Veterinary Anti-Infectives Market Size, Share, Trends, Growth and Forecast 2032

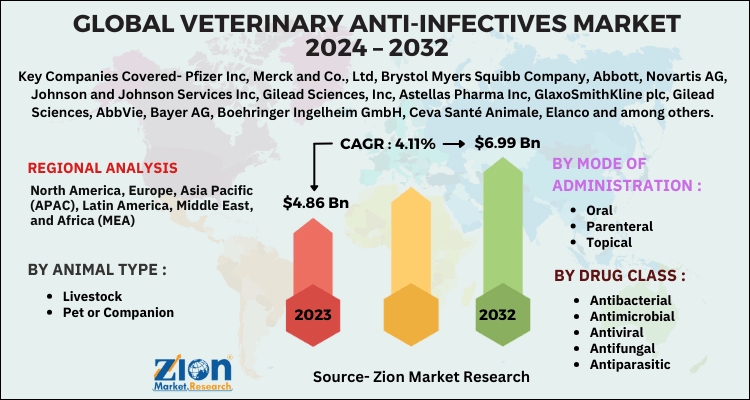

Veterinary Anti-Infectives Market By Animal Type (Livestock and Pet), By Drug Class (Antibacterial, Antimicrobial, Antiviral, Antifungal and Antiparasitic Agents), By Mode of Administration (Oral, Parenteral and Topical): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032

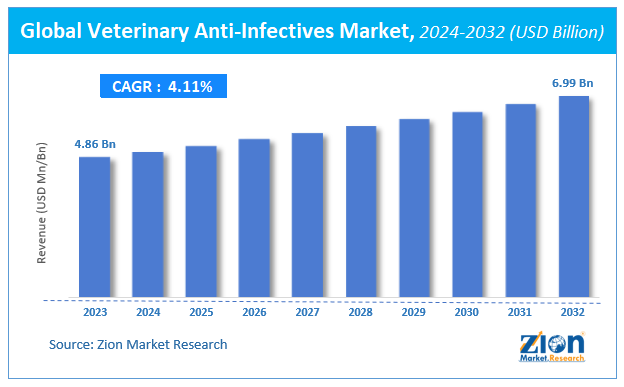

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 4.86 Billion | USD 6.99 Billion | 4.11% | 2023 |

Veterinary Anti-Infectives Market Insights

Zion Market Research has published a report on the global Veterinary Anti-Infectives Market, estimating its value at USD 4.86 Billion in 2023, with projections indicating that it will reach USD 6.99 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 4.11% over the forecast period 2024-2032. The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Veterinary Anti-Infectives Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Market Overview

Anti-Infectives are products which help in preventing spread or transmission of diseases. And veterinary anti-infectives are products which prevent or cures spreading of animal infectious diseases to humans. The increase in demand for animal products such as meat, milk, etc. consumption and the diseases related to these animals have promoted the use of anti infectives.

The increases in foodborne diseases are one of the key market drivers for anti-infectives. 75 percent of all infectious diseases are infact animal borne and spread to humans from them. These diseases are health hazards to humans and are prime concerns of public health department to control them. The adoption culture is increasing over the globe especially dogs and cats and the issues related to their health and hygiene is also one of the factors promoting anti-infectives market.

Anti-infectives are chemical substances capable of combating malfunction caused due to foreign bacteria such as Corona and Salmonella. These substances act in order to inhibit, prevent, and completely cure bacterial animal infections. Application of biological anti-infective makes the animal’s body immune from a particular bacterial infection, and also prevents future chances of contracting the infection. Veterinary pharmaceutical companies offer various products such as antibiotics, vaccines, parasiticides, medical feed additives and others. Of all product types, anti-infective formulations are more used by veterinary doctors. In recent years, studies have shown how fatal veterinary diseases are not limited to wild species, but may also occur in domestic animals. Increasing incidence of zoonotic and food-borne disorders and the need of mitigating such diseases is projected to render an exponential growth for veterinary therapeutics, including veterinary anti-infectives drug market.

Specialty and biologic care are offering huge investment opportunities for key players in anti-infectives market. Due to the aged product portfolio, the market anticipates NPD (New Product Development) in urgency. Entry of new market players and launch of abridged formulations, followed by changing distribution channels, a considerable rise in pet insurance, and competitive branded products for animal health care are collectively observed as key facets in this market. Improvised research & development methods in biologics will provide a huge array of opportunities in the market. Availability of generic drugs at affordable prices and increased end-user awareness for pet care is also offering significant growth opportunities for the veterinary anti-infective market.

Growth Factors

The growing demand for pet animals and their health care is one major part of global veterinary anti-infectives. Pets like dogs and cats are very susceptible to bacterial diseases, such as plague etc. Studies have shown us that they can pass on these to humans, which is why there is increase in number of vaccinations for pets, control and cure of acquired diseases by them. There are researches going on to develop new and more effective drugs. Clinical trials are being conducted to test the efficiency of these new drugs.

The Livestock and cattle market which is largest single consumer of anti-infectives. The eating habits of people are such that they will consume meat in any from and there are various diseases that can be transmitted to us from these products. Rural people are getting more and more aware of anti-infectives which are benefiting them and the manufactures. Rural people hold cattle’s in huge numbers for their consumptions are mostly unaware of the infectious disease these cattle’s carry on them.

Veterinary Anti-Infectives Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Veterinary Anti-Infectives Market |

| Market Size in 2023 | USD 4.86 Billion |

| Market Forecast in 2032 | USD 6.99 Billion |

| Growth Rate | CAGR of 4.11% |

| Number of Pages | 110 |

| Key Companies Covered | Pfizer Inc, Merck and Co., Ltd, Brystol Myers Squibb Company, Abbott, Novartis AG, Johnson and Johnson Services Inc, Gilead Sciences, Inc, Astellas Pharma Inc, GlaxoSmithKline plc, Gilead Sciences, AbbVie, Bayer AG, Boehringer Ingelheim GmbH, Ceva Santé Animale, Elanco and among others |

| Segments Covered | By Animal Type, By Drug Class, By Mode of Administration and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Veterinary Anti-Infectives Market: Segmentation Analysis

The Global Veterinary Anti-Infectives Market is segmented based on animal type, drug class, mode of administration and region. All the segments of Veterinary Anti-Infectives Market market have been analyzed based on present and future trends and the market is estimated from 2024 to 2032.

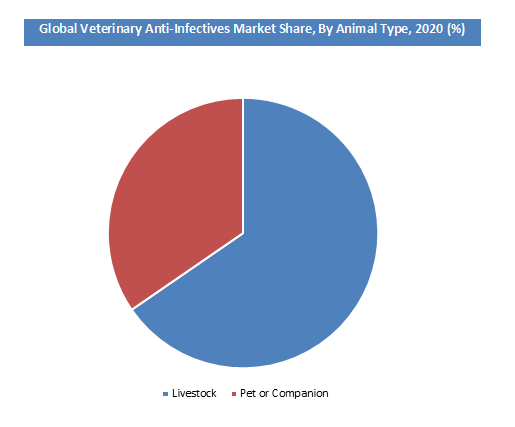

Animal Type Segment Analysis Preview

Livestock segment held a share of around 65.41% in 2020. Livestock can further be sub segmented into poultry, pork, beef, fish, seafood, etc. This segments growth is attributable to the significant increase in meat and non-vegetarian items consumption. This segment is going to see largest increase because of above factor.

Drug Segment Analysis Preview

Antibacterials in drug will grow at a CAGR of over 5.5% from 2021 to 2028. This is attributable to the number of bacterial infections in livestock and pet segment. There are new developments in the drug segment. Researches are being conducted to test their potency or effectiveness.

Antiviral is also set to see demand in the market as pets are very prawn to viral infections such as rabies, yellow fever and pappataci fever, etc. if not treated on time it can pass on to humans easily. Dogs are the prime example as they account for 90plus percent of rabies transmitted to humans.

Oral mode of administration is the largest segment in mode of administration. This is mainly due to convince, its hassle free and less messy than mode of administration.

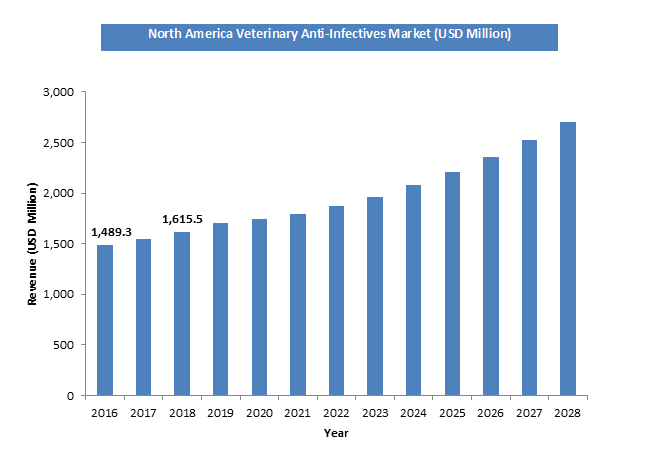

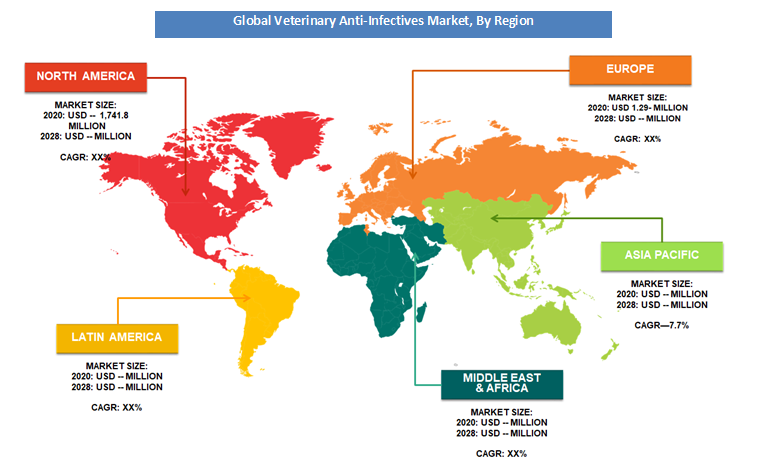

Regional Analysis Preview

The North American region held a share of 1,741.8% in 2020. This is attributable to the presence of top companies such as Pfizer Inc, Brystol Myers Squibb Company, Johnson and Johnson Services Inc among others. This is associated to the advanced technological progress this region has made over the course of time. North America is home to world’s largest exotic pets market. Moreover, the increasing usage of veterinary anti-infectivesexpected to generate huge demand for the market in this region.

The Asia Pacific region is projected to grow at a CAGR of 7.7% over the forecast period. This surge is due to the increasing awareness among common people regarding the benefits of using veterinary anti-infectivesto their benefit. APAC region is also one of the major exporters of livestock, for which they have to keep a check that they are not infected to any unwanted things. APAC region is also seeing an increase in number of pets which will be a major reason for market growth in this region.

Increasing pet ownership and vigorous demand for improved animal nutrition are fueling the veterinary anti-infective market in North America. Balancing the animal’s nutrition with use of anti-infectives has proven to improve the immunity of animals, and help them in gaining resistance against most infections. In North America, people are more concerned about the health of their pet animal or livestock, so their focus on food safety, which is another influencing factor associated with higher nutritional demand in the global market for veterinary anti-infectives. Owing to high awareness, end-users continue to prefer drugs that are FDA-approved. Newly-launched generic drugs are estimated to increase market share for anti-infectives in the Asia Pacific. Moreover, the presence of generic companies and increasing level of disposable income is also expected to fuel the market’s growth further in this region.

Key Market Players & Competitive Landscape.

Some of key players in global veterinary anti-infectivesmarket are: Investments in R&D and new manufacturing units for veterinary anti-infectives in economically stable countries and acquisitions and collaborations with manufacturers in different regions are other key differentiating strategies of the leading market players.

- Pfizer Inc

- Merck and Co., Ltd

- Brystol Myers Squibb Company

- Abbott

- Novartis AG

- Johnson and Johnson Services Inc

- Gilead Sciences, Inc

- Astellas Pharma Inc

- GlaxoSmithKline plc

- Gilead Sciences

- AbbVie

- Bayer AG

- Boehringer Ingelheim GmbH

- Ceva Santé Animale

- Elanco and among others.

Zoetis Inc. and Regeneron Pharmaceuticals, Inc have signed a pact around mid-2018, they are going to collaborate for antibody technology for next five years

The global veterinary anti-infectivesis segmented as follows:

By Animal Type

- Livestock

- Pet or Companion

By Drug Class

- Antibacterial

- Antimicrobial

- Antiviral

- Antifungal

- Antiparasitic

By Mode of Administration

- Oral

- Parenteral

- Topical

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed