Gluten Free Food Market Size, Share, Trends, Growth & Forecast 2034

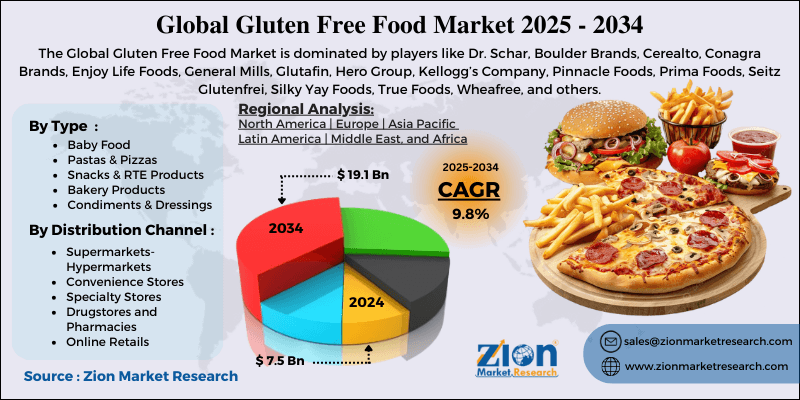

Gluten Free Food Market By Type (Baby Food, Pastas & Pizzas, Snacks & RTE Products, Bakery Products, and Condiments & Dressings), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Drugstores and Pharmacies, and Online Retails), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

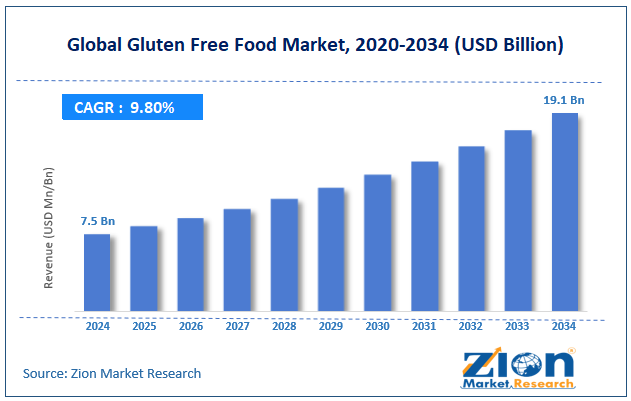

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 7.5 Billion | USD 19.1 Billion | 9.8% | 2024 |

Gluten Free Food Industry Perspective:

The global gluten free food market size was worth around USD 7.5 billion in 2024 and is predicted to grow to around USD 19.1 billion by 2034, with a compound annual growth rate (CAGR) of roughly 9.8% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global gluten free food market is estimated to grow annually at a CAGR of around 9.8% over the forecast period (2025-2034).

- In terms of revenue, the global gluten free food market size was valued at around USD 7.5 billion in 2024 and is projected to reach USD 19.1 billion by 2034.

- The rising health awareness among the population is expected to drive the gluten free food market over the forecast period.

- Based on the type, the bakery product segment is expected to hold the largest market share over the forecast period.

- Based on the distribution channel, the convenience stores segment is expected to dominate the market over the projected period.

- Based on region, North America is expected to dominate the market during the forecast period.

Gluten Free Food Market: Overview

The gluten-free food is defined as the food that doesn’t contain gluten. The main source of gluten includes wheat, rye, and barley, which are proteins. This includes fruits, vegetables, meat, and fish that don't naturally contain gluten, as well as processed gluten-free foods such as breads and pastas designed for individuals who can't eat gluten. Consuming gluten-free foods is the primary method for treating celiac disease and protecting the small intestine. The gluten free food market is growing due to several reasons, which include the increasing awareness among the population of gluten-related disorders, trends related to health and wellness, and innovation in products and ingredients. However, the high cost of production and distribution poses a major challenge to the industry's growth.

Gluten Free Food Market: Growth Drivers

Why does the rising incidence of gluten intolerance drive the gluten free food market growth?

Food allergies have become a global public health and food safety issue and are now referred to as the "second wave" of the allergy-based epidemic. People have known about food sensitivities and allergies for a long time. Their frequency has significantly risen in recent years in both industrialized and developing countries. Gluten intolerance is one of the most common dietary sensitivities that people throughout the world have. The rapid change in eating habits is probably the main reason why there are more celiac sufferers.

In the last few years, people's eating habits have changed a lot, as they like packaged processed foods more. Ultra-processed foods are very popular these days since they last a long time on the shelf and are easy to use. The key ingredients in these items are rye, barley, and wheat, which are also the primary sources of gluten, helping to keep the items stable and thick. Because of this, eating a lot of processed foods like snacks can make people sensitive to gluten, which makes them want gluten-free options even more.

Gluten Free Food Market: Restraints

How high production & retail costs hinder the growth of the gluten free food market?

The gluten free food industry has substantially higher production and retail pricing than regular gluten-containing foods. This is because the ingredients are expensive, testing standards are strict, the supply chain is complicated, and economies of scale are reduced. Core gluten-free foods like quinoa, amaranth, millet, and certified oats are more expensive and harder to get than wheat. This is because they are only available at certain times of the year and must be sourced carefully to avoid cross-contamination. Producers have to pay more for supplies, and small and medium-sized firms are hit the most by unreliable supply chains and a lack of ingredients. Also, specialized facilities, quality controls, and regular batch testing for gluten contamination all add to the cost of making things.

Gluten Free Food Market: Opportunities

How does the expansion in the key players' portfolio offer a potential opportunity for the gluten free food industry growth?

The expansion in the key players' portfolio is expected to offer a potential opportunity for gluten free food market. For instance, in May 2025, Kameda LT Foods is a joint venture between LT Foods, a global FMCG company based in India that sells consumer food, and Kameda Seika, a leading Rice Cracker and Rice Innovation company in Japan. They are expanding their line of roasted gluten-free snacks under the brand Kari Kari with the release of a new product called "Krispy Hopu" in the happy flavor "Sweet and Salty." The product is one of a kind and specifically designed for individuals who crave tasty, gluten-free, vegan snacks that are also not fried. The new roasted rice-based snack features a unique "Happy Flavor" that mixes sweet, salty, and umami flavors in every crispy bite.

Gluten Free Food Market: Challenges

Why does the risk of cross-contamination pose a major challenge to market expansion?

People with celiac disease or gluten sensitivity need to be extra careful about cross-contamination at every step of making, preparing, and selling food. Gluten can readily get into gluten-free dishes when people share kitchens, utensils, and appliances like toasters, ovens, and cutting boards.

Additionally, bulk bins, deli counters, and salad bars pose a significant risk since people often use the same scoops, spill, and tools when switching between gluten-free and gluten-containing products. Also, cooking gluten-free pasta in water that had been used to boil wheat-based pasta could render the food too unclean to eat. Thus, the cross-contamination poses a major challenge to the gluten free food market.

Gluten Free Food Market : Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Gluten Free Food Market |

| Market Size in 2024 | USD 7.5 Billion |

| Market Forecast in 2034 | USD 19.1 Billion |

| Growth Rate | CAGR of 9.8% |

| Number of Pages | 215 |

| Key Companies Covered | Dr. Schar, Boulder Brands, Cerealto, Conagra Brands, Enjoy Life Foods, General Mills, Glutafin, Hero Group, Kellogg’s Company, Pinnacle Foods, Prima Foods, Seitz Glutenfrei, Silky Yay Foods, True Foods, Wheafree, and others. |

| Segments Covered | By Type, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Gluten Free Food Market: Segmentation

The global gluten free food industry is segmented based on type, distribution channel, and region.

Based on the type, the global gluten free food market is bifurcated into baby food, pastas & pizzas, snacks & RTE products, bakery products, and condiments & dressings. The bakery products are expected to capture the largest market share over the projected period. Bakery products have become the most popular segment of the market because a growing number of individuals desire them. They talk about how healthy cookies, pastries, breads, and baking mixes that don't have gluten are. Bakery items are staples in Europe and North America, therefore, their popularity has grown among people who can't eat gluten and health-conscious people. Because of this, bakers in these areas are making new gluten-free baked goods, which will help the industry flourish.

For instance, in December 2023, Oreo, a brand owned by Mondelez, released gluten-free golden cookies, which are the company's newest product. There are two kinds of these cookies: peanut butter cakesters and chocolate soft snack cakes with peanut butter filling. Also, increasing innovation in the bakery industry in developing countries like India, China, and others is expected to help the segment thrive.

Based on the distribution channel, the global gluten free food industry is bifurcated into supermarkets/hypermarkets, convenience stores, specialty stores, drugstores and pharmacies, and online retails. The convenience stores segment holds the major market share. Consumers are increasingly turning to convenience-based purchasing as a result of urbanization and busy lifestyles, with gluten-free snacks, drinks, and "grab-and-go" meals becoming popular. Increased awareness of gluten intolerance, celiac illness, and overall wellness trends drives demand in mainstream places, making convenience stores an important growth avenue.

Gluten Free Food Market: Regional Analysis

Why does North America dominate the gluten free food market over the projected period?

North America is expected to dominate the global gluten free food market over the projected period. The geographical growth is due to increasing numbers of individuals knowing about gluten-related diseases, including celiac disease and gluten sensitivity that isn't celiac. People are increasingly adopting gluten-free diets because they believe they are beneficial for their health, such as aiding digestion and promoting weight loss.

Additionally, the popularity of clean-label diets, plant-based eating, and lifestyle choices that focus on meals low in carbs or free of allergens has driven demand significantly higher. Besides, the Asia Pacific is expected to grow at the highest CAGR during the forecast period owing to the growing health and wellness trends and increasing demand for bakery products.

Gluten Free Food Market: Competitive Analysis

The global gluten free food market is dominated by players like:

- Dr. Schar

- Boulder Brands

- Cerealto

- Conagra Brands

- Enjoy Life Foods

- General Mills

- Glutafin

- Hero Group

- Kellogg’s Company

- Pinnacle Foods

- Prima Foods

- Seitz Glutenfrei

- Silky Yay Foods

- True Foods

- Wheafree

The global gluten free food market is segmented as follows:

By Type

- Baby Food

- Pastas & Pizzas

- Snacks & RTE Products

- Bakery Products

- Condiments & Dressings

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Stores

- Drugstores and Pharmacies

- Online Retails

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The gluten-free food is defined as the food that doesn’t contain gluten. The main sources of gluten include wheat, rye, and barley, which are types of protein. This includes fruits, vegetables, meat, and fish that don't naturally contain gluten, as well as processed gluten-free foods like breads and pastas that are designed for people who can't eat gluten.

The gluten free food market is growing due to several reason, which includes the increasing awareness among the population for gluten-related disorders, trends related to health and wellness, and innovation in products and ingredients.

The high cost of production and distribution poses a major challenge to the gluten free food industry's growth.

Based on the distribution channel, the convenience stores segment is expected to dominate the industry growth during the projected period.

The increasing health consciousness among consumers and product innovation is a major impacting factor for the gluten free food industry growth over the projected period.

According to the report, the global gluten free food market size was worth around USD 7.5 billion in 2024 and is predicted to grow to around USD 19.1 billion by 2034.

The global gluten free food market is expected to grow at a CAGR of 9.8% during the forecast period.

The global gluten free food industry growth is expected to be driven by the North American region. It is currently the world’s highest revenue-generating market due to the rising health awareness and increasing incidence of celiac disease.

The global gluten free food market is dominated by players like Dr. Schar, Boulder Brands, Cerealto, Conagra Brands, Enjoy Life Foods, General Mills, Glutafin, Hero Group, Kellogg’s Company, Pinnacle Foods, Prima Foods, Seitz Glutenfrei, Silky Yay Foods, True Foods, and Wheafree, among others.

The gluten free food market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed