Insulin Delivery Devices Market Trend, Share, Growth, Size and Forecast 2032

Insulin Delivery Devices Market by Product (Insulin Pens, Insulin Syringes, and Insulin Pumps) and Distribution Channel (Diabetes Clinics and Centers, Retail Pharmacy, Hospital Pharmacy, and Online Sales): Global Industry Perspective, Comprehensive Analysis, and Forecast, 2024-2032

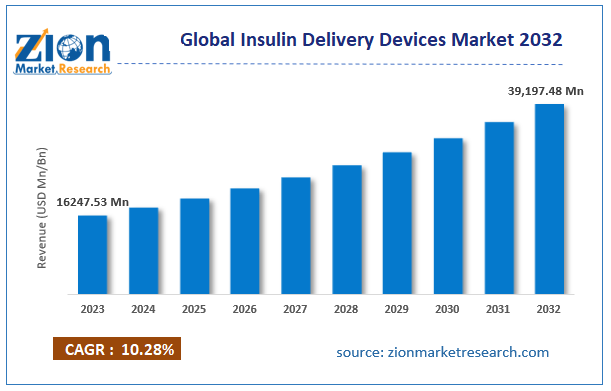

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 16247.53 million | USD 39,197.48 million | 10.28% | 2023 |

Insulin Delivery Devices Industry Perspective:

The global Insulin Delivery Devices market size accrued earnings worth approximately USD 16247.53 Million in 2023 and is predicted to gain revenue of about USD 39,197.48 Million by 2032, is set to record a CAGR of nearly 10.28% over the period from 2024 to 2032.

Key Insights

- As per the analysis shared by our research analyst, the global insulin delivery devices market is estimated to grow annually at a CAGR of around 10.28% over the forecast period (2024-2032).

- In terms of revenue, the global insulin delivery devices market size was valued at around USD 16247.53 Million in 2023 and is projected to reach USD 39,197.48 Million by 2032.

- The growth of the insulin delivery devices market is being driven by the increasing prevalence of diabetes and demand for convenient, accurate insulin administration methods.

- Based on product, the insulin pens segment is growing at a high rate and is projected to dominate the market.

- On the basis of distribution channel, the diabetes clinics and centers segment is projected to swipe the largest market share.

- By region, North America is expected to dominate the global market during the forecast period.

Insulin delivery devices including syringes, pens, pumps, and jet injectors are used to deliver insulin to diabetic patients. One of the foremost factors contributing to the growth of the market is the surging number of diabetics due to aging, obesity, and unhealthy lifestyles. Obesity is believed to be a major factor leading to the development of diabetes in individuals. According to the WHO, in 2014, over 1.9 billion people were identified to be overweight, of which, around 600 million people were obese.

The study includes drivers and restraints for the insulin delivery devices market along with the impact they have on the demand over the forecast period. Additionally, the report includes the study of opportunities available in the insulin delivery devices market on a global as well as regional level.

Insulin Delivery Devices Market Overview

Risk factors, such as obesity and being overweight are highly linked to the incidence of diabetes, which is rising by epidemic proportions, thus rendering a high prevalence of diabetes. Consequently, the large population afflicted with diabetes is driving the market for insulin delivery devices. In addition, the high demand for advanced insulin delivery devices is supporting the adoption of recently launched innovative pen devices and portable pumps, which is estimated to boost the market growth. However, stringent government rules and regulations governing the product approval process and the high cost of insulin analogs in diabetes care management could hinder the market growth.

In order to give the users of this report a comprehensive view of the insulin delivery devices market, we have included a competitive landscape and an analysis of Porter’s Five Forces model for the market. The study encompasses a market attractiveness analysis, wherein Product segment is benchmarked based on their market size, growth rate, and general attractiveness.

Insulin, a peptide hormone, is manufactured by beta cells present in the pancreatic islets. It is regarded as the major anabolic hormone of the human body. It coordinates the metabolism of proteins, fats, and carbohydrates by stimulating the assimilation of carbohydrates, majorly glucose into fat, liver, and skeletal muscle cells from the blood. Insulin helps in maintaining the blood sugar level. If a person’s body is incapable of producing enough insulin or the cells are impervious to insulin effects, then that person might become hyperglycemic (elevated blood sugar).

Diabetes affects the body’s capability to process blood sugar. Gestational diabetes, type 1, and type 2 are three major diabetes types. Gestational diabetes occurs in females during pregnancy. Type 1 diabetes is developed when the body is incapable of producing insulin. People with diabetes type 1 are completely dependent on insulin and have to intake artificial insulin on a daily basis. Type 2 diabetes affects the body’s utilization of insulin. It is the most prevalent diabetes type. Multiple studies have found obesity to be the major cause of type 2 diabetes. Insulin is an essential part of therapy for patients with types 1 and 2 diabetes. Multiple devices are used for insulin delivery, such as including pens, syringes, injectors, and pumps.

Global Insulin Delivery Devices Market

As per the WHO, the diabetic population has grown from 108 million adults in 1980 to approximately 422 million adults in 2014. Furthermore, diabetic prevalence globally has doubled from 4.7% in 1980 to around 8.5% in 2014. According to the latest statistics for the United States of 2017, approximately 30 million people have diabetes, out of which around 24 million patients were diagnosed and around 6 million patients continue to be undiagnosed.

Rise in chronic diseases associated with diabetes, injury recovery time, increase in the demand for insulin transmission products, and growing awareness regarding insulin delivery products are likely to act as major growth driving factors in the global insulin delivery devices market. Furthermore, increase in the occurrences of pediatric and geriatric diabetes, various advantages offered by minimally invasive treatment options, such as pumps, improved functioning and design of insulin devices, unhealthy eating habits, lack of active lifestyle, increasing healthcare expenditure, and increasing research and development activities, are also projected to propel this market’s growth.

Efforts taken by various governments and non-government organizations to increase awareness regarding insulin devices and rapid advancements in the technology are anticipated to act as opportunities for the players operating in the insulin delivery devices market. However, the high cost of insulin devices, the discrepancy in insulin uptake adherence, needle-phobia of many individuals, resistance to self-injection, inadequate per capita expenditure on diabetes, and the absence of insurance and reimbursement in developing regions might restrict the global insulin delivery devices market.

The report provides company market share analysis in order to give a broader overview of the key players in the insulin delivery devices market. In addition, the report also covers key strategic developments of the market including acquisitions & mergers, new product launch, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the insulin delivery devices market on a global and regional basis.

Insulin Delivery Devices Market Growth

The growth in this market is attributed to several factors, including the rising prevalence of diabetes, technological advancements in insulin delivery devices, and increasing awareness about diabetes. Other contributing factors comprise favorable government initiatives and heightened research and development activities. The insulin delivery devices market is expected to witness a steady increase over the forecast period due to various factors. Insulin pumps are projected to lead the market, with North America emerging as the largest market.

Insulin Delivery Devices Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Insulin Delivery Devices Market |

| Market Size in 2023 | USD 16.25 Billion |

| Market Forecast in 2032 | USD 39.20 Billion |

| Growth Rate | CAGR of 10.28% |

| Number of Pages | 194 |

| Key Companies Covered | Novo Nordisk A/S, Sanofi, Eli Lilly and Company, Biocon Ltd., Ypsomed AG, Wockhardt Ltd., Medtronic, Abbott Laboratories, Hoffmann-La Roche, Ltd., Becton, Dickinson, and Company, Other Market Players |

| Segments Covered | By Distribution Channel, By Product, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Insulin Delivery Devices Market Segment Analysis

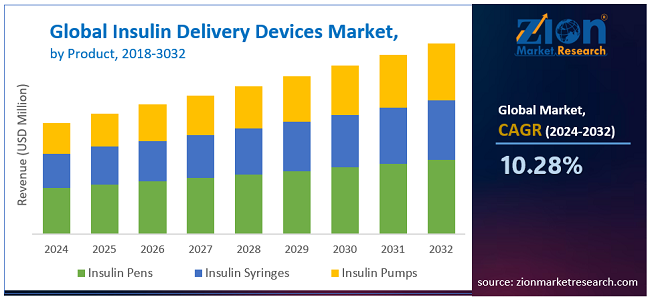

The study provides a decisive view on the insulin delivery devices market by segmenting the market based on product, distribution channel, and region. The segments have been analyzed based on present and future trends and the market is estimated from 2018 to 2024.

Based on the product, the insulin delivery devices market has been segmented into insulin pens, insulin syringes, and insulin pumps. Insulin pens hold the majority share of the product segment, due to increased demand for improved diabetes management and minimally invasive property of pens.

The distribution channel segment has been segmented into diabetes clinics and centers, retail pharmacy, hospital pharmacy, and online sales.

Insulin Delivery Devices Market Regional Analysis

North America holds a dominant position in the market, commanding a market share of 36.9% throughout the forecast period, making it the most lucrative region in the global insulin delivery device market. The substantial growth in North America is driven by the increasing number of diabetic patients and the presence of technologically advanced devices. The Canadian Diabetes Association projects a rise to 5 million diabetics in Canada by 2025, contributing significantly to market expansion. The insulin delivery device market is poised for rapid growth in the Asia Pacific region, particularly in developing economies like China and India. The surge is fueled by the high prevalence of diabetes and a growing public awareness. The entry of international vendors, offering premium diabetic products, is a key factor propelling growth in the Asia Pacific market.

Europe is likely to display substantial growth in the near future, due to increasing healthcare expenditure and rising awareness regarding several diabetic complications. The Asia Pacific is likely to propagate at a speedy rate over the forecast time period. Increasing geriatric population, growing pediatric diabetic population, multiple efforts taken by governments and non-government organizations are likely to boost this market’s growth. Latin America is likely to record a swift growth rate over the estimated time period. The Middle Eastern and African countries are expected to experience noticeable growth in the near future.

The regional segmentation includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa with its further bifurcation into major countries including the U.S. Canada, Germany, France, UK, China, Japan, India, and Brazil. This segmentation includes demand for insulin delivery devices based on individual segments and types in all regions and countries.

Some key players in the global insulin delivery devices market include Eli Lilly and Company, Medtronic plc., B. Braun Melsungen AG, Sanofi S.A., Novo Nordisk A/S, F. Hoffmann-La Roche Ltd., Biocon Ltd., Becton, Dickinson and Company, Valeritas, Inc., MannKind Corporation, and Insulet Corporation, among others.

Insulin Delivery Devices Market Key Players

The report also includes detailed profiles of end players, such as

- Novo Nordisk A/S

- Sanofi

- Eli Lilly and Company

- Biocon Ltd.

- Ypsomed AG

- Wockhardt Ltd.

- Medtronic

- Abbott Laboratories

- Hoffmann-La Roche Ltd.

- Becton

- Dickinson

- and Company

- Other Market Players

This report segments the global insulin delivery devices market as follows:

Global Insulin Delivery Devices Market: By Product

- Insulin Pens

- Insulin Syringes

- Insulin Pumps

Global Insulin Delivery Devices Market: By Distribution Channel

- Diabetes Clinics and Centers

- Retail Pharmacy

- Hospital Pharmacy

- Online Sales

Insulin Delivery Devices Market: By Region

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

List of Contents

Industry Perspective:Key InsightsMarket OverviewGlobal MarketInsulin DeliveryDevices Market GrowthInsulin DeliveryDevices Report ScopeInsulin DeliveryDevices Market Segment AnalysisInsulin DeliveryDevices Market Key PlayersThis report segments the global insulin delivery devices market as follows:RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed