Non Carbon Fuel Heavy Vehicle And Machinery Market Size 2034

Non Carbon Fuel Heavy Vehicle And Machinery Market By Type (Hydrogen Fuel Cells, Battery Electric, Biofuels, and Others), By Propulsion Type (Hybrid, Plug-in Hybrid, Pure Electric, Fuel Cell), By Power Output (Low Power [Less than 50 HP], Medium Power [50-200 HP], High Power [Over 200 HP], Custom/Variable Power), By Application (Construction Equipment, Agriculture, Mining, Cargo and Transportation, Military and Defense, and Others), By End-Users (Construction Companies, Agricultural Sector, Mining Industry, Transportation and Logistics, Defense and Military, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

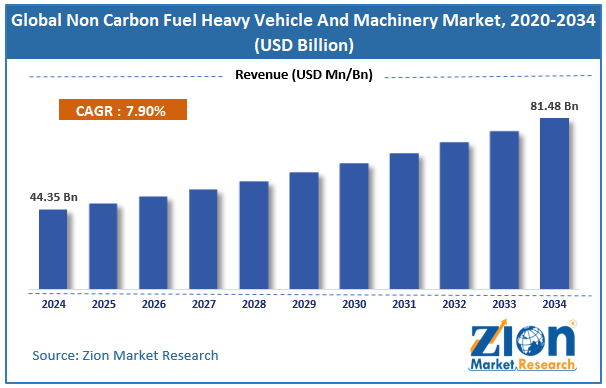

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 44.35 Billion | USD 81.48 Billion | 7.90% | 2024 |

Non Carbon Fuel Heavy Vehicle And Machinery Industry Perspective:

The global non carbon fuel heavy vehicle and machinery market size was around USD 44.35 billion in 2024 and is projected to reach USD 81.48 billion by 2034, with a compound annual growth rate (CAGR) of roughly 7.90% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global non carbon fuel heavy vehicle and machinery market is estimated to grow annually at a CAGR of around 7.90% over the forecast period (2025-2034)

- In terms of revenue, the global non carbon fuel heavy vehicle and machinery market size was valued at around USD 44.35 billion in 2024 and is projected to reach USD 81.48 billion by 2034.

- The non carbon fuel heavy vehicle and machinery market is projected to grow significantly owing to rising demand for sustainability and corporate ESG goals, increasing availability of green hydrogen, and expansion of non-carbon fuel infrastructure.

- Based on type, the battery electric segment is expected to lead the market, while the hydrogen fuel cells segment is expected to grow considerably.

- Based on propulsion type, the pure electric segment is the largest, while the fuel cell segment is projected to record sizeable revenue over the forecast period.

- Based on power output, the high-power (over 200 HP) segment is expected to lead the market, followed by the medium-power (50-200 HP) segment.

- Based on application, the construction equipment segment is the largest, while the mining segment is projected to record sizeable revenue over the forecast period.

- Based on end-users, the construction companies segment is expected to lead the market, followed by the mining industry segment.

- By region, Europe is projected to dominate the global market during the forecast period, followed by the Asia Pacific.

Non Carbon Fuel Heavy Vehicle And Machinery Market: Overview

Non-carbon fuel heavy vehicles and machinery use energy sources that do not depend on fossil fuels, thereby reducing emissions in different industries. These technologies comprise hydrogen fuel cells, electric power, hybrid systems, and biofuels designed for long-duration work and high torque. They offer low noise, cleaner operation, and reduced ecological impact while enhancing energy efficiency. The global non-carbon fuel heavy vehicle and machinery market is poised for notable growth, driven by strict environmental regulations, decarbonization commitments, and technological advancements. Governments across the globe are enforcing stringent emissions limits, low-emission zones, and carbon taxes. Heavy machinery is targeted because of its disproportionate contribution to pollution, pushing manufacturers and fleet operators to adopt cleaner powertrains.

Moreover, corporations in the mining, construction, and transport industries are pledging net-zero targets. To meet these goals, they should reduce reliance on diesel and capitalize on low- or zero-carbon or alternatives. This strategic imperative fuels demand for non-carbon-intensive vehicles. Furthermore, improvements in battery chemistry, such as solid-state batteries, cost-effective hydrogen fuel-cell systems, and more efficient electric drivetrains, are enhancing performance, reducing costs, and boosting reliability. These technological benefits make non-carbon solutions increasingly competitive.

Nevertheless, the global market faces limitations due to high capital costs and limited energy density. Non-carbon-intensive machinery and vehicles usually require significant upfront investment. Fuel-cell systems, hydrogen storage, and batteries are still costlier than conventional diesel engines at scale, increasing obstacles for buyers operating on tight capital budgets. Likewise, batteries – even the modern ones- usually store less energy per unit weight and weigh more than diesel. This limitation restricts the runtime and payload capacity of electric heavy machinery, especially for long-haul and high-load applications.

Still, the global non carbon fuel heavy vehicle and machinery industry benefits from several favorable factors, such as fleet electrification in mining and construction, and the adoption of green hydrogen. There is a growing opportunity to replace or retrofit diesel-heavy fleets in mining and construction with hydrogen- or electric-powered machines, particularly in regions that offer subsidies or promote sustainability.

As green hydrogen production scales, heavy industries can leverage it into power fuel-cell equipment and vehicles. Companies can build hydrogen refueling stations near depots, construction sites, or mines, unveiling a significant growth pathway.

Non Carbon Fuel Heavy Vehicle And Machinery Market Dynamics

Growth Drivers

How are rapid technological advances in fuel-cell & battery systems fueling the non carbon fuel heavy vehicle and machinery market?

Technological improvements are significantly improving the viability of non-carbon heavy vehicles. Advancements in hydrogen fuel-cell efficiency, cost, storage, and durability are reducing the obstacles to heavy machinery use. Hydrogen and electric powertrains are approaching cost-competitiveness with diesel trucks on a total cost of ownership basis when operating costs and infrastructure are considered. Furthermore, manufacturers are adopting fuel-fuel, hybrid, and modular designs to accommodate different vehicle sizes and duty cycles.

How does the expanding infrastructure for alternative fuels drive the non carbon fuel heavy vehicle and machinery market?

The build-out of non-carbon fueling infrastructure is accelerating, in turn supporting the adoption of non-carbon-fueled heavy vehicles and machinery. Governments are progressively investing in hydrogen stations, biofuel supply chains, and battery-charging hubs. For instance, national strategies are emerging to designate zero-freight corridors, incorporating hydrogen refueling and electric charging into long-haul routes. This infrastructure development reduces operational risk for fleet operators and gives manufacturers the confidence to scale production.

Restraints

Battery technology limitations unfavorably impact the market progress

Despite advancements, current battery technology has restrictions for heavy-duty applications. High-capacity batteries for long-haul trucks are heavy, decreasing payload and raising energy use, while heavy loads or extreme temperatures may degrade runtime and performance. Fast-charging large batteries remains time-consuming, and without broader ultra-high-power chargers, vehicles experience extended downtime. These limitations offer significant challenges for operators running multi-shift or 24x7 operations.

Opportunities

How do corporate ESG mandates and decarbonization goals create promising avenues for the non carbon fuel heavy vehicle and machinery industry growth?

Large logistics, construction, and mining companies are under growing pressure to meet ESG commitments. Investing in non-carbon-intensive machinery, such as hydrogen- and electric-powered trucks, decreases emissions and supports net-zero targets and sustainability. Early adoption also offers reputational benefits, potential tax incentives, and preferential financing. This increases the significance of non-carbon vehicles as a strategic tool for supporting investor and regulatory expectations. These efforts are further beneficial for the growth of the non carbon fuel heavy vehicle and machinery industry.

Challenges

Regulatory fragmentation and standardization uncertainties restrict the market growth

There is no globally harmonized standard for hydrogen refueling pressures, certification of fuel-cell heavy vehicles, or safety protocols. Different regions have different regulations, which forces OEMs to design diverse versions of fueling systems or vehicles, slowing scale and raising costs. Regulatory uncertainty also makes long-term investment risky. Without standardization or policy clarity, several players may be deterred from committing to large-scale deployment.

Non Carbon Fuel Heavy Vehicle And Machinery Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Non Carbon Fuel Heavy Vehicle And Machinery Market |

| Market Size in 2024 | USD 44.35 Billion |

| Market Forecast in 2034 | USD 81.48 Billion |

| Growth Rate | CAGR of 7.90% |

| Number of Pages | 215 |

| Key Companies Covered | Caterpillar, Komatsu, Volvo Construction Equipment, Hyundai Construction Equipment / HD Hyundai Infracore, JCB, Hitachi Construction Machinery, CNH Industrial, SANY, Kobelco Construction Machinery, Bobcat, Terex, Wacker Neuson, Manitou Group, Yanmar, XCMG, and others. |

| Segments Covered | By Type, By Propulsion Type, By Power Output, By Application, By End Users, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Non Carbon Fuel Heavy Vehicle And Machinery Market: Segmentation

The global non carbon fuel heavy vehicle and machinery market is segmented by type, propulsion type, power output, application, end-user, and region.

Based on type, the global non carbon fuel heavy vehicle and machinery industry is divided into hydrogen fuel cells, battery electric, biofuels, and others. The battery-electric segment dominates due to mature technology, expanding charging infrastructure, and low operating costs.

Based on propulsion type, the global market is segmented into hybrid, plug-in hybrid, pure electric, and fuel cell. The pure electric segment leads due to its cost efficiency, sophisticated drivetrains, and expanding charging infrastructure.

Based on power output, the global market is segmented into low power (less than 50 HP), medium power (50-200 HP), high power (over 200 HP), and custom/variable power. The high-power (over 200HP) segment leads, as most industrial machinery and heavy vehicles demand high power for load-bearing, long-duration operations and torque.

Based on application, the global non carbon fuel heavy vehicle and machinery market is segmented into construction equipment, agriculture, mining, cargo and transportation, military and defense, and others. The construction equipment segment holds a significant share, as urbanization and infrastructure development drive the highest demand for non-carbon-intensive construction machinery.

Based on end-users, the global market is segmented into construction companies, the agricultural sector, the mining industry, transportation and logistics, defense and military, and others. The construction companies segment holds a leading position, as they drive substantial demand for heavy machinery to build infrastructure and are increasingly investing in non-carbon equipment.

Non Carbon Fuel Heavy Vehicle And Machinery Market: Regional Analysis

What enables Europe to have a strong foothold in the global Non Carbon Fuel Heavy Vehicle and Machinery Market?

Europe is projected to maintain its dominant position in the global non carbon fuel heavy vehicle and machinery market, driven by strict environmental regulations, strong government incentives, and advanced infrastructure development. Europe enforces stringent emissions standards for heavy machinery, pushing manufacturers to adopt hydrogen and electric powertrains. Policies like the European Green Deal offer additional incentives for zero-emission solutions. This regulatory pressure drives adoption across the mining, construction, and agricultural industries.

Moreover, governments provide tax credits, subsidies, and grants to support the deployment of non-carbon-intensive machinery. Funding programs for electric construction equipment and hydrogen infrastructure decrease upfront costs. These incentives motivate companies to transition fleets faster than in other markets. Additionally, Europe is investing significantly in hydrogen refueling networks and EV charging stations near industrial hubs. This decreases operational downtime and range anxiety for heavy machinery operators. Growing infrastructure supports large-scale deployment of non-carbon fleets.

Asia Pacific maintains its position as the second-largest region in the global non carbon fuel heavy vehicle and machinery industry, driven by hydrogen vehicle adoption, strong OEM presence, and government policies and incentives. Hydrogen-powered heavy vehicles are gaining prominence due to their fast refueling and long-range capabilities. Investments in hydrogen infrastructure are rising in South Korea, Japan, and China. This makes the region a leading adopter of fuel-cell heavy machinery.

Moreover, major Asia Pacific manufacturers such as Foton, Hyundai, and Toyota are leading in the deployment of electric and hydrogen-powered machinery. Their R&D and local production augment technology deployment. This amplifies the region's competitive position worldwide. Governments in South Korea, China, and Japan offer tax incentives, infrastructure, and subsidies to support non-carbon heavy vehicles. Policies aim to decrease emissions in the transport and industrial sectors. These measures motivate fleet advancement and the adoption of clean machinery.

Non Carbon Fuel Heavy Vehicle And Machinery Market: Competitive Analysis

The leading players in the global non carbon fuel heavy vehicle and machinery market are:

- Caterpillar

- Komatsu

- Volvo Construction Equipment

- Hyundai Construction Equipment / HD Hyundai Infracore

- JCB

- Hitachi Construction Machinery

- CNH Industrial

- SANY

- Kobelco Construction Machinery

- Bobcat

- Terex

- Wacker Neuson

- Manitou Group

- Yanmar

- XCMG

Non Carbon Fuel Heavy Vehicle And Machinery Market: Key Market Trends

Battery electrification scaling up:

Heavy machinery like loaders, haul trucks, and excavators is increasingly going electric as battery costs decline. Energy density improves, and charging infrastructure is being adapted for industrial sites with high-power, fast chargers. OEMs are introducing electric models that match diesel performance for off-highway applications.

Trolley-assist & electrified infrastructure:

Heavy-duty trucks and mining are using trolley-assisted electric drives for continuous power supply and uphill hauls. This decreases battery size requirements and enhances operational efficacy. Integration with autonomous systems improves energy and productivity management

The global non carbon fuel heavy vehicle and machinery market is segmented as follows:

By Type

- Hydrogen Fuel Cells

- Battery Electric

- Biofuels

- Others

By Propulsion Type

- Hybrid

- Plug-in Hybrid

- Pure Electric

- Fuel Cell

By Power Output

- Low Power (Less than 50 HP)

- Medium Power (50-200 HP)

- High Power (Over 200 HP)

- Custom/Variable Power

By Application

- Construction Equipment

- Agriculture

- Mining

- Cargo and Transportation

- Military and Defense

- Others

By End Users

- Construction Companies

- Agricultural Sector

- Mining Industry

- Transportation and Logistics

- Defense and Military

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Non-carbon fuel heavy vehicles and machinery use energy sources that do not depend on fossil fuels, thereby reducing emissions across industries. These technologies comprise hydrogen fuel cells, electric power, hybrid systems, and biofuels designed for long-duration work and high torque.

The global non carbon fuel heavy vehicle and machinery market is projected to grow due to infrastructure, mining, and construction projects, government incentives and subsidies, and digitalization and telematics for efficiency gains.

According to a study, the global non carbon fuel heavy vehicle and machinery market size was around USD 44.35 billion in 2024 and is predicted to grow to around USD 81.48 billion by 2034.

The CAGR of the non carbon fuel heavy vehicle and machinery market is expected to be around 7.90% during 2025-2034.

When is the non carbon fuel heavy vehicle and machinery market expected to reach its peak potential?

The non carbon fuel heavy vehicle and machinery market is expected to reach its peak potential around 2035–2040 as infrastructure, technology adoption, and regulations mature worldwide.

Pricing trends in the non carbon fuel heavy vehicle and machinery market are showing declines in battery pack costs (around 7–10% per year) and in fuel-cell and hydrogen system costs. Still, significant upfront vehicle costs remain a challenge compared to diesel.

Europe is expected to lead the global non carbon fuel heavy vehicle and machinery market during the forecast period.

The key players profiled in the global non carbon fuel heavy vehicle and machinery market include Caterpillar, Komatsu, Volvo Construction Equipment, Hyundai Construction Equipment / HD Hyundai Infracore, JCB, Hitachi Construction Machinery, CNH Industrial, SANY, Kobelco Construction Machinery, Bobcat, Terex, Wacker Neuson, Manitou Group, Yanmar, and XCMG.

Stakeholders should focus on flexible business models, R&D, strategic partnerships, data-driven fleet management, and scalable manufacturing to stay competitive.

The report examines key aspects of the non carbon fuel heavy vehicle and machinery market, including a detailed analysis of current growth factors and restraints, as well as future growth opportunities and challenges.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed