Transceivers Market Size, Share, Trends, Growth & Forecast 2034

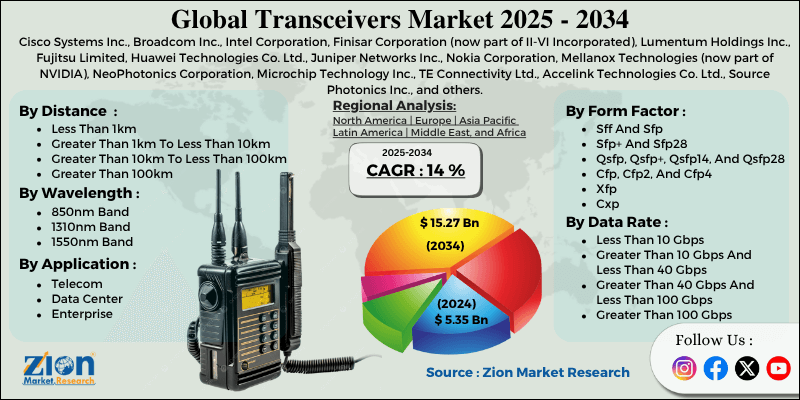

Transceivers Market By Form Factor (Sff And Sfp, Sfp+ And Sfp28, Qsfp, Qsfp+, Qsfp14, And Qsfp28, Cfp, Cfp2, And Cfp4, Xfp, Cxp, and Others), By Data Rate (Less Than 10 Gbps, Greater Than 10 Gbps And Less Than 40 Gbps, Greater Than 40 Gbps And Less Than 100 Gbps, Greater Than 100 Gbps), By Distance (Less Than 1km, Greater Than 1km To Less Than 10km, Greater Than 10km To Less Than 100km, Greater Than 100km), By Wavelength (850nm Band, 1310nm Band, 1550nm Band), By Application (Telecom, Data Center, Enterprise), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

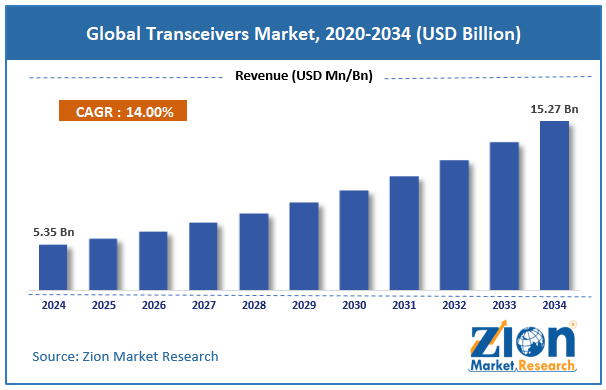

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 5.35 Billion | USD 15.27 Billion | 14% | 2024 |

Transceivers Industry Perspective:

The global transceivers market size was worth around USD 5.35 billion in 2024 and is predicted to grow to around USD 15.27 billion by 2034, with a compound annual growth rate (CAGR) of roughly 14% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global transceivers market is estimated to grow annually at a CAGR of around 14% over the forecast period (2025-2034)

- In terms of revenue, the global transceivers market size was valued at around USD 5.35 billion in 2024 and is projected to reach USD 15.27 billion by 2034.

- The transceivers market is projected to grow significantly due to the expansion of 5G network infrastructure, the growing adoption of IoT and smart devices, and the rising demand for high-bandwidth connectivity.

- Based on form factor, the Qsfp, Qsfp+, Qsfp14, And Qsfp28 segment is expected to lead the market, while the Sfp+ and Sfp28 segment is expected to grow considerably.

- Based on the data rate, the greater than 100 Gbps segment is the dominating segment. In comparison, the greater than 40 Gbps and less than 100 Gbps segment is projected to witness sizeable revenue over the forecast period.

- Based on distance, the greater than 1km to less than 10km segment is expected to lead the market compared to the greater than 10km to less than 100km segment.

- Based on Wavelength, the 850nm Band segment is the dominating segment, while the 1310nm Band segment is projected to witness sizeable revenue over the forecast period.

- Based on application, the data center segment is expected to lead the market compared to the telecom segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Europe.

Transceivers Market: Overview

Transceivers are the electronic devices that combine both a receiver and a transmitter within a single module, allowing bidirectional communication of data signals. They are crucial components in modern communication systems, comprising wireless networks, fiber optics, and Ethernet connections. The global transceivers market is projected to witness substantial growth driven by the increasing demand for high-speed data transmission and internet, the expansion of fiber optic networks and 5G, and the rise of cloud services and data centers. Global data traffic is progressing remarkably due to video streaming, cloud computing, and the connection of devices. This growth propels the need for high-speed transceivers that can manage massive data volumes effectively. Enterprise networks and telecom are upgrading to 100G and 400G transceivers to meet bandwidth demands.

Moreover, the worldwide rollout of 5G infrastructure is fueling huge demand for advanced transceivers, backing low-latency and faster communication. Fiber-optic deployments are increasing in regions for higher capacity and reliability. As 5G base stations proliferate, the use of RF and optical transceivers continues to rise. Furthermore, data centers are increasingly adopting optical transceivers to manage the explosion of remote computing and digital content. Hyperscale facilities from companies like Google, Microsoft, and Amazon need ultra-fast interconnects. The drive for 800G and 400G optical modules is changing the efficiency of backbone communication.

Although drivers exist, the global market is challenged by factors like the high initial cost of optical transceivers and complex integration and compatibility issues. Advanced optical modules, mainly 800G and 400G, comprise primary production and infrastructure expenses. In addition, frequent upgrades raise total capital expenditure. Likewise, different interface standards and vendor-specific technologies create challenges in transceiver incorporation. Incompatibility between systems raises maintenance and installation time. Network operators usually experience added costs to promise cross-platform functionality.

Even so, the global transceivers industry is well-positioned due to the integration of silicon photonics technology and rising edge computing applications. Silicon photonics blends electrical and optical components on a single chip, improving cost-efficiency and performance. It allows higher data throughput while decreasing energy size and consumption. Leading players like Cisco and Intel are fueling the commercialization of photonic transceivers. Edge data centers need high-performance and compact transceivers to process data closer to users. These devices enhance network responsiveness and latency in remote environments. The Edge computing infrastructure is offering fresh growth opportunities for short-reach optical modules.

Transceivers Market Dynamics

Growth Drivers

How is the expansion of 5G and emerging 6G infrastructure driving the transceivers market?

The worldwide emergence of 6G research and the rollout of 5G are fueling strong growth in the demand for transceivers, impacting the transceivers market. As per GSMA 2025, 5G connections will surpass 2.1 billion, creating the need for more reliable and faster RF and optical transceivers.

In 2025, Ericsson and Nokia introduced energy-efficient 5G radio modules to improve network performance. The continued evolution of mobile networks will keep driving the adoption of high-speed transceivers across the globe.

How is the transceivers market fueled by technological improvements in optical and wireless transceivers?

The incorporation of transceivers in industrial automation and automotive networks is amplifying, fueled by V2X and ADAS communication needs. Automotive-grade Ethernet transceiver shipments progressed more than 27% year-over-year in 2024, driven by autonomous and electric vehicles. Industrial automation systems using PROFINET and EtherCAT depend on rugged transceivers for real-time connectivity. Companies like Marvell and NXP are developing modules for harsh environments, backing smart manufacturing and Industry 4.0 growth.

Restraints

Technological complexity and integration challenges negatively impact the market progress

Modern transceivers, especially those using co-packaged optics or silicon photonics, need complex integration with networking hardware. The IEEE 802.3cd and 802.3bs standards for high-speed modules comprise precise engineering that several manufacturers struggle to implement effectively.

According to the 2024 reports by Yole Développement, approximately 30% of novel transceiver projects are expected to experience delayed commercialization due to technological challenges. Integrating these modules with legacy infrastructure is also tricky, restricting deployment in areas with older networks. Such complexity raises R&D costs and slows the global adoption.

Opportunities

How does the emergence of high-speed optical technologies create promising avenues for the transceivers industry's growth?

Technologies like co-packaged optics, photonics, and coherent modules offer growth opportunities in the transceivers industry by delivering higher bandwidth and low energy consumption. Yole Développement (2024) anticipates that the silicon photonics transceiver industry may surpass USD 2.5 billion by 2026, fueled by high-performance computing, machine learning, and AI needs. Companies like Lumentum and Intel are actively investing in these solutions, creating fresh opportunities in data-intensive industries. Early adoption enables industry players to differentiate and gain a competitive advantage.

Challenges

Vulnerability to supply chain and geopolitical risks restricts the market growth

Worldwide transceiver production depends on lasers, semiconductors, and rare materials, making it susceptible to supply chain disturbances and geopolitical stresses. According to the reports, semiconductor scarcities delayed more than 15% of optical transceivers deliveries in Europe and North America. Trade restrictions, component scarcity, and tariffs may further restrict the industry's growth. Companies should diversify suppliers and maintain inventory buffers, actions that raise operational complexity and costs.

Transceivers Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Transceivers Market |

| Market Size in 2024 | USD 5.35 Billion |

| Market Forecast in 2034 | USD 15.27 Billion |

| Growth Rate | CAGR of 14% |

| Number of Pages | 215 |

| Key Companies Covered | Cisco Systems Inc., Broadcom Inc., Intel Corporation, Finisar Corporation (now part of II-VI Incorporated), Lumentum Holdings Inc., Fujitsu Limited, Huawei Technologies Co. Ltd., Juniper Networks Inc., Nokia Corporation, Mellanox Technologies (now part of NVIDIA), NeoPhotonics Corporation, Microchip Technology Inc., TE Connectivity Ltd., Accelink Technologies Co. Ltd., Source Photonics Inc., and others. |

| Segments Covered | By Form Factor, By Data Rate, By Distance, By Wavelength, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Transceivers Market: Segmentation

The global transceivers market is segmented based on form factor, data rate, distance, Wavelength, application, and region.

Based on form factor, the global transceivers industry is divided into Sff and Sfp, Sfp+ and Sfp28, Qsfp, Qsfp+, Qsfp14, And Qsfp28, Cfp, Cfp2, and Cfp4, Xfp, Cxp, and Others. The Qsfp, Qsfp+, Qsfp14, And Qsfp28 segment registers a leading share of the market due to their high data scalability, capacity, and broader use in 40G/100G Ethernet networks and data centers.

Based on data rate, the global transceivers market is segmented into less than 10 Gbps, greater than 10 Gbps and less than 40 Gbps, greater than 40 Gbps and less than 100 Gbps, and greater than 100 Gbps. The greater than 100 Gbps segment holds a substantial share due to the growing adoption in hyperscale data centers, 5G backhaul networks, and AI-driven workloads demanding ultra-high bandwidth.

Based on distance, the global market is segmented into less than 1km, greater than 1km to less than 10km, greater than 10km to less than 100km, and greater than 100km. The greater than 1km to less than 10km segment captures a substantial share because of its broader use in metro networks, enterprise backbones, and data centers that need high-speed and medium-range connectivity.

Based on Wavelength, the global market is segmented into 850nm Band, 1310nm Band, and 1550nm Band. The 850nm Band segment holds a dominating share due to its broader use in enterprise and short-reach data center applications, utilizing cost-effective multi-mode fiber solutions.

Based on application, the global market is segmented into telecom, data center, and enterprise. The data center segment registers a leading share because of the speedy growth of hyperscale facilities, cloud computing, and high-speed interconnect demands.

Transceivers Market: Regional Analysis

What enables North America's strong foothold in the global Transceivers Market?

North America is likely to sustain its leadership in the transceivers market due to advanced data center infrastructure, early adoption of 5G networks, digitalization, and high internet penetration. North America houses a leading number of enterprise and hyperscale data centers, especially in the United States, supporting cloud giants like Microsoft, Amazon, and Google. These facilities need high-speed optical transceivers for low-latency connectivity and effective data transfer. Canada and the United States have been early adopters of 5G technology, resulting in high demand for backhaul and base station networks. Telecom operators are actively investing billions in 5G infrastructure, with the U.S. spending anticipated to hit 50 billion by 2026.

Furthermore, North America holds the leading internet penetration rates worldwide, surpassing 90% in the United States, propelling the demand for more reliable and faster networking solutions. Consumers and businesses increasingly need high-speed connections for cloud services, streaming, and IoT applications. This sustained connectivity demand fuels the industry growth.

Europe continues to secure the second-highest share in the transceivers industry due to rising 5G infrastructure deployment, a strong presence of networking and technology companies, and high cloud and data center adoption. European countries are fast-tracking 5G rollout, especially in industrial and urban hubs, to improve mobile connectivity. Operators like Deutsche Telekom, Vodafone, and Orange are actively investing billions in 5G networks, surging the demand for high-speed transceivers. Europe houses major telecom equipment providers like Infineon, Ericsson, and Nokia, as well as transceiver manufacturers. Local production and R&D facilities facilitate faster innovation and supply for regional markets. This presence assures early adoption of next-generation transceiver solutions.

Moreover, European nations are increasing cloud services and data center infrastructure to support digital services and AI analytics. Data centers in Germany, the UK, and the Netherlands fuel the demand for 400G and 100G optical transceivers.

Transceivers Market: Competitive Analysis

The leading players in the global transceivers market are:

- Cisco Systems Inc.

- Broadcom Inc.

- Intel Corporation

- Finisar Corporation (now part of II-VI Incorporated)

- Lumentum Holdings Inc.

- Fujitsu Limited

- Huawei Technologies Co. Ltd.

- Juniper Networks Inc.

- Nokia Corporation

- Mellanox Technologies (now part of NVIDIA)

- NeoPhotonics Corporation

- Microchip Technology Inc.

- TE Connectivity Ltd.

- Accelink Technologies Co. Ltd.

- Source Photonics Inc.

Transceivers Market: Key Market Trends

Shift toward higher data rates (400G and 800G):

Telecom networks and data centers are progressively adopting 800G and 400G transceivers to manage increasing bandwidth channels. AI workloads and hyperscale cloud services fuel this move toward ultra-high modules. Vendors are actively investing in next-gen optical technologies to meet these rising requirements.

Adoption of silicon photonics technology:

Silicon photonics is gaining momentum for incorporating electronic and optical components on a single chip. This reduces energy consumption, cost, and size, while allowing higher data throughput. Brands like Cisco and Intel are leading commercialization efforts in this domain.

The global transceivers market is segmented as follows:

By Form Factor

- Sff And Sfp

- Sfp+ And Sfp28

- Qsfp, Qsfp+, Qsfp14, And Qsfp28

- Cfp, Cfp2, And Cfp4

- Xfp

- Cxp

- Others

By Data Rate

- Less Than 10 Gbps

- Greater Than 10 Gbps And Less Than 40 Gbps

- Greater Than 40 Gbps And Less Than 100 Gbps

- Greater Than 100 Gbps

By Distance

- Less Than 1km

- Greater Than 1km To Less Than 10km

- Greater Than 10km To Less Than 100km

- Greater Than 100km

By Wavelength

- 850nm Band

- 1310nm Band

- 1550nm Band

By Application

- Telecom

- Data Center

- Enterprise

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed