Escape Room Market Size, Share, Trends, Growth & Forecast 2034

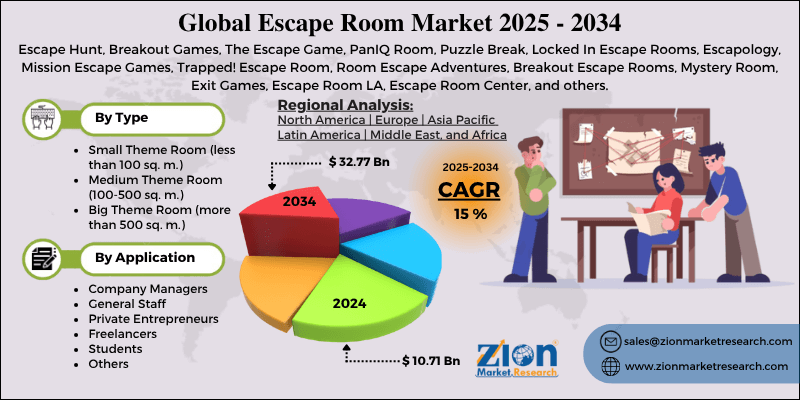

Escape Room Market By Type [Small Theme Room (less than 100 sq. m.], Medium Theme Room [100-500 sq. m.], Big Theme Room [more than 500 sq. m.]), By Application (Company Managers, General Staff, Private Entrepreneurs, Freelancers, Students and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

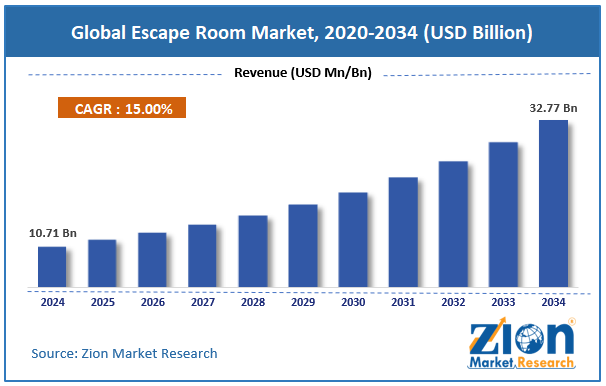

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 10.71 Billion | USD 32.77 Billion | 15.00% | 2024 |

Escape Room Industry Perspective:

The global escape room market size was worth around USD 10.71 billion in 2024 and is predicted to grow to around USD 32.77 billion by 2034, with a compound annual growth rate (CAGR) of roughly 15% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global escape room market is estimated to grow annually at a CAGR of around 15% over the forecast period (2025-2034)

- In terms of revenue, the global escape room market size was valued at around USD 10.71 billion in 2024 and is projected to reach USD 32.77 billion by 2034.

- The escape room market is projected to grow significantly due to the increasing popularity of team-building activities among corporates, the expansion of the tourism and leisure industry, and the rise in marketing of unique experiences and social media influence.

- Based on type, the small theme room (less than 100 sq. m.) segment is expected to lead the market, while the medium theme room (100-500 sq. m.) segment is expected to grow considerably.

- Based on application, the company managers segment is the dominating segment, while the general staff segment is projected to witness sizeable revenue over the forecast period.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Europe.

Escape Room Market: Overview

Escape rooms are immersive and interactive entertainment experiences where contestants uncover clues, complete challenges, and solve puzzles within a set time to 'escape' a themed room. The elements of teamwork, storytelling, and problem-solving are usually assimilated, featuring themes like adventure, fantasy, mystery, or horror. The global escape room market is projected to witness substantial growth driven by the growing prominence of experiential entertainment, the demand for corporate team-building, and the integration of advanced technology. Consumers are inclining towards interactive experiences from passive forms of entertainment. Escape rooms offer immersive challenges that actively engage participants. This trend is fueling repeat visits and higher footfall worldwide. Several businesses are using escape rooms to improve communication and teamwork among employees. These activities reinforce problem-solving skills in a fun environment. Hence, corporate bookings have become a key revenue source.

Moreover, augmented reality and virtual reality are progressively integrated into escape rooms. This technology improves user engagement and creates unique gameplay experiences. Tech-based rooms appeal to digital-savvy and younger audiences.

Although drivers exist, the global market is challenged by factors like high initial investment costs and limited space availability. Opening an escape room needs significant capital for technology, infrastructure, and props. Several new entrants find it challenging to secure enough funding. High upfront costs may restrict industry expansion and entry. Similarly, urban areas usually have limited real estate suitable for elaborate or large escape rooms. High property costs are a key factor hampering the design of immersive experiences. Space limitation may inhibit growth in densely populated areas.

Even so, the global escape room industry is well-positioned due to virtual escape rooms, collaborations with entertainment & media brands, and educational and corporate packages. Virtual and online escape experiences enable operators to reach worldwide audiences. Remote candidates can enjoy games without geographical restrictions. Virtual platforms create fresh revenue streams beyond physical locations. Partnerships with movies, gaming franchises, and TV shows appeal to fans through themed experiences. Licensed content may raise brand value and industry appeal. Co-branded rooms usually generate high consumer interest.

Additionally, colleges, schools, and corporate businesses progressively adopt escape rooms for learning and training. Customized programs diversify customer segments. This approach increases steady revenue generation and brand recognition.

Escape Room Market Dynamics

Growth Drivers

How is growth in tourism and entertainment hubs driving the escape room market?

Escape rooms are strategically benefiting from increased worldwide tourism and the development of entertainment hubs in key cities. According to the UN World Tourism Organization, international tourist arrivals reached over 1.5 billion in 2024, with leisure activities like escape rooms experiencing increased demand. Cities like London, New York, Singapore, and Tokyo have become major hubs for high-class themed escape room experiences targeting tourists seeking localized and unique adventures. Operators are collaborating with resorts and hotels to create package experiences, driving revenue and footfall. Recent reports show that destinations integrating these rooms into cultural tourism itineraries experience up to a 25% rise in visitor engagement.

How is AR/VR integration and technological improvements propelling the escape room market?

The integration of technology, including VR, AR, and mobile applications, has transformed the escape room experience, appealing to tech-savvy players seeking more immersive and interactive challenges. Many operators like Enigma Room and The Escape Game now offer hybrid digital-physical experiences where candidates solve puzzles through AR overlays or VR portals. News from 2024 highlights the introduction of an entirely virtual escape room, which can be accessed remotely, thereby increasing market reach beyond physical locations. This tech-driven enhancement has broadened the audience base and raised session frequency, fueling the growth of the escape room market.

Restraints

Safety and liability concerns adversely impact the market development

Safety regulations and liability issues are the key restraints in the global market. Escape rooms inherently involve physical activity, sometimes intense scenarios, and confined spaces, which may result in health risks or accidents. According to a 2023 report, nearly 8% of escape room operators in North America reported mishaps needing legal intervention. In 2024, news reports incidents in Australia where operators faced fines for emergency exit and fire safety violations. Compliance with strict laws and insurance raises operational complexity and may limit growth opportunities.

Opportunities

How do themed collaborations with popular IPs and franchises open lucrative opportunities for the growth of the escape room market?

Collaborations with entertainment franchises, gaming IPs, or movies allow operators to appeal to fans and raise footfall. For instance, Stranger Things, Harry-Potter, and Marvel-themed rooms have gained massive popularity across the globe. A 2024 report indicated that IP-based escape rooms can produce up to 25% higher revenue than regular themes. Recent news highlights Escape Hunt's association with Disney to introduce a Marvel-themed room in London, appealing to international tourists. Leveraging popular IPs raises customer engagement, media attention, and repeat visits, offering high ROI potential and impacting the escape room industry.

Challenges

High maintenance costs and technological barriers restrict the market growth

Incorporating VR, AR, and advanced puzzle technologies requires continuous maintenance and significant upfront investment. According to the 2025 reports, nearly 25-30% of medium and small operators struggle to maintain AR/VR equipment due to technical challenges or high costs. News from 2024 indicates that most United States escape room startups have temporarily suspended operations due to equipment failures. Balancing technology adoption with operational feasibility is still a challenge.

Escape Room Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Escape Room Market |

| Market Size in 2024 | USD 10.71 Billion |

| Market Forecast in 2034 | USD 32.77 Billion |

| Growth Rate | CAGR of 15% |

| Number of Pages | 214 |

| Key Companies Covered | Escape Hunt, Breakout Games, The Escape Game, PanIQ Room, Puzzle Break, Locked In Escape Rooms, Escapology, Mission Escape Games, Trapped! Escape Room, Room Escape Adventures, Breakout Escape Rooms, Mystery Room, Exit Games, Escape Room LA, Escape Room Center, and others. |

| Segments Covered | By Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Escape Room Market: Segmentation

The global escape room market is segmented based on type, application, and region.

Based on type, the global escape room industry is divided into small theme room (less than 100 sq. m.), medium theme room (100-500 sq. m.), and big theme room (more than 500 sq. m.). The small theme room segment held a dominating share in the global market. They are compact setups, more specifically designed for 2-6 candidates. They are cost-effective to maintain and build, making them popular among small operators and new entrants. These rooms emphasize intimate gameplay and intricate puzzles instead of elaborate props. Nonetheless, their low capacity may constrain revenue potential per session.

On the other hand, the medium theme rooms segment holds a second-leading share in the worldwide market. They balance immersive experiences and operational efficiency, accommodating large groups of 6-12 candidates. These rooms enable props, detailed storytelling, and technology integration without excessive real estate costs. Their prominence stems from offering premium experiences while promising profitable occupancy rates.

Based on application, the global escape room market is segmented into company managers, general staff, private entrepreneurs, freelancers, students, and others. The company managers segment held leadership in the market. These rooms emphasize leadership, strategic thinking, and decision-making skills. These sessions are usually a part of corporate retreats or executive training. While impactful, participation is restricted because of smaller target groups. Revenue contribution is moderate but appreciated for premium corporate packages.

Nonetheless, the general staff segment holds a second rank in the market. Companies use escape rooms broadly for team-building, problem-solving practices, and communication among mid-level employees. The large participant base promises steady revenue generation and frequent bookings. These programs strengthen the association while maintaining an enjoyable and engaging environment.

Escape Room Market: Regional Analysis

What enables North America to have a strong foothold in the global Escape Room Market?

North America is likely to sustain its leadership in the escape room market due to high disposable income, an established entertainment culture, and demand for corporate team-building activities. North America holds a higher per capita income, allowing consumers to spend more on the finest entertainment experiences. Escape rooms are considered a leisure activity with moderate pricing, which increases accessibility to a broader audience. According to Statista, the United States household spending on entertainment and recreation reached over USD 330 billion in 2024, backing industry growth.

Moreover, the region holds a long-standing culture of recreational and interactive entertainment, comprising escape rooms, theme parks, and immersive experiences. Consumers willingly pay for experiential activities, boosting the industry adoption. This cultural acceptance has aided the regional market share, valued at more than 35% in 2024. Several North American companies integrate escape rooms into team-building and employee engagement programs. The corporate segment signifies a significant revenue share, as escape rooms nurture problem-solving, communication, and collaboration skills. Corporate bookings register for nearly 30-35% of the total industry revenue in Canada and the United States.

Europe continues to secure the second-highest share in the escape room industry due to the growing demand for experiential entertainment, the adoption of corporate team-building and training, and technological improvements in gaming. Europe has experienced growing interest in immersive and interactive entertainment activities. Escape rooms are increasingly popular among Gen Z and millennials.

According to the European market reports, the European market accounted for nearly 25% of the worldwide revenue in 2024, denoting a strong adoption. European companies are progressively using escape rooms for corporate training and team-building practices. These sessions enhance problem-solving, collaboration, and communication among employees. Corporate bookings add a significant revenue, mainly in economies like France, Germany, and the UK.

Additionally, European operators are integrating AR-VR and interactive puzzle technologies to improve gameplay. Advanced tech appeals to tech-oriented and younger candidates seeking unique experiences. These advancements help operators maintain and distinguish repeat customer engagement.

Escape Room Market: Competitive Analysis

The leading players in the global escape room market are:

- Escape Hunt

- Breakout Games

- The Escape Game

- PanIQ Room

- Puzzle Break

- Locked In Escape Rooms

- Escapology

- Mission Escape Games

- Trapped! Escape Room

- Room Escape Adventures

- Breakout Escape Rooms

- Mystery Room

- Exit Games

- Escape Room LA

- Escape Room Center

Escape Room Market: Key Market Trends

Themed and narrative-driven experiences:

Operators are emphasizing unique themes, intricate storytelling, and customized experiences to distinguish their offerings. Popular themes comprise mystery, horror, movie-based narratives, or fantasy. Strong storylines raise replayability and motivate group participation, improving customer loyalty.

Integration of Augmented Reality (AR) and Virtual Reality (VR):

Escape room operators are progressively integrating AR and VR to create more interactive and immersive experiences. These technologies enable candidates to engage with digital elements along with physical puzzles. This trend appeals to tech-savvy users and improves customer engagement and repeat visits.

The global escape room market is segmented as follows:

By Type

- Small Theme Room (less than 100 sq. m.)

- Medium Theme Room (100-500 sq. m.)

- Big Theme Room (more than 500 sq. m.)

By Application

- Company Managers

- General Staff

- Private Entrepreneurs

- Freelancers

- Students

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Escape rooms are immersive and interactive entertainment experiences where contestants uncover clues, complete challenges, and solve puzzles within a set time to 'escape' a themed room. The elements of teamwork, storytelling, and problem-solving are usually assimilated, featuring themes like adventure, fantasy, mystery, or horror.

The global escape room market is projected to grow due to rising demand for immersive entertainment experiences, advancements in virtual and augmented reality, and the growth of franchising and licensing models in escape rooms.

According to study, the global escape room market size was worth around USD 10.71 billion in 2024 and is predicted to grow to around USD 32.77 billion by 2034.

The CAGR value of the escape room market is expected to be around 15% during 2025-2034.

Market trends and consumer preferences are evolving toward tech-driven, immersive, and themed experiences with a focus on replayability and team-building.

North America is expected to lead the global escape room market during the forecast period.

The key players profiled in the global escape room market include Escape Hunt, Breakout Games, The Escape Game, PanIQ Room, Puzzle Break, Locked In Escape Rooms, Escapology, Mission Escape Games, Trapped! Escape Room, Room Escape Adventures, Breakout Escape Rooms, Mystery Room, Exit Games, Escape Room LA, and Escape Room Center.

Leading players are adopting partnerships, franchising, themed experience diversification, and technology integration to expand their market presence globally.

Investment and partnership opportunities exist in virtual platforms, technology-driven escape rooms, corporate or educational programs, and themed collaborations.

The report examines key aspects of the escape room market, including a detailed analysis of existing growth factors and restraints, as well as future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed