Glyphosate Market Size, Share, Sales, Trends, Forecast, 2032

Glyphosate Market - By Application (Conventional Crops, Genetically Modified Crops), and By Region: Global Industry Perspective, Market Size, Statistical Research, Market Intelligence, Comprehensive Analysis, Historical Trends, and Forecasts, 2024-2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 11.18 Billion | USD 19.04 Billion | 6.10% | 2023 |

Glyphosate Market: Industry Perspective

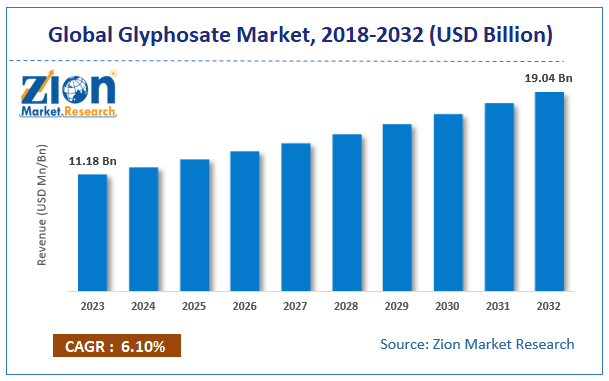

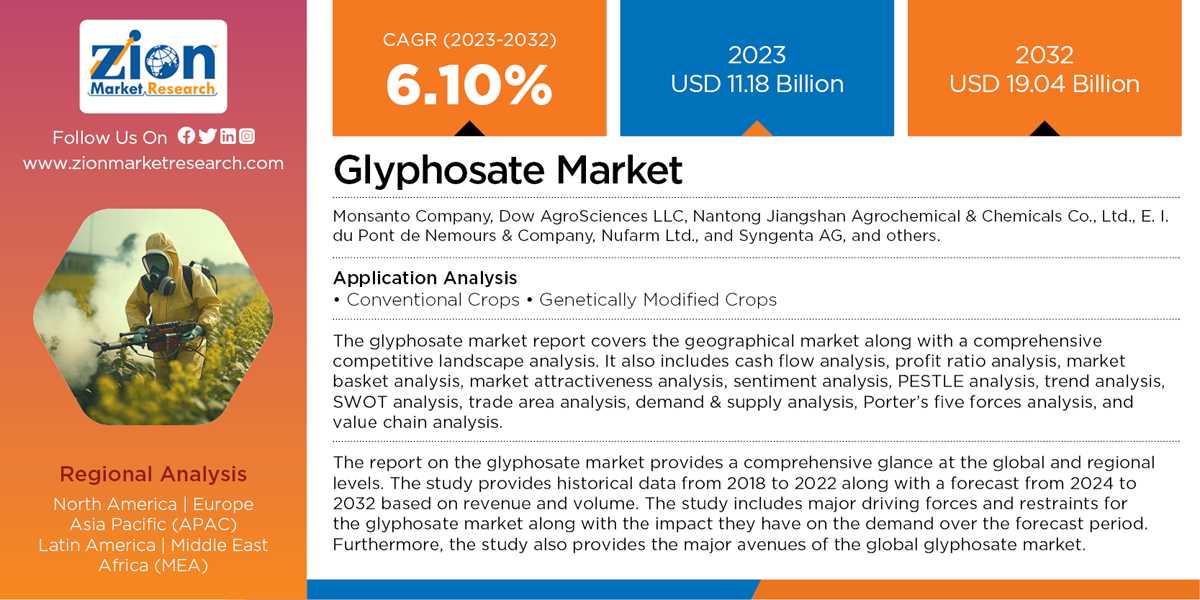

The global glyphosate market size was worth around USD 11.18 billion in 2023 and is predicted to grow to around USD 19.04 billion by 2032 with a compound annual growth rate (CAGR) of roughly 6.10% between 2024 and 2032. The report on the glyphosate market provides a comprehensive glance at the global and regional levels. The study provides historical data from 2018 to 2022 along with a forecast from 2024 to 2032 based on revenue and volume.

Glyphosate Market: Overview

Glyphosate has herbicide properties which are used to destroy or control the unwanted plants present in the agricultural lands. It is used as non-selective herbicides, i.e., total weed killers. It can find a broad spectrum of applications such as to clear waste ground, railway embankments, industrial and construction sites, etc. Glyphosate is one of the most preferred herbicides among farmers. The prime use of glyphosate in the U.S. is done in agriculture and then in home and garden. Moreover, growing demand for glyphosate especially for agricultural purposes across the globe is likely to witness a significant growth over the upcoming years.

The global glyphosate market is primarily driven by growing demand for glyphosate in agricultural applications across the globe. Secondly, growing demand for genetically modified (GM) crops is expected to propel the market size of glyphosate over the coming years. However, stringent rules and regulations on the usage of glyphosate may impede the growth of the market. Nonetheless, immense demand for genetically modified crops especially in emerging countries such as India and China is likely to spur the profit margin of the major players in the glyphosate market during the forthcoming years.

The study includes major driving forces and restraints for the glyphosate market along with the impact they have on the demand over the forecast period. Furthermore, the study also provides the major avenues of the global glyphosate market.

The global glyphosate market study also comprises a detailed value chain analysis to provide a comprehensive view of the market. Moreover, the study also includes Porter’s Five Forces model for glyphosate, to understand the competitive landscape of the global market. The study includes a market attractiveness analysis of all the segments related to the market.

Glyphosate Market: Segmentation

The study provides a significant view of the global glyphosate market by classifying it into application and region segmentation. These segments have been estimated and forecasted with the future and past trends.

Based on diverse applications, the global glyphosate market is segmented into conventional crops and genetically modified crop applications. Among these two, the conventional crop application segment was leading the global glyphosate market in 2023. However, in order to achieve good yield, the growth of the unwanted weeds and plants in the field should be reduced. Hence, there is a great demand for glyphosate herbicide before sowing the crops. Moreover, genetically modified crops segment is projected to be the fastest growing application within the forecast period owing to the surging adoption rate of GM crops in developing countries such as China, India, and Brazil.

Glyphosate Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Glyphosate Market |

| Market Size in 2023 | USD 11.18 Billion |

| Market Forecast in 2032 | USD 19.04 Billion |

| Growth Rate | CAGR of 6.10% |

| Number of Pages | 215 |

| Key Companies Covered | Monsanto Company, Dow AgroSciences LLC, Nantong Jiangshan Agrochemical & Chemicals Co., Ltd., E. I. du Pont de Nemours & Company, Nufarm Ltd., and Syngenta AG, and others. |

| Segments Covered | By Application, and Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Glyphosate Market: Regional Analysis

The regional segmentation includes the Middle East & Africa, Asia Pacific, Europe, Latin America, and North America. Furthermore, it is bifurcated into major countries such as the U.S., UK, Germany, France, China, India, Japan, and Brazil, among others.

In terms of geographies, Asia Pacific was the largest market for glyphosate in 2023. Surging demand for glyphosate for agricultural purposes is likely to bolster the market growth in the region over the years to come. The Asia Pacific was followed by North America and Europe in the same year. Surging penetration of genetically modified crops is expected to boost the demand for glyphosate globally in the near future. Moreover, Asia Pacific is expected to be the fastest growing market of glyphosate within the forecast period owing to the availability of arable land in countries such as China, India, Korea, Thailand, etc. On the other hand, China is a major consumer and producer of glyphosate in the region and is expected to grow at a significant CAGR within the forecast period.

Glyphosate Market: Competitive Analysis

The global glyphosate market is dominated by players like:

- Monsanto Company

- Dow AgroSciences LLC

- Nantong Jiangshan Agrochemical & Chemicals Co., Ltd.

- E. I. du Pont de Nemours & Company

- Nufarm Ltd.

- Syngenta AG

This report segments the global glyphosate market as follows:

Global Glyphosate Market: Application Analysis

- Conventional Crops

- Genetically Modified Crops

Global Glyphosate Market: Regional Analysis

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Glyphosate is a chemical that can enhance weed resistance qualities. It is mostly utilized as a herbicide in a variety of settings, including agriculture, horticulture, floriculture, gardening, building sites, and grounds maintenance.

According to a study, the global glyphosate market size was worth around USD 11.18 billion in 2023 and is expected to reach USD 19.04 billion by 2032.

The global glyphosate market is expected to grow at a CAGR of 6.10% during the forecast period.

Asia Pacific is expected to dominate the glyphosate market over the forecast period.

Leading players in the global glyphosate market include Monsanto Company, Dow AgroSciences LLC, Nantong Jiangshan Agrochemical & Chemicals Co., Ltd., E. I. du Pont de Nemours & Company, Nufarm Ltd., and Syngenta AG, among others.

The glyphosate market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed