U.S. Movie Theatres Market Size, Share, Report 2034

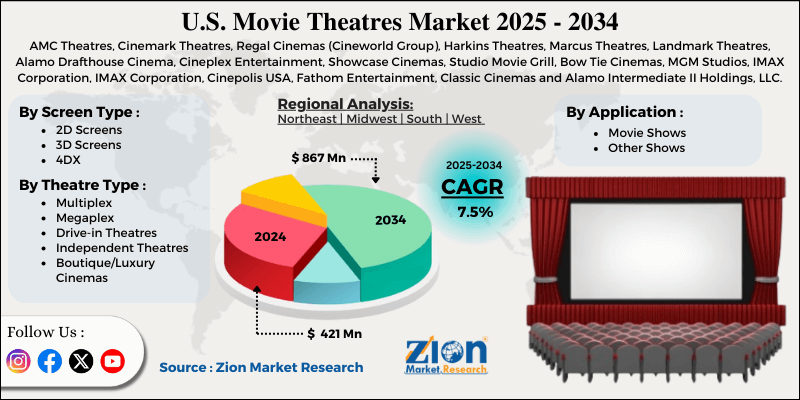

U.S. Movie Theatres Market By Screen Type (2D Screens, 3D Screens, and 4DX), By Theatre Type (Multiplex, Megaplex, Drive-in Theatres, Independent Theatres, Boutique/Luxury Cinemas, and Others), By Application (Movie Shows and Other Shows), and By Region - Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

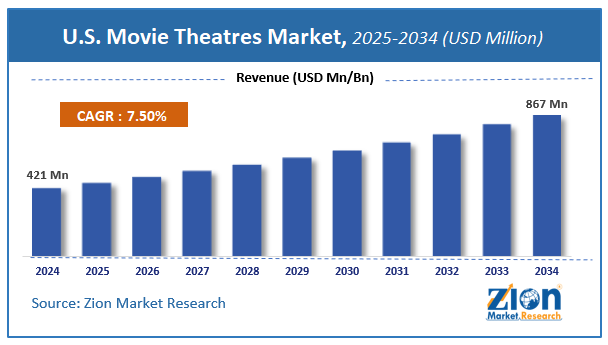

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 421 Million | USD 867 Million | 7.5% | 2024 |

U.S. Movie Theatres Industry Prospective:

The U.S. Movie Theatres market size was worth around USD 421 million in 2024 and is predicted to grow to around USD 867 million by 2034, with a compound annual growth rate (CAGR) of roughly 7.5% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the U.S. Movie Theatres market is estimated to grow annually at a CAGR of around 7.5% over the forecast period (2025-2034).

- In terms of revenue, the U.S. Movie Theatres market size was valued at around USD 421 million in 2024 and is projected to reach USD 867 million by 2034.

- The growing disposable income & consumer spending are expected to drive the U.S. Movie Theatres market over the forecast period.

- Based on the screen type, the 2D Screens segment is expected to hold the largest market share over the forecast period.

- Based on the theatre type, the multiplex segment is expected to dominate the market expansion over the projected period.

- Based on the application, the movie shows segment is expected to dominate the market expansion over the projected period.

U.S. Movie Theatres Market: Overview

The public can watch films on large screens in movie theaters, also called cinemas. This allows everyone to see the same thing in a more immersive way. Their infrastructure is one-of-a-kind. For instance, they have high-resolution digital projection systems, surround sound or immersive audio technology, regulated lighting, and tiered seating that makes it easier to see and hear. The majority of a movie theater's income comes from ticket sales and other services, like food and drinks, advertising, and premium viewing formats. They're more than just venues for watching movies; they're also vital social and cultural spaces where people can share screenings, premieres, and other events. This is what makes going to the theater different from watching movies at home or owning a movie.

U.S. Movie Theatres Market Dynamics

Growth Drivers

How do the strong blockbuster content & franchise films drive the U.S. movie theatre market growth?

The U.S. movie theatre market is mainly driven by strong blockbuster content and franchise films, which act as the primary catalysts for footfall, revenue concentration, and premium pricing. Event cinema moments created by large-scale franchise films—like Marvel Studios' and Star Wars', and Avatar's—make it hard for people not to come to the theaters, as they want to have the whole cinematic experience. The films have very high production values, brilliant visuals driven by spectacle, and very immersive sound; all of these are for large-screen viewing in cinemas with IMAX, Dolby Cinema, and other premium formats.

People are surely going to benefit the most. Blockbusters also drive weekend attendance, which is vital to theatres’ profits, as during the first few weeks of a movie’s release, a large share of box office and concession revenue is generated. Loyalty to the franchise further ensures that viewers will return; they come from all age groups, and over time, they even encourage group outings, which result in additional food and drink purchases. Furthermore, lucrative drama scripts help stabilize theater demand by shaping annual release calendars around predictable tentpole movies, thereby improving scheduling, marketing tie-ins, and capacity utilization. In the U.S. market, in particular, where discretionary income fuels demand for luxury entertainment, blockbusters and franchise films still contend with streaming services as the most influential factors in keeping cinemas relevant and generating revenue.

Restraints

Will competition from streaming & home entertainment pose a significant restraint to the U.S. movie theatre market growth?

The competition from streaming services and home entertainment systems is a major hindrance to market growth, as it directly reduces theatre attendance, weakens the ability to set prices, and diminishes the uniqueness of the theatrical experience. Consumers perceive that viewing at home is a more affordable and convenient alternative to going to the cinema, especially since services such as Netflix, Disney+, and Amazon Prime Video have made large libraries of content available at relatively low monthly fees. The home viewing experience is further enhanced by high-quality smart TVs, soundbars, and home theatre systems.

This competition also aims to shorten theatrical release times as studios increasingly adopt rapid digital distribution or hybrid releases, thereby limiting the time available for theatres to earn from new films. Hence, cinemas become more reliant on a small number of blockbuster movies, while mid-budget and niche films struggle to attract audiences. Also, the possibility of pausing, rewatching, and personalizing viewing at home alters consumer habits, especially among younger audiences, thereby reducing the frequency of visits. In total, these factors keep exerting continuous pressure on box office revenues, concession sales, and long-run footfall growth, making streaming and home entertainment one of the major structural restraints on the movie theatre market.

Opportunities

How does the growing partnership offer a potential opportunity for the U.S. movie theatre industry growth?

The growing partnership is expected to foster the market growth over the projected period. For instance, in May 2025, Regal Cinemas and IMAX revealed further stages of their collaboration, including the installation of new IMAX® with Laser systems in the US's most populous cities. The noteworthy deal also includes a Regal IMAX projection for the well-known L.A. LIVE entertainment hub in Downtown Los Angeles, where the new IMAX 70mm film projector and the 80-foot screen will be among the largest setups in the city. Three of the new IMAX locations are scheduled to begin operations this year, while the last is planned to open in 2026.

Challenges

High operational & infrastructure costs pose a major challenge to market expansion

The dominance of high operational and infrastructure costs in the cinema industry is a major challenge; they compress profit margins, increase financial risks, and restrict the growth and modernization of theatres. The operating costs of movie theatres include high fixed and recurring costs, such as rent or real estate leasing, energy, employees, repairs, and insurance. Not to mention, the constant flow of cash is necessary to keep up with competitors—for instance, purchasing digital and laser projection, immersive sound systems, recliner seating, and premium formats such as IMAX or Dolby Cinema, which require substantial cash investment.

These high costs are particularly burdensome for independent and mid-size operators, as they do not enjoy the economies of scale that larger chains like AMC Entertainment and Cinemark do. The situation worsens when attendance declines, especially during the off-peak seasons when major production companies are not releasing new movies. Then fixed costs come into play; they remain unchanged, intensifying pressure on profits. Rising labor costs and utility bills add to the company's overhead, but consumer demand for lower prices prevents the theatres from passing these costs on through higher ticket and concession prices. The direct result is a downward trend in profitability, a corresponding increase in the number of screens being closed, and a drawdown of investment in new places or technologies. All these factors together make high operational and infrastructure costs a very important constraint on the long-term growth of the industry of movie theatre industry.

U.S. Movie Theatres Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | U.S. Movie Theatres Market |

| Market Size in 2024 | USD 421 Million |

| Market Forecast in 2034 | USD 867 Million |

| Growth Rate | CAGR of 7.5% |

| Number of Pages | 260 |

| Key Companies Covered | AMC Theatres, Cinemark Theatres, Regal Cinemas (Cineworld Group), Harkins Theatres, Marcus Theatres, Landmark Theatres, Alamo Drafthouse Cinema, Cineplex Entertainment, Showcase Cinemas, Studio Movie Grill, Bow Tie Cinemas, MGM Studios, IMAX Corporation, IMAX Corporation, Cinepolis USA, Fathom Entertainment, Classic Cinemas and Alamo Intermediate II Holdings, LLC among others. |

| Segments Covered | By Screen Type, By Theatre Type, By Application and By Region |

| Regions Covered in U.S. | Northeast, Midwest, South, and West |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

U.S. Movie Theatres Market: Segmentation

By Screen Type

The 2D Screens segment is expected to hold the largest market share over the forecast period. The main reason is that 2D screenings still hold the position of the most common and accessible format, accounting for the largest share of all theatres and screening time in the United States; large chains such as AMC Entertainment, Cinemark, and Regal Cinemas are no exception. Another important factor in this growth is the operational efficiency and scalability. 2D cinemas are less expensive to set up and maintain than premium formats, enabling exhibitors to offer more showtimes and increase screen utilization on weekdays. During this time, sales from concessions would also add to their profit margins. Moreover, the studios are still releasing most titles in 2D, ensuring a steady flow of content that keeps these screens busy year-round, not just during blockbuster seasons.

By Theatre Type

The multiplex segment dominates the market. The expansion is supported by the fact that the company can maximize the use of its screens, offer a variety of content, and increase spending per customer. Multiplexes, which typically have several screens in one location, enable cinemas to show different films simultaneously. This not only attracts different groups of people but also reduces reliance on a single movie's success. This adaptability is the main reason for the stability of the revenue stream; it plays a particularly important role during periods when the release of blockbusters is restricted.

By Application

The movie shows segment dominates the market. The emphasis on major or blockbuster releases is a key factor driving increased revenue; consequently, cinemas offer more daily performances in the first two to three weeks of a movie's release to attract audiences with the highest interest. Major movie theater chains such as AMC, Cinemark, and Regal are quick to increase the number of daily screenings for major films and, at the same time, reduce the number of screenings for less successful ones, thereby maximizing the use of screens.

U.S. Movie Theatres Market: Competitive Analysis

U.S. Movie Theatres market is dominated by players like-

- AMC Theatres

- Cinemark Theatres

- Regal Cinemas (Cineworld Group)

- Harkins Theatres

- Marcus Theatres

- Landmark Theatres

- Alamo Drafthouse Cinema

- Cineplex Entertainment

- Showcase Cinemas

- Studio Movie Grill

- Bow Tie Cinemas

- MGM Studios

- IMAX Corporation

- IMAX Corporation

- Cinepolis USA

- Fathom Entertainment

- Classic Cinemas and Alamo Intermediate II Holdings

- LLC among others.

U.S. Movie Theatres market is segmented as follows:

By Screen Type

- 2D Screens

- 3D Screens

- 4DX

By Theatre Type

- Multiplex

- Megaplex

- Drive-in Theatres

- Independent Theatres

- Boutique/Luxury Cinemas

- Others

By Application

- Movie Shows

- Other Shows

By Region

The U.S.

- Northeast

- Midwest

- South

- West

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed