Electrophysiology Devices Market Size, Share, Trends, Growth and Forecast 2034

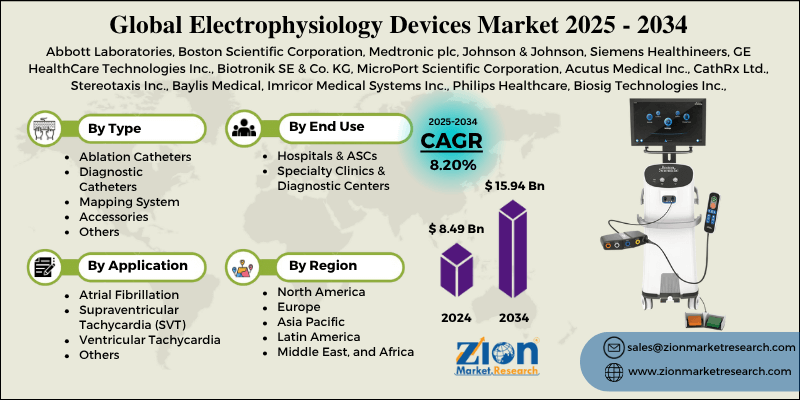

Electrophysiology Devices Market By Type (Ablation Catheters, Diagnostic Catheters, Mapping System, Accessories, and Others), By Application (Atrial Fibrillation, Supraventricular Tachycardia [SVT], Ventricular Tachycardia, and Others), By End-User (Hospitals & ASCs, Specialty Clinics & Diagnostic Centers), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

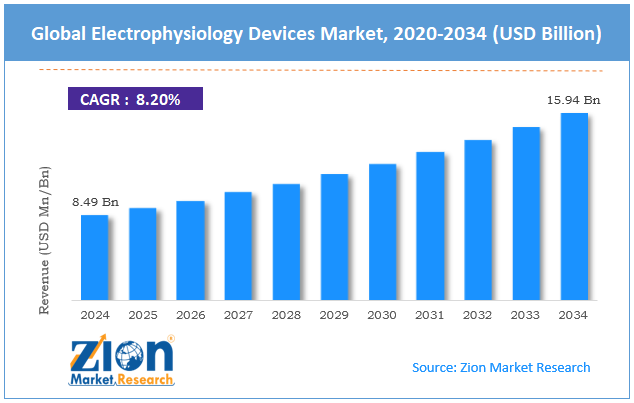

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 8.49 Billion | USD 15.94 Billion | 8.20% | 2024 |

Electrophysiology Devices Industry Perspective:

The global electrophysiology devices market size was worth around USD 8.49 billion in 2024 and is predicted to grow to around USD 15.94 billion by 2034, with a compound annual growth rate (CAGR) of roughly 8.20% between 2025 and 2034.

Electrophysiology Devices Market: Overview

Electrophysiology devices are medical tools that diagnose and treat arrhythmias by recording the electrical activity of the patient's heart. These devices help doctors locate the source of arrhythmias and deliver targeted therapies, such as cryoablation or radiofrequency, to restore a normal heart rhythm.

The worldwide electrophysiology devices market is expected to experience substantial growth due to the increasing prevalence of atrial fibrillation and other conditions, advancements in ablation techniques, and higher adoption of minimally invasive surgeries.

The rising cases of cardiac arrhythmias across the globe are a leading driver. CDC states that more than 12 million individuals in America are expected to suffer from AF by 2030. This growing pressure amplifies the demand for ablation solutions and EP diagnostics.

Moreover, modernizations such as contact force-sensing catheters, high-resolution 3D electroanatomical mapping, and (PFA) pulsed field ablation significantly improve operational accuracy and safety, fueling their adoption in developed regions.

Additionally, electrophysiology procedures are less invasive and less painful than open-heart surgeries, resulting in shorter hospital stays and faster patient recovery times. This trend backs the transformation from conventional interventions to catheter-enabled methods.

Nevertheless, the global market is limited by the high cost of EP procedures and devices, as well as the associated risks and complications. Improved EP systems, mapping devices, and catheters may be excessively costly, particularly in low-income regions, which restricts their broader adoption.

In addition, possible complications like stroke, phrenic nerve injury, or perforation may restrict providers and patients from using EP ablations, mainly during complex situations.

Yet, the global electrophysiology devices industry is expected to progress remarkably over the coming years, driven by the adoption of ambulatory EP monitoring, increasing CE and FDA approvals, and the growing use of personalized electrophysiology. There is an increasing demand for home-based ECGs and loop recorders integrated with electrophysiology (EP) workflows, particularly with the increasing popularity of remote monitoring.

Additionally, growth in device approvals is enabling companies to invest in clinical enhancements. Furthermore, advancing technologies such as personalized mapping, advanced signal analytics, and genetic profiling simplify the management of precision arrhythmias, offering enduring potential.

Key Insights:

- As per the analysis shared by our research analyst, the global electrophysiology devices market is estimated to grow annually at a CAGR of around 8.20% over the forecast period (2025-2034)

- In terms of revenue, the global electrophysiology devices market size was valued at around USD 8.49 billion in 2024 and is projected to reach USD 15.94 billion by 2034.

- The electrophysiology devices market is projected to grow significantly due to the increasing geriatric population with high cardiac risk, the rising use of remote monitoring devices, and technological advancements in ablation and 3D mapping.

- Based on type, the ablation catheters segment is expected to lead the market, while the diagnostic catheters segment is expected to grow considerably.

- Based on application, the atrial fibrillation segment is the largest segment, while the supraventricular tachycardia (SVT) segment is projected to witness substantial revenue growth over the forecast period.

- Based on end user, the hospitals & ASCs segment is expected to lead the market compared to the specialty clinics & diagnostic centers segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Europe.

Electrophysiology Devices Market: Growth Drivers

Growth in outpatient and minimally invasive procedures drives market growth

The move towards outpatient and minimally painful procedures is one of the key propellers of the electrophysiology devices market. Electrophysiology procedures, particularly catheter ablation, have increasingly shifted to outpatient settings due to growing confidence among clinicians and technological advancements. This change is backed by modern catheters that reduce fluoroscopy exposure and enable speedy lesion formation.

This outpatient trend is driving the need for diagnostic EP technologies, such as wireless patch-based ECG monitors and loop recorders, which could be damaged by prolonged periods outside of clinics.

As worldwide healthcare systems strive to reduce hospitalizations and shift toward value-based care, the significance of EP devices, which support minimally invasive, scalable, and efficient procedures, will continue to grow rapidly.

Technological improvements in electrophysiology technologies propel the market growth

Technological advancements in robotic navigation, 3D mapping, and radiofrequency ablation have significantly expanded the capabilities of electrophysiology laboratories. Newer EP devices offer real-time intracardiac imaging and improved signal processing, thereby enhancing success rates and procedural accuracy.

The incorporation of machine learning (ML) and artificial intelligence (AI) in endoscopic procedures is transforming patient outcomes and reducing procedural time.

Additionally, robotic catheter navigation systems are gaining prominence and being widely adopted.

Electrophysiology Devices Market: Restraints

Shortage of skilled experts and training facilities unfavorably impacts market progress

The complexity of EP procedures requires highly specialized training, and there is a universal scarcity of trained electrophysiologists, especially in developing regions.

Even in Europe and the United States, training for an EP specialist is lengthy, requiring 10-12 years of post-secondary education and fellowship. This talent barrier is restricting procedure capacity in emerging and established regions, resulting in underutilization and long wait times for improved EP labs.

To address this, companies like Abbott and Biosense Webster have introduced AI simulation labs and online EP training platforms in 2024; however, the gap persists as a key constraint, primarily in the African and Asian markets.

Electrophysiology Devices Market: Opportunities

Growing adoption of outpatient electrophysiology procedures positively impacts market growth

The global shift towards outpatient cardiology procedures and ASCs is fueling the demand for compact, faster, and mobile EP solutions. Improved anesthesia protocols, advancements in catheter design, and minimally invasive ablation techniques have enabled several electrophysiology procedures, primarily for paroxysmal atrial fibrillation and SVT, to be performed securely in outpatient settings.

This outpatient migration presents a lucrative opportunity for manufacturing companies to offer portable ablation solutions, disposable diagnostic catheters, and AI-based mapping tools, which reduce recovery and preparation time. This is remarkably progressing in the electrophysiology devices industry.

Electrophysiology Devices Market: Challenges

Integration issues and data security in Digital EP systems restrict the growth of the market

The growing digitalization of electrophysiology, facilitated by wearable ECGs, cloud-based diagnostics, AI-enabled mapping systems, and remote monitoring devices, presents challenges in data integration and cybersecurity. Patient rhythm data, diagnostic reports, and imaging files must be securely stored and transmitted, particularly as tele-EP services evolve.

Additionally, patient privacy protocols such as GDPR, HIPAA, and the DPDP Act require stringent compliance, which increases the time and costs associated with introducing new digital electrophysiology solutions to the market.

Electrophysiology Devices Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Electrophysiology Devices Market |

| Market Size in 2024 | USD 8.49 Billion |

| Market Forecast in 2034 | USD 15.94 Billion |

| Growth Rate | CAGR of 8.20% |

| Number of Pages | 213 |

| Key Companies Covered | Abbott Laboratories, Boston Scientific Corporation, Medtronic plc, Johnson & Johnson, Siemens Healthineers, GE HealthCare Technologies Inc., Biotronik SE & Co. KG, MicroPort Scientific Corporation, Acutus Medical Inc., CathRx Ltd., Stereotaxis Inc., Baylis Medical, Imricor Medical Systems Inc., Philips Healthcare, Biosig Technologies Inc., and others. |

| Segments Covered | By Type, By Application, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Electrophysiology Devices Market: Segmentation

The global electrophysiology devices market is segmented based on type, application, end user, and region.

Based on type, the global electrophysiology devices industry is divided into ablation catheters, diagnostic catheters, mapping systems, accessories, and others. The ablation catheters segment dominates the industry due to their vital role in treating cardiac arrhythmias, such as atrial fibrillation.

With the rising adoption of catheter ablation as the primary treatment and improvements such as irrigated-tip catheters and contact force-sensing, the segment leads the market. The growth of minimally invasive procedures and enhanced patient outcomes aids segmental dominance.

Based on application, the global electrophysiology devices market is segmented into atrial fibrillation, supraventricular tachycardia (SVT), ventricular tachycardia, and others. Atrial fibrillation is the dominating segment fueled by its high prevalence, impacting over 37 million individuals across the globe, and associated risks like heart failure and stroke.

The increasing use of catheter ablation as a primary treatment, driven by favorable reimbursement policies and guideline updates, continues to propel demand for electrophysiology devices in the management of atrial fibrillation (AF).

Based on end-user, the global market is segmented into hospitals & ASCs and specialty clinics & diagnostic centers. The hospitals and ASCs segment captured a leading market share due to the availability of skilled electrophysiologists, improved infrastructure, and the ability to manage complex procedures such as 3D mapping and catheter ablations. These settings also benefit from revised reimbursement frameworks and high patient volumes, especially in outpatient and inpatient arrhythmias treatments.

Electrophysiology Devices Market: Regional Analysis

North America to witness significant growth over the forecast period

North America is expected to maintain its leadership in the global electrophysiology devices market in the coming years. This growth is attributed to the rising incidence of cardiac arrhythmias, a well-developed healthcare infrastructure, and a supportive reimbursement landscape.

Annually, the United States records over 6 million incidences of atrial fibrillation, which is anticipated to increase remarkably by 2030. This high pressure notably demands ablation and diagnostic EP devices. With arrhythmias being a key cause of heart failure and stroke, hospitals in North America emphasize EP interventions.

North America, primarily the United States, boasts over 1,500 EP laboratories equipped with modern navigation systems and mapping technology. These hubs hold great potential for adopting next-generation devices, such as contact force-sensing catheters. North America's speedy integration of modernization nurtures sustained industry prominence.

Additionally, private insurers and Medicare in the region offer comprehensive coverage for EP procedures, which include catheter ablation and diagnostic mapping. For example, CMS reimburses more than $20,000 for complicated ablation procedures. This incentivizes both patients and hospitals, thus extending their industry penetration.

Europe is making considerable progress in the global electrophysiology devices industry, driven by a robust public healthcare network, a growing preference for catheter-enabled ablation, and the incorporation of digital and AI EP technologies. European nations, such as France, Germany, and the United Kingdom, have robust, publicly funded healthcare infrastructures that support improved cardiac care.

For instance, Germany alone has over 200 electrophysiology hubs that perform large volumes of ablation surgeries. These mature systems support procedure accessibility and device adoption in the region, thereby enhancing regional dominance; European regulations now recommend catheter ablation as the primary treatment for symptomatic atrial fibrillation.

Therefore, procedure volumes have progressed remarkably by 30% in the past five years in the key European nations. This inclination drives the sales of improved mapping systems and ablation catheters.

Furthermore, European cardiac centers are actively adopting remote monitoring tools and AI mapping systems, thus enhancing outcomes and accuracy. Nations such as Sweden and the Netherlands are implementing digital electrophysiology workflows, enabling remote diagnostics and real-time analysis.

Electrophysiology Devices Market: Competitive Analysis

The leading players in the global electrophysiology devices market are:

- Abbott Laboratories

- Boston Scientific Corporation

- Medtronic plc

- Johnson & Johnson

- Siemens Healthineers

- GE HealthCare Technologies Inc.

- Biotronik SE & Co. KG

- MicroPort Scientific Corporation

- Acutus Medical Inc.

- CathRx Ltd.

- Stereotaxis Inc.

- Baylis Medical

- Imricor Medical Systems Inc.

- Philips Healthcare

- Biosig Technologies Inc.are (RH)

- Baker Furniture

- Bentley Home

- Versace Home

- Poltrona Frau

- Christopher Guy

- Ligne Roset

- Visionnaire Home Philosophy

- Loro Piana Interiors

- Armani/Casa

- Cassina

- DelightFULL

Electrophysiology Devices Market: Key Market Trends

-

Evolution of next-generation ablation technologies:

Modernizations in ablation solutions, such as ultra-low-temperature cryoablation and pulsed-field ablation, are transforming treatment models. PFA, especially, is gaining traction for its potential to ablate cardiac tissues with minimal collateral damage, selectively.

Firms such as Boston Scientific and Medtronic are conducting clinical trials in this domain. These next-generation solutions ensure enhanced procedural safety and long-term results.

- Integration of machine learning and artificial intelligence:

Electrophysiology systems are integrating AI to enhance procedural planning and diagnostic accuracy. AI algorithms help in predicting ablation results and understanding complicated arrhythmic signals. Leading companies are focusing on navigation systems and smart mapping to improve workflow efficiency. This trend is transforming electrophysiology into a predictive and data-driven specialty.

The global electrophysiology devices market is segmented as follows:

By Type

- Ablation Catheters

- Diagnostic Catheters

- Mapping System

- Accessories

- Others

By Application

- Atrial Fibrillation

- Supraventricular Tachycardia (SVT)

- Ventricular Tachycardia

- Others

By End User

- Hospitals & ASCs

- Specialty Clinics & Diagnostic Centers

By Region

-

North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Electrophysiology devices are medical tools that diagnose and treat arrhythmias by recording the electrical activity of the patient's heart. These devices help doctors locate the source of arrhythmias and deliver targeted therapies, such as cryoablation or radiofrequency, to restore a normal heart rhythm.

The global electrophysiology devices market is projected to grow due to surging healthcare expenditures in developing countries, supportive reimbursement policies in developed regions, and the increasing adoption of minimally invasive surgeries.

According to study, the global electrophysiology devices market size was worth around USD 8.49 billion in 2024 and is predicted to grow to around USD 15.94 billion by 2034.

The CAGR value of the electrophysiology devices market is expected to be approximately 8.20% from 2025 to 2034.

North America is expected to lead the global electrophysiology devices market during the forecast period.

The key players profiled in the global electrophysiology devices market include Abbott Laboratories, Boston Scientific Corporation, Medtronic plc, Johnson & Johnson, Siemens Healthineers, GE HealthCare Technologies Inc., Biotronik SE & Co. KG, MicroPort Scientific Corporation, Acutus Medical, Inc., CathRx Ltd., Stereotaxis, Inc., Baylis Medical, Imricor Medical Systems, Inc., Philips Healthcare, and Biosig Technologies, Inc.

The report examines key aspects of the electrophysiology devices market, including a detailed discussion of existing growth factors and restraints, as well as future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed