Iron Chromium Flow Battery Market Size, Share, Trends, Growth 2034

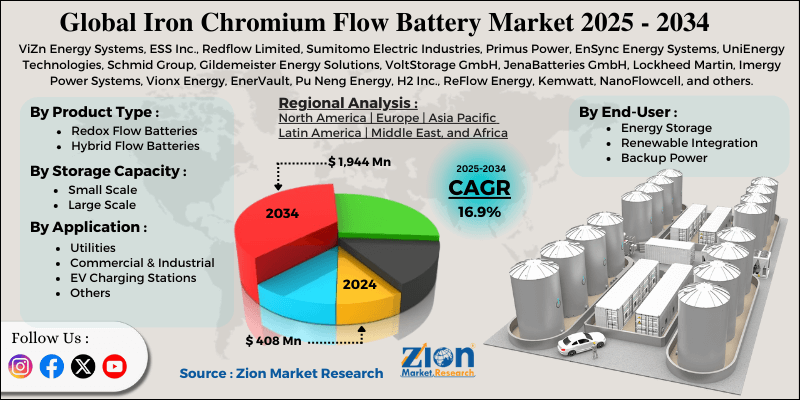

Iron Chromium Flow Battery Market By Product Type (Redox Flow Batteries and Hybrid Flow Batteries), By Application (Utilities, Commercial & Industrial, EV Charging Stations, and Others), By Storage Capacity (Small Scale and Large Scale), By End-User (Energy Storage, Renewable Integration, Backup Power, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

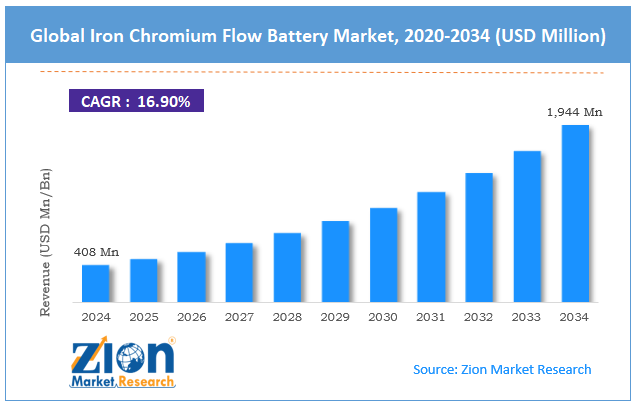

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 408 Million | USD 1944 Million | 16.9% | 2024 |

Iron Chromium Flow Battery Industry Perspective:

The global iron chromium flow battery market size was worth around USD 408 million in 2024 and is predicted to grow to around USD 1944 million by 2034, with a compound annual growth rate (CAGR) of roughly 16.9% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global iron chromium flow battery market is estimated to grow annually at a CAGR of around 16.9% over the forecast period (2025-2034).

- In terms of revenue, the global iron chromium flow battery market size was valued at around USD 408 million in 2024 and is projected to reach USD 1944 million by 2034.

- The growing adoption of EVs globally is expected to drive the iron chromium flow battery market over the forecast period.

- Based on the product type, the redox flow batteries segment is expected to capture the largest market share over the projected period.

- Based on the application, the EV charging stations segment is expected to capture the largest market share over the projected period.

- Based on the storage capacity, the large-scale segment is expected to capture the largest market share over the projected period.

- Based on the end-user, the energy storage segment is expected to capture the largest market share over the projected period.

- Based on region, North America is expected to dominate the market during the forecast period.

Iron Chromium Flow Battery Market: Overview

An Iron Chromium Flow Battery is a type of redox flow battery that uses electrochemical interactions between iron (Fe) and chromium (Cr) ions in liquid electrolytes to store and release energy. During charging and discharging, electrolytes are kept in tanks outside the cell stack and pushed through the stack. ICFBs don't hold as much energy as lithium-ion batteries, but they last far longer, are safer on their own, and are better for the environment. This makes them great for long-term storage that doesn't move.

Also, newer versions include additives such as LiCl to improve performance and enable operation at ambient temperature with efficiencies above 80%. The iron chromium flow battery market is being driven by several factors, including the adoption of renewable energy & need for long-duration storage, material cost and abundance advantages, safety, durability & long cycle life, and government policies, energy transition & grid modernization. However, the high initial capital cost poses a major challenge to industry expansion.

Iron Chromium Flow Battery Market Dynamics

Growth Drivers

How do the adoption of renewable energy & need for long-duration storage drive the growth of the iron-chromium flow battery market?

The iron chromium flow battery market is growing rapidly as more people adopt renewable energy sources that require long-term energy storage. As the world moves toward more wind and solar power generation, with a goal of over 1,000 GW of renewable capacity by 2030, the fact that these sources only work sometimes makes it very important to have energy storage solutions that are efficient, scalable, and reliable. These solutions should be able to store extra energy and release it when demand is high or generation is low. The costs of making things are going down, and ongoing technological advances that make energy storage more efficient and denser help compete with other types of storage, such as lithium-ion and vanadium flow batteries.

Restraints

High initial capital cost impedes the market growth

The iron chromium flow battery market is not growing as quickly as it could because the high initial capital cost is a significant barrier to buyers. This is especially true in sectors or applications where budgets are tight or short-term financial concerns are the primary factor in decision-making. The overall capital expenditure (CAPEX) for ICFB systems includes costs for electrolytes, electrochemical cell stacks, pumps, membranes, balance-of-plant equipment, and installation infrastructure. Iron and chromium are inexpensive and readily available compared to other battery chemistries. However, the complex engineering required for cell stack design, ion-exchange membranes, and system integration makes the overall setup costs higher than those of traditional batteries such as lead-acid or lithium-ion.

Opportunities

How do the government policies, energy transition & grid modernization contribute to the iron chromium flow battery industry growth?

Government policies, energy transition initiatives, and grid modernization efforts present significant opportunities for the growth of the iron chromium flow battery market for a variety of reasons, including the fact that many governments around the world are implementing supportive policies, subsidies, tax credits, and regulatory frameworks to encourage renewable energy deployment and energy storage adoption. These financial incentives make ICFB initiatives cheaper by reducing their initial costs and increasing their likelihood of success.

Policies that aim to lower carbon emissions and achieve clean energy objectives also encourage people to invest in long-term energy storage systems, which are essential for integrating intermittent renewables such as solar and wind. There are also specific programs that support the research, development, and deployment of ICFB technology by focusing on battery development and the development of new clean technologies. This leads to market growth and the sale of goods.

Challenges

Why does the competition from established storage technologies pose a major challenge to the iron chromium flow battery market expansion?

Established energy storage technologies pose a significant challenge to the growth of the iron chromium flow battery market. This is because they are more mature, perform better, are more widely used, and offer other advantages over technologies such as lithium-ion, vanadium redox flow batteries, and lead-acid systems. Lithium-ion batteries have been used in business for a long time. They have well-established supply chains, manufacturing capacities, and a wide range of uses, including portable devices, electric cars, and grid storage. This maturity builds trust in consumers and keeps the market stable, which new ICFB solutions must do.

Iron Chromium Flow Battery Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Iron Chromium Flow Battery Market |

| Market Size in 2024 | USD 408 Million |

| Market Forecast in 2034 | USD 1,944 Million |

| Growth Rate | CAGR of 16.9% |

| Number of Pages | 212 |

| Key Companies Covered | ViZn Energy Systems, ESS Inc., Redflow Limited, Sumitomo Electric Industries, Primus Power, EnSync Energy Systems, UniEnergy Technologies, Schmid Group, Gildemeister Energy Solutions, VoltStorage GmbH, JenaBatteries GmbH, Lockheed Martin, Imergy Power Systems, Vionx Energy, EnerVault, Pu Neng Energy, H2 Inc., ReFlow Energy, Kemwatt, NanoFlowcell, and others. |

| Segments Covered | By Product Type, By Application, By Storage Capacity, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Iron Chromium Flow Battery Market: Segmentation

The global iron chromium flow battery industry is segmented based on product type, application, storage capacity, end-user, and region.

Based on product type, the global iron chromium flow battery market is bifurcated into redox flow batteries and hybrid flow batteries. The redox flow batteries segment is expected to capture the largest market share over the projected period. The increasing use of intermittent renewable energy sources such as wind and solar generates an urgent need for scalable, dependable long-duration storage systems. Iron-chromium flow batteries provide multi-hour discharge capacity that is consistent with grid requirements for stable and dispatchable electricity. Furthermore, ICFBs use available, low-cost minerals like iron and chromium, making them a more cost-effective and environmentally friendly alternative to vanadium or lithium-based flow batteries, increasing their industrial appeal.

Based on application, the global iron chromium flow battery industry is bifurcated into utilities, commercial & industrial, EV charging stations, and others. The EV charging stations segment holds the major market share. ICFBs provide long-duration energy storage, helping smooth peak demand from fast EV chargers, reducing grid stress, and cutting charging network operating costs.

Based on the storage capacity, the global iron chromium flow battery market is bifurcated into small scale and large scale. The large scale is expected to hold the largest market share over the projected period. As more solar and wind farms are built, they require energy storage systems capable of long-term storage (from a few hours to a few days) to balance the grid's needs with the electricity supply. ICFBs with electrolyte volumes that can be easily increased satisfy these criteria.

Based on the end-user, the global iron chromium flow battery industry is bifurcated into energy storage, renewable integration, backup power, and others. The energy storage segment captures the largest revenue share. This growth is part of the wider global flow battery market, which is expected to expand rapidly due to the adoption of redox flow battery technologies catering to large-scale energy storage needs.

Iron Chromium Flow Battery Market: Regional Analysis

Why does North America dominate the iron chromium flow battery market over the projected period?

The North America region is expected to dominate the Iron chromium flow battery market. The US and Canada are at the forefront of projects that combine renewable energy sources with energy storage. There is a growing need for iron-chromium flow batteries in North America, as people increasingly seek to use renewable energy sources and maintain grid stability. The industry can thrive in this field because major corporations are active in the market, and research and development projects are ongoing.

Also, the Asia Pacific region would develop the fastest over the forecast period, as countries like China and India are using more energy and modernizing rapidly. As the population and industry in the area grow, it becomes increasingly important to have reliable and efficient ways to store energy. China is spending heavily on renewable energy projects and energy storage technology to meet its energy needs without relying on as many fossil fuels. The need for solutions to keep the grid stable and the growing use of renewable energy sources are two significant drivers of the market's development in the Asia Pacific.

Iron Chromium Flow Battery Market: Competitive Analysis

The global iron chromium flow battery market is dominated by players like:

- ViZn Energy Systems

- ESS Inc.

- Redflow Limited

- Sumitomo Electric Industries

- Primus Power

- EnSync Energy Systems

- UniEnergy Technologies

- Schmid Group

- Gildemeister Energy Solutions

- VoltStorage GmbH

- JenaBatteries GmbH

- Lockheed Martin

- Imergy Power Systems

- Vionx Energy

- EnerVault

- Pu Neng Energy

- H2 Inc.

- ReFlow Energy

- Kemwatt

- NanoFlowcell

The global iron chromium flow battery market is segmented as follows:

By Product Type

- Redox Flow Batteries

- Hybrid Flow Batteries

By Application

- Utilities

- Commercial & Industrial

- EV Charging Stations

- Others

By Storage Capacity

- Small Scale

- Large Scale

By End-User

- Energy Storage

- Renewable Integration

- Backup Power

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

An Iron Chromium Flow Battery is a type of redox flow battery that uses electrochemical interactions between iron (Fe) and chromium (Cr) ions in liquid electrolytes to store and release energy.

The iron chromium flow battery market is being driven by several factors, including the adoption of renewable energy & need for long-duration storage, material cost and abundance advantages, safety, durability & long cycle life, and government policies, energy transition & grid modernization.

The high initial capital cost poses a major challenge to the industry expansion.

Based on the product type, the cup style segment is expected to dominate the iron chromium flow battery market growth during the projected period.

The growing investment in advanced technology poses a major impact factor for the iron chromium flow battery industry's growth over the projected period.

According to the report, the global iron chromium flow battery market size was worth around USD 408 million in 2024 and is predicted to grow to around USD 1944 million by 2034.

The global iron chromium flow battery market is expected to grow at a CAGR of 16.9% during the forecast period.

The global iron chromium flow battery industry growth is expected to be driven by the North America region. It is currently the world’s highest revenue-generating market due to the integration of renewable energy.

The global iron chromium flow battery market is dominated by players like ViZn Energy Systems, ESS Inc., Redflow Limited, Sumitomo Electric Industries, Primus Power, EnSync Energy Systems, UniEnergy Technologies, Schmid Group, Gildemeister Energy Solutions, VoltStorage GmbH, JenaBatteries GmbH, Lockheed Martin, Imergy Power Systems, Vionx Energy, EnerVault, Pu Neng Energy, H2 Inc., ReFlow Energy, Kemwatt, and NanoFlowcell, among others.

The market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed