Global Pet Food Market Size, Share, Growth Analysis Report - Forecast 2034

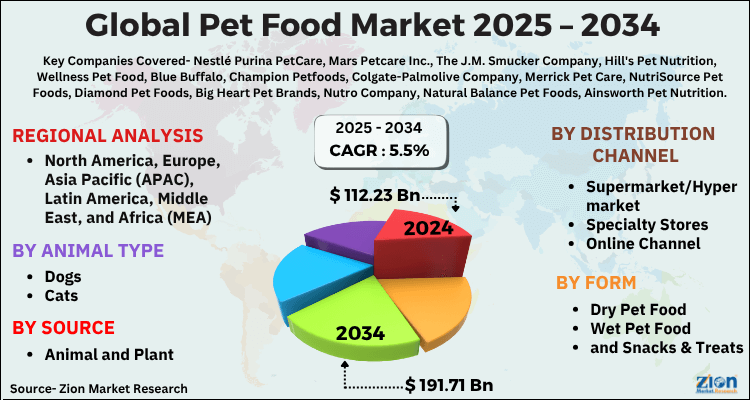

Pet Food Market By Source (Plant-Based, Animal-Based), By Form (Wet Pet Food, Dry Pet Food, Snacks & Treats), By Animal Type (Therapy Pets, Domesticated Pets, Dogs, Cats), By By Distribution Channel (Supermarket/Hypermarket, Specialty Stores, Online Channel, Others), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 112.23 Billion | USD 191.71 Billion | 5.5% | 2024 |

Pet Food Market: Industry Perspective

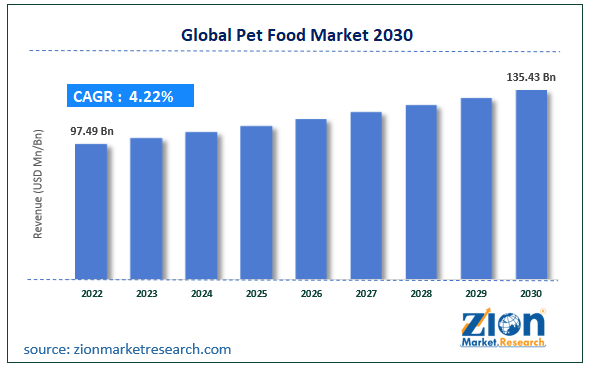

The global pet food market size was worth around USD 112.23 Billion in 2024 and is predicted to grow to around USD 191.71 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 5.5% between 2025 and 2034. The report analyzes the global pet food market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the pet food industry.

Pet Food Market: Overview

Pet foods are edible items that are consumed by pets. These products are typically available in retail stores and supermarkets with specific products for each pet category depending on their nutritional needs. There are two main types of pet food available in the commercial market. One that includes meat and the other variants purely plant-based. Meat products used in pet feed are typically a byproduct generated from the human food industry that is not ideal for human consumption. Every domesticated pet has specific nutritional requirements and the chosen feed should incorporate those needs. For instance, pet feed meant for fish generally contains trace vitamins and minerals along with micronutrients that help keep fish alive and healthy. On the other hand, pet food for cats contains the amino acid taurine since cats cannot survive on food items that are not taurine-rich. In addition to this, certain pet food items have to be cooked while some can be given in raw form but there are certain doubts over the efficiency of raw feeding practice. The pet food market is likely to witness steady growth during the forecast period.

Key Insights

- As per the analysis shared by our research analyst, the global pet food market is estimated to grow annually at a CAGR of around 5.5% over the forecast period (2025-2034).

- Regarding revenue, the global pet food market size was valued at around USD 112.23 Billion in 2024 and is projected to reach USD 191.71 Billion by 2034.

- The pet food market is projected to grow at a significant rate due to rising pet ownership, growing awareness of pet health, and demand for premium and specialized nutrition products.

- Based on source, the animal-based segment is expected to lead the global market.

- On the basis of form, the wet pet food segment is growing at a high rate and will continue to dominate the global market.

- Based on the animal type, the domesticated pets segment is projected to swipe the largest market share.

- By distribution channel, the supermarket/hypermarket segment is expected to dominate the global market.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Pet Food Market: Growth Drivers

Increasing number of pet owners to drive market growth

The global pet food market is expected to grow owing to the increasing number of pet owners across the globe. As per the latest research, more than 90 million homes in Europe owned at least one pet as of 2022. Such staggering statistics are also observed in emerging economies that are witnessing a growth in middle-income groups. For instance, as per official estimates, China is home to more than 64 million pet cats and 50 million pet dogs. Several factors have worked together in the last few years to drive the growth in pet adoption trends. For instance, more people are willing to adopt pets instead of reproducing biological children. The decision could either be medically induced or a personal choice. Rover conducted a recent survey in which it concluded that 1 in every 10 American parents waited to have children and instead adopted a cat or a dog. The decision was a result of the high upfront costs associated with birthing and raising children.

Additionally, doctors are recommending pets for people with medical conditions. Pet therapy or animal-assisted therapy has become extremely popular in recent times. It includes the use of animals or pets to manage certain medical issues. The main intention of pet therapy is to help a patient improve cognitive, social, and emotional functioning. This method is backed by proof and evidence suggesting that animals are known to improve the overall effectiveness of medical therapy procedures. They help to control hormone and blood pressure levels. Some of the most common conditions in which pet therapy has shown excellent results include attention deficit hypersensitivity disorder (ADHD), depression, dementia, anxiety, autism spectrum disorder, and schizophrenia.

All of these factors are expected to help deliver higher sales revenue for pet food.

Pet Food Market: Restraints

Growing concerns over the environmental impact of wet pet food to restrict market growth

The global pet food market size is expected to be restrained due to the growing concerns and questions over the environmental impact of dog food and wet pet food as compared to dry food. Studies and research suggest that wet food can be 8 times more damaging to the environment than dry food. This is mainly because most of the pet food is based on meat which is considered as one of the largest environmental footprint producing segments in the food industry. A Japan-based study concluded that the ecological pawprint of a dog is close to that of citizens based in Japan.

Pet Food Market: Opportunities

Growing consumption of organic pet food to create growth possibilities

The pet food industry is likely to benefit from the growing production and consumption of plant-based or organic pet food. As awareness among pet owners about the impact of pet food on animals is growing along with doubts over the impact of meat-based feed on certain animals, the demand for safer alternatives has grown tremendously. In September 2023, THE PACK, a leading dog food company, launched the company’s first dry dog food formula. Although similar to a wet diet, the product is completely plant-based and it is formulated with key functional ingredients that ensure the overall well of pet dogs. In August 2023, another player in the segment, VEGDOG, a vegan dog food, that received an investment of USD 3.9 million during the last months of 2022, is now investing these funds for brand expansion into new and emerging markets. Similar launches and collaborations have been witnessed across the globe including the launch of new vegetable protein for pet food by BENECO and Wild Earth on two separate occasions.

Pet Food Market: Challenges

Stringent government regulations controlling pet food ingredients to challenge market expansion trend

The pet food industry is expected to face obstacles against its growth trajectory owing to the existence of stringent government regulations determining the ingredients used in pet food production along with the management of the supply chain. Since the rules tend to vary from one market to another, pet food manufacturers have to ensure adherence to the rules which can be time-consuming and resource-intensive. This also includes changing laws around product labeling which may lead to confusion in the commercial market. Moreover, certain reports claim that feeding raw or uncooked pet food can lead to medical concerns in pets including the risk of zoonoses and food-borne illnesses.

Pet Food Market: Segmentation

The global pet food market is segmented based on source, form, animal type,distribution channel, and region.

Based on source, the global market segments are plant-based and animal-based. In 2024, the highest revenue was generated from animal-based sources since most of the brands and products available in the market consist of some form of meat. However, during the forecast period, plant-based pet food is likely to grow at a higher rate, especially in areas with higher awareness of the benefits of organic pet food. The growing number of pet owners in emerging countries along with higher emphasis on improving pet health is likely to drive segmental expansion in new markets. In September 2023, Allana Group, an exporter of processed food products and agro commodities, announced that it would invest INR 200 crore toward the construction of a pet food facility in the Telangana region in India. The plant will run at a capacity of 10 tonnes per hour and is expected to become Asia’s largest pet food-producing unit.

Based on form, the pet food industry is segmented into wet pet food, dry pet food, and snacks & treats.

Based on animal type, the global pet food market divisions are therapy pets, domesticated pets, dogs, and cats. In 2024, domesticated pets were the largest segment driven by an increased rate of voluntary pet adoption. The positive psychological impact of owning pets is a crucial segmental driver. Statistics presented by Rainwalk Pet Insurance claim that more than 4 million animals are adopted in America every year. The therapy pets segment is projected to gain higher momentum during the forecast period.

By distribution channel, the global pet food market is split into supermarket/hypermarket, specialty stores, online channel, and others.

Pet Food Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Pet Food Market |

| Market Size in 2024 | USD 112.23 Billion |

| Market Forecast in 2034 | USD 191.71 Billion |

| Growth Rate | CAGR of 5.5% |

| Number of Pages | 219 |

| Key Companies Covered | Nestlé Purina PetCare, Mars Petcare Inc., The J.M. Smucker Company, Hill's Pet Nutrition, Wellness Pet Food, Blue Buffalo, Champion Petfoods, Colgate-Palmolive Company, Merrick Pet Care, NutriSource Pet Foods, Diamond Pet Foods, Big Heart Pet Brands, Nutro Company, Natural Balance Pet Foods, Ainsworth Pet Nutrition., and others., and others. |

| Segments Covered | By Source, By Form, By Animal Type, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Pet Food Market: Regional Analysis

North America to continue its position as the dominant market

The global pet food market is projected to be dominated by North America as it controlled more than 43.12% of the global share in 2024. A growing number of pet adopters and increasing awareness about the benefits of pet food products on animals’ overall health are the leading regional revenue contributors. The US is expected to lead with the highest regional share as a result of the presence of key pet food producers. In August 2025, HelloFresh announced the launch of a new premium-grade pet food brand called The Pets Table. The product is developed in association with experienced veterinarians and the company will provide subscription-based services. The Pets Table will deliver air-dried and human-grade fresh recipes depending on the dog’s specific calorie needs. The growing sale of pet food over online sale platforms has helped in bringing new revenue streams into the regional ecosystem. These companies have adopted excellent customer service strategies to attract more consumers. In June 2025, Chewy, a US-based online platform for all types of pet needs, announced the launch of CarePlus insurance and wellness offerings. The company has a customer database of more than 20 million.

Pet Food Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the pet food market on a global and regional basis.

The global pet food market is dominated by players like:

- Nestlé Purina PetCare

- Mars Petcare Inc.

- The J.M. Smucker Company

- Hill's Pet Nutrition

- Wellness Pet Food

- Blue Buffalo

- Champion Petfoods

- Colgate-Palmolive Company

- Merrick Pet Care

- NutriSource Pet Foods

- Diamond Pet Foods

- Big Heart Pet Brands

- Nutro Company

- Natural Balance Pet Foods

- Ainsworth Pet Nutrition.

The global pet food market is segmented as follows:

By Source

- Plant-Based

- Animal-Based

By Form

- Wet Pet Food

- Dry Pet Food

- Snacks & Treats

By Animal Type

- Therapy Pets

- Domesticated Pets

- Dogs

- Cats

By Distribution Channel

- Supermarket/Hypermarket

- Specialty Stores

- Online Channel

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Pet foods are edible items that are consumed by pets.

The global pet food market is expected to grow due to rising pet ownership, growing awareness of pet health, and demand for premium and specialized nutrition products.

According to a study, the global pet food market size was worth around USD 112.23 Billion in 2024 and is expected to reach USD 191.71 Billion by 2034.

The global pet food market is expected to grow at a CAGR of 5.5% during the forecast period.

North America is expected to dominate the pet food market over the forecast period.

Leading players in the global pet food market include Nestlé Purina PetCare, Mars Petcare Inc., The J.M. Smucker Company, Hill's Pet Nutrition, Wellness Pet Food, Blue Buffalo, Champion Petfoods, Colgate-Palmolive Company, Merrick Pet Care, NutriSource Pet Foods, Diamond Pet Foods, Big Heart Pet Brands, Nutro Company, Natural Balance Pet Foods, Ainsworth Pet Nutrition., and others., among others.

The report explores crucial aspects of the pet food market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed