Oncology Nutrition Market Size, Share, Trends, Analysis, Growth 2032

Oncology Nutrition Market by Cancer Type (Blood, Liver, Pancreatic, Breast, Lung, Head & Neck, Esophageal, Stomach & Gastrointestinal) : Global Industry Perspective, Comprehensive Analysis, And Forecast 2024-2032

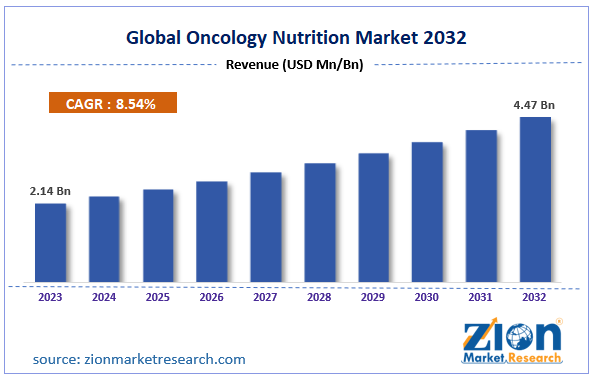

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 2.14 Billion | USD 4.47 Billion | 8.54% | 2023 |

Oncology Nutrition Industry Perspective:

The global oncology nutrition market size was worth around USD 2.14 billion in 2023 and is predicted to grow to around USD 4.47 billion by 2032 with a compound annual growth rate (CAGR) of roughly 8.54% between 2024 and 2032. The study includes drivers and restraints for the oncology nutrition market along with the impact they have on the demand over the forecast period. Additionally, the report includes the study of opportunities available in the oncology nutrition market on a global as well as regional level.

Key Insights

- As per the analysis shared by our research analyst, the oncology nutrition market is anticipated to grow at a CAGR of 8.54% during the forecast period (2024-2032).

- The global oncology nutrition market was estimated to be worth approximately USD 2.14 billion in 2023 and is projected to reach a value of USD 4.47 billion by 2032.

- The growth of the oncology nutrition market is being driven by growing steadily as cancer incidence rises globally and the importance of tailored nutritional support in cancer care gains recognition.

- Based on the cancer type, the blood segment is growing at a high rate and is projected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

Good nutrition is one of the most important things required to lead a healthy life and in patients suffering from cancer a balanced nutrition is even more important. Oncology nutrition is a vital part of the entire process for recovering from cancer. Consuming a wide variety of foods and nutritious meals helps in coping with the heavy medication that is a part of cancer treatment. Following a well-balanced oncology, nutrition helps in improving strength, maintaining body weight, and assists the body in recovering from cancer. In most cases, well-nourished patients respond better to cancer treatments. Balanced oncology nutrition includes consumption of foods and liquids that are rich in macronutrients - which include proteins, fats, and carbohydrates as well as micronutrients such as minerals and vitamins. A qualified and registered dietician is an important member of the healthcare team taking care of the cancer patients. The dietician provides focused counseling about proper oncology nutrition to be followed during the cancer treatment.

Following well-balanced oncology nutrition is vital to prevent malnutrition during the course of cancer treatment. It also helps the patients to achieve and maintain a healthy weight, to manage the side-effects of cancer treatment, to be physically active, and at the same time reduces the risk of cancer coming back. It is observed that people diagnosed with cancer are highly motivated to improve or maintain their health. The patients often search for information on the web or reach out to experts. The major aim during the cancer treatment is to eat healthy and keep the body replete with nutrients and calories for healing, recovery, repair, and energy. A well-balanced diet must be coupled with targeted oncology nutrition products during and after cancer treatment. The products packed with macro- and micro-nutrients fill the nutrition gap left by regular meals. In cancer patients, inadequate intake of calories, proteins, or other nutrients like vitamins and minerals can lead to malnourishment.

Malnourishment, caused due to cancer treatment or other related complications, can make patients weak or drained. Furthermore, it may lead to disruptions or delays in the cancer treatment and longer hospital stays. On the other hand, consuming excessive calories could lead to excessive weight gain, in turn, increasing the risk of cancer recurrence. According to Cancer Treatment Centers of America (CTCA), approximately 65 to 70% of oncology patients suffer from malnutrition. In 2023 WHO recorded cancer as the second leading cause of death globally and which accounted for 8.9 million deaths. WHO further stated that between 30% and 50% of cancer deaths are preventable by avoiding key risk factors that include tobacco products, alcohol consumption, and by maintaining a healthy body weight.

Increasing demand for nutritional feeding in homecare sector, growing trend towards an enteral mode of nutrition from parenteral, increasing number of cancer cases, and increasing incidence of malnutrition in cancer patients are expected to be the major drivers for the global oncology nutrition market. In addition, developing clinical research in oncology nutrition is expected to trigger the growth of global oncology nutrition industry in the coming years. However, tube feeding-related complications and restricted reimbursement may pose challenges to oncology nutrition market. Rapid product innovation and advancement of elemental formulas in the field is expected to act as an opportunity for oncology nutrition market in the near future.

Request Free Sample

Request Free Sample

Oncology Nutrition Market: Growth Factors

In order to give the users of this report a comprehensive view on the oncology nutrition market, we have included competitive landscape and analysis of Porter’s Five Forces model for the market. The study encompasses a market attractiveness analysis, wherein cancer type segment is benchmarked based on their market size, growth rate, and general attractiveness.

The report provides company market share analysis in order to give a broader overview of the key players in the market. In addition, the report also covers key strategic developments of the market including acquisitions & mergers, new product launch, agreements, partnerships, collaborations & joint ventures, research & development, regional expansion of major participants involved in the market on the global and regional basis.

The study provides a decisive view on the oncology nutrition market by segmenting the market based on cancer type and regions. Both the segments have been analyzed based on present and future trends and the market is estimated from 2023 to 2032.

Based on cancer type, the oncology nutrition market has been segmented into blood, liver, pancreatic, breast, lung, head & neck, esophageal, and stomach & gastrointestinal. Head & neck cancer segment holds the maximum share of the global oncology nutrition market.

Recent Development

- In September 2025, SERB Pharmaceuticals, a global specialty pharmaceutical company specializing in rare diseases and medical emergencies, announced the successful completion of its acquisition of Y-mAbs Therapeutics, Inc. A commercial-stage biopharmaceutical company, Y-mAbs, focuses on developing and commercializing antibody-based therapies for cancer treatment.

- In March 2025, Sun Pharmaceutical Industries, India’s largest drugmaker by revenue, announced plans to acquire Nasdaq-listed Checkpoint Therapeutics in a $355 million deal. This acquisition aims to strengthen Sun Pharma’s oncology portfolio, especially within the high-margin specialty pharmaceuticals segment in the United States.

Oncology Nutrition Market : Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Oncology Nutrition Market Research Report |

| Market Size in 2023 | USD 2.14 Billion |

| Market Forecast in 2032 | USD 4.47 Billion |

| Growth Rate | CAGR of 8.54% |

| Number of Pages | 210 |

| Key Companies Covered | Fresenius Kabi AG, Nestle S.A., Abbott Laboratories, Danone, Global Health Products, Mead Johnson Nutrition Company, B.Braun Melsungen AG, Victus, Meiji Holdings, and Hormel Foods |

| Segments Covered | By Cancer Type and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

North America will be the dominant region during the forecast period. Increasing prevalence of cancer in the region and availability of assisted living facilities are the factors that will boost the market in the region. Europe will be the second largest market. The Asia Pacific will grow at the fastest rate over the forecast period. Increasing healthcare expenditure and growing attention towards oncology nutrition are the driving factors for the growth of the oncology nutrition market in this region. Latin America market is projected to grow at a moderate rate during the forecast period. The Middle East and Africa are expected to experience noticeable growth in the years to come.

The regional segmentation includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa with its further divided into major countries including the U.S. Canada, Germany, France, UK, China, Japan, India, and Brazil. This segmentation includes demand for oncology nutrition based on individual segment and applications in all the regions and countries.

Some of the key players in oncology nutrition market include Fresenius Kabi AG, Nestle S.A., Abbott Laboratories, Danone, Global Health Products, Mead Johnson Nutrition Company, B.Braun Melsungen AG, Victus, Meiji Holdings, and Hormel Foods, among others.

Oncology Nutrition Market: Competitive Analysis

The global oncology nutrition market is dominated by players like:

- Fresenius Kabi AG

- Nestle S.A.

- Abbott Laboratories

- Danone

- Global Health Products

- Mead Johnson Nutrition Company

- B.Braun Melsungen AG

- Victus

- Meiji Holdings

- Hormel Foods

This report segments the global oncology nutrition market as follows:

Global Oncology Nutrition Market: By Cancer Type

- Blood

- Liver

- Pancreatic

- Breast

- Lung

- Head & Neck

- Esophageal

- Stomach & Gastrointestinal

Global Oncology Nutrition Market: By Region

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Oncology nutrition pertains to the unique dietary requirements and obstacles encountered by patients enduring cancer therapy. It consists of providing nutritional support to cancer patients prior to, during, and subsequent to their treatment. Aiding in the management of cancer treatment-related adverse effects, maintaining or improving nutritional status, promoting overall health, and enhancing the quality of life for cancer patients are the principal objectives of oncology nutrition.

The escalating global incidence of cancer serves as a catalyst for the expanding need for oncology nutrition services. The demand for specialized nutrition support to address the nutritional challenges associated with cancer and its treatments is increasing in tandem with the incidence of cancer cases. Exploring the relationship between nutrition and cancer treatment outcomes through ongoing research and clinical trials may result in the creation of novel and more effective nutrition interventions. The potential benefits derived from these investigations could stimulate the implementation of sophisticated nutrition approaches within the field of oncology.

The global oncology nutrition market size was worth around USD 2.14 billion in 2023 and is predicted to grow to around USD 4.47 billion by 2032.

The global oncology nutrition market with a compound annual growth rate (CAGR) of roughly 8.54% between 2024 and 2032.

The regional segmentation comprises present and projected demand for the following regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Additionally, it is subdivided into significant countries such as the United States, Canada, Germany, France, the United Kingdom, China, Japan, India, and Brazil. This segmentation comprises the demand for oncology nutrition across all regions and countries, with consideration given to each segment's specific applications.

The report also includes detailed profiles of end players such as Fresenius Kabi AG, Nestle S.A., Abbott Laboratories, Danone, Global Health Products, Mead Johnson Nutrition Company, B.Braun Melsungen AG, Victus, Meiji Holdings, and Hormel Foods.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed