Proton Exchange Membrane Fuel Cell Market Size, Share, Trends, Growth and Forecast 2034

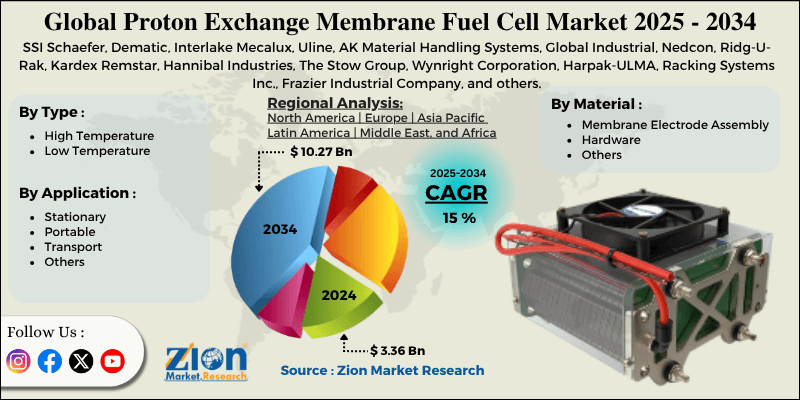

Proton Exchange Membrane Fuel Cell Market By Type (High Temperature, Low Temperature), By Material (Membrane Electrode Assembly, Hardware, and Others), By Application (Stationary, Portable, Transport, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 3.36 Billion | USD 10.27 Billion | 15% | 2024 |

Proton Exchange Membrane Fuel Cell Industry Perspective:

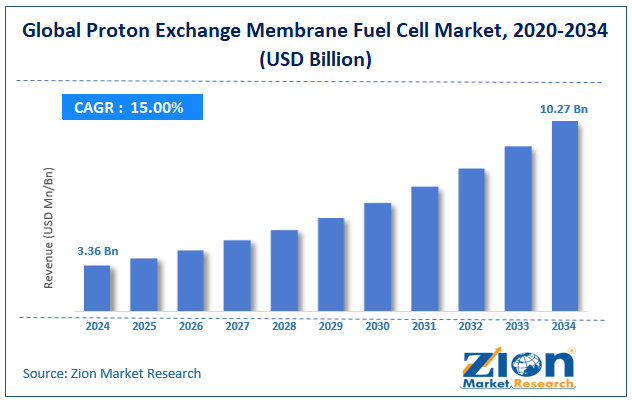

The global proton exchange membrane fuel cell market size was worth around USD 3.36 billion in 2024 and is predicted to grow to around USD 10.27 billion by 2034, with a compound annual growth rate (CAGR) of roughly 15% between 2025 and 2034.

Proton Exchange Membrane Fuel Cell Market: Overview

A proton exchange membrane (PEM) fuel cell is an electrochemical device that converts oxygen and hydrogen into electricity, producing heat and water as byproducts. It utilizes a solid polymer electrolyte membrane to transport protons from the anode to the cathode while forcing electrons through an external circuit to produce power.

The worldwide proton exchange membrane fuel cell market is driven by the growing demand for zero-emission vehicles, hydrogen policies, and government incentives, as well as advancements in hydrogen infrastructure. Proton exchange membrane fuel cells are widely used in electric vehicles (EVs) due to their zero-emission nature. They are suitable for heavy-duty and long-range transport where batteries may not be an ideal choice.

The pressure for clean mobility is notably fueling the industry's growth. Additionally, several nations are supporting hydrogen technologies through subsidies, national roadmaps, and tax incentives. This policy backing is encouraging investments and driving advancements in proton-exchange membrane (PEM) fuel cells.

Also, governments are viewing hydrogen as a means to decarbonize the transportation and energy sectors. Further, improvements in refueling networks and hydrogen production are facilitating the widespread adoption of PEM fuel cell systems. With the rising convenience of fueling, the viability of fuel cell systems and vehicles also increases.

However, the global market is hindered by limited hydrogen infrastructure and concerns regarding the safety and storage of hydrogen. The lack of broader hydrogen refueling infrastructure restricts the efficient use of PEM fuel cells. Without convenient access to hydrogen, several users may prefer alternative solutions.

Hence, this infrastructure gap limits the expansion of the proton exchange membrane fuel cell industry. Additionally, hydrogen's flammability and the complexity of its storage pose safety challenges. These issues demand stringent regulations and strong containment. This complicates the handling and transport of hydrogen.

Nonetheless, the global market is well-positioned for growth in heavy-duty transport and rising interest in microgrids and stationary power. Fuel cells are the best choice for long-haul trucks, trains, and buses due to their higher energy density. These segments demand faster refueling and a longer range than batteries could offer. Proton exchange membrane fuel cell technology is an ideal choice in this niche.

Moreover, there is a rising interest in backup power systems and off-grid systems using fuel cells. PEM systems can promise reliable power during outages or in remote areas. They also accompany renewables in decentralized energy setups.

Key Insights:

- As per the analysis shared by our research analyst, the global proton exchange membrane fuel cell market is estimated to grow annually at a CAGR of around 15% over the forecast period (2025-2034)

- In terms of revenue, the global proton exchange membrane fuel cell market size was valued at around USD 3.36 billion in 2024 and is projected to reach USD 10.27 billion by 2034.

- The proton exchange membrane fuel cell market is projected to grow significantly due to the increasing number of initiatives aimed at establishing a hydrogen economy, growing adoption in the transportation sector, and supportive government policies and incentive programs.

- Based on type, the low temperature segment is expected to lead the market, while the high temperature segment is expected to grow significantly.

- Based on material, the membrane electrode assembly segment is the largest, while the hardware segment is projected to witness substantial revenue growth over the forecast period.

- Based on application, the transport segment is expected to lead the market, surpassing the stationary segment.

- Based on region, Asia Pacific is projected to dominate the global market during the estimated period, followed by North America.

Proton Exchange Membrane Fuel Cell Market: Growth Drivers

Escalating use in backup and off-grid power applications spurs market growth

Proton exchange membrane fuel cells are gaining prominence in both the portable and stationary sectors due to their low noise, rapid start-up times, and clean emissions. They are largely used in backup power systems for data centers, hospitals, defense applications, and telecom towers. The global stationary fuel cell industry exceeded USD 4.8 billion, with proton exchange membrane accounting for a notable share.

Prominent telecom companies, such as Verizon and Jio, are integrating PEM fuel cells for seamless and continuous tower operation.

Technological improvements in PEM stack efficiency considerably fuel the market growth

The current advancements in catalyst loading, membrane materials, bipolar plates, and water management systems are notably enhancing PEM fuel cell performance, thus propelling the proton exchange membrane fuel cell market. Research groups are focusing on reducing platinum loading while enhancing power density and durability. As of 2024, many producers have achieved over 20,000 hours of durability and 60% efficacy in lab-scale PEM systems.

The latest innovations comprise the United States (NREL) National Renewable Energy Laboratory’s improvement of platinum-alloy catalysts that decrease noble metal use by 80%.

Proton Exchange Membrane Fuel Cell Market: Restraints

High-priced platinum-based catalysts are a key hindrance to the market’s progress

PEM fuel cells are highly dependent on platinum-group metal (PGM) catalysts, which significantly increase production costs. Platinum is primarily used to enhance electrochemical reactions, but it is scarce and expensive. As of 2025, the cost of platinum remains consistently high, ranging from USD 950 to USD 1,000 per ounce due to high demand from the hydrogen and automotive industries, as well as restricted supply.

Proton Exchange Membrane Fuel Cell Market: Opportunities

Defense and military sector applications positively impact market growth

Proton exchange membrane fuel cells are gaining popularity in military applications due to their quiet operation, high energy density, and low heat signature, which are vital for mobile and stealth missions. The NATO and United States Department of Defense allies are heavily investing in hydrogen fuel cell-based UAVs, portable power units, and surveillance systems.

The United States Army Futures Command's 2023 report highlighted fuel cells as a means to meet future battlefield power demands. This focus presents an opportunity for the global proton exchange membrane fuel cell industry to grow.

Proton Exchange Membrane Fuel Cell Market: Challenges

Growing competition from alternative technologies restricts the growth of the market

PEM fuel cells are experiencing growing competition from battery-electric technologies and solid oxide fuel cells, particularly in short-range transportation applications and stationary applications. SOFCs, which operate at high temperatures, offer enhanced fuel flexibility and efficiency, for example, with natural gas.

Companies like Ceres Power and Bloom Energy increased their SOFC portfolios, winning major contracts in Europe and Asia in 2024. These contracts were dedicated to industrial energy backup and data center applications.

Proton Exchange Membrane Fuel Cell Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Proton Exchange Membrane Fuel Cell Market |

| Market Size in 2024 | USD 3.36 Billion |

| Market Forecast in 2034 | USD 10.27 Billion |

| Growth Rate | CAGR of 15% |

| Number of Pages | 215 |

| Key Companies Covered | SSI Schaefer, Dematic, Interlake Mecalux, Uline, AK Material Handling Systems, Global Industrial, Nedcon, Ridg-U-Rak, Kardex Remstar, Hannibal Industries, The Stow Group, Wynright Corporation, Harpak-ULMA, Racking Systems Inc., Frazier Industrial Company, and others. |

| Segments Covered | By Type, By Material, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Proton Exchange Membrane Fuel Cell Market: Segmentation

The global proton exchange membrane fuel cell market is segmented based on type, material, application, and region.

Based on type, the global proton exchange membrane fuel cell industry is divided into high-temperature and low-temperature categories. The low temperature segment leads, as it is widely adopted in the portable and power sectors. Their supportive operating conditions and compatibility with automotive systems make them the best choice for use in fuel cell vehicles, drones, backup power supplies, and forklifts.

In addition, LT-PEMFCs benefit from extensive research and development (R&D) backing, a well-developed supply chain, and strong governmental support, especially in South Korea, Germany, the United States, and Japan. Their comparatively low operating temperature requires the use of low-cost materials and streamlined thermal management, which enhances their wide commercial viability.

Based on material, the global proton exchange membrane fuel cell market is segmented into membrane electrode assembly, hardware, and others. The membrane electrode assembly segment holds a notable market share, as it forms the core of a PEM fuel cell, where the electrochemical reaction takes place.

Segmental dominance is attributed to its vital role in determining the power output, efficiency, and overall performance of the fuel cell. The segmental growth is also supported by current advancements in membrane durability, improved ion conductivity, and reduced catalyst loading.

Based on application, the global market is segmented into stationary, portable, transport, and others. The transport segment dominates the market due to the rising demand for zero-emission vehicles. PEM fuel cells are highly preferred for buses, trucks, passenger cars, material handling vehicles, and trains due to their high energy density, quick refueling, and long driving range. Leading manufacturers are improving commercial fuel cell vehicles, thereby driving the segment. Incentives for hydrogen vehicle infrastructure, government mandates for clean mobility, and concerns over urban air quality are driving the adoption of PEMFCs in the transportation sector.

Proton Exchange Membrane Fuel Cell Market: Regional Analysis

Asia Pacific to witness significant growth over the forecast period

The Asia Pacific is projected to lead as the dominant region in the global proton exchange membrane fuel cell market due to its leadership in fuel cell vehicle production, rapid infrastructure development, and a higher focus on clean energy transition. The Asia Pacific is a leading center for fuel cell manufacturing, driven by prominent automakers such as Honda, Toyota, and Hyundai.

As of 2024, nearly 75% of the global fuel cell electric vehicles (EVs) are manufactured and sold in the Asia-Pacific (APAC) region. The prosperity of models like Toyota's Prius, Hyundai's NEXO, and Mirai denotes regional dominance. APAC also boasts a rapidly progressing hydrogen refueling infrastructure, which is vital for PEMFC adoption.

China aims to have 1,000 stations by 2023, while Japan has already constructed over 160 hydrogen power stations. This strong network directly propels the scaling of PEMFC-based energy systems and mobility.

Furthermore, governments are pressuring for clean energy solutions and decarbonization amid concerns about climate change. South Korea plans for carbon neutrality by 2050, and PEMFC is crucial to its green strategy. These goals are boosting private and public sector investments in PEM fuel cell technology.

North America progresses as the second-leading region in the proton exchange membrane fuel cell industry. This growth is attributed to the dominance in fuel cell innovation and R&D, the development of hydrogen refueling infrastructure, and the growing demand for stationary and backup power.

North America is a leader in research institutions and companies like Cummins, Plug Power, Ballard Power Systems, and Bloom Energy. The region registers a considerable share of the global PEMFC prototypes and patents. Extensive research and development efforts are fueling innovations in membrane durability, systems, design, and catalyst reduction.

Additionally, the region is rapidly expanding its hydrogen station infrastructure, with California boasting over 55 retail hydrogen stations as of 2024. These hubs are dedicated to integrating storage, production, and end-use applications that comprise PEMFCs.

In addition, the United States industry is experiencing growth in stationary PEM fuel cells for data centers, telecom towers, and off-grid facilities. Ballard and Bloom energy-like companies are using systems in critical networks. Decarbonization and grid stability objectives are driving businesses towards reliable and clean PEMFC-based power.

Proton Exchange Membrane Fuel Cell Market: Competitive Analysis

The players profiled in the global proton exchange membrane fuel cell market are:

- SSI Schaefer

- Dematic

- Interlake Mecalux

- Uline

- AK Material Handling Systems

- Global Industrial

- Nedcon

- Ridg-U-Rak

- Kardex Remstar

- Hannibal Industries

- The Stow Group

- Wynright Corporation

- Harpak-ULMA

- Racking Systems Inc.

- Frazier Industrial Company

Proton Exchange Membrane Fuel Cell Market: Key Market Trends

Assimilation with renewable hydrogen production:

PEMFCs are largely paired with green hydrogen from renewable sources, such as solar and wind energy. The government aims to address this trend to achieve energy independence and decarbonization. The shift backs the deployment of totally zero-emission energy networks for mobility and power uses.

Growth of fuel cell hubs and hydrogen infrastructure:

Worldwide, nations are capitalizing on hydrogen hubs and hydrogen refueling stations to support the adoption of PEMFC. The United States, South Korea, China, and the EU are building regional clusters to link hydrogen storage, production, and fuel cell deployment. This ecosystem is vital for scaling up stationary and mobility applications.

The global proton exchange membrane fuel cell market is segmented as follows:

By Type

- High Temperature

- Low Temperature

By Material

- Membrane Electrode Assembly

- Hardware

- Others

By Application

- Stationary

- Portable

- Transport

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

A proton exchange membrane (PEM) fuel cell is an electrochemical device that converts oxygen and hydrogen into electricity, producing heat and water as byproducts. It utilizes a solid polymer electrolyte membrane to transport protons from the anode to the cathode, while forcing electrons through an external circuit to produce power.

The global proton exchange membrane fuel cell market is projected to grow due to increasing demand for zero-emission vehicles, improvements in hydrogen infrastructure, and superior performance and energy efficiency.

According to study, the global proton exchange membrane fuel cell market size was worth around USD 3.36 billion in 2024 and is predicted to grow to around USD 10.27 billion by 2034.

The CAGR value of the proton exchange membrane fuel cell market is expected to be approximately 15% from 2025 to 2034.

Asia Pacific is expected to lead the global proton exchange membrane fuel cell market during the forecast period.

The key players profiled in the global proton exchange membrane fuel cell market include SSI Schaefer, Dematic, Interlake Mecalux, Uline, AK Material Handling Systems, Global Industrial, Nedcon, Ridg-U-Rak, Kardex Remstar, Hannibal Industries, The Stow Group, Wynright Corporation, Harpak-ULMA, Racking Systems Inc., and Frazier Industrial Company.

The report examines key aspects of the packaging racks market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed