Medical Carts Market Trend, Share, Growth, Size, and Forecast 2032

Medical Carts Market By Product Segments(Mobile Computing Carts(Telemedicine Carts, Computer Carts, Medication Carts, Documentation Carts), Medical Carts(Anesthesia Carts, Procedure Carts, Emergency Carts, Other Carts), Wall Mount Workstations(Wall Arm Workstations, Wall Cabinet Workstations), Medical Cart Accessories), By Material Segments(Metal, Plastic, Wood), By End-User Segments(Hospitals, Nursing Homes, Long-Term Care Centers, Physician Offices or Clinics, Others), and By Region: Global Industry Perspective, Comprehensive Analysis, and Forecast 2024-2032

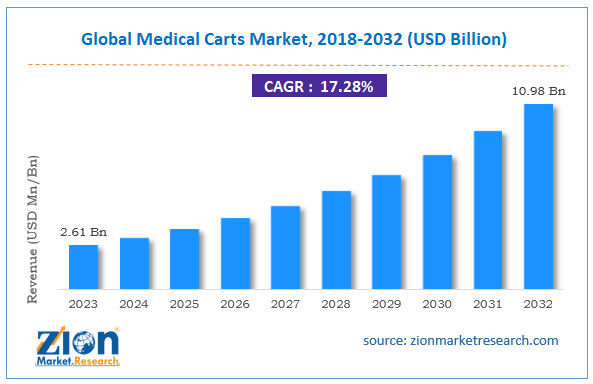

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 2.61 Billion | USD 10.98 Billion | 17.28% | 2023 |

Medical Carts Industry Perspective:

The global Medical Carts market size accrued earnings worth approximately USD 2.61 Billion in 2023 and is predicted to gain revenue of about USD 10.98 Billion by 2032, is set to record a CAGR of nearly 17.28% over the period from 2024 to 2032. The study includes the drivers and restraints for the medical carts market along with the impact they have on the demand over the forecast period. Additionally, the report includes the study of opportunities available in the medical carts market on a global level.

Key Insights

- As per the analysis shared by our research analyst, the medical carts market is anticipated to grow at a CAGR of 17.28% during the forecast period.

- The global medical carts market was estimated to be worth approximately USD 2.61 billion in 2023 and is projected to reach a value of USD 10.98 billion by 2032.

- The growth of the medical carts market is being driven by increasing demand for efficient, mobile healthcare solutions that enhance patient care and streamline hospital workflows.

- Based on the product, the mobile computing carts segment is growing at a high rate and is projected to dominate the market.

- On the basis of material, the metal segment is projected to swipe the largest market share.

- In terms of end-user, the hospitals segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

Medical Carts Market: Overview

In order to give the users of this report a comprehensive view of the medical carts market, we have included a competitive landscape and an analysis of Porter’s Five Forces model for the market. The study encompasses a market attractiveness analysis, wherein product, material, end-user, and regional segments are benchmarked based on their market size, growth rate, and general attractiveness.

Medical carts are mobile or moving carts that are durable and lightweight. They are mainly used to carry equipment during emergencies. In order to provide hassle-free care to the patients, selection of apt mobile carts is crucial. For instance, the demand for small handheld devices is rising to streamline the routine clinical workflow, which includes detailed documentation of in-patient admissions, supplies used for fluid administration, and medication recording. During surgeries, the use of a secure medication cart which has a tablet PC installed is better rather than using separate carts for medication and computer. This saves space and money. Critical care units have limited floor space and the use of appropriate medical cart can benefit in emergencies.

Medical Carts Market Growth Analysis

Due to the growing need for easy and rapidly accessible medical supplies, there has been an increasing focus on nursing efficiency, patient safety, and development of advanced technologies, such as telemedicine, are propelling the market growth for medical carts. Besides, investments made by government bodies in healthcare infrastructure in developed and developing countries are further fostering the demand for the medical carts market. Moreover, computer carts provide workflow solutions and ergonomic features to reduce and accommodate lengthy tasks associated with providing improved personal care for patients. As these carts are mobile in nature, it helps the caregivers to have a highly mobile workflow. Mobile computer carts allow a single computer system to be used in multiple places of the hospitals, clinics, and labs. This, in turn, saves time, especially in old structures or buildings where the set-up cannot accommodate costly technological solutions. However, the high cost associated with the demand for customized medical carts and lack of skilled professionals are hindering the growth of medical carts market, especially in the developing countries, such as China and India.

Medical Carts Market Share Analysis

The report provides a company market share analysis in order to give a broader overview of the key players in the market. In addition, the report also covers key strategic developments of the market including acquisitions and mergers, new product launches, agreements, partnerships, collaborations, joint ventures, research and development, and regional expansion of major participants involved in the market on a global and regional basis.

Medical Carts Market Segment Analysis

The medical carts market is divided on the basis of product, material, and end-user. On the basis of product type, the market is categorized into mobile computing carts, medical carts, wall mount workstations, and medical cart accessories. The mobile computing carts segment is further sub-divided into telemedicine carts, computer carts, medication carts, and documentation carts. The medical carts segment are further sub-divided into procedure carts, emergency carts, anesthesia carts, and other carts. The wall mount workstations market is sub-segmented into wall cabinet workstations and wall arm workstations. On the basis of material type, the market is classified into metal, plastic, and wood. Based on end-user, the medical carts market is fragmented into hospitals, nursing homes, and long-term care centers, physician offices or clinics, and others.

Medical Carts Market Regional Analysis

North America and Europe are anticipated to dominate the medical carts market and are likely to hold a major market share in the forecast timeframe. This growth can be attributed to the smooth running of healthcare operations, i.e., starting from hospital admission of patients to their reimbursements and the availability of integrated healthcare IT systems to maintain EHR are some growth factors contributing toward this market’s growth of these two regions. Moreover, medical device manufacturers in these regions focus on developing advanced and customized medical carts that are suitable for various customer requirements. Companies are focused on enhancing their product portfolio to include more technically advanced products, such as clinical workstations with security drawers, automated dispensing systems, and batteries, etc. The Asia Pacific region is likely to witness an attractive growth rate, as the manufacturers in this region are focusing on developing low-cost devices with higher efficiency. Additionally, the leading market players are investing in local companies due to low costs of raw materials and labor in this region.

Recent Development

- In October 2023, Ergotron finalized the acquisition of Enovate Medical. This acquisition is considered positive for Ergotron, as company statements indicate it accelerates their capabilities and cements their position as a leading provider of healthcare workflow solutions.

- In December 2022, GCX Mounting Solutions acquired Jaco, Inc., significantly strengthening its portfolio of healthcare-focused point-of-care IT workstation solutions. The acquisition added Jaco's complementary powered mobile cart product lines, notably the battery-powered EVO Series, and expanded GCX's manufacturing and commercial capabilities.

- In August 2021, Capsa Healthcare acquired Specialty Carts, Inc., a healthcare cart manufacturer, in a move to broaden its reach and strengthen its product offerings in the long-term care (LTC) and extended care medication management sectors.

Medical Carts Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Medical Carts Market |

| Market Size in 2023 | USD 2.61 Billion |

| Market Forecast in 2032 | USD 10.98 Billion |

| Growth Rate | CAGR of 17.28% |

| Number of Pages | 205 |

| Key Companies Covered |

ITD GmbH, Midmark Corporation, Omnicell, Inc., Armstrong Medical Industries, Inc., The Bergmann Group, Jaco, Inc., AFC Industries, Inc., InterMetro Industries Corporation, Ergotron, Inc., and Medline Industries, Inc. |

| Segments Covered | By Product, By Material, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Some of the leading players in the medical carts market include

- ITD GmbH

- Midmark Corporation

- Omnicell, Inc.

- Armstrong Medical Industries, Inc.

- The Bergmann Group

- Jaco, Inc.

- AFC Industries, Inc.

- InterMetro Industries Corporation

- Ergotron, Inc.

- and Medline Industries, Inc.

This report segments the global medical carts market as follows:

By Product Segments

-

Mobile Computing Carts

- Telemedicine Carts

- Computer Carts

- Medication Carts

- Documentation Carts

- Medical Carts

- Anesthesia Carts

- Procedure Carts

- Emergency Carts

- Other Carts

- Wall Mount Workstations

- Wall Arm Workstations

- Wall Cabinet Workstations

- Medical Cart Accessories

By Material Segments

- Metal

- Plastic

- Wood

By End-User Segments

- Hospitals

- Nursing Homes and Long-Term Care Centers

- Physician Offices or Clinics

- Others

By Regional Segments

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- The Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed