billion |

| Market Forecast in 2032 | USD 621 Billion |

| Growth Rate | CAGR of 8.5% |

| Number of Pages | 223 |

| Key Companies Covered | AXA Group, Chubb Limited, American International Group Inc., Allianz SE, Allstate Insurance Company, The Travelers Indemnity Company, Liberty Mutual Insurance Company, Berkshire Hathaway Homestate Companies (BHHC), Zurich Insurance Group, Progressive, and others. |

| Segments Covered | By Type, By Enterprise Size, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Market Segmentation

The commercial property insurance market can be segmented by property type, coverage type, business size, distribution channel, and region.

Based on property type, the commercial property insurance industry is classified into office buildings, retail properties, industrial facilities, hospitality properties, and multi-family residential buildings. Office buildings are expected to maintain a significant market share during the forecast period due to their high property values and concentration in urban areas with established insurance markets.

Based on coverage type, the commercial property insurance market is segregated into named peril policies, all-risk policies, business interruption coverage, equipment breakdown insurance, and flood insurance. All-risk policies are expected to lead the market during the forecast period due to their comprehensive protection approach, appealing to businesses seeking broad coverage.

Based on business size, the market is divided into small enterprises, medium-sized businesses, and large corporations. Large corporations lead the market due to their extensive property portfolios, high insured values, and sophisticated risk management programs requiring customized insurance solutions.

Based on distribution channel, the commercial property insurance market is categorized into insurance agents, insurance brokers, direct sales, and online platforms. Insurance brokers lead the market by serving as advisors, helping businesses navigate complex coverage needs and negotiate favorable terms with multiple insurers.

North America leads the commercial property insurance market because it has a well-developed insurance system with strong underwriting skills and a large number of commercial buildings that need protection. The region faces many natural disaster risks, such as hurricanes along the coasts, earthquakes in California, tornadoes in central states, and wildfires in western areas, which increase demand for reliable property coverage. Strong regulations require many commercial properties to carry proper insurance, especially those financed through mortgages. The United States has a wide commercial real estate base, including office buildings, shopping centers, industrial parks, and hotels, all representing significant insured value. Insurance companies use advanced catastrophe modeling tools to understand risks and set accurate policy prices for different locations. The region also benefits from strong reinsurance markets that help insurers handle large losses from major disasters. Well-established legal systems support policy enforcement and help resolve coverage disputes fairly and consistently.

Key Market Players

Leading companies operating in the global commercial property insurance market include:

- AXA Group

- Chubb Limited

- American International Group Inc.

- Allianz SE

- Allstate Insurance Company

- The Travelers Indemnity Company

- Liberty Mutual Insurance Company

- Berkshire Hathaway Homestate Companies (BHHC)

- Zurich Insurance Group

- Progressive

Recent Developments

- In September 2025, Arbol introduced a wildfire-focused parametric insurance product for commercial and residential properties, offering automatic payouts based on fire severity rather than traditional damage-based claims.

The global commercial property insurance market is segmented as follows:

By Type

- Buildings Insurance

- Contents Insurance

- Flood Insurance

- Earthquake Insurance

- Others

By Enterprise Size

- Small and Medium-sized Enterprises

- Large-Scale Enterprise

By Application

- Open Perils

- Named Perils

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

About Us:

Zion Market Research is an obligated company. We create futuristic, cutting-edge, informative reports ranging from industry reports, the company reports to country reports. We provide our clients not only with market statistics unveiled by avowed private publishers and public organizations but also with vogue and newest industry reports along with pre-eminent and niche company profiles. Our database of market research reports comprises a wide variety of reports from cardinal industries. Our database is been updated constantly in order to fulfill our clients with prompt and direct online access to our database. Keeping in mind the client’s needs, we have included expert insights on global industries, products, and market trends in this database. Last but not the least, we make it our duty to ensure the success of clients connected to us—after all—if you do well, a little of the light shines on us.

Contact Us:

Zion Market Research

244 Fifth Avenue, Suite N202

New York, 10001, United States

Tel: +49-322 210 92714

USA/Canada Toll-Free No.1-855-465-4651

Email: sales@zionmarketresearch.com

Website: https://www.zionmarketresearch.com

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed