Petroleum Coke Market Demand, Size, Share, Growth, Forecast 2032

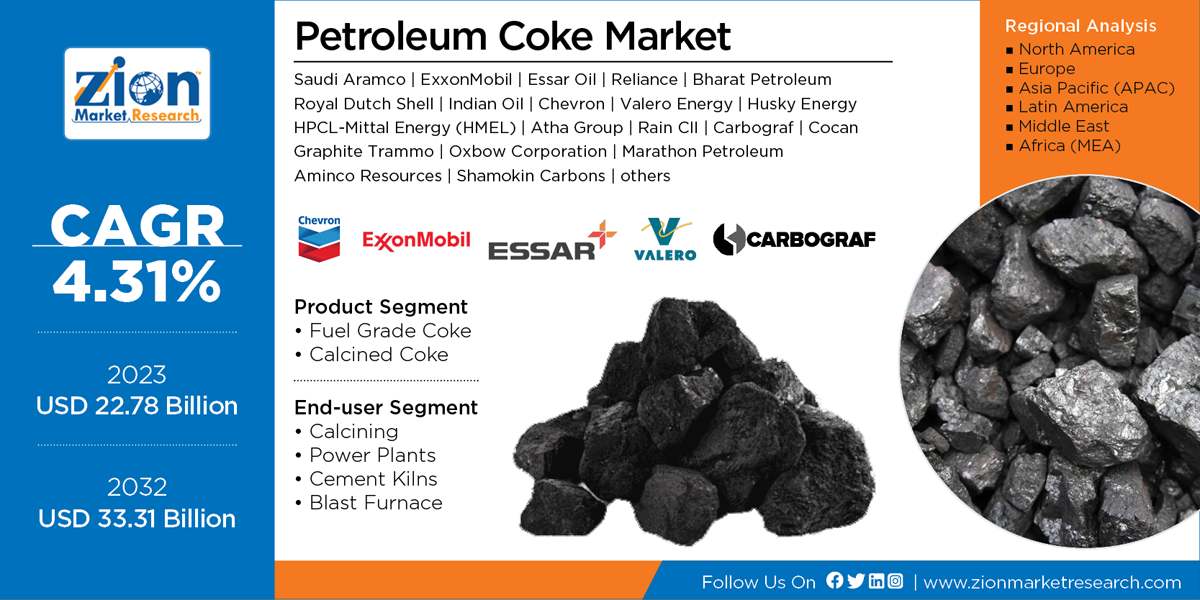

Petroleum Coke Market by Product (Calcined Coke and Fuel Grade Coke), and by End-User (Calcining, Power Plants, Cement Kilns, and Blast Furnace): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032

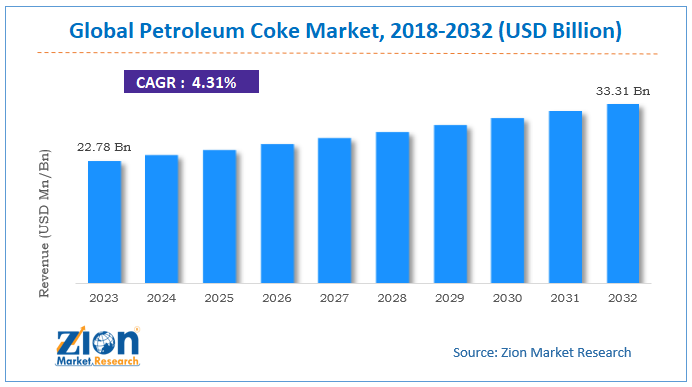

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 22.78 Billion | USD 33.31 Billion | 4.31% | 2023 |

Petroleum Coke Market: Industry Perspective

The global petroleum coke market size was worth around USD 22.78 billion in 2023 and is predicted to grow to around USD 33.31 billion by 2032 with a compound annual growth rate (CAGR) of roughly 4.31% between 2024 and 2032.

Petroleum Coke Market Overview

Petroleum coke, also known as pet coke, is a solid material which is made from unrefined petroleum refining. In the modern world, petroleum coke is considered as a valuable commodity. Distinctive types of petroleum coke can be created by shifting the coking activity temperature, coking time duration, and type of crude and unrefined material utilized during the process. Those distinctive types are purge coke, needle coke, sponge coke, catalyst coke, and shot coke. These distinctive types of petcoke contrast in their substantial properties and volatile organic content. Petcoke and their types are used as the source of energy in various industries because the combustion and calorific value that the substance generates is high when compared to metallurgical coal and bituminous coal. The petcoke is generally used in cement factories and power plants. Petcoke is also utilized in the manufacturing process of metal, in which it is utilized to make anodes in an electric arc furnace. The specialty use of petroleum coke incorporates the generation of titanium dioxide which is used in the paint and shading industry.

The report covers forecasts and analysis for the petroleum coke market on a global and regional level. The study provides historical data from 2018 to 2022 along with a forecast from 2024 to 2032 based on revenue (USD Billion). The study includes drivers and restraints for the petroleum coke market along with the impact they have on the demand over the forecast period. Additionally, the report includes the study of opportunities available in the petroleum coke market on a global level.

Petroleum Coke Market Growth Dynamics

Petroleum coke is experiencing the highest growth rate in developed as well as developing countries. The rising demand for cleaner, greener, and low-emission fuel in power generation and electricity industries across the globe is boosting the market. This demand from developing nations and countries coupled with rapid industrialization and urbanization within those nations is escalating the growth and development of the market. Mainly the cement factories in developing countries are considered to be the largest energy consumers.In 2023, Arabian Cement in Egypt declared to invest an amount of USD 9 million for the construction of a petroleum coke mill. The main focus of this construction was to trim down the general operating expenditures by lowering the shipment charges of the products. This implementation of lowering the shipment charges coupled with the lesser carbon emission can be considered as an imperative feature that will increase the petroleum coke market growth.

Moreover, the need for eco-friendly fuel to enhance the tank and engine efficiency of any vehicle will foster the petroleum coke market development. In addition, rigorous government norms to reduce nitrogen dioxide emission and carbon emissions will further set off the industry growth. In 2023, the European Union formulated a regulation named 2016/2284/EU with the aim to reduce the air pollutants in the atmosphere including sulfur dioxides, VOC, ammonia, and fine particulate matter by 2032.

In order to give the users of this report a comprehensive view of the petroleum coke market, we have included a competitive landscape and analysis of Porter’s Five Forces model for the market. The study encompasses a market attractiveness analysis, wherein the product segment and end-user segment are benchmarked based on their market size, growth rate, and general attractiveness.

The report provides a company market share analysis in order to give a broader overview of the key players in the market. In addition, the report also covers key strategic developments of the market including acquisitions & mergers, new technology launches, agreements, partnerships, collaborations & joint ventures, research & development, technology and regional expansion of major participants involved in the market on a global and regional basis. Moreover, the study covers price trend analysis, and the product portfolio of various companies according to the region.

The study provides a decisive view of the petroleum coke market by segmenting the market based on product, end-user, and regions. All the segments have been analyzed based on present and future trends and the market is estimated from 2024 to 2032.

Based on product, the petroleum coke market is categorized into calcined coke and fuel grade coke.

On the basis of end-user, the market is bifurcated into cement kilns, calcining, power plants, and blast furnaces.

Petroleum Coke Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Petroleum Coke Market |

| Market Size in 2023 | USD 22.78 Billion |

| Market Forecast in 2032 | USD 33.31 Billion |

| Growth Rate | CAGR of 4.31% |

| Number of Pages | 245 |

| Key Companies Covered | Saudi Aramco, ExxonMobil, Essar Oil, Reliance, Bharat Petroleum, Royal Dutch Shell, Indian Oil, Chevron, Valero Energy, Husky Energy, HPCL-Mittal Energy (HMEL), Atha Group, Rain CII, Carbograf, Cocan Graphite Trammo, Oxbow Corporation, Marathon Petroleum, Aminco Resources, Shamokin Carbons, and others. |

| Segments Covered | By Product, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Petroleum Coke Market Regional Analysis

The Asia Pacific held a substantial revenue share of the global petroleum coke market in 2023 and the region is anticipated to continue with its regional supremacy over the forecast period. The growth of this regional market is attributed due to the growing population and rapid industrialization in developing countries. Moreover, the increasing number of government initiatives for a clean, green, and sustainable environment will drive market growth. Thus, Asia Pacific is predicted to provide significant opportunities for the petroleum coke market. In developing countries like China and India, current capital expenditure and fundraising activities in commercial and industrial sectors including the measures to decrease dependency on coal will boost the petroleum coke market growth. Such factors are expected to drive the petroleum coke market growth in the Asia Pacific region over the forecast timeframe.

Petroleum Coke Market: Competitive Analysis

The global petroleum coke market is dominated by players like:

- Saudi Aramco

- ExxonMobil

- Essar Oil

- Reliance

- Bharat Petroleum

- Royal Dutch Shell

- Indian Oil

- Chevron

- Valero Energy

- Husky Energy

- HPCL-Mittal Energy (HMEL)

- Atha Group

- Rain CII

- Carbograf

- Cocan Graphite Trammo

- Oxbow Corporation

- Marathon Petroleum

- Aminco Resources

- Shamokin Carbons

This report segments the global petroleum coke market as follows:

Global Petroleum Coke Market: Product Segment Analysis

- Fuel Grade Coke

- Calcined Coke

Global Petroleum Coke Market: End-user Segment Analysis

- Calcining

- Power Plants

- Cement Kilns

- Blast Furnace

Global Petroleum Coke Market: Regional Segment Analysis

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Petroleum coke, also known as pet coke, is a solid, carbon-rich material that is a byproduct of the refining of crude oil. During the refining process, crude oil is heated to high temperatures to separate it into its various components, such as gasoline, diesel fuel, and heating oil. Petroleum coke is left behind after the lighter oil fractions have been removed. It's essentially a leftover solid material with a high carbon content.

According to a study, the global petroleum coke market size was worth around USD 22.78 billion in 2023 and is expected to reach USD 33.31 billion by 2032.

The global petroleum coke market is expected to grow at a CAGR of 4.31% during the forecast period.

Asia Pacific is expected to dominate the petroleum coke market over the forecast period.

Leading players in the global petroleum coke market include Saudi Aramco, ExxonMobil, Essar Oil, Reliance, Bharat Petroleum, Royal Dutch Shell, Indian Oil, Chevron, Valero Energy, Husky Energy, HPCL-Mittal Energy (HMEL), Atha Group, Rain CII, Carbograf, Cocan Graphite Trammo, Oxbow Corporation, Marathon Petroleum, Aminco Resources, and Shamokin Carbons, among others.

The petroleum coke market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed