Loose Leaf Tea Market Size, Share, Trends, Growth & Forecast 2034

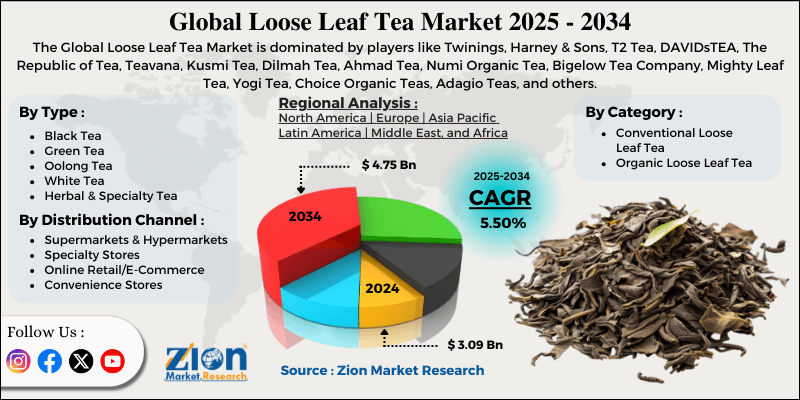

Loose Leaf Tea Market By Type (Black Tea, Green Tea, Oolong Tea, White Tea, Herbal & Specialty Tea), By Category (Conventional Loose Leaf Tea, Organic Loose Leaf Tea), By Distribution Channel (Supermarkets & Hypermarkets, Specialty Stores, Online Retail/E-Commerce, Convenience Stores, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

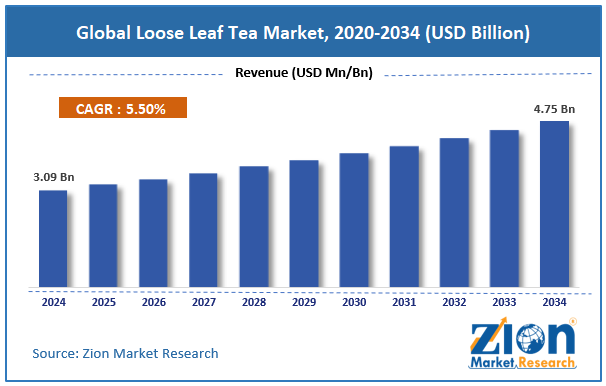

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 3.09 Billion | USD 4.75 Billion | 5.50% | 2024 |

Loose Leaf Tea Industry Perspective:

The global loose leaf tea market size was approximately USD 3.09 billion in 2024 and is projected to reach around USD 4.75 billion by 2034, with a compound annual growth rate (CAGR) of approximately 5.50% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global loose leaf tea market is estimated to grow annually at a CAGR of around 5.50% over the forecast period (2025-2034)

- In terms of revenue, the global loose leaf tea market size was valued at around USD 3.09 billion in 2024 and is projected to reach USD 4.75 billion by 2034.

- The loose leaf tea market is projected to grow significantly due to the rising awareness of health and wellness benefits, the growing café and tea shop culture worldwide, and innovations in flavors and blends.

- Based on type, the black tea segment is expected to lead the market, while the green tea segment is expected to grow considerably.

- Based on category, the conventional loose leaf tea segment is the largest, while the organic loose leaf tea segment is projected to experience substantial revenue growth over the forecast period.

- Based on the distribution channel, the supermarkets & hypermarkets segment is expected to lead the market compared to the specialty stores segment.

- Based on region, the Asia Pacific is projected to dominate the global market during the estimated period, followed by Europe.

Loose Leaf Tea Market: Overview

Loose-leaf tea is partially broken or whole tea leaves that are not confined to customary tea bags, offering a more aromatic, fresher, and higher-quality brew. Unlike bagged tea, it enables the leaves to fully expand during steeping, releasing essential oils, more decadent flavors, and antioxidants. The global loose leaf tea market is poised for significant growth, driven by increasing health and wellness awareness, premiumization, a shift in taste preferences, and the rise of cafés and specialty tea shops. Consumers are actively inclining towards beverages rich in antioxidants, catechins, and polyphenols. Loose-leaf tea is considered a healthier alternative to coffee and soft drinks, thereby fueling its demand. The growing demand for artisanal and premium beverages is surging interest in loose-leaf tea.

Unlike tea bags, it offers a quality and rich flavor, supported by consumer willingness to pay more for a premium experience. This trend is exceptionally robust in urban centers where lea lounges and specialty cafés flourish. Moreover, tea-focused cafés, luxury tea brands, and boutique shops are on the rise worldwide, offering curated experiences for loose-leaf tea. Leading companies like DAVIDsTEA and Teavana underscore their cultural heritage and unique blends, motivating consumers to discover beyond mass-market choices.

Nevertheless, the global market faces limitations due to factors such as lower convenience than tea bags and supply chain issues. Consumers find loose-leaf tea less convenient since it requires longer preparation time and more brewing accessories. The new preference for 'on-the-go' drinks may restrict this industry's growth. Since loose-leaf tea often relies on small-scale growers, inconsistent quality, supply chain disruptions, and seasonal dependencies introduce complexities. Climate change is also negatively impacting tea-growing regions, such as Sri Lanka and India.

Still, the global loose leaf tea industry benefits from several favorable factors, including the growth of subscription boxes, the increasing demand for organic teas, and the rise of wellness and functional-infused, fair-trade teas. Direct-to-consumer platforms and subscription models offer substantial growth potential. Curated tea experiences and doorstep delivery improve industry reach.

Rising consumer preference for clean-label and sustainable products creates opportunities for organic loose-leaf tea companies. Certifications help tap into eco-conscious and premium domains. Furthermore, infusions with adaptogens, superfoods, and botanicals offer fresh revenue streams. Brands offering stress-relieving or immunity-boosting blends support the worldwide wellness trends.

Loose Leaf Tea Market: Growth Drivers

Premiumization & specialty tea demand fuel the market growth

Premiumization is yet another key propeller as consumers are actively moving towards single-origin, specialty, and artisanal teas. Loose-leaf tea offers a richer taste, authenticity, and aroma than mass-produced CTC teas, motivating buyers to pay high prices for unique flavors. Provenance storytelling, small-batch harvest teas, and estate-grown branding are gaining prominence, especially in Europe and North America. This premium trend enables tea companies to maintain higher margins and differentiate themselves in a strong and competitive market.

How do sustainability & ethical sourcing trends propel the loose leaf tea industry growth?

Sustainability has become a central driver for the loose leaf tea market, as modern users increasingly prefer environmentally responsible and ethically sourced products. Loose-leaf tea brands are adopting fair-trade certifications, carbon-neutral practices, and organic labels to appeal to eco-conscious consumers. Ethical sourcing not just enhances brand reputation, but also promises better livelihoods for tea growers. Several companies are utilizing QR code traceability and blockchain to improve the transparency in their supply chains. As environmental concerns grow worldwide, the sustainability movement continues to enhance consumer loyalty and justify premium price points for high-quality teas.

Loose Leaf Tea Market: Restraints

How do unstable supply chains and climate change adversely impact the loose leaf tea market progress?

Loose-leaf tea production heavily relies on stable climate conditions, but extreme weather events are negatively impacting production in the key growing areas. Droughts in Kenya, erratic monsoon rains in Sri Lanka, and heavy floods in Assam have notably dropped crop quality and decreased harvest volumes. Kenyan media reported that prolonged droughts led to a significant decline in national tea production in early 2024, resulting in a substantial increase in auction prices. These supply chain disturbances lead to price instability, making it increasingly difficult for loose-leaf tea companies to maintain consistent affordability and quality.

Loose Leaf Tea Market: Opportunities

How do flavor innovation and product diversification offer advantageous conditions for the development of the loose leaf tea market?

The surging interest in cultural blends and diverse flavors presents opportunities for tea advancement, influencing the growth of the loose leaf tea industry. Leading companies are experimenting with fusions such as spiced blends, fruit infusions, tea-based wellness tonics, and floral teas. Limited-edition culturally inspired infusions and seasonal flavors (for example, Moroccan mint, Japanese matcha, and Indian Masala Chai) are appealing to young demographics. This trend aligns with the premium pricing while broadening the traction of loose-leaf teas in non-traditional regions.

Loose Leaf Tea Market: Challenges

The high cost of premium certifications limits the market growth

Obtaining organic, sustainable, and fair-trade certifications can be time-consuming and costly, especially for small-scale farmers. Certification fees can run into thousands of dollars per year, excluding audit and infrastructure costs. Small producers without certification struggle to access high-value export markets in North America and Europe. This imbalance restricts the growth and inclusivity of ethically ranked loose-leaf teas.

Loose Leaf Tea Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Loose Leaf Tea Market |

| Market Size in 2024 | USD 3.09 Billion |

| Market Forecast in 2034 | USD 4.75 Billion |

| Growth Rate | CAGR of 5.50% |

| Number of Pages | 213 |

| Key Companies Covered | Twinings, Harney & Sons, T2 Tea, DAVIDsTEA, The Republic of Tea, Teavana, Kusmi Tea, Dilmah Tea, Ahmad Tea, Numi Organic Tea, Bigelow Tea Company, Mighty Leaf Tea, Yogi Tea, Choice Organic Teas, Adagio Teas, and others. |

| Segments Covered | By Type, By Category, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Loose Leaf Tea Market: Segmentation

The global loose-leaf tea market is segmented based on type, category, distribution channel, and region.

Based on type, the global loose leaf tea industry is divided into black tea, green tea, oolong tea, white tea, and herbal & specialty tea. The black tea segment holds a leadership position in the market, accounting for the highest global tea consumption. Its prominence is rooted in cultural traditions in North America, the Asia-Pacific region, and Europe, where black tea is typically consumed on a daily basis. Renowned for its intense flavor, versatility in blends, and high caffeine content, it remains a staple in both the foodservice and household sectors.

Based on category, the global loose leaf tea market is segmented into conventional loose leaf tea and organic loose leaf tea. The conventional loose leaf segment held a dominant share due to its wide availability, well-established consumer base, and affordability. It dominates in price-sensitive regions, such as Africa and the Asia Pacific, where tea is a staple drink consumed daily. Well-established supply chains, large-scale production, and low retail prices increase its accessibility for mass consumers. Despite growing interest in organic teas, traditional loose-leaf tea is still prominent worldwide.

Based on distribution channel, the global market is segmented as supermarkets & hypermarkets, specialty stores, online retail/e-commerce, convenience stores, and others. The supermarkets & hypermarkets segment captured a substantial share of the market. These outlets offer consumers a broad variety, trusted quality, and competitive pricing, increasing their preference. In developing regions, they serve as one-stop destinations for grocery shopping, where these teas are prominently featured. The prominence of this channel is supported by its substantial global presence, consumer preference for in-store purchases, and bulk buying capabilities.

Loose Leaf Tea Market: Regional Analysis

What gives Asia Pacific a competitive edge in the global Loose Leaf Tea Market?

The Asia Pacific is projected to maintain its dominant position in the global loose leaf tea market, owing to its strong tea production base, deep-rooted cultural consumption, and growing disposable income. The Asia Pacific region holds a leading position in tea production, with economies such as Sri Lanka, China, and India accounting for over 75% of the global tea output. These economies supply international and domestic markets with premium loose-leaf tea varieties. The numerous plantations promise worldwide leadership in supply and cost efficiency. Tea drinking is an integral part of daily life in the APAC region, making it the leading consumer base. India and China together consume more than 60% of the worldwide tea, with loose leaf variety being the traditional preference. This legacy promises resilient and consistent demand in demographics.

Furthermore, the growing middle-class populations in China, India, and Southeast Asia are driving the demand for specialty and premium loose-leaf tea. Urbanization also aligns with the growth of café culture and the adoption of premium products.

Europe maintains its position as the second-largest region in the global loose leaf tea industry, driven by strong tea consumption, growing demand for specialty and premium teas, and increasing health and wellness trends. Europe has a long-standing tea culture, with economies like Russia, the UK, and Turkey holding the largest share of tea consumers. For instance, Turkey, among others, leads the way, registering more than 3 kg of tea per person annually. Loose-leaf tea, mainly herbal and black blends, is a daily staple in the majority of households on the continent.

Moreover, European consumers are increasingly opting for artisanal and high-quality teas. In Germany alone, specialty tea sales registered for more than 60% of tea revenue, underscoring the preference for loose-leaf tea over traditional tea bags. This trend is fueled by wellness, premiumization, and experimentation with different flavors.

Additionally, loose-leaf tea and herbal teas are experiencing rapid growth due to increasing health awareness in the region. The European herbal tea market reached $2.5 billion in 2023, indicating robust consumer interest in antioxidant-rich and naturally sourced products. This supports Europe's broader adoption of organic and clean-label products.

Loose Leaf Tea Market: Competitive Analysis

The leading players in the global loose leaf tea market are:

- Twinings

- Harney & Sons

- T2 Tea

- DAVIDsTEA

- The Republic of Tea

- Teavana

- Kusmi Tea

- Dilmah Tea

- Ahmad Tea

- Numi Organic Tea

- Bigelow Tea Company

- Mighty Leaf Tea

- Yogi Tea

- Choice Organic Teas

- Adagio Teas

Loose Leaf Tea Market: Key Market Trends

Growth of sustainable and organic teas:

Sustainability is transforming consumer choices, with a rising demand for fair-trade, organic, and eco-friendly loose-leaf teas. Brands are actively adopting biodegradable packaging and marketing chemical-free farming to support green consumerism.

Expansion of wellness and functional teas:

Loose-leaf teas infused with botanicals, herbs, and adaptogens are gaining prominence for their health benefits. Blends targeting stress relief, digestive health, and immunity are in exceptionally high demand following the pandemic.

The global loose leaf tea market is segmented as follows:

By Type

- Black Tea

- Green Tea

- Oolong Tea

- White Tea

- Herbal & Specialty Tea

By Category

- Conventional Loose Leaf Tea

- Organic Loose Leaf Tea

By Distribution Channel

- Supermarkets & Hypermarkets

- Specialty Stores

- Online Retail/E-Commerce

- Convenience Stores

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Loose-leaf tea is partially broken or whole tea leaves that are not confined to customary tea bags, offering a more aromatic, fresher, and higher-quality brew. Unlike bagged tea, it enables the leaves to fully expand during steeping, releasing essential oils, more decadent flavors, and antioxidants.

The global loose leaf tea market is projected to grow due to rising consumer preferences for specialty and premium teas, increasing disposable incomes in emerging economies, and the growing prominence of handcrafted and artisanal beverages.

According to study, the global loose leaf tea market size was worth around USD 3.09 billion in 2024 and is predicted to grow to around USD 4.75 billion by 2034.

The CAGR value of the loose leaf tea market is expected to be around 5.50% during the period 2025-2034.

The conventional loose-leaf tea segment is expected to dominate the global loose-leaf tea market by 2034, due to its widespread availability, affordability, and strong consumption base in developing regions.

Regulatory and environmental factors affecting the loose leaf tea market include strict quality and pesticide regulations, climate change impacts on tea-growing regions, and organic certification requirements, which can affect supply consistency and increase production costs.

Asia Pacific is expected to lead the global loose leaf tea market during the forecast period.

China is a leading contributor to the global loose leaf tea market, being the largest exporter and producer of premium teas, including black, green, and specialty varieties.

The key players profiled in the global loose leaf tea market include Twinings, Harney & Sons, T2 Tea, DAVIDsTEA, The Republic of Tea, Teavana, Kusmi Tea, Dilmah Tea, Ahmad Tea, Numi Organic Tea, Bigelow Tea Company, Mighty Leaf Tea, Yogi Tea, Choice Organic Teas, and Adagio Teas.

The report examines key aspects of the loose leaf tea market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed