Fiberglass Recycling Market Size, Share, Trends, Growth & Forecast 2034

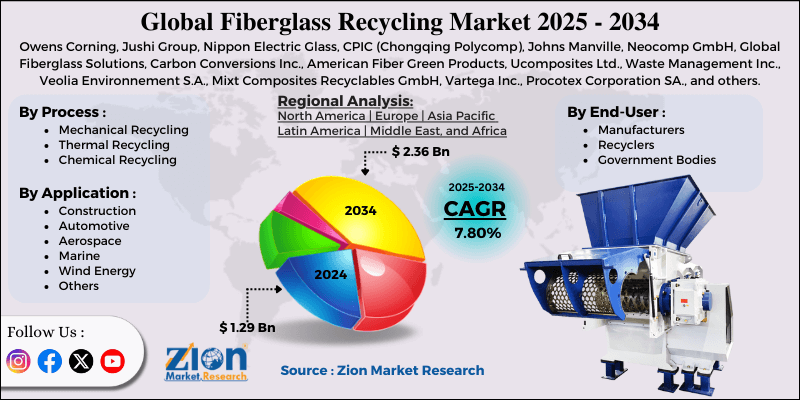

Fiberglass Recycling Market By Process (Mechanical Recycling, Thermal Recycling, Chemical Recycling), By Application (Construction, Automotive, Aerospace, Marine, Wind Energy, and Others), By End-User (Manufacturers, Recyclers, Government Bodies, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

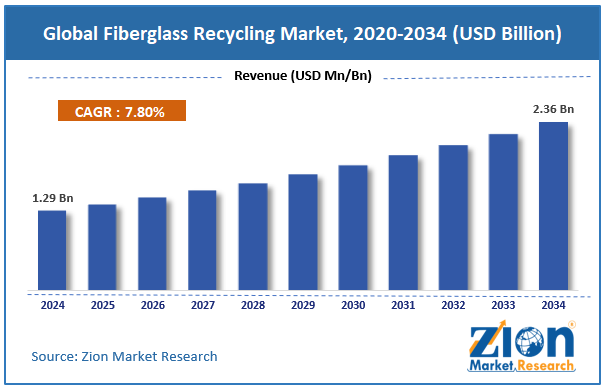

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1.29 Billion | USD 2.36 Billion | 7.80% | 2024 |

Fiberglass Recycling Industry Perspective:

What will be the size of the global fiberglass recycling market during the forecast period?

The global fiberglass recycling market size was around USD 1.29 billion in 2024 and is projected to reach USD 2.36 billion by 2034, with a compound annual growth rate (CAGR) of roughly 7.80% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global fiberglass recycling market is estimated to grow annually at a CAGR of around 7.80% over the forecast period (2025-2034)

- In terms of revenue, the global fiberglass recycling market size was valued at around USD 1.29 billion in 2024 and is projected to reach USD 2.36 billion by 2034.

- The fiberglass recycling market is projected to grow significantly owing to the expansion of the wind energy sector, rising construction industry activity, and corporate ESG commitments.

- Based on process, the mechanical recycling segment is expected to lead the market, while the thermal and chemical recycling segments are expected to grow considerably.

- Based on application, the construction segment is the dominating segment, while the automotive segment is projected to witness sizeable revenue over the forecast period.

- Based on end-user, the manufacturers segment is expected to lead the market, followed by the recyclers segment.

- By region, North America is projected to dominate the global market during the forecast period, followed by Europe.

Fiberglass Recycling Market: Overview

Fiberglass recycling is complicated because it is a composite material composed of resin and glass fiber, which cannot be separated easily. Conventional recycling techniques are limited, hence most fiberglass waste ends up in landfills. Still, newer approaches such as asphalt, cement, and new composite products help reduce waste. The global fiberglass recycling market is likely to expand rapidly, driven by pressure for sustainable waste management, growth in wind energy installations, and improvements in recycling technologies. Growing landfill restrictions and environmental concerns are pushing industries to reduce composite waste. Fiberglass recycling helps meet sustainability targets and regulatory expectations. This pressure ultimately supports industry demand.

Moreover, large volumes of end-of-life wind turbine blades are entering the waste stream. Since blades are made of fiberglass, recycling is essential. This creates a steady, growing feedstock supply. Improvements in thermal, mechanical, and chemical recycling enhance efficiency and material recovery. These improvements expand usability and reduce the costs of recycled fiberglass. Technology progress strengthens industry feasibility.

Furthermore, fiberglass combines glass fibers with thermoset resins, making separation complex. Recycling processes are highly complex, restricting scalability and efficiency. Advanced recycling methods need costly equipment and energy. Smaller companies struggle with capital investment. High costs reduce profit margins.

Despite growth, the global market is constrained by factors such as a complex composite structure and high processing costs. Fiberglass combines glass fibers with thermoset resins that cannot be reshaped or melted easily, limiting effectiveness and ease of use. Likewise, recycling technologies, particularly advanced thermal and chemical methods, often require substantial capital investment, processing expertise, and energy resources.

Nonetheless, the global fiberglass recycling industry stands to benefit from several key opportunities, such as the development of advanced recycling technologies and new applications for recycled fiberglass. Emerging techniques can enhance fiber recovery and resin separation. Elevated efficiency reduces operating costs, opening new commercial opportunities. Additionally, recycled material can be used in asphalt, cement, insulation, and fillers. These applications do not need high fiber strength; industry diversification raises demand.

Fiberglass Recycling Market: Dynamics

Growth Drivers

How are rising costs and supply volatility of virgin raw materials driving the fiberglass recycling market?

Varying prices and limited virgin fiberglass supply are prompting manufacturers to adopt recycled substitutes to maintain cost stability. Recycled fiberglass offers a financially appealing option that reduces reliance on volatile global supply chains. Lower feedstock costs and predictable long-term pricing improve its appeal for large-scale production. Industries like construction and automotive are increasingly integrating recycled fiberglass to manage supply risks. This move also backs sustainability goals while ensuring economic efficiency.

How are technological advancements in recycling methods propelling the fiberglass recycling market?

Innovations in thermal, mechanical, and chemical recycling turn difficult-to-recycle fiberglass into usable raw materials. Advanced systems boost separation, material quality, and efficiency, making recycled fiberglass rival virgin inputs. Investments in process technology yield outputs like powdered composites for construction and reinforcements for manufacturing. These advancements cut processing costs and boost recyclate quality. As a result, industries increasingly adopt recycled fiberglass in ecological applications, driving growth in the fiberglass recycling market.

Restraints

Limited and uneven recycling infrastructure unfavorably impacts the market progress

Several regions still lack collection networks and dedicated recycling facilities for fiberglass waste, resulting in logistical barriers and low processing rates. In some parts of Asia, less than a tenth of fiberglass waste is diverted to formal recycling channels, revealing major infrastructure gaps. The fragmentation of recycling systems raises transport costs and lowers the reliability of feedstock supply for recyclers. This irregular infrastructure deployment hinders scalability and discourages investment in new facilities.

Opportunities

How does expanding the wind turbine blade recycling sector create promising avenues for the fiberglass recycling industry's growth?

The decommissioning of wind turbines generates significant amounts of fiberglass waste; the global fiberglass recycling industry is expected to grow from USD 68 million in 2025 to over USD 1.1 billion by 2033. This growth provides recyclers with a steady supply of feedstock and the opportunity to build scalable facilities designed for turbine blades. Groups and technologies focused on this waste stream may create high-value recycled products.

Challenges

Public and industry awareness gaps restrict the market growth

Awareness of fiberglass recycling capabilities and benefits remains limited among end users and businesses. Misconceptions over recycled material performance and uncertainty around lifecycle sustainability may reduce demand and participation in recycling programs. Educational efforts and industry outreach are important for fostering wider acceptance and collaboration in supply chains.

Fiberglass Recycling Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Fiberglass Recycling Market |

| Market Size in 2024 | USD 1.29 Billion |

| Market Forecast in 2034 | USD 2.36 Billion |

| Growth Rate | CAGR of 7.80% |

| Number of Pages | 215 |

| Key Companies Covered | Owens Corning, Jushi Group, Nippon Electric Glass, CPIC (Chongqing Polycomp), Johns Manville, Neocomp GmbH, Global Fiberglass Solutions, Carbon Conversions Inc., American Fiber Green Products, Ucomposites Ltd., Waste Management Inc., Veolia Environnement S.A., Mixt Composites Recyclables GmbH, Vartega Inc., Procotex Corporation SA., and others. |

| Segments Covered | By Process, By Application, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Fiberglass Recycling Market: Segmentation

The global fiberglass recycling market is segmented based on process, application, end-user, and region.

Why will the mechanical recycling segment emerge as the leading segment in the fiberglass recycling industry?

Based on the process, the global fiberglass recycling industry is divided into mechanical, thermal, and chemical recycling. The mechanical recycling segment registers 58% of the total market. It comprises grinding, shredding, or milling fiberglass waste into smaller particles for recycling. It is energy-efficient, cost-effective, and broadly adopted in automotive, construction, and industrial applications.

Conversely, the thermal and chemical recycling segments together register for 31% of the worldwide market. They use chemical or thermal processes to recover high-purity, cleaner fibers from composites. These techniques are costly but produce recycled fiberglass ideal for high-performance applications.

Why will the construction segment lead the fiberglass recycling market?

Based on application, the global fiberglass recycling market is segmented into construction, automotive, aerospace, marine, wind energy, and others. The construction segment accounts for 45% of the market, driven by the use of recycled fiberglass in insulation, roofing, reinforced concrete, and panel products. Recycled fiberglass supports green building practices and sustainability standards in residential projects and infrastructure. Its cost-efficiency, durability, and environmental benefits make it a preferred material in construction applications.

Nonetheless, the automotive segment ranks second with 40% market share, indicating strong demand for high-strength, lightweight recycled fiberglass in structural components, interior parts, and vehicle body panels. This adoption helps manufacturers reduce vehicle weight, meet sustainability goals, and improve fuel efficiency. Growth in eco-friendly and electric vehicle production further augments the use of recycled fiberglass in this industry.

What share does the manufacturers segment hold in the fiberglass recycling industry?

Based on end-user, the global market is segmented into manufacturers, recyclers, government bodies, and others. The manufacturers segment is the leading group, holding 55% of the market. They generate recycled materials and fiberglass waste, which they return to the production process. They fuel demand for recycled fiberglass to meet sustainability goals and reduce raw material prices.

However, the recyclers segment holds second rank with 35% of the total market. It offers the core processing infrastructure and expertise required to convert waste into usable feedstock. They support manufacturers and other buyers by supplying processed material and developing recycling solutions.

Fiberglass Recycling Market: Regional Analysis

Why is North America outperforming other regions in the global Fiberglass Recycling Market?

North America is anticipated to retain its leading role in the global fiberglass recycling market, with a 30% CAGR, driven by strict environmental regulations and standards, advanced recycling infrastructure and technology adoption, and high demand from major end-use industries. Stringent environmental regulations and sustainability directives in Canada and the US promote the adoption of fiberglass recycling. Companies are motivated to meet green building and ESG standards by using recycled materials. These rules fuel continuous and environmental priorities strengthen industry growth.

Moreover, the region benefits from mature recycling facilities and improved processing systems. High-efficiency sorting and recovery solutions enhance the usability and quality of recycled fiberglass. A strong R&D ecosystem backs the development and commercialization of innovative recycling techniques. This technological dominance reduces costs, improves efficiency, and strengthens regional competitive rank. Furthermore, the automotive, wind energy, and aerospace industries generate remarkable fiberglass waste, creating a robust feedstock for recycling. Recycled fiberglass is broadly used in insulation, structural components, panels, and turbine blades. The United States represents the leading national market, fueling regional demand. Industrial consumption promises a continuous supply and supports sustained industry growth.

What will help Europe emerge as the second-largest region in the fiberglass recycling industry?

Europe ranks as the second-largest region, with a 27% CAGR in the global fiberglass recycling industry, driven by advanced recycling technology and infrastructure, strong industrial and end-use demand, and corporate sustainability initiatives and investment. Europe holds well-developed fiberglass recycling facilities and processing solutions. advanced mechanical, chemical, and thermal techniques improve recovery rates and material quality. Continuous research and development efforts back innovative recycling solutions in novel applications. This technological advancement boosts Europe’s competitiveness in global markets.

Major industries, including aerospace and wind energy, generate significant amounts of fiberglass waste in Europe. Recycled fiberglass is extensively used in insulation, panels, and structural components in these industries. High industrial adoption promises a steady feed of material for recycling. This consistent demand underscores Europe’s ranking as the second-largest market.

Additionally, European companies actively incorporate recycled fiberglass to meet ESG goals and sustainability targets. Investments in circular supply chains and closed-loop recycling systems improve material quality and availability. These initiatives enhance environmental performance and lower dependency on virgin raw materials. Corporate commitment reinforces regional dominance in the worldwide market.

Fiberglass Recycling Market: Competitive Analysis

The leading players in the global fiberglass recycling market are:

- Owens Corning

- Jushi Group

- Nippon Electric Glass

- CPIC (Chongqing Polycomp)

- Johns Manville

- Neocomp GmbH

- Global Fiberglass Solutions

- Carbon Conversions Inc.

- American Fiber Green Products

- Ucomposites Ltd.

- Waste Management Inc.

- Veolia Environnement S.A.

- Mixt Composites Recyclables GmbH

- Vartega Inc.

- Procotex Corporation SA.

What are the key trends in the global Fiberglass Recycling Market?

Progress of wind turbine blade recycling initiatives:

As older wind turbines reach the end of their lifespans, a growing volume of fiberglass blades is entering waste streams. Specialized recycling programs emphasize thermally or mechanically processing these large composite structures. This trend is supported by sustainability commitments and the expansion of renewable energy. It is creating new recycling pathways and industry demand for blade-derived materials.

Increasing use of recycled fiberglass in new products:

Manufacturers are integrating recycled fiberglass into construction materials, consumer goods, and automotive components. Recycled content helps companies meet sustainability and carbon reduction targets. Product performance has made recycled materials more competitive with virgin fiberglass. This trend expands commercial acceptance and diversifies uses.

The global fiberglass recycling market is segmented as follows:

By Process

- Mechanical Recycling

- Thermal Recycling

- Chemical Recycling

By Application

- Construction

- Automotive

- Aerospace

- Marine

- Wind Energy

- Others

By End-User

- Manufacturers

- Recyclers

- Government Bodies

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed