Polymer Membrane Market Size, Share, Trends, Growth & Forecast 2034

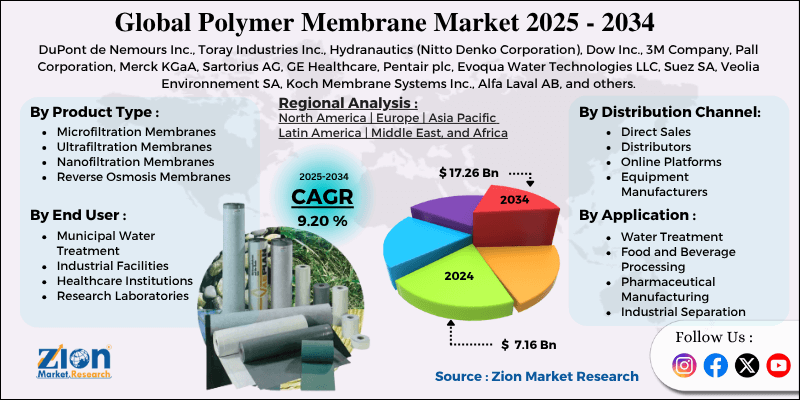

Polymer Membrane Market By Product Type (Microfiltration Membranes, Ultrafiltration Membranes, Nanofiltration Membranes, and Reverse Osmosis Membranes), By Application (Water Treatment, Food and Beverage Processing, Pharmaceutical Manufacturing, and Industrial Separation), By Distribution Channel (Direct Sales, Distributors, Online Platforms, and Equipment Manufacturers), By End-User (Municipal Water Treatment, Industrial Facilities, Healthcare Institutions, and Research Laboratories), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

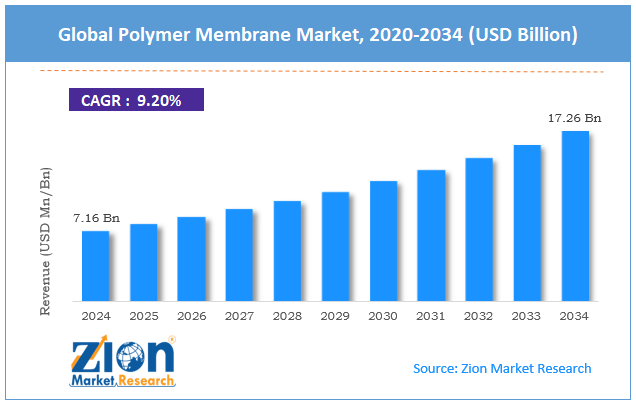

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 7.16 Billion | USD 17.26 Billion | 9.2% | 2024 |

Polymer Membrane Industry Perspective:

The global polymer membrane market was valued at approximately USD 7.16 billion in 2024 and is expected to reach around USD 17.26 billion by 2034, growing at a compound annual growth rate (CAGR) of roughly 9.20% between 2025 and 2034.

Polymer Membrane Market: Overview

Polymer membranes are thin, selective barriers made from synthetic polymer materials that allow certain substances to pass through while blocking others based on size, charge, or chemical properties. These advanced filters are used to separate, purify, and concentrate many substances across many industries. The polymer membrane market covers water purification and wastewater treatment, as well as pharmaceuticals and food processing. Modern polymer membranes are more durable, chemically resistant, and selective than ever before and are a key part of sustainable industrial processes. The products range from basic microfiltration for particle removal to reverse osmosis membranes for molecular level separation, for industrial and municipal use.

The increasing global focus on water scarcity solutions and growing environmental regulations are expected to drive substantial growth in the polymer membrane market over the forecast period.

Key Insights:

- As per the analysis shared by our research analyst, the global polymer membrane market is estimated to grow annually at a CAGR of around 9.20% over the forecast period (2025-2034)

- In terms of revenue, the global polymer membrane market size was valued at around USD 7.16 billion in 2024 and is projected to reach USD 17.26 billion by 2034.

- The polymer membrane market is projected to grow significantly due to the increasing global water treatment needs and expanding applications in the pharmaceutical and biotechnology industries.

- Based on product type, reverse osmosis membranes lead the segment and will continue to dominate the global market.

- Based on the application, water treatment is expected to lead the market.

- Based on the distribution channel, direct sales are anticipated to command the largest market share.

- Based on end-users, municipal water treatment facilities are expected to lead the market during the forecast period.

- Based on region, North America is projected to lead the global market during the forecast period.

Polymer Membrane Market: Growth Drivers

Water scarcity and environmental sustainability initiatives

The polymer membrane market is growing fast as water shortages increase and governments enforce stricter rules on water treatment and waste control. City water treatment plants are using advanced polymer membranes to meet higher water quality needs and serve growing populations. The shift toward eco-friendly manufacturing is pushing industries to use membrane technology for recycling wastewater and lowering their environmental impact.

Developing nations are making large investments in membrane-based water systems to improve access to clean water and support their economic progress. Climate change is also leading to new membrane innovations for seawater desalination, water reuse, and recovering valuable resources.

Technological advancements in membrane materials

The polymer membrane industry is growing due to significant improvements in polymer science and how membranes are made, which boost their performance, strength, and cost-effectiveness. New types of polymers offer better filtering ability, chemical resistance, and protection against clogging, while still allowing high water flow for better efficiency.

Advanced production methods like phase inversion, electrospinning, and interfacial polymerization help control the membrane's structure and properties more precisely. Smart membranes now include self-cleaning features and real-time monitoring, which lower maintenance needs and increase how long they last.

Polymer Membrane Market: Restraints

High capital investment

Despite the advanced technology, the polymer membrane market faces major challenges due to high initial investment and complex system operations, which can discourage smaller facilities. Setting up membrane systems requires a significant upfront investment in equipment, installation, and integration with existing infrastructure, particularly in large industrial setups.

Running these systems is technically demanding and needs skilled staff for regular monitoring, maintenance, and solving problems, which adds to training and operating costs. Issues like membrane clogging and wear can lead to frequent replacements and system downtime, which hurts overall cost efficiency.

Polymer Membrane Market: Opportunities

Expanding pharmaceutical and biotechnology applications

The polymer membrane industry has strong growth opportunities by entering the fast-growing pharmaceutical and biotechnology sectors that need precise separation and purification solutions. Drug manufacturing is increasingly using membrane systems for protein purification, vaccine production, and cell culture work, which all need high purity and sterile conditions. The rise of gene therapy and personalized medicine is opening new markets for advanced membranes that can handle delicate biological materials while keeping product quality intact.

Membrane bioreactors are becoming more popular for treating pharmaceutical wastewater, as they mix biological treatment with membrane filtration for better performance. As biosimilar drug production increases, there’s more need for affordable purification systems, creating demand for new membrane technologies that can lower costs while keeping high product standards.

Polymer Membrane Market: Challenges

Membrane fouling and performance degradation issues

The polymer membrane market faces challenges from fouling, which lowers efficiency, raises operating costs, and shortens system life in all uses. Build-up of organic and inorganic materials can reduce membrane flow and separation ability, requiring frequent cleanings and eventually full replacements. Different water sources and industrial processes have unique fouling issues that require custom solutions and continuous research into better anti-fouling materials.

Making membranes that resist fouling involves balancing strength, filtering ability, and cost, making it hard to improve everything at once. Stopping fouling before it happens is difficult and needs constant system checks, smart control tools, and routine maintenance, all of which add complexity and raise costs.

Polymer Membrane Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Polymer Membrane Market |

| Market Size in 2024 | USD 7.16 Billion |

| Market Forecast in 2034 | USD 17.26 Billion |

| Growth Rate | CAGR of 9.20% |

| Number of Pages | 213 |

| Key Companies Covered | DuPont de Nemours Inc., Toray Industries Inc., Hydranautics (Nitto Denko Corporation), Dow Inc., 3M Company, Pall Corporation, Merck KGaA, Sartorius AG, GE Healthcare, Pentair plc, Evoqua Water Technologies LLC, Suez SA, Veolia Environnement SA, Koch Membrane Systems Inc., Alfa Laval AB, and others. |

| Segments Covered | By Product Type, By Application, By Distribution Channel, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Polymer Membrane Market: Segmentation

The global polymer membrane market is segmented into product type, application, distribution channel, end-user, and region.

Based on product type, the polymer membrane market is segregated into microfiltration membranes, ultrafiltration membranes, nanofiltration membranes, and reverse osmosis membranes. Reverse osmosis membranes lead the market due to their superior separation capabilities, widespread adoption in desalination plants, and effectiveness in removing dissolved salts and contaminants from water sources.

Based on application, the polymer membrane industry is classified into water treatment, food and beverage processing, pharmaceutical manufacturing, and industrial separation. Water treatment holds the largest market share due to increasing global water scarcity, stringent water quality regulations, and growing demand for clean water in both developed and developing regions.

Based on the distribution channel, the polymer membrane market is divided into direct sales, distributors, online platforms, and equipment manufacturers. Direct sales are expected to lead the market during the forecast period due to the technical complexity of membrane systems, the need for customization, and the importance of direct technical support and service relationships.

Based on the end user, the market is segmented into municipal water treatment, industrial facilities, healthcare institutions, and research laboratories. Municipal water treatment leads the market share due to increasing urbanization, government investments in water infrastructure, and growing public awareness of water quality and safety issues.

Polymer Membrane Market: Regional Analysis

North America to lead the market

North America leads the global polymer membrane market due to its advanced water treatment systems, strict environmental laws, and large investments in industrial water use and pharmaceutical production. The region accounts for 35% of the global market, with the U.S. being the largest consumer of polymer membranes across all applications. Industrial plants in North America are upgrading their membrane systems to meet environmental rules and boost efficiency. The region has strong manufacturing and research centers that help develop new membrane materials and system designs.

Teamwork between membrane producers, technology companies, and research institutes is speeding up the creation and use of advanced membrane solutions. Strong regulations for water quality and environmental safety are pushing cities and industries to adopt membrane technologies more widely. Government funding and incentives for clean water technologies are further boosting the adoption of polymer membrane systems across critical sectors.

Asia Pacific is expected to demonstrate strong growth.

Asia Pacific is experiencing strong growth in the polymer membrane market as rising population and industrial expansion create high demand for water treatment and separation technologies. Countries across the region are making major investments in water infrastructure, desalination, and wastewater treatment to deal with water shortages and pollution. Rapid growth in industries like pharmaceuticals, electronics, and chemicals is increasing the need for advanced membrane systems to improve efficiency and treat waste.

Government programs supporting sustainable development and environmental protection are helping boost the use of membrane technologies. Local membrane producers are increasing their production and improving their technologies to meet the rising demand at home and for exports. Growing concerns about food safety and quality in emerging markets are also pushing the adoption of membrane filtration in food and beverage processing.

Recent Market Developments:

- In June 2025, DuPont launched a revolutionary line of anti-fouling polymer membranes featuring advanced surface modification technology, targeting industrial water treatment applications with enhanced durability and reduced maintenance requirements.

Polymer Membrane Market: Competitive Analysis

The global polymer membrane market is led by players like:

- DuPont de Nemours Inc.

- Toray Industries Inc.

- Hydranautics (Nitto Denko Corporation)

- Dow Inc.

- 3M Company

- Pall Corporation

- Merck KGaA

- Sartorius AG

- GE Healthcare

- Pentair plc

- Evoqua Water Technologies LLC

- Suez SA

- Veolia Environnement SA

- Koch Membrane Systems Inc.

- Alfa Laval AB

The global polymer membrane market is segmented as follows:

By Product Type

- Microfiltration Membranes

- Ultrafiltration Membranes

- Nanofiltration Membranes

- Reverse Osmosis Membranes

By Application

- Water Treatment

- Food and Beverage Processing

- Pharmaceutical Manufacturing

- Industrial Separation

By Distribution Channel

- Direct Sales

- Distributors

- Online Platforms

- Equipment Manufacturers

By End User

- Municipal Water Treatment

- Industrial Facilities

- Healthcare Institutions

- Research Laboratories

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Polymer membranes are thin, selective barriers made from synthetic polymer materials that allow certain substances to pass through while blocking others based on size, charge, or chemical properties.

The polymer membrane market is expected to be driven by increasing global water treatment needs, growing environmental regulations, expanding pharmaceutical and biotechnology applications, technological advancements in membrane materials, and rising demand for sustainable industrial processes.

According to our study, the global polymer membrane market was worth around USD 7.16 billion in 2024 and is predicted to grow to around USD 17.26 billion by 2034.

The CAGR value of the polymer membrane market is expected to be around 9.20% during 2025-2034.

The global polymer membrane market will register the highest revenue contribution from North America during the forecast period.

Key players in the polymer membrane market include DuPont de Nemours Inc., Toray Industries Inc., Hydranautics (Nitto Denko Corporation), Dow Inc., 3M Company, Pall Corporation, Merck KGaA, Sartorius AG, GE Healthcare, Pentair plc, Evoqua Water Technologies LLC, Suez SA, Veolia Environnement SA, Koch Membrane Systems Inc., and Alfa Laval AB.

The report provides a comprehensive analysis of the polymer membrane market, including an in-depth examination of market drivers, restraints, emerging trends, regional dynamics, and future growth prospects. It also examines the competitive dynamics, product innovations, distribution strategies, and technological advancements that shape the modern chemical and materials ecosystem.

List of Contents

Polymer MembraneIndustry Perspective:OverviewKey Insights:Growth DriversRestraintsOpportunitiesChallengesReport ScopeSegmentationRegional AnalysisAsia Pacific is expected to demonstrate strong growth.Recent Market Developments:Competitive AnalysisThe global polymer membrane market is segmented as follows:HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed