Online Map Gas Analyzers Market Size, Share, Growth & Forecast 2034

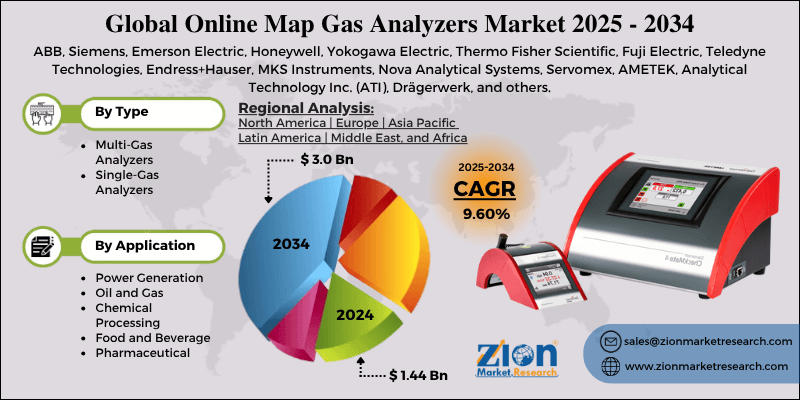

Online Map Gas Analyzers Market By Type (Multi-Gas Analyzers, Single-Gas Analyzers), By Application (Power Generation, Oil and Gas, Chemical Processing, Food and Beverage, Pharmaceutical), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

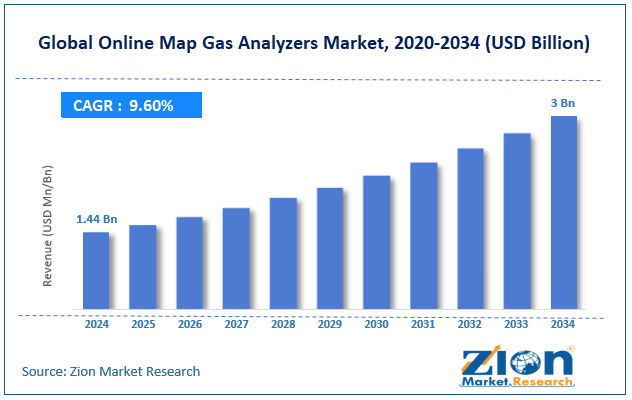

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1.44 Billion | USD 3.0 Billion | 9.60% | 2024 |

Online Map Gas Analyzers Industry Perspective:

The global online map gas analyzers market size was around USD 1.44 billion in 2024 and is projected to reach USD 3 billion by 2034, with a compound annual growth rate (CAGR) of roughly 9.60% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global online map gas analyzers market is estimated to grow annually at a CAGR of around 9.60% over the forecast period (2025-2034)

- In terms of revenue, the global online map gas analyzers market size was valued at around USD 1.44 billion in 2024 and is projected to reach USD 3 billion by 2034.

- The online map gas analyzers market is projected to grow significantly owing to the expansion of petrochemical and oil & gas infrastructure, growth of indoor air quality and HVAC safety mandates, and rising demand for real-time monitoring in power generation plants.

- Based on type, the multi-gas analyzers segment is expected to lead the market, while the single-gas analyzers segment is expected to grow considerably.

- Based on application, the food and beverage segment is the largest, while the pharmaceutical segment is projected to record sizeable revenue over the forecast period.

- By region, Asia Pacific is projected to dominate the global market during the forecast period, followed by North America.

Online Map Gas Analyzers Market: Overview

Online MAP (Modified Atmosphere Packaging) gas analyzers are real-time instruments used to measure carbon dioxide, oxygen, and, at times, nitrogen levels inside food packages without damaging them. They promise that the gas composition remains in the required range to increase shelf life, meet safety regulations, and maintain product freshness. The global online map gas analyzers market is projected to witness substantial growth, driven by rising packaged food consumption, increasing food safety and compliance pressures, and adoption in pharmaceutical and medical device sterilizable packs. Growing e-commerce grocery, urbanization, and lifestyle changes are driving the demand for packaged, ready-to-eat food. This fuels the elevated adoption of MAP systems and, hence, online analyzers. Retailers now mandate real-time gas validation to increase shelf life and avoid recalls. Stringent regulations such as EFSA, FDA, BRC, and FSSAI are driving inline gas analysis. Processors are obligated to prove package safety in audit trials. Online units offer constant compliance documentation without sample destruction.

Moreover, sterile barrier pouches for blister and device pharma packs need gas verification. Automated analyzers remove intrusive tests that jeopardize sterility. The regulated nature of these industries anchors recurring demand.

Although drivers exist, the global market is challenged by factors such as high initial capex for mid- and small-scale plants and the burden of calibration & drift maintenance. Inline analyzers are substantially less expensive than handheld spot testers. Smaller co-packers are delaying investments due to margin pressure. ROI is not seen until a chain or spoilage event occurs. Likewise, sensors need periodic calibration to avoid false rejects or escapes. This contributes to technician and consumable costs. Downtime during calibration is resisted in high-speed plants.

Even so, the global online map gas analyzers industry is well positioned due to the shift from random sampling to 100% inspection mandates and increased penetration in snacks, bakery & confectionery MAPs. Worldwide retailers and QSR chains are increasingly mandating full-pack verification rather than sample testing. This will structurally force processors and converters to adopt online analyzers. Vendors can leverage this move with compliance-ready and audit-linked systems.

Additionally, MAP is growing into categories once dominated by simple barrier films or chemicals. Premium chocolate, salty snacks, and fresh bakery are now adopting gas control to prolong shelf life. This opens incremental white-space beyond dairy and meats.

Online Map Gas Analyzers Market Dynamics

Growth Drivers

How is the global online map gas analyzers market boosted by the acceleration of automation/Industry 4.0 CAPEX in packaging halls?

Post-2023 inflationary labor restrictions drove processors to substitute QC headcount with automated inline measurement. Global F&B automation CAPEX grew nearly 14% in 2024, with packaging analytics & QA instruments as the fastest-growing sub-cluster, according to PMMI's 2024 Outlook. Online MAP analyzers with OPC-UA/Modbus hooks are now natively integrated with MES/SCADA, enabling closed-loop gas control. In 2024, two leading OEMs introduced 'self-tuning MAP skids,' in which analyzer feedback automatically trims gas dosing in real time. This digital feedback loop makes analyzers foundational in new smart-line bids.

How is the scale-up of ready-to-eat/chilled convenience lines in APAC & LATAM considerably fueling the online map gas analyzers market?

Chilled convenience and RTE categories are growing at double-digit rates in urban Asia. These SKUs are MAP-sensitive, and brand entrants are leapfrogging by using inline analyzers instead of legacy sampling to preempt recall risk. In 2024, three brownfield RTE centers were operational in India's western corridor, with spec online analyzers in URS tender baselines (ET Retail, Aug-2024). As developing regions move from stable/dry to chilled distribution, gas integrity becomes a structural rather than an optional requirement. The category mix shift, not only volume, increases analyzer intensity per new line, impacting the progress of the online map gas analyzers market.

Restraints

Preference for cheaper periodic offline sample testing unfavorably impacts the market progress

Offline carbon dioxide or oxygen checkers covering 2-5% of packs are still considered 'good enough' for SKUs with moderate shelf-life elasticity. In 2024, a German bakery chain publicly stated that 'MP failures are low-severity' and capped QC offline sampling to preserve cash (LZ Retail). For several bakery/produce SKUs with low MAP risk gradients, offline regimes show tolerable incident rates. A 2023 Asia Pacific survey presented 61% of processors 'see no payback case' for inline unless they had a recent recall (F&S). This rational inertia holds back inline as long as cases are low-cost or rare.

Opportunities

How is the APAC greenfield surge in chilled/RTE lines, which is leapfrogging offline QC, presenting favorable prospects for the online map gas analyzers market?

Asia Pacific RTE and chilled protein lines are running double-digit build cycles (SEA chilled: 17%; F&S 2024; India RTE CAGR: 22%). New lines have no sunk-cost bias for offline QC—they install what worldwide buyers specify upfront. 2024 India western corridor RTE centers (announced in ET retail, Aug-2024) embedded inline gas QA in URS baseline. Where capacity is still formative, standards can be set 'correct' at birth instead of retrofit-expensive later. This greenfield effect generates compounding installed-base tailwind through 2028. This greenfield surge ultimately drives growth in the online map gas analyzers industry.

Challenges

The competency gap to convert data into action restricts the market growth

Continuous signals need SPC literacy, MES hygiene, and alarm discipline. Nordic audit (2024) found that >40% of MAP alarms were overridden or occurred due to throughput pressure. Asia Pacific QA staffing <2-3 years median instrumentation experience. Underused analyzers erode ROI narratives and slow peer imitation. Talent. Process lag decouples hardware speed from realized value – cycling back into reluctance.

Online Map Gas Analyzers Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Online Map Gas Analyzers Market |

| Market Size in 2024 | USD 1.44 Billion |

| Market Forecast in 2034 | USD 3.0 Billion |

| Growth Rate | CAGR of 9.60% |

| Number of Pages | 213 |

| Key Companies Covered | ABB, Siemens, Emerson Electric, Honeywell, Yokogawa Electric, Thermo Fisher Scientific, Fuji Electric, Teledyne Technologies, Endress+Hauser, MKS Instruments, Nova Analytical Systems, Servomex, AMETEK, Analytical Technology Inc. (ATI), Drägerwerk, and others. |

| Segments Covered | By Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Online Map Gas Analyzers Market: Segmentation

The global online map gas analyzer market is segmented based on type, application, and region.

Based on type, the global online map gas analyzers industry is divided into multi-gas analyzers and single-gas analyzers. The multi-gas analyzer segment held a dominant share, as a majority of MAP lines control at least two gases, requiring simultaneous verification for compliance. Inline multi-channel instruments allow 100% inspection without disturbing throughput, unlike offline sequential tests. Their ability to feed QC data directly into ERP/MES enhances audit readiness and traceability. This increases their preference for exporters, regulated environments, and FMCG plants.

Conversely, the single-gas analyzers segment registered a second-leading share as an economic solution for plants that online monitor oxygen because of laxer customer mandates or simpler product biology. They appeal to retrofit phases in which producers upgrade stepwise rather than complete automation. These units suit low-speed lines, domestic-only supply, and co-packers without export compliance pressure. Low capex and skill requirements, along with easy maintenance, support their persistent demand.

Based on application, the global online map gas analyzers market is segmented into power generation, oil and gas, chemical processing, food and beverage, and pharmaceutical. The food and beverage segment accounted for a substantial share, as MAP is predominantly used to enhance the freshness, integrity, and shelf life of meats, bakery products, produce, and dairy products. Inline analyzers promise every pack meets specified gas ratios, preventing spoilage-led recalls. Export buyers and retailers now demand digital QC proof, increasing the significance of online analyzers on modern MAP lines. High packaging volumes and stringent compliance keep F&B in the lead.

However, the pharmaceutical segment ranks second in the market because of sterile barrier packaging, validated atmospheres, and moisture-sensitive blisters in device pouches. Non-destructive online analysis promises sterility without breaching the pack and satisfies audit and GMP requirements. Audit readiness and serialization raise dependence on digital QC traces. Higher price tolerance in regulated pharma fuels faster adoption than in heavy sectors.

Online Map Gas Analyzers Market: Regional Analysis

What gives Asia Pacific a competitive edge in the global Online Map Gas Analyzers Market?

Asia Pacific is likely to sustain its leadership in the online map gas analyzers market due to the fastest packaged food volume growth worldwide, the highest MAP line installation run-rate, and export intensity, which are fueling compliance adoption. APAC accounts for 42-54% of global packaged food volume growth (2023-24), driven by urbanization, the cold chain, and D2C grocery penetration. China. Japan, China, and ASEAN are swiftly inclining to MAP for perishables.

Growing retail freshness promises make in-line gas validation on new lines a priority. Nearly 55-60% of novel MAP packaging line installations over the past few years occurred in APAC, driven by greenfield food factories in Vietnam, Thailand, China, and India. New plants are built 'inline-QC-ready', unlike retrofit-heavy Western plants. This structurally pulls online analyzers with first-fit automation.

Asia accounts for approximately 50% of worldwide seafood, meat, and produce exports by volume, and exports to regions with stringent audit regimes (Japan, the US, and the EU). Exporters should demonstrate 100% gas integrity to pass importer QA and avert detentions. Inline analyzers offer defensible digital traceability, lessening rejection risk.

North America continues to hold the second-highest share in the online map gas analyzers industry, owing to established high MAP penetration in packaged foods, a strict FSMA/HACCP-driven real-time QC culture, and large QSR & private-label contract discipline. North America accounts for nearly 30-32% of worldwide MAP-packaged chilled food sales, led by ready meals, dairy, and meat. Well-developed industrial chains already rely on controlled atmospheres to defend freshness and brand quality. This entrenched MAP base naturally sustains the online demand for analyzers.

Moreover, US plants operate under GFSI and FSMA standards where constant verification outranks random sampling. Retailers discard loads on traceability gaps, driving inline analyzers into SOP. Nearly 65-70% of large USDA-inspected protein sites report with semi-inline or inline gas QC.

Additionally, North America houses the leading concentration of CPG/QSR procurement contracts that hard-code MAP performance; importer-exporter disputes drove millions in recalls in 2022-23, hastening the installation of real-time analyzers. Contractual compliance locks recurring capex in automated QC.

Online Map Gas Analyzers Market: Competitive Analysis

The leading players in the global online map gas analyzers market are:

- ABB

- Siemens

- Emerson Electric

- Honeywell

- Yokogawa Electric

- Thermo Fisher Scientific

- Fuji Electric

- Teledyne Technologies

- Endress+Hauser

- MKS Instruments

- Nova Analytical Systems

- Servomex

- AMETEK

- Analytical Technology Inc. (ATI)

- Drägerwerk

Online Map Gas Analyzers Market: Key Market Trends

AI-assisted leak detection and auto-calibration:

Vendors are embedding edge analytics to predict auto-correct and micro-leak drift. This decreases false rejections, the need for frequent manual recalibration, and downtime. AI features are becoming a premium differentiator among models.

Cloud traceability & audit-ready data logging:

Pharma and food buyers now demand digital QC proof, not paper logbooks. Online analyzers are shipping with MES connectors or an encrypted cloud for real-time evidence trials. This turns QC data into a procurement and compliance asset.

The global online map gas analyzers market is segmented as follows:

By Type

- Multi-Gas Analyzers

- Single-Gas Analyzers

By Application

- Power Generation

- Oil and Gas

- Chemical Processing

- Food and Beverage

- Pharmaceutical

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Online MAP (Modified Atmosphere Packaging) gas analyzers are real-time instruments used to measure carbon dioxide, oxygen, and, at times, nitrogen levels inside food packages without damaging them. They promise that the gas composition remains in the required range to increase shelf life, meet safety regulations, and maintain product freshness.

The global online map gas analyzers market is projected to grow due to increasing industrial emissions monitoring regulations, growing focus on workplace safety and toxic gas detection, and investments in wastewater treatment and municipal utilities.

According to a study, the global online map gas analyzers market size was around USD 1.44 billion in 2024 and is expected to reach USD 3 billion by 2034.

The CAGR value of the online map gas analyzers market is expected to be around 9.60% during 2025-2034.

Prices are gradually increasing due to added AI, compliance features, and connectivity, but entry-tier models are still stable to serve cost-sensitive plants.

Asia Pacific is expected to lead the global online map gas analyzers market during the forecast period.

The key players profiled in the global online map gas analyzers market include ABB, Siemens, Emerson Electric, Honeywell, Yokogawa Electric, Thermo Fisher Scientific, Fuji Electric, Teledyne Technologies, Endress+Hauser, MKS Instruments, Nova Analytical Systems, Servomex, AMETEK, Analytical Technology Inc. (ATI), and Drägerwerk.

The market is moderately consolidated, led by a few global OEMs, with several mid-tier regional players and integrated MAP automation portfolios offering niche, specialized, or cost-optimized analyzers.

Leading players are pursuing OEM bundling with MAP lines, expanding service networks, launching AI-enabled connected analyzers, and acquiring regional specialists to fast-track penetration in high-growth developing regions.

The report examines key aspects of the online map gas analyzers market, including a detailed analysis of current growth factors and restraints, as well as future growth opportunities and challenges.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed