Global Smart Water Management System Market Size, Share, Growth Analysis Report - Forecast 2034

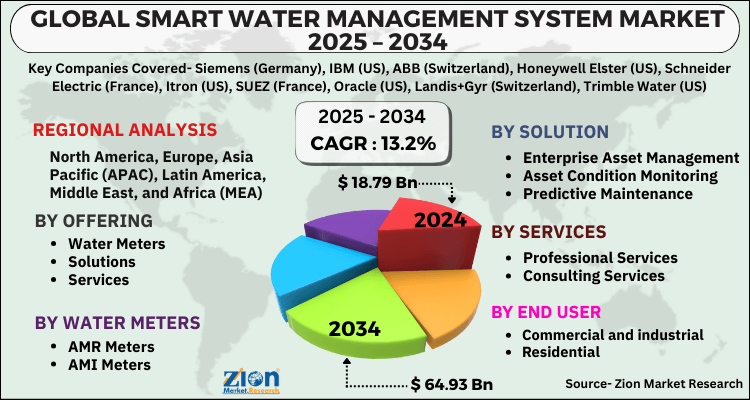

Smart Water Management System Market By Offering (Water Meters, Solutions, Services), By Water Meters (AMR Meters, AMI Meters), Solution (Enterprise Asset Management, Asset Condition Monitoring, Predictive Maintenance, Analytics And Data Management, Meter Data Management, Supervisory Control And Data Acquisition, Security, Smart Irrigation Management, Advanced Pressure Management, Mobile Wo), Services (Professional Services, Consulting Services, System Integration And Deployment Services, Support And Maintenance Services, Managed Services), End User (Commercial and industrial, Residential), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

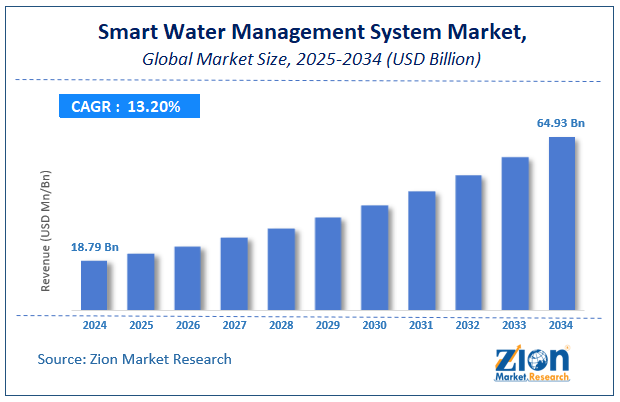

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 18.79 Billion | USD 64.93 Billion | 13.2% | 2024 |

Smart Water Management System Market: Industry Perspective

The global smart water management system market size was worth around USD 18.79 Billion in 2024 and is predicted to grow to around USD 64.93 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 13.2% between 2025 and 2034. The report analyzes the global smart water management system market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the smart water management system industry.

The report analyzes the drivers of the smart water management system market, restraints/challenges, and their effects on the demands during the projection period. In addition, the report explores emerging opportunities in the smart water management system market.

Smart Water Management System Market: Overview

Smart water management systems enable efficient water management and minimize wastage of water which is a highly important natural resource that could lead to catastrophic effects if it's not managed effectively.

Rapid urbanization, increasing water consumption, strict mandates to regulate water usage, increasing adoption of smart technologies, and increasing focus on sustainable living, are some major factors that positively influence the Smart water management system market potential over the forecast period.

Lack of skilled workforce and high costs associated with the implementation of smart water management systems are expected to restrain Smart water management system market growth through 2028. The trend is expected to change as the focus on water management increases on a global scale

Smart Water Management (SWM) makes use of Information and Communication Technology (ICT), real-time data and response to meet the challenges of water management. SWM is becoming a topic of interest as governments from across the globe are trying to implement smart principles into urban, national and regional SMW strategies. The application of smart systems in water management includes solutions for water quality, leaks, efficient irrigation, pressure, water quantity, flow, floods, and drought, among others. Implementation of SWM infrastructure which includes GIS and satellite mapping, sensors, monitors, smart meters and other data-sharing tools for the management of water, real-time solutions may be implemented and broad networks work together in order to solve the current challenges of water management.

Key Insights

- As per the analysis shared by our research analyst, the global smart water management system market is estimated to grow annually at a CAGR of around 13.2% over the forecast period (2025-2034).

- Regarding revenue, the global smart water management system market size was valued at around USD 18.79 Billion in 2024 and is projected to reach USD 64.93 Billion by 2034.

- The smart water management system market is projected to grow at a significant rate due to increasing water scarcity, aging water infrastructure, and the growing need for efficient water resource management through advanced technologies like IoT and data analytics.

- Based on Offering, the Water Meters segment is expected to lead the global market.

- On the basis of Water Meters, the AMR Meters segment is growing at a high rate and will continue to dominate the global market.

- Based on the Solution, the Enterprise Asset Management segment is projected to swipe the largest market share.

- By Services, the Professional Services segment is expected to dominate the global market.

- In terms of End User, the Commercial and industrial segment is anticipated to command the largest market share.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Smart Water Management System Market: Growth Drivers

Increasing Population to Boost Market Potential

The surge in population, rapid economic development, and continuous urbanization of multiple economies have led to a substantial increase in demand for smart water management systems and are expected to be major drivers for market growth over the forecast period. Increasing focus on efficiently managing water resources and rising demand for potable water on a global scale under the threat of depleting resources is anticipated to propel the adoption of a Smart water management systems over the forecast period.

Smart Water Management System Market: Restraints

Shortage of Skilled Workforce

The workforce market is shrinking due to the aging population and changing lifestyle trends across the world and the lack of skilled workforces to effectively man the water utilities. The demand for water supply is more than ever and so is the demand for an increasing workforce to manage the rising workload. These factors are expected to restrain Smart water management system market growth over the forecast period.

Smart Water Management System Market: Segmentation Analysis

The global smart water management system market is segmented based on Offering, Water Meters, Solution, Services, End User, and region.

Based on Offering, the global smart water management system market is divided into Water Meters, Solutions, Services.

On the basis of Water Meters, the global smart water management system market is bifurcated into AMR Meters, AMI Meters.

By Solution, the global smart water management system market is split into Enterprise Asset Management, Asset Condition Monitoring, Predictive Maintenance, Analytics And Data Management, Meter Data Management, Supervisory Control And Data Acquisition, Security, Smart Irrigation Management, Advanced Pressure Management, Mobile Wo.

In terms of Services, the global smart water management system market is categorized into Professional Services, Consulting Services, System Integration And Deployment Services, Support And Maintenance Services, Managed Services.

By End User, the global Smart Water Management System market is divided into Commercial and industrial, Residential.

Smart Water Management System Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Smart Water Management System Market |

| Market Size in 2024 | USD 18.79 Billion |

| Market Forecast in 2034 | USD 64.93 Billion |

| Growth Rate | CAGR of 13.2% |

| Number of Pages | 187 |

| Key Companies Covered | Siemens (Germany), IBM (US), ABB (Switzerland), Honeywell Elster (US), Schneider Electric (France), Itron (US), SUEZ (France), Oracle (US), Landis+Gyr (Switzerland), Trimble Water (US), HydroPoint (US), i2O Water (UK), Xenius (India), Neptune Technology (US), Takadu (Israel), Badger Meter (US), AquamatiX (UK), Fluid (US), Lishtot (Israel), Elentec (UK), Syrinix (UK), CityTaps (France), FREDsense (Canada), Fracta (US), and Xylem (US), and others. |

| Segments Covered | By Offering, By Water Meters, By Solution, By Services, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2024 |

| Forecast Year | 2025 to 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Recent Developments

- In October 2021 – ABB a leading multinational firm announced a collaborative effort with DHI Group which is a Danish environment specialist to develop digital solutions that will facilitate faster and more effective decision-making tactics in order to conserve and effectively manage water resources on a global scale.

Smart Water Management System Market: Regional Analysis

Asia Pacific region is projected to lead the global smart water management system market and is expected to be majorly driven by the rising adoption of smart grids in this region. Rapid urbanization and industrialization in emerging economies such as India and China is also expected to majorly boost Smart water management system market growth in this region over the forecast period. The exponential rise in population, supportive government initiatives, and increasing investments are some additional factors that shape the Smart water management system market potential by the end of 2028.

Rising technological proliferation and increasing digitization are two major factors that influence Smart water management system market growth in North America. The United States is expected to be the leading market in this region and is expected to have a bright outlook owing to the rapid adoption of new technology in the nation. Other factors such as favorable government initiatives, increasing investments, and rising demand for smart systems are also expected to shape the Smart water management system market over the forecast period.

Smart Water Management System Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the smart water management system market on a global and regional basis.

The global smart water management system market is dominated by players like:

- Siemens (Germany)

- IBM (US)

- ABB (Switzerland)

- Honeywell Elster (US)

- Schneider Electric (France)

- Itron (US)

- SUEZ (France)

- Oracle (US)

- Landis+Gyr (Switzerland)

- Trimble Water (US)

- HydroPoint (US)

- i2O Water (UK)

- Xenius (India)

- Neptune Technology (US)

- Takadu (Israel)

- Badger Meter (US)

- AquamatiX (UK)

- Fluid (US)

- Lishtot (Israel)

- Elentec (UK)

- Syrinix (UK)

- CityTaps (France)

- FREDsense (Canada)

- Fracta (US)

- and Xylem (US)

The global smart water management system market is segmented as follows;

By Offering

- Water Meters

- Solutions

- Services

By Water Meters

- AMR Meters

- AMI Meters

By Solution

- Enterprise Asset Management

- Asset Condition Monitoring

- Predictive Maintenance

- Analytics And Data Management

- Meter Data Management

- Supervisory Control And Data Acquisition

- Security

- Smart Irriga

By Services

- Professional Services

- Consulting Services

- System Integration And Deployment Services

- Support And Maintenance Services

- Managed Services

By End User

- Commercial and industrial

- Residential

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed